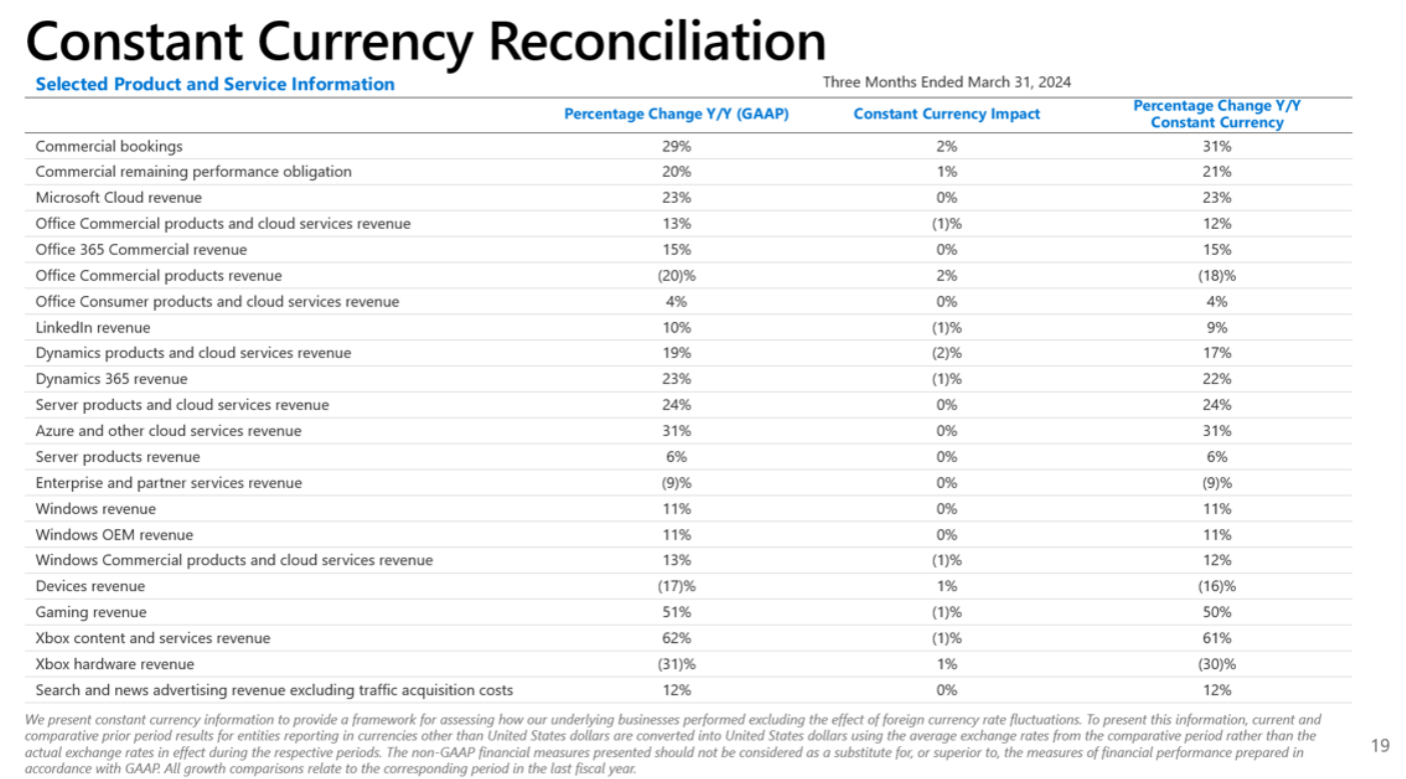

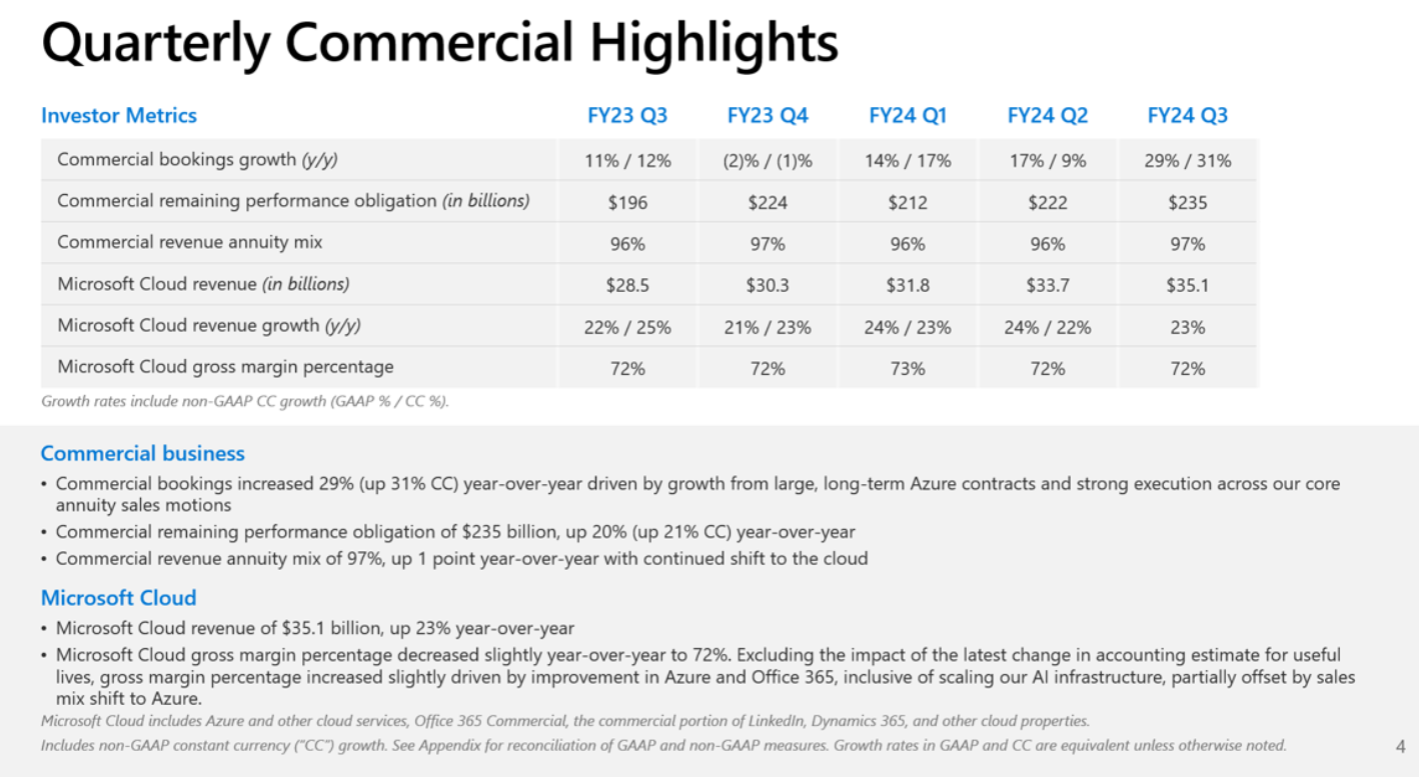

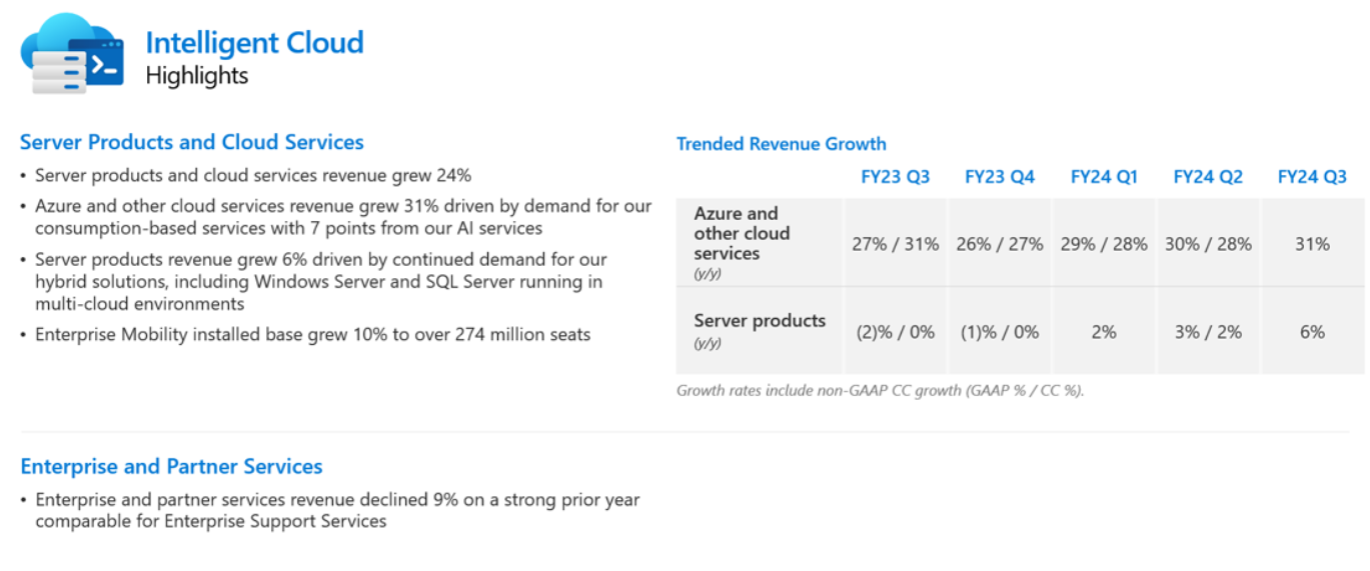

Microsoft reported a strong third quarter with revenue growth was 17% with Microsoft Cloud revenue up 23% from a year ago. Azure and other cloud services revenue growth was 31% driven by AI services.

