MicroStrategy has transformed its offerings with cloud, artificial intelligence and a unified platform that runs on all three big hyperscalers. But you'd never really know it since MicroStrategy is best known as a bitcoin development company.

When MicroStrategy reported its fourth quarter earnings I got a serious case of whiplash. Sure, I'm used to companies that have multiple businesses and tech conglomerates. But the dueling banjos with MicroStrategy CEO Phong Le, CFO Andrew Kang and Executive Chairman Michael Saylor was jarring. One minute MicroStrategy is talking like a Bitcoin ETF and investor and the next minute we’re transitioning from perpetual licenses to cloud subscriptions.

The two businesses--business intelligence and analytics software and Bitcoin investing--only go together because they reside in one company. The other thread is that the software business helps fund investments in bitcoin. MicroStrategy is the largest corporate holder of bitcoin on its balance sheet.

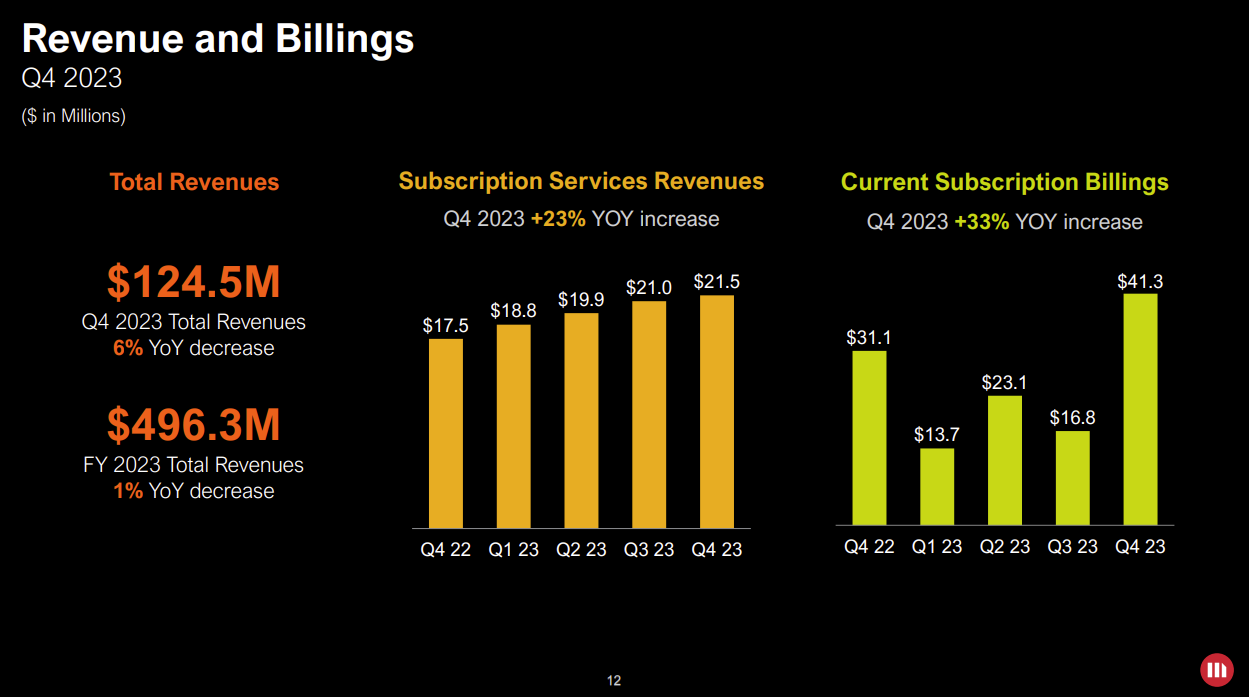

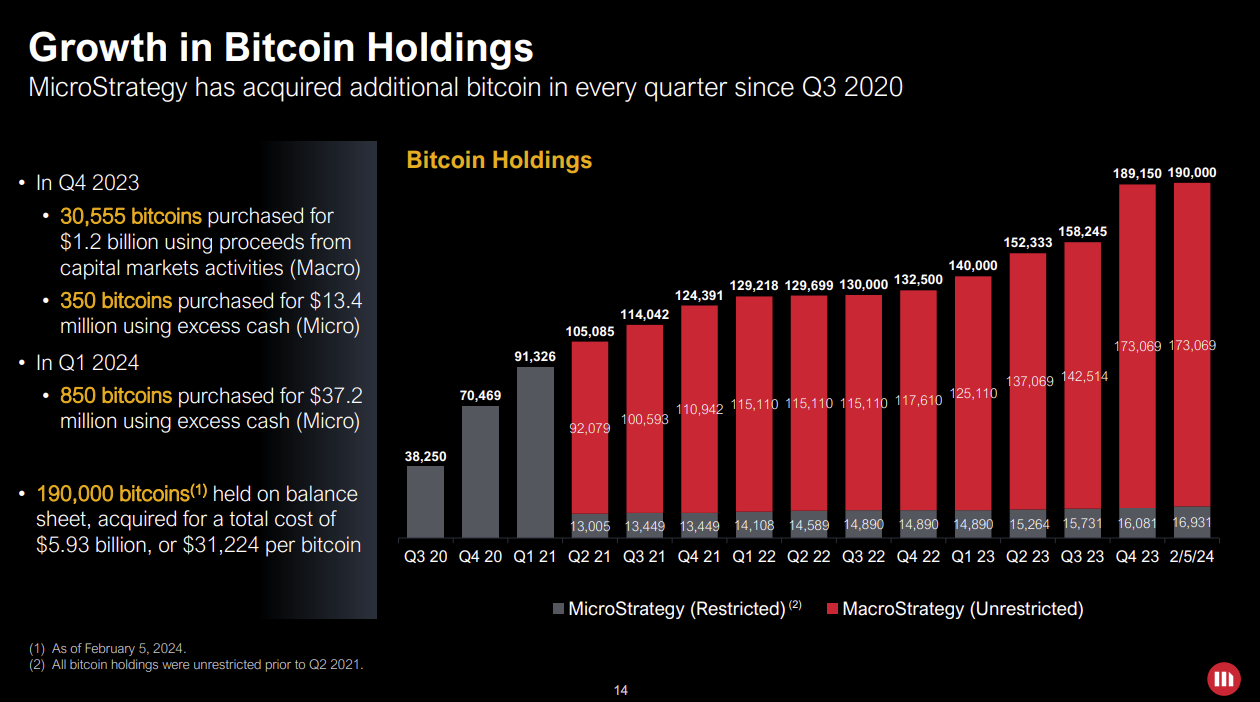

Indeed, MicroStrategy's fourth quarter earnings press release touted holdings of 190,000 bitcoins at a total cost of $5.93 billion. And oh by the way, MicroStrategy revenue (the software business) was $124.5 million, down 6% from the previous year, and net income was $89 million including a $150 million tax benefit. Le noted that MicroStrategy has a unique model but drives shareholder value.

Given MicroStrategy's enterprise installed base it would almost make sense to have separate calls--one on the software business and one on the bitcoin investing. Simply put, MicroStrategy can be confusing to enterprise buyers even as it's loved by Wall Street.

Le explained (or tried to) on an earnings conference call:

"With our bitcoin strategy being so significant to our overall business value, while we also continue to pursue growth in our enterprise analytics business, some may ask, what kind of a company is MicroStrategy now? It's a fair question and a question that takes on even more significance with the approval of Spot Bitcoin ETFs in the United States. We consider MicroStrategy to be unique. We consider MicroStrategy to be the world's first bitcoin development company.

Let me explain what we mean. We are a publicly traded operating company committed to the continued development of the bitcoin network through activities in the financial markets, advocacy, and technology innovation. As an operating business, we're able to use cash flows as well as proceeds from equity and debt financing to accumulate bitcoin, which serve as our primary treasury reserve asset. We also develop and provide industry leading AI powered enterprise analytics software that promotes our vision of intelligence everywhere and are also using our software development capabilities to develop bitcoin applications. We believe that the combination of our operating structure, bitcoin strategy, and focus on technology innovation provides a unique opportunity for value creation."

Perhaps you get MicroStrategy and how it fits together, but CIOs need to focus. After all, a buying decision can't be made on how much bitcoin a vendor owns.

Here's a look at the key points about MicroStrategy's software business for CIOs.

