If you were waiting for Intel's turnaround you'll have to wait a while longer. Intel posted a disastrous second quarter, eliminated its dividend, cut its outlook and said it would lay off 15% of its workforce.

Intel, which is getting squeezed by both Nvidia and AMD, reported a second quarter net loss of 38 cents a share on revenue of $12.8 billion, down 1% from a year ago. Non-GAAP earnings in the second quarter were 2 cents a share.

Wall Street was expecting Intel to report second quarter earnings of 10 cents a share on $12.98 billion in revenue. Intel rival AMD reported a strong second quarter.

Intel projected third quarter revenue of $12.5 billion to $13.5 billion with a non-GAAP loss of 3 cents a share. Wall Street was expecting third quarter earnings of 31 cents a share on revenue of $14.39 billion.

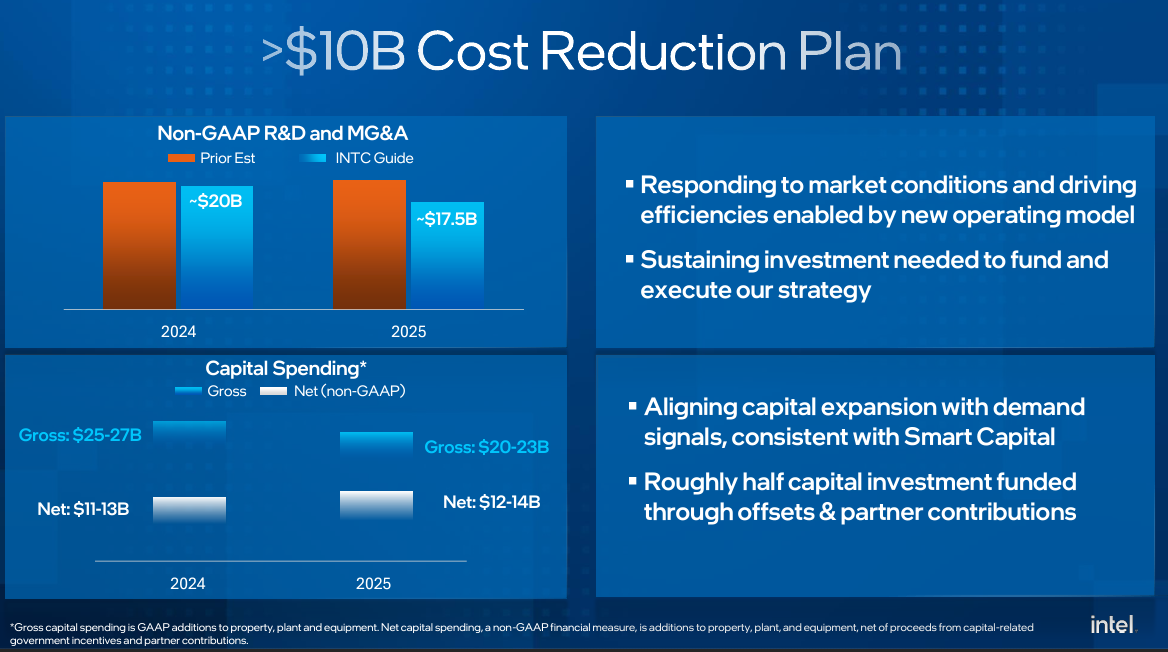

Given the results, Intel said it would aim to reduce costs by $10 billion and cut 15% of its workers. Intel is also suspending its dividend.

CEO Pat Gelsinger said:

"Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected."

Intel CFO David Zinser said the company saw "gross margin headwinds" from the ramp of AI PCs, unused capacity and charges due to non-core business.

Given the second quarter results, Intel said it will cut spending and headcount to reduce non-GAAP R&D, marketing and general and administrative costs by about $20 billion in 2024 and $17.5 billion in 2025. Intel also said it will shift toward "capital efficiency and investment levels aligned to market requirements." Intel is planning to reduce gross capital expenditures in 2024 by 20% from previous guidance to $25 billion to $27 billion.

Constellation Research analyst Holger Mueller said:

"Intel can’t catch growth and now Pat Gelsinger and team have decided to change the cost base – 15% layoff is unheard of in the industry in general and for Intel specifically. But the biggest contributor to the loss in operating income came actually from ‘restructuring and other charges’. The question will be if Intel can achieve still the same revenue run rate and R&D results with under 100,000 employees. The other concern is that future revenue streams – like data center / AI and Network & Edge are sightly shrinking. It will be another rough second half of the year for Intel."