The company reported third quarter net income of $21.9 billion, or $2.94 a share, on revenue of $61.9 billion. Wall Street was expecting Microsoft to report third quarter earnings of $2.84 a share on revenue of $60.89 billion.

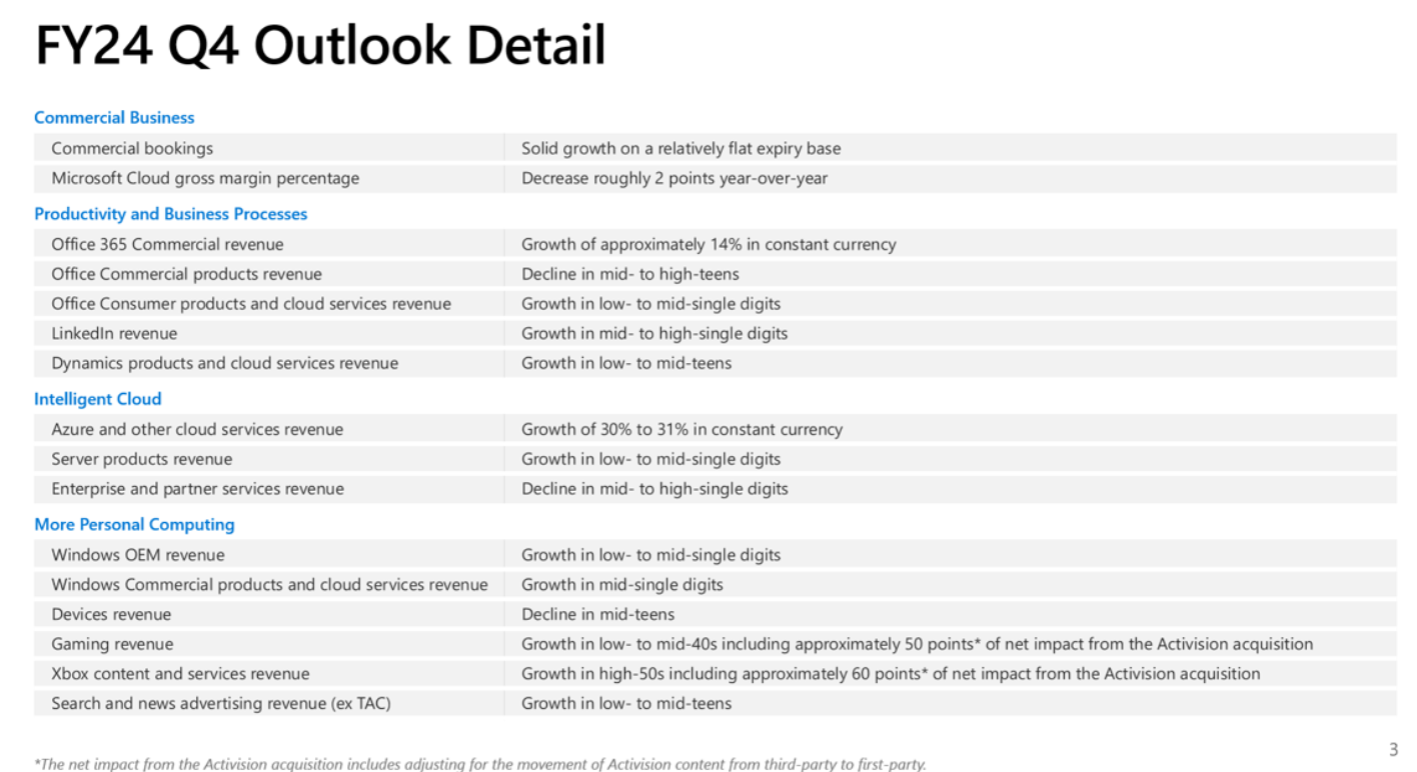

All eyes were on Azure and AI services. Here's the money slide:

Satya Nadella, CEO of Microsoft, said: "Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry."

CFO Amy Hood Microsoft had good sales execution for Microsoft Cloud.

Hood said capital expenses including finance leases were $14 billion to support cloud demand and AI infrastructure.

