Microsoft delivered a better-than-expected fourth quarter and said Azure revenue growth was up 29%.

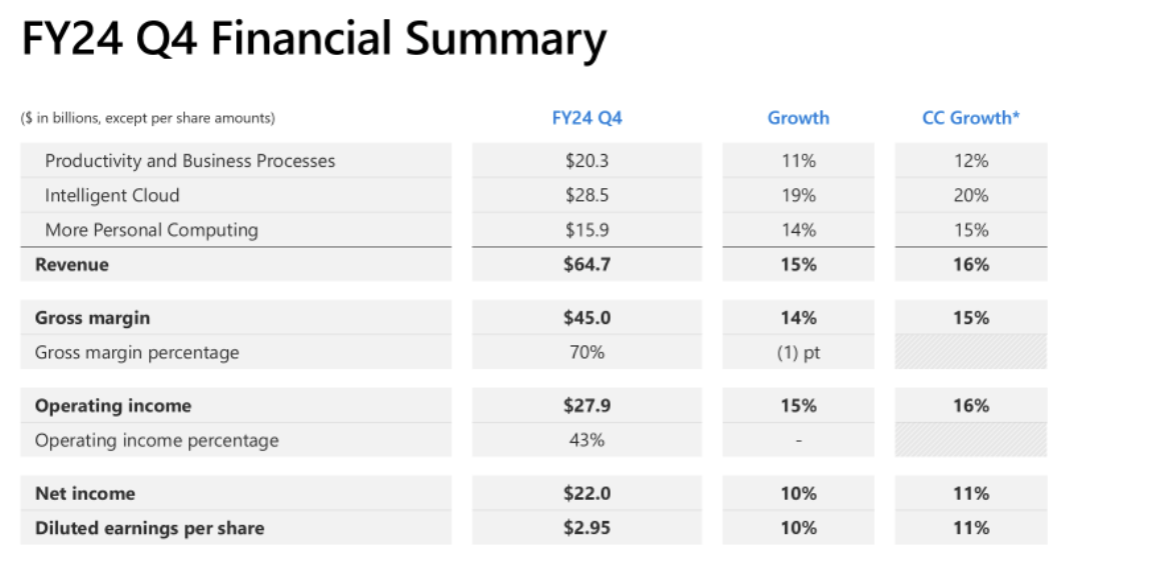

The company reported fourth quarter net income of $22 billion, or $2.95 a share, on revenue of $64.7 billion, up 15% from a year ago.

Wall Street was expecting Microsoft to report fourth quarter earnings of $2.93 a share on revenue of $64.39 billion. Microsoft’s cloud business was expected to show fourth quarter growth of about 30%.

Microsoft CEO said the company is focused on meeting at-scale workloads for AI. CFO Amy Hood noted that Microsoft Cloud revenue in the quarter was $36.8 billion, up 21% from a year ago.

- OpenAI and Microsoft: Symbiotic or future frenemies?

- Microsoft raises Dynamics 365 prices starting Oct. 1

- Microsoft expands at Coca-Cola as part of multi-cloud strategy that includes AWS

- ServiceNow to integrate Now Assist with Microsoft Copilot

- The real reason Windows AI PCs will be interesting

For fiscal 2024, Microsoft reported net income of $88.1 billion, or $11.80 a share, on revenue of $245.1 billion, up 16% from a year ago.

By the fourth quarter numbers:

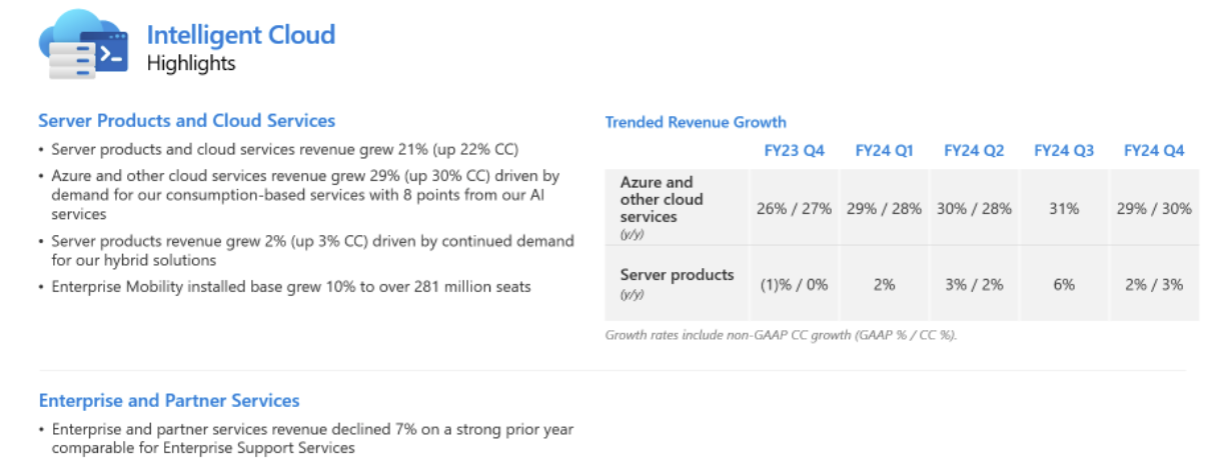

- Intelligent Cloud operating income was $12.86 billion followed by Productivity and Business Processes operating income of $10.14 billion.

