LogicMonitor raised $800 million in a move that's designed to accelerate its observability growth, fund mergers and acquisitions and expand into new markets and industries.

Under the terms of the deal, LogicMonitor controlling shareholder Vista Equity Partners sold a stake to a consortium of investors including PSG, Golub Capital and others. The investment values LogicMonitor at $2.4 billion including debt.

New Relic went private last year to accelerate its observability efforts in a deal valued at $6.5 billion. For reference, publicly traded observability players Datadog and Dynatrace have market caps at $45.3 billion and $15.4 billion, respectively. Splunk was acquired by Cisco for $28 billion last year.

The game plan for these observability vendors is to ride the AI wave. LogicMonitor CEO Christina Kosmowski said:

"We are a mission critical part of the AI race - in short, AI needs data centers. We are the connective tissue between AI and data center performance as we have the muscle, pedigree, and, most importantly, the data insights to advance the most important and life-altering AI initiatives."

In a blog post, Kosmowski said LogicMonitor is at an inflection point where it can scale. The investment “is a clear signal of the commitment to helping businesses unlock the full potential of AI and data center technologies—empowering them to work smarter, faster, and more responsibly,” she said.

LogicMonitor Adds AIOps Capabilities to Its Hybrid Observability Platform

The race

Observability is a hot space and LogicMonitor may need to bulk up with the additional funding to run with the larger players. LogicMonitor said that it has had a 36% compound annual growth rate in the last 5 years and has more than 2,400 customers.

For comparison, DataDog has more than 29,000 customers.

Constellation ShortList™ Observability

Olivier Pomel, CEO of Datadog, said the company's third quarter highlighted how customers are looking to observability vendors to expand into next-gen AI. "We kept broadening our platform in observability and beyond, including in next gen AI where interest continues to rise. And we added new customers while expanding with existing ones as they grow into the cloud," said Pomel.

Pomel added:

"We are seeing initial signs of traction for our LLM observability product. Today, hundreds of customers are using LLM observability, with more exploring it every day. And some of our first paying customers have told us that they have cut the time spent investigating LLM latency errors and quality from days to hours to just minutes.

Our customers don't only want to understand the performance and cost of the LLM applications, they also want to understand LLM model performance within the context of their entire application."

Datadog reported third quarter revenue of $690 million, up 26% from a year ago, with earnings of 14 cents a share. Non-GAAP earnings of 46 cents a share topped estimates.

Cisco's Splunk purchase is transforming the company. Observability revenue in Cisco's first quarter was up 36% including Splunk.

Dynatrace CEO Rick McConnell said:

"We believe that AI-driven observability is no longer optional. Organizations are expected to find issues and resolve the incidents before they impact customers. This can't be done efficiently in complex environments through reactive dashboard monitor. Rather, organizations need to be able to trust answers from an end-to-end observability platform to action issues automatically."

Dynatrace reported earnings of 15 cents a share in its fiscal second quarter (37 cents non-GAAP) on revenue of $418 million, up 19%.

LogicMonitor's plan

With the $800 million investment, LogicMonitor outlined three goals.

- Accelerate and expand LogicMonitor's platform including mergers and acquisitions. The observability industry could use a bit of consolidation and LogicMonitor could pick up tuck-in players.

- Expand internationally. LogicMonitor said about 30% of its customers in 2023 were international.

- Diversify into new industries. LogicMonitor said it has the opportunity to focus its data center observability efforts on new verticals.

Vista first invested in LogicMonitor in 2018 and has seen the company organically scale more than 650% since. It's quite possible that LogicMonitor will now look to scale with mergers and acquisitions too.

Constellation Research analyst Andy Thurai said:

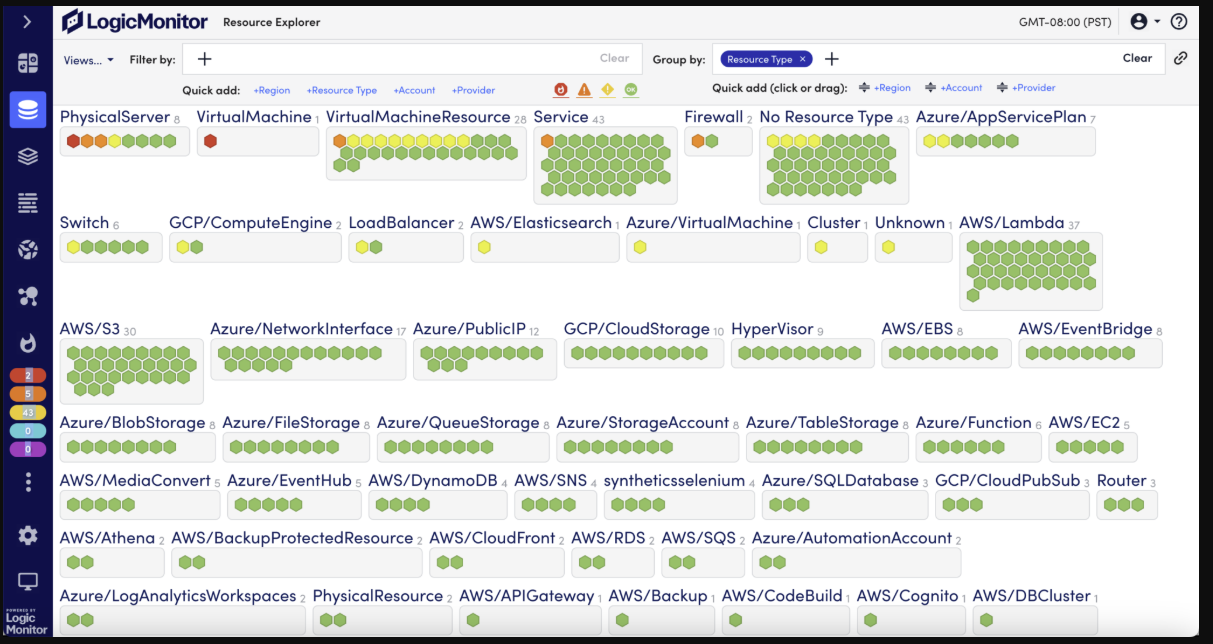

"LogicMonitor, which used to play mostly in the infrastructure and networking space, has leveled up its game to higher levels of observability. In addition, the company has also acquired and continued to invest in their Dexda platform which offers AIOps capabilities. With this investment, LogicMonitor get some flexibility to grow its platform by either acquiring some players in the open telemetry (OTEL) space or strengthening their existing observability platform."