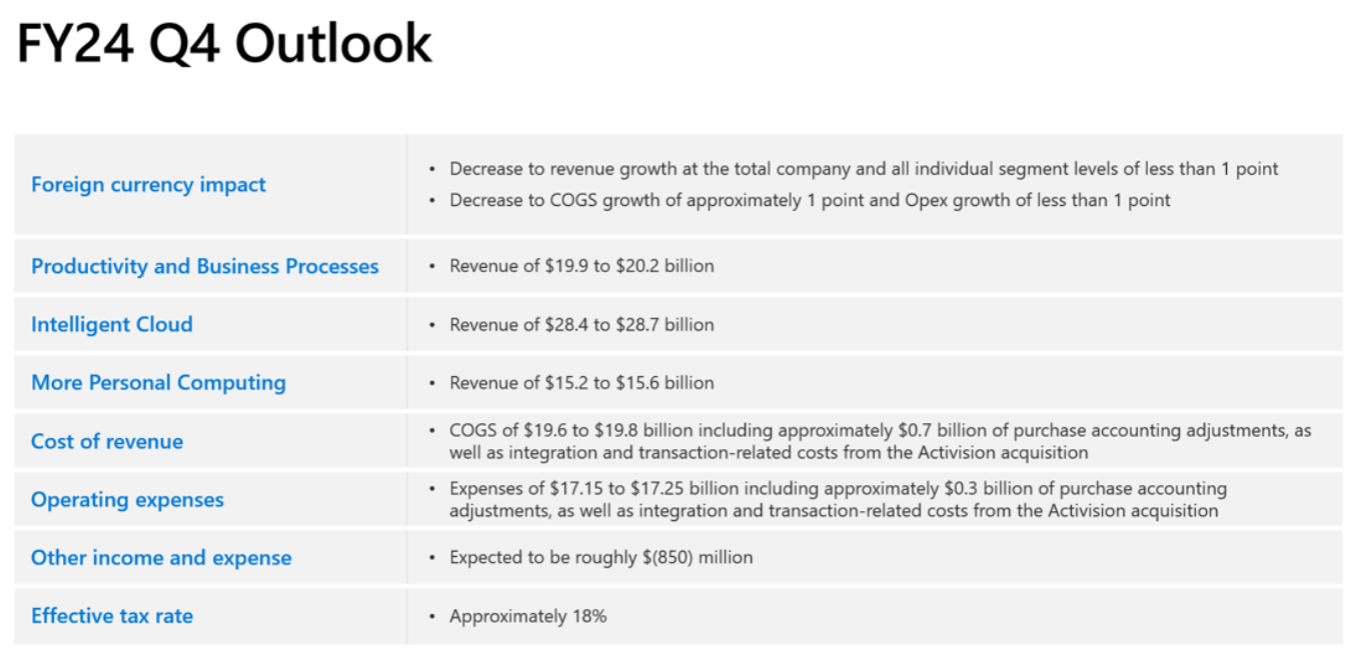

As for the outlook, Hood said fourth quarter revenue for intelligent cloud will be between $28.4 billion to $28.7 billion. She said demand is outpacing capacity. For the fiscal 2025 year, revenue will grow at a double digit clip with higher capital expenditures than fiscal 2024. Hood said:

"We continue to focus on building businesses that create meaningful value for our customers, and therefore significant growth opportunities for years to come. For FY 2025 that focus and execution should again lead to double digit revenue and operating income growth, to scale to meet the growing demand signal for our cloud and AI products. We expect FY 25 capital expenditures to be higher than FY 24 expenditures over the course of the next year are dependent on demand signals and adoption of our services. So we will manage that signal through the year."

The quarter in review:

- Microsoft names Suleyman head of consumer AI, Microsoft AI

- Microsoft expands at Coca-Cola as part of multi-cloud strategy that includes AWS

- Microsoft raises Dynamics 365 prices starting Oct. 1

- Microsoft's Copilot for Security will go for $4 an hour

- Quantinuum, Microsoft claim quantum reliability breakthrough

- Foundation model debate: Choices, small vs. large, commoditization

Key points from Nadella on the earnings conference call include:

- More than 65% of the Fortune 500 now use Azure OpenAI Service.

- Azure Arc has 33,000 customers.

- "We are seeing an acceleration in the number of large Azure deals from leaders across industries," he said.

- Half of Azure AI customers also use Microsoft's data and analytics products.

- Microsoft Fabric has more than 11,000 paid cusotmers.

- "We're also seeing increased usage and density from early adopters including a nearly 50% increase in the number of copilot assisted interactions per user in teams, bridging group activities and business processes, workflows and enterprise knowledge," he said.

- AI features are accelerating LinkedIn's Premium subscription growth.

Hood said commercial remaining performance obligation in the third quarter was $235 billion and 45% of that will be recognized in the next 12 months.

By business:

- Microsoft said revenue in productivity and business processes was $19.6 billion, up 13%, with strength in Office 365 Commercial.

- LinkedIn revenue was up 10%.

- Dynamics product and cloud services sales were up 19%.

- Revenue in intelligent cloud was $26.7 billion, up 21% from a year ago.

- Windows revenue was up 11%.