- More Personal Computing operating income was $4.92 billion.

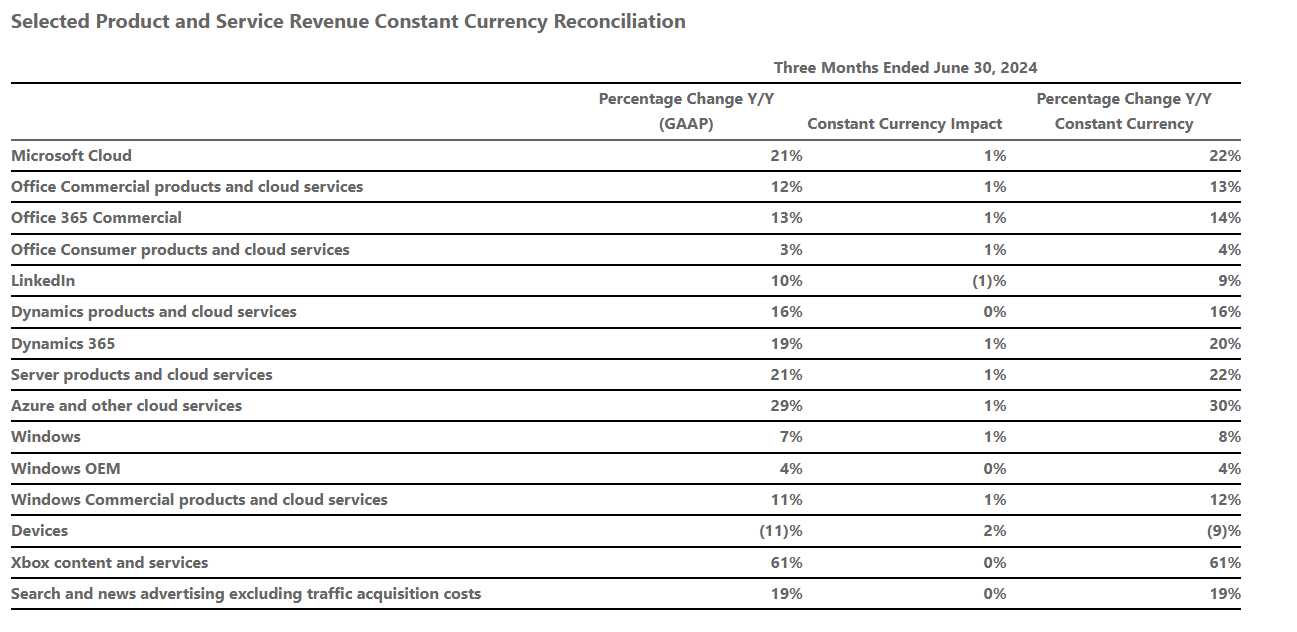

- Office Commercial revenue ws up 12% and Office Consumer revenue was up 3%.

- LinkedIn revenue was up 10%.

- Dynamics 365 revenue growth was 19%.

- Windows revenue was up 7%.

Microsoft said first quarter revenue will be between $63.8 billion and $64.8 billion.

Takeaways from the conference call include:

- Microsoft is adding Azure AI customers, but remains capacity constrained. Nadella said: "We now have over 60,000 Azure AI customers, up nearly 60% year-over-year, and average spend per customer continues to grow."

- Models as a service customers doubled sequentially in the fourth quarter.

- Copilot accounted for 40% of GitHub's revenue growth in the fourth quarter. Nadella said Copilot was driving growth across the portfolio. He said: "Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees."

- Capital expenditures will continue to grow for the AI buildout. Hood said: "Capital expenditures including finance leases were $19 billion, in line with expectations, and cash paid for PP&E was $13.9 billion. Cloud and AI related spend represents nearly all of total capital expenditures. Within that, roughly half is for infrastructure needs where we continue to build and lease datacenters that will support monetization over the next 15 years and beyond. The remaining cloud and AI related spend is primarily for servers, both CPUs and GPUs, to serve customers based on demand signals. For the full fiscal year, the mix of our cloud and AI related spend was similar to Q4."

- The genAI payoff will take time for Microsoft and will drive growth across the product line, said Nadella. He added: "At the end of the day, GenAI is just software. So it is really translating into fundamentally growth on what has been our M365 SaaS offering with a newer offering that is the Copilot SaaS offering, which today is on a growth rate that's faster than any other previous generation of software we launched as a suite in M365. That's, I think, the best way to describe it."