Nvidia said its Blackwell processor samples are shipping to customers and demand for its Hopper platform remains strong. The company reported better-than-expected second quarter earnings as data center revenue continued to carry the team.

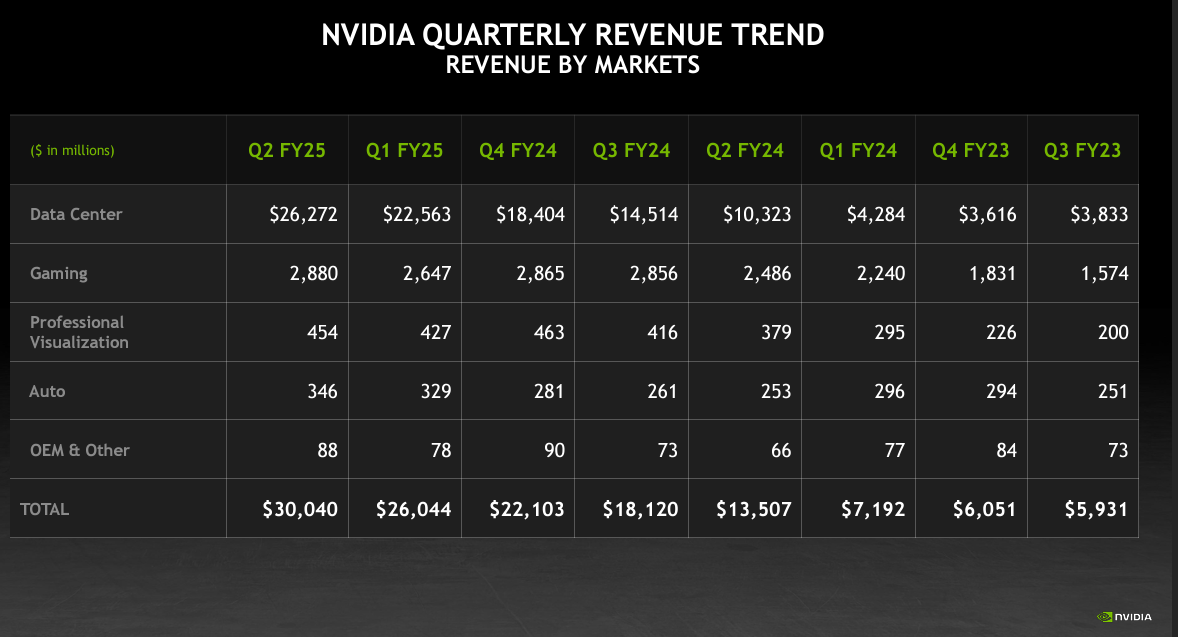

The company reported second quarter net income of $16.6 billion, or 67 cents a share, on revenue of $30.04 billion, up 122% from a year ago. Non-GAAP earnings for the second quarter were 68 cents a share. Wall Street was expecting Nvidia to report second quarter non-GAAP earnings of 64 cents a share on revenue of $28.73 billion.

Data center revenue in the second quarter was $26.3 billion, up 154% from a year ago.

As for the outlook, Nvidia projected third quarter revenue of about $32.5 billion with non-GAAP gross margins about 74.4% to 75%. For the third quarter, analysts were modeling earnings of 71 cents a share on revenue of $31.75 billion.

CEO Jensen Huang said:

"Hopper demand remains strong. Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and NVIDIA AI Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform. Across the entire stack and ecosystem, we are helping frontier model makers to consumer internet services, and now enterprises."

- The generative AI buildout, overcapacity and what history tells us

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

Going into the quarter, Constellation Research CEO Ray Wang noted that Nvidia is the bellwether for AI and the spending on genAI infrastructure is still strong. “This buying cycle will continue for about two more quarters and then we’ll see a pullback,” said Wang. “That said Nvidia is priced for perfection right now”

Key themes from CFO Colette Kress:

- “Data Center revenue was a record, up 154% from a year ago and up 16% sequentially. The strong sequential and year-on-year growth was driven by demand for our Hopper GPU computing platform for training and inferencing of large language models, recommendation engines, and generative AI applications. Sequential growth was driven by consumer internet and enterprise companies. Cloud service providers represented roughly 45% of our Data Center revenue, and more than 50% stemmed from consumer internet and enterprise companies.”

- “Networking revenue was $3.7 billion, up 114% from a year ago driven by InfiniBand and Ethernet for AI revenue, which includes Spectrum-X end-to-end ethernet platform.”

- “We shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.”

- “Inventory was $6.7 billion with 81 days sales of inventory (DSI). Purchase commitments and obligations for inventory and manufacturing capacity were $27.8 billion, including new commitments for Blackwell capacity and components. Prepaid supply agreements were $4.7 billion.”

- The company has authorized another $50 billion to buy back shares.

Speaking on the earnings call, Huang made the following points:

- Hopper demand remains strong even as Blackwell looms because the upgrade path is simple and companies are moving from traditional data centers.

