Nvidia reported strong first quarter results as its data center demand remains strong. The company’s writedown for H20 chips designed for China was also lower than expected.

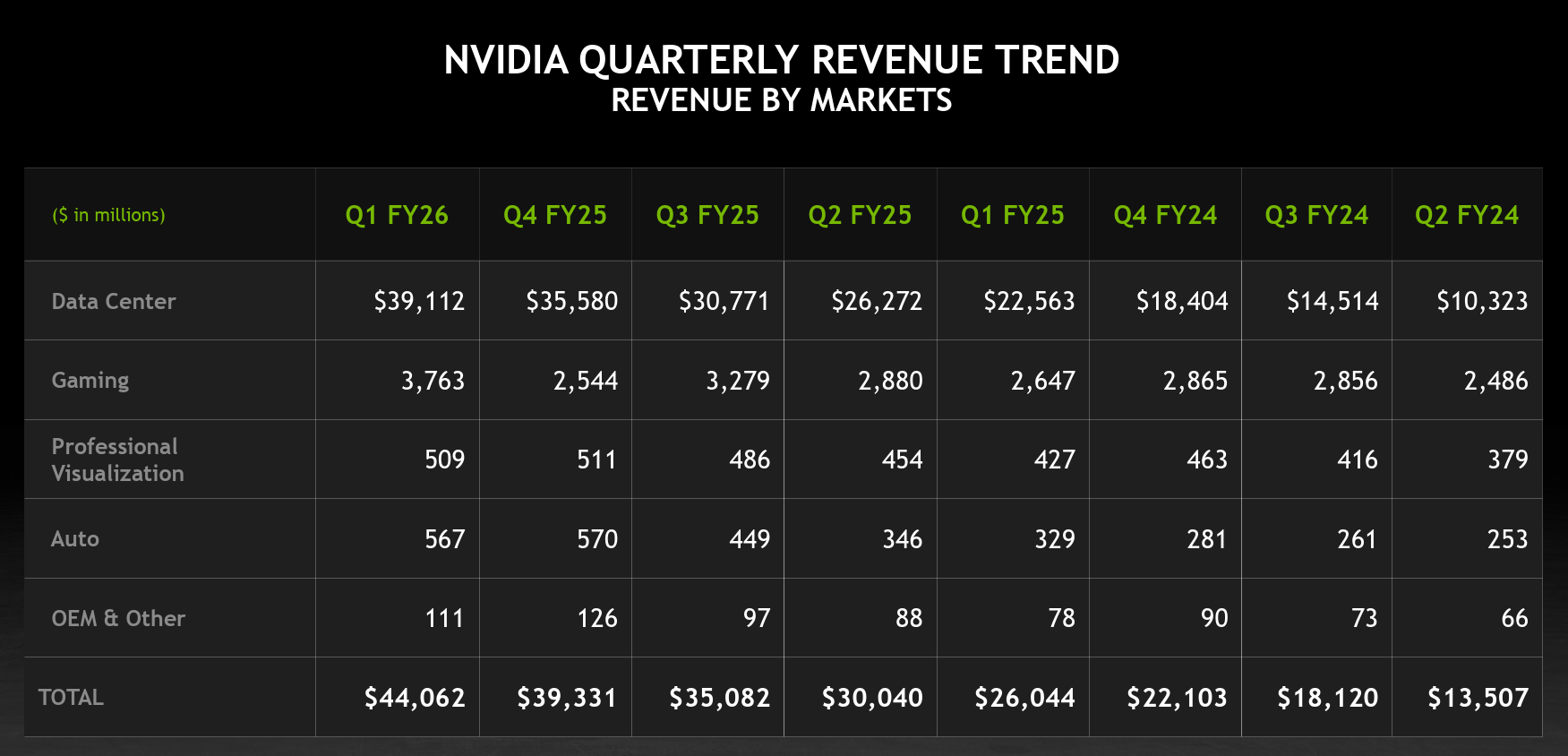

The company reported first quarter earnings of 76 cents a share on revenue of $44.1 billion, up 69% from a year ago. Of those sales, data center revenue was $39.1 billion, up 73% from a year ago. Excluding a writedown of $4.5 billion, non-GAAP first quarter earnings would have been 96 cents a share.

Wall Street was expecting Nvidia to report non-GAAP earnings of 75 cents a share on revenue of $43.25 billion. Nvidia previously said it will take a $5.5 billion inventory charge due to chips it can’t sell in China due to US bans.

- Nvidia launches NVLink Fusion to connect any CPU with its GPU, AI stack

- Nvidia NeMo Microservices generally available, aims for AI agent data flywheel

- Nvidia GTC 2025: Six lingering questions

- Nvidia launches DGX Spark, DGX Station personal AI supercomputers

- Nvidia launches Blackwell Ultra, Dynamo. outlines roadmap through 2027

Going into the results, Nvidia’s quarter was expected to be messy due to the charges due to export controls to China. Sales of H20 products destined for China in the first quarter were $4.6 billion. Nvidia said it was unable to ship an additional $2.5 billion of H20 revenue in the first quarter.

Nvidia CEO Jensen Huang said the company’s Blackwell NVL72 AI supercomputer is now in full-scale production across systems and cloud computing providers. “Global demand for Nvidia’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate,” said Huang.

CFO Colette Kress said in prepared remarks:

“We saw our Blackwell architecture ramp expand to all customer categories, while large cloud service providers remained our largest at just under 50% of Data Center revenue. Data Center compute revenue was $34.2 billion, up 76% from a year ago and up 5% sequentially. Networking revenue was $5.0 billion, up 56% from a year ago and up 64% sequentially, driven by the growth of NVLink compute fabric in our GB200 systems and continued adoption of Ethernet for AI solutions at cloud service providers and consumer internet companies.”

As for the outlook, Nvidia projected revenue of $45 billion including a loss of $8 billion due to H20 revenue.

Here's what Huang had to say on the earnings call:

- "On export control, China is one of the world's largest AI markets and a springboard to global success with half of the world's AI researchers based there, the platform that wins China is positioned to lead globally today. However, the $50 billion China market is effectively closed to us."

- "China's AI moves on, with or without us. The question is not whether China will have it. It already does. The question is whether one of the world's largest AI markets will run on American platforms, shielding Chinese chip makers from us. Competition only strengthens them abroad and weakens America's position. Export restrictions have spurred China's innovation and scale. The AI race is not just about chips, it's about which stack the world runs on. The US has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable, and now it's clearly wrong."

- "It's very clear that every company will have AI factories, and very soon there'll be robotics companies and those companies will be also building AI to drive the robots. We're at the beginning of all of this build out."

- "We're also increasing our supply chain and building out our supply chain. They're doing a fantastic job. We're building it here onshore, United States, but we're going to keep our supply chain quite busy for several, many more years coming."

Constellation Research analyst Holger Mueller said:

"Nvidia keeps firing on all cylinders, and beats expectations despite regulatory writedowns. Nothing seems to be able to stop Jensen Huang and company. With its deals in the Middle East, Nvidia is planting the seeds for a few $100 billion in future revenue from sovereign cloud. We also know now what role China revenue could have been given the writedowns. With all the data center revenue, the other Nvidia business don't have to do well, but the question one can ask is why the automotive business is not taking off."