- Le said that MicroStrategy has had its most transformative year with the launch of MicroStrategy One, MicroStrategy AI and MicroStrategy Cloud for Microsoft Azure, AWS and Google Cloud. "

- MicroStrategy boasts that it is the largest independent business intelligence company. It competes with Qlik, Salesforce Tableau, Microsoft's PowerBI and SAP among others.

- There are 1,900 employees focused on the software business.

- Subscription revenue for 2023 was $81.2 million, up 34% from a year ago. However, product license revenue is falling as product support and maintenance is flat. Support and maintenance revenue was $263.89 million in 2023, down from $266.5 million in 2022.

- The MicroStrategy transition to a cloud model has been done before. In general, the company's software business will see lumpy quarters for roughly a year to 18 months before growing again. "The strong growth in our subscription services revenue was driven by both existing customer migrations to the cloud and new customer wins," said Le, who noted that 2024 will be a transition year as support and license revenue falls and subscription revenue grows.

- MicroStrategy has launched a customer success organization to improve experience, onboarding, adoption, migration and upsell. The company has also rebuilt its marketing team and just named a CMO.

- Partners include Microsoft, AWS, Google and Snowflake.

- Le said that the software business is the core revenue and cash flow generator and allows MicroStrategy to acquire bitcoin. He did note that MicroStrategy can pursue software innovations that leverage the bitcoin blockchain.

- In 2024, MicroStrategy will focus on AI and BI and accelerate the transition to a cloud model. MicroStrategy will also launch a private cloud version later this year.

- The game plan is to make MicroStrategy Cloud the most flexible and easy to deploy.

Add it up and MicroStrategy is hoping to sit at the intersection of AI and BI. "Our platform's AI/BI capabilities enable customers to automate their BI workflows, including building data wrangling, dashboard creation, and data exploration. This elevates the role of data throughout the organization, allowing companies to make better database decisions and take actions," said Le, who also highlighted the company's large language model development with MicroStrategy AI.

In the end, MicroStrategy's overshadowed AI-BI software is worth a look. The platform sits on two Constellation Research shortlists and Le noted that CXOs are interested in moving MicroStrategy workloads to the cloud.

- Constellation ShortList™ Embedded Analytics

- Constellation ShortList™ Multicloud Analytics and Business Intelligence Platforms

And about that bitcoin plan...

Whether you buy into MicroStrategy's bitcoin play or not is up to you. Saylor is positioning the company's strategy as one that revolves around the digital transformation of capital.

Saylor said:

"Bitcoin is up 260% since we embarked on our bitcoin strategy. That's why it's outperforming the S&P and the NASDAQ. That's why it's outperforming gold, silver and bonds. Bitcoin isn't a company. And it's profoundly important to understand that it's not a company, it's an asset class. And as such, based on a commodity, it has spawned an entire universe of companies, products, and services built on that asset class. So part of the driver of bitcoin's performance is not just its protocol and superior fundamental characteristics, but another driver is the industry of bitcoin miners that secure the network and bitcoin custodians and a set of bitcoin exchanges."

MicroStrategy has published its bitcoin development playbook and Saylor said that new bitcoin ETFs will take the digital asset mainstream. Saylor said MicroStrategy has control over its capital structure and will do whatever it can to advance the bitcoin network and acquire digital assets.

Ultimately, MicroStrategy will develop bitcoin network applications. "As we develop this software, we will release it either to the benefit of the bitcoin network or we'll release it to generate more revenue and work to generate more cash flow so that we can buy more bitcoin. Another thing that we can do uniquely as an operating company is, we can generate cash from operations," said Saylor.

According to Le, CIOs shouldn't fret about bitcoin development. Le said:

"On the R&D piece, we will invest more in R&D into bitcoin software development. It will not be at the expense of our business intelligence and AI and cloud-based software development. Some of the things that we've been doing, you've seen at our Bitcoin and Lightning and MicroStrategy World event last year, where we implemented a Lightning Rewards program on the Layer 2 network. We're also looking at some things that will leverage the native bitcoin blockchain technology, some security applications that we'll reveal at our next MicroStrategy World Conference."

MicroStrategy World be held in Las Vegas April 29 to May 2 in Las Vegas and features a Business Intelligence track and Bitcoin for Corporations track.