- "Generative AI is a fundamental new form of computer science. It's affecting how every layer of computing is done, from CPU to GPU, from human engineered algorithms to machine learning algorithms, and the type of applications you could now develop and produce."

- "We have to continue to drive the generational performance up quite significantly so we can drive down the energy consumed and drive down the cost necessary to do it."

- "A generative AI company spends the vast majority of their invested capital into infrastructure so that they could use an AI to help them create products. And so these companies need it now."

Nvidia’s software game

Nvidia this week outlined a series of announcements that may highlight the company’s real moat: The ability to leverage its software ecosystem to boost performance. In addition, Nvidia is looking to make it easier for enterprises to bring generative AI projects from pilot to production.

Among the key highlights:

- Nvidia highlights algorithmic research as it moves to FP4

- Nvidia launches NIM Blueprints aims for more turnkey genAI use cases

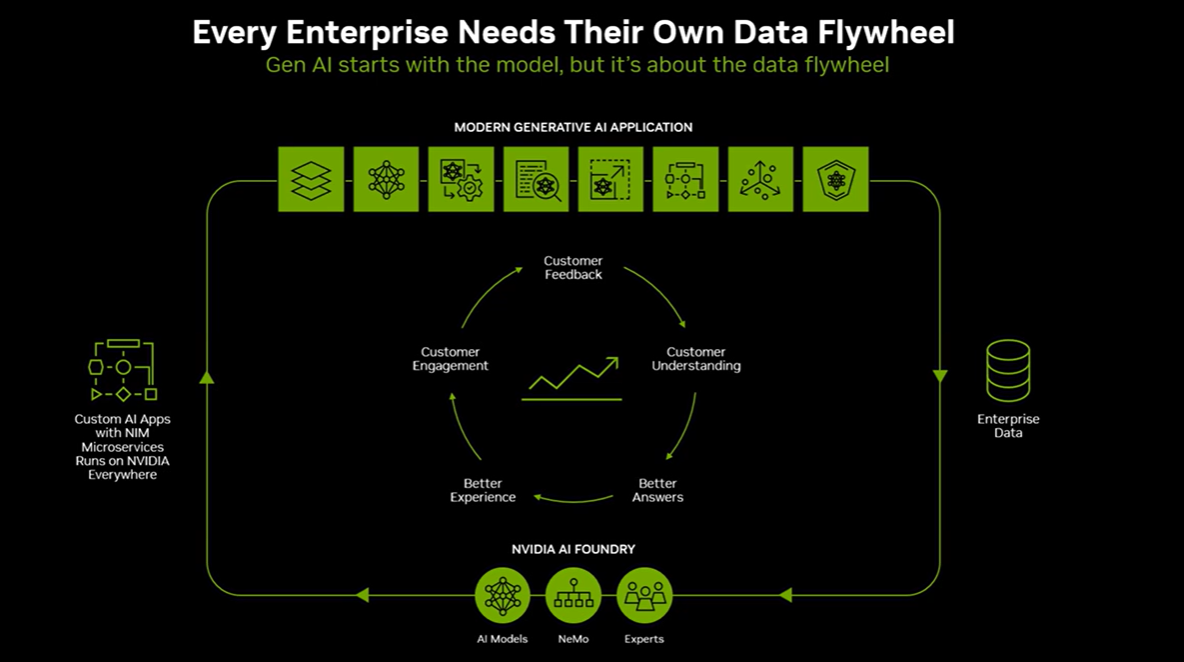

According to Nvidia, NIM Agent Blueprints are a jump start and designed to be modified and enhanced with what the company calls a "data-driven generative AI flywheel." NIM Agent Blueprints are free to download for developers and can be deployed via Nvidia AI Enterprise.

Nvidia's Justin Boitano, vice president of enterprise AI software products, said: "The first wave of generative AI was really the infusion of AI into internet scale services driven by makers of foundation models and expanded into productivity tools. The next wave is really starting now, and it represents a bigger business process transformation that's going to affect how teams work across an enterprise. AI is going to help teams reason through complex business decisions."

- Why aren't genAI projects scaling? Data issues, says Deloitte

- 14 takeaways from genAI initiatives midway through 2024

- Enterprises start to harvest AI-driven exponential efficiency efforts

- Secrets to a Successful AI Strategy

Constellation Research analyst Holger Mueller said: "Nvidia's NIM Agent Blueprints offering should enable enterprises to uptake AI faster to power their next generation applications. As expected the AI game is becoming a little more about the software (than the hardware)."

Previously:

- Nvidia outlines roadmap including Rubin GPU platform, new Arm-based CPU Vera

- Nvidia's 10Q filing sets off customer guessing game

- Nvidia acquires Run.ai for GPU workload orchestration

- Nvidia Huang lays out big picture: Blackwell GPU platform, NVLink Switch Chip, software, genAI, simulation, ecosystem

- Nvidia today all about bigger GPUs; tomorrow it's software, NIM, AI Enterprise