More:

- Intel Foundry had $7 billion operating loss in 2023

- Intel launches Gaudi 3 accelerator with availability in Q2

- Intel's AI everywhere strategy rides on AI PCs, edge, Xeon CPUs for model training, Gaudi3 in 2024

Intel said it will continue to invest in innovation across process technology and products.

By the second quarter numbers:

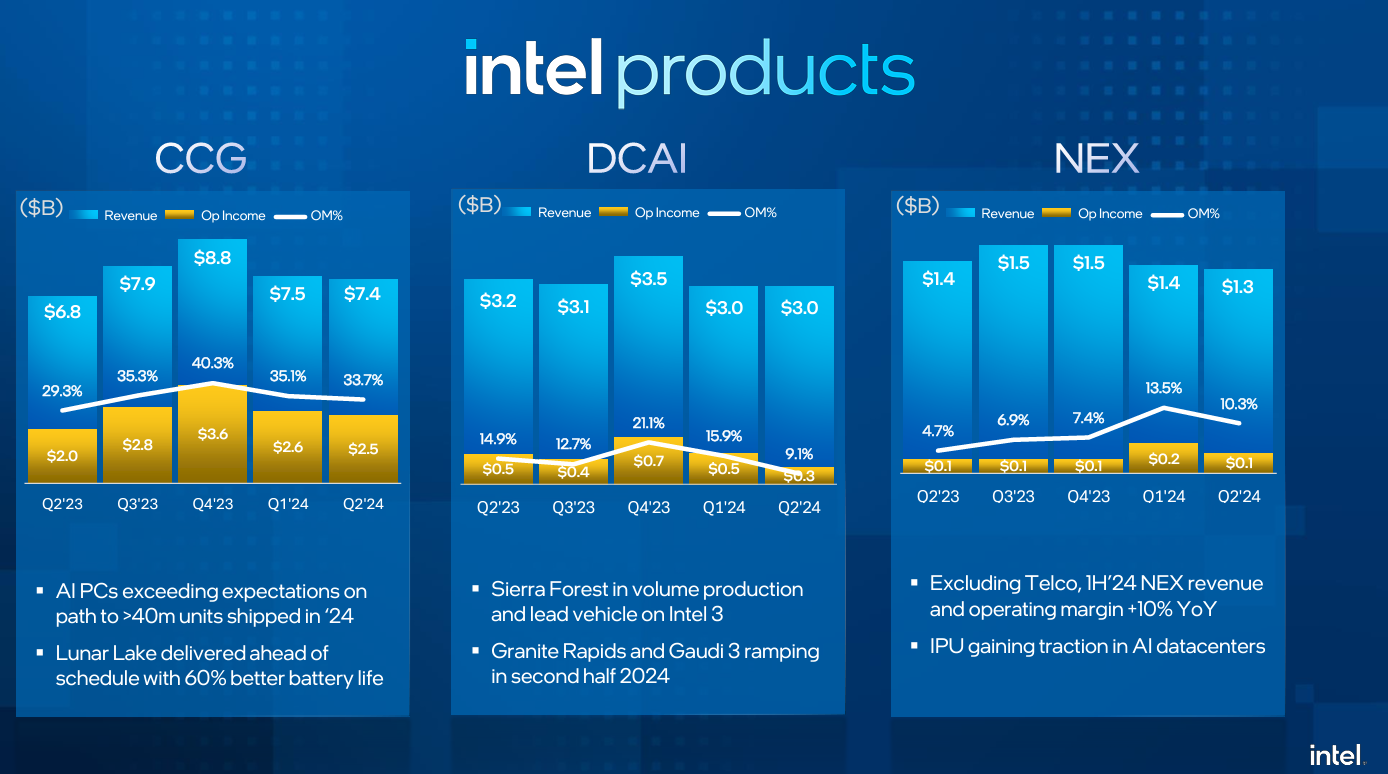

- Client Computing Group revenue was $7.4 billion, up 9% from a year ago.

- Data Center and AI revenue was $3 billion, down 3% from a year ago.

- Network and Edge revenue was $1.3 billion, down 1% from a year ago.

- Intel Foundry revenue was $4.3 billion, up 4% from a year ago.