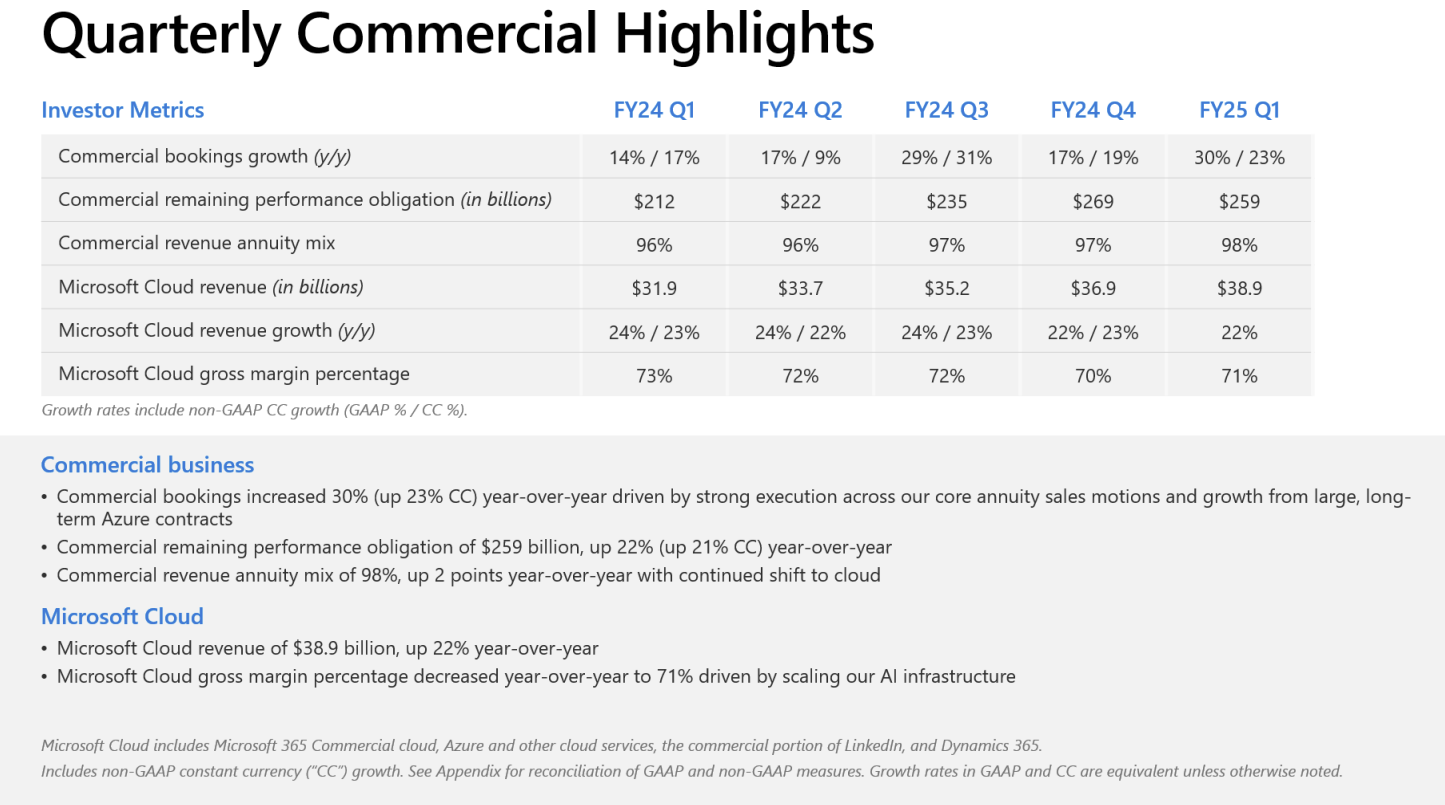

Microsoft reported better-than-expected first quarter earnings as commercial cloud revenue was up 22% and Azure grew 33% from a year ago.

The company reported first quarter net income of $24.7 billion, or $3.30 a share, on revenue of $65.6 billion, up 16% from a year ago.

Wall Street was looking for first quarter earnings of $3.10 a share on revenue of $64.51 billion.

Microsoft CEO Satya Nadella said AI is "expanding our opportunity and winning new customers."

CFO Amy Hood said the company's first quarter execution "delivered a solid start to our fiscal year."

As for the outlook, Microsoft said second-quarter revenue will be between $68.1 billion to $69.1 billion. Wall Street was expecting Microsoft to deliver second-quarter revenue of $69.83 billion.

Nadella said suppliers are late with data center infrastructure and the company won't be able to meet demand.

