Monday.com said it is landing more CRM customers and large enterprise accounts as it outlined plans to double-down on its strategy with a consumption model for AI.

The company, which offers work management software and has expanded with MondayDB and CRM, reported strong fourth quarter earnings and said it will continue to invest in AI.

Monday.com's results highlight how work management has become a popular category as the company dukes it out with Smartsheet and Asana. Monday.com's annual recurring revenue surpassed the $1 billion mark. Atlassian is also making a work management play and highlighted gains on its most recent quarter.

- Smartsheet to go private in deal valued at $8.4 billion

- Smartsheet vs. Asana vs. Monday: What you need to know

Co-CEO Roy Mann said on an earnings conference call:

"We continue to make considerable progress in our multi-product strategy. Monday CRM has exceeded expectations, and we added a record number of net new accounts for both CRM and dev during the year."

Mann also touted AI features including AI capabilities throughout the platform. In the fourth quarter, customers performed about 10 million AI actions. Mann noted that AI agents via Monday.com or third parties can also be a boon to drive consumption.

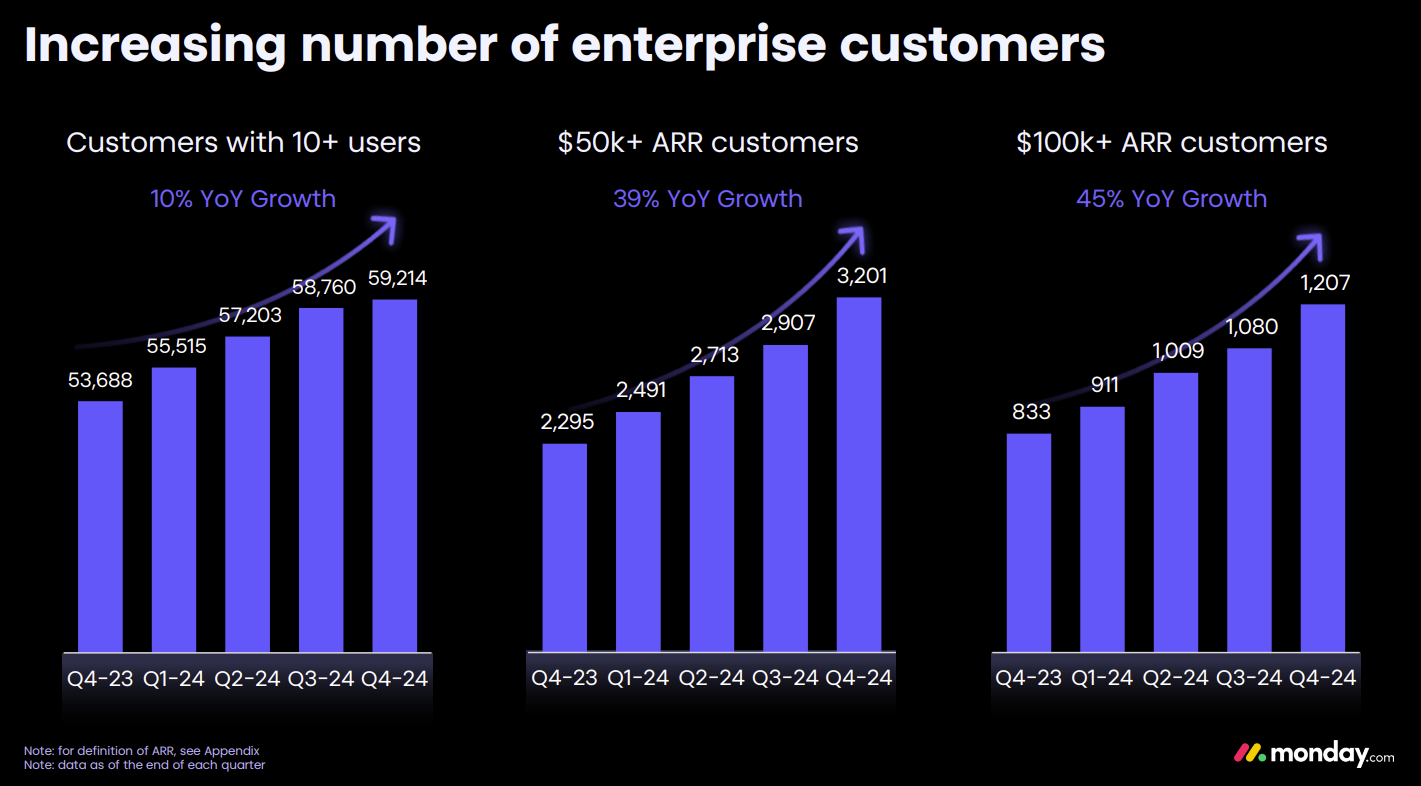

A move upstream also helped Monday.com. "One of the most significant milestones of 2024 was our strategic expansion into the enterprise market. We successfully grew our largest seat count to 80,000 seats, signaling strong adoption and deepening enterprise customer engagement," said Mann.

Monday.com's AI pricing model revolves around flexible consumption with a baseline level of free usage in all plans. As usage increases, Monday.com customers can buy more AI blocks of capacity.

This AI operating model is starting to gain traction across enterprises including ServiceNow and Salesforce. ServiceNow aims for 'Goldilocks' software model, SaaS industry likely to follow

Eran Zinman, Co-CEO, said Monday.com, said the company will focus on providing AI blocks that can automate tasks and focus on use cases.

Zinman said:

"In 2025, our AI strategy will be focused on three main areas. AI Blocks; Product Power-ups; and Digital Workforce. AI Blocks will be expanded to provide more advanced ways to automate tasks. Through Product Power-ups, AI will be deeply integrated into each product to address specific user needs. And finally, the digital workforce will include AI agents like Monday expert, Deal Facilitator, and Service Analyzer, which will offer actionable insights and streamlined processes for users."

These plans highlight how Monday.com focuses on the art of consumption. The company wants to give you enough of a free tier to gain usage and then leverage workflow automation to drive more consumption.

Monday.com will include 500 free AI Credits per month with the option to purchase more capacity from 2,500 credits to 250,000 credits.

Results and outlook

Monday.com reported fourth quarter earnings of 43 cents a share on revenue of $268 million, up 32% from a year ago. Non-GAAP earnings in the quarter were $1.08 a share.

For 2024, Monday.com reported earnings of 62 cents a share on revenue of $972 million, up 33% from a year ago. As for the outlook, Monday.com projected first quarter revenue between $274 million and $276 million, up 26% to 27%. For 2025, Monday.com expects revenue of $1.208 billion to $1.221 billion.

Zinman noted that demand has been solid across all regions, but 2025 is likely to be unpredictable. He said:

"This year is more unpredictable when you compare it to prior years. The geopolitical situation across the world is to a certain extent, there are something that you can't really predict. So this is also something that we took into account as part of our guidance."

Another wild-card for Monday.com is that its expanding product lineup each has a different go-to-market strategy and sales motion.

Monday.com ended the quarter with 245,000 customers and can do well expanding within its customer base by cross-selling. To that end, Monday.com is ramping its sales capacity and adding people.