- Microsoft launches AI agents for Dynamics 365, customization via Copilot Studio

- Microsoft outlines Copilot agents for enterprises

- Microsoft Build 2024: Microsoft Fabric opens up, adds real-time intelligence, Snowflake, Databricks connections

Key points:

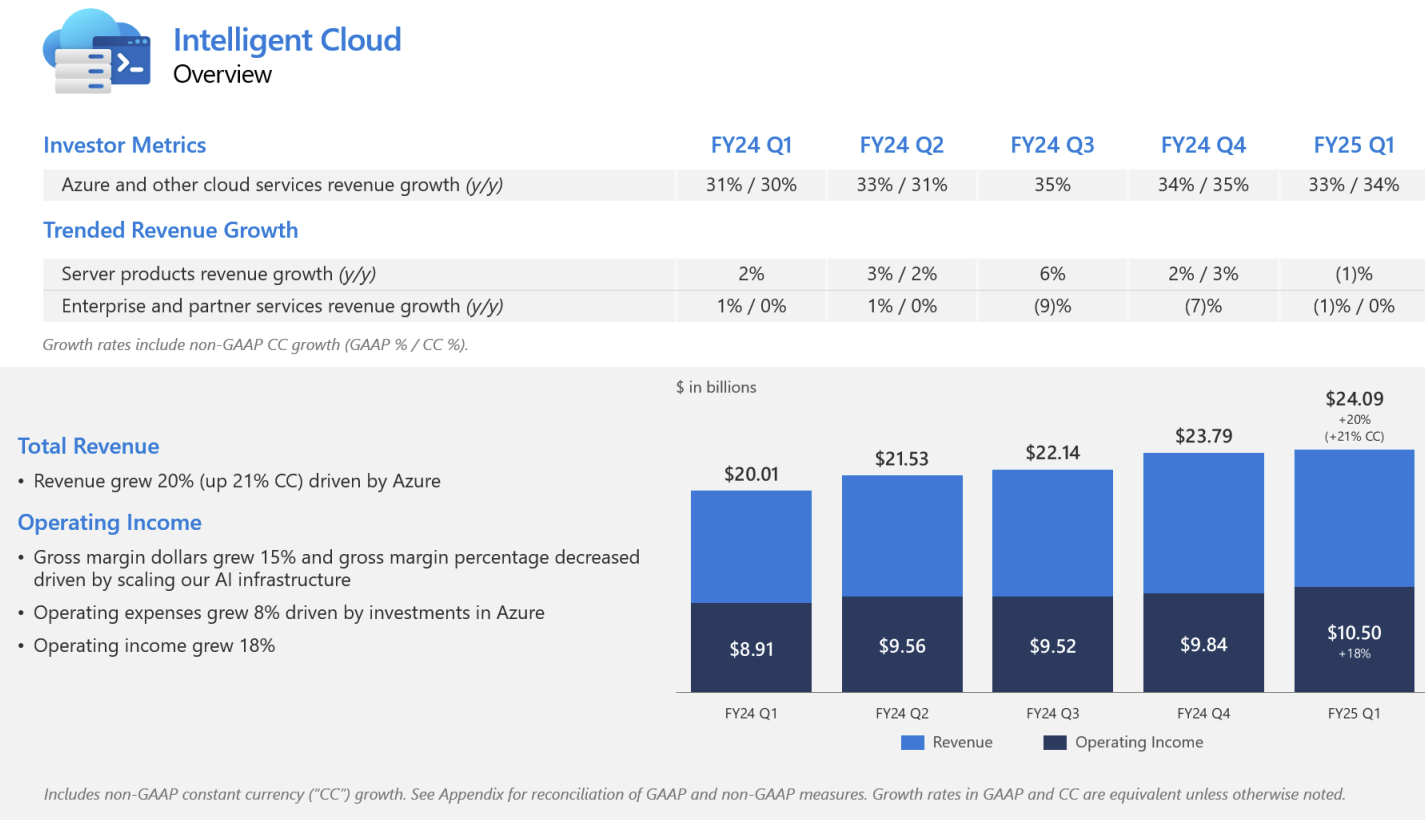

- Azure revenue was up 33%.

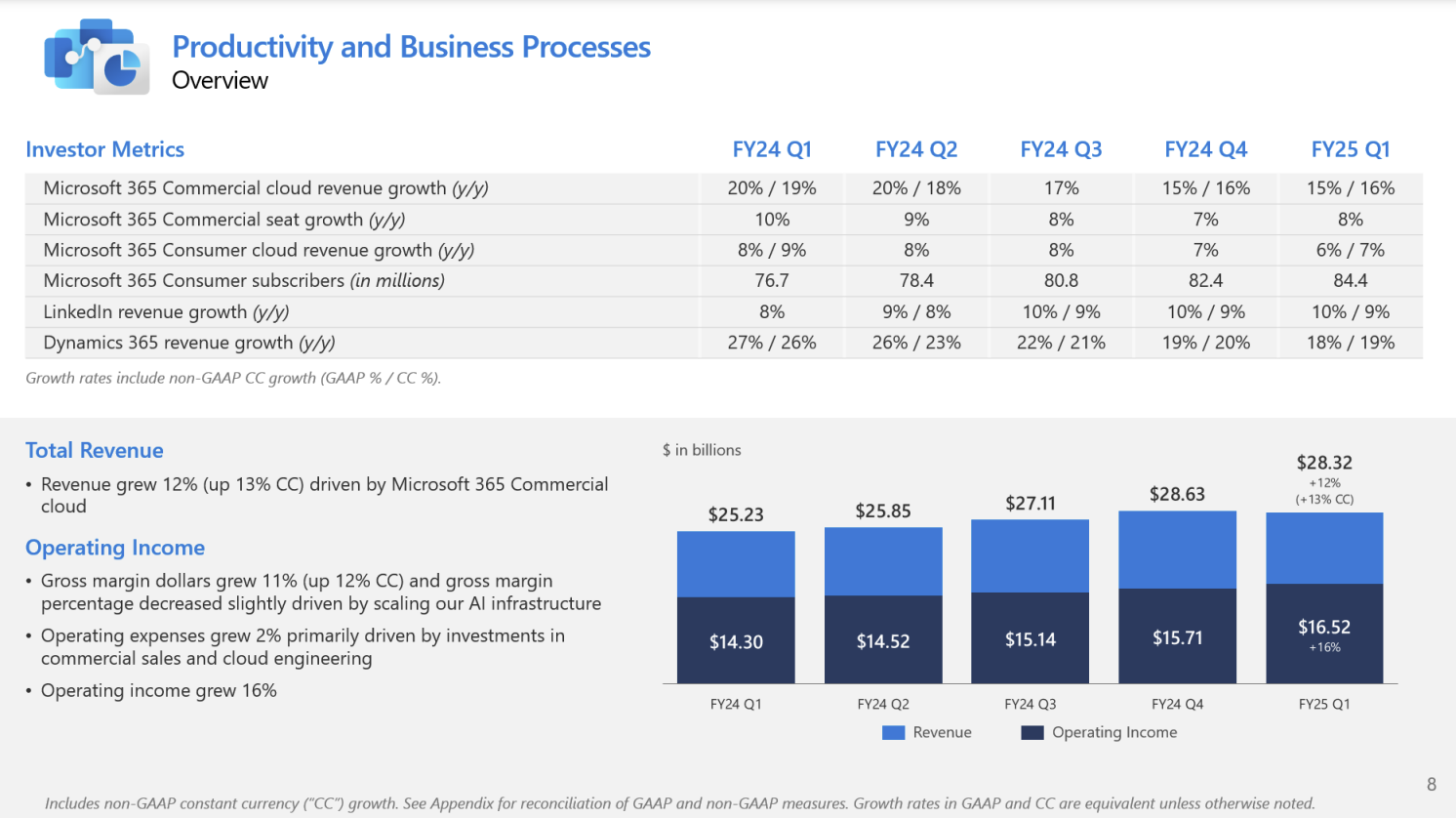

- Microsoft 365 Commercial products and cloud services revenue was up 13% from a year ago.

- Microsoft 365 Consumer products and cloud services revenue was up 5%.

- LinkedIn revenue was up 10%.

- Dynamics 365 revenue growth was up 18%.

Speaking on an earnings conference call, Nadella said:

"At the silicon layer, our new Cobalt 100 VMs are being used by companies like Databricks, Elastic, Siemens, Snowflake, and Synopsys to power their general-purpose workloads at up to 50% better price performance than previous generations. On top of this, we are building out our next-generation AI infrastructure, innovating across the full stack to optimize our fleet for AI workloads."

Nadella added that data centers (DCs) are a constraint. He said:

"We ran into a set of constraints, which are everything because DCs don't get built overnight. So, there is DCs, there is power. And so that's sort of been the short-term constraint. Even in Q2, for example, some of the demand issues we have or our ability to fulfill demand is because of, in fact, external third-party stuff that we leased moving up. So that's the constraints we have. But in the long run, we do need effectively power and we need DCs. And some of these things are more long lead."

Hood addressed capital expenditures.

"Capital expenditures, including finance leases, were $20 billion, in line with expectations, and cash paid for PP&E was $14.9 billion. Roughly half of our cloud and AI-related spend continues to be for long-lived assets that will support monetization over the next 15 years and beyond. The remaining cloud and AI spend is primarily for servers, both CPUs and GPUs, to serve customers based on demand signals."

She said that the capital expenses will pay off over time as capacity catches up to demand.

"In H2, we still expect Azure growth to accelerate from H1 as our capital investments create an increase in available AI capacity to serve more of the growing demand."