Intel is still on the hunt for a CEO, but the company's fourth quarter results were better-than-expected even as sales fell from a year ago in every division except for network and edge computing.

The company reported a fourth quarter net loss of 3 cents per share on revenue of $14.3 billion, down 7% from a year ago. Non-GAAP earnings were 13 cents a share.

Wall Street was expecting Intel to report non-GAAP fourth quarter earnings of 12 cents a share on revenue of $13.83 billion.

The financial report was the first since Pat Gelsinger retired as CEO in December to be replaced by co-CEOs David Zinsner and Michelle (MJ) Johnston Holthaus.

Intel reported a 2024 loss of $18.8 billion, or $4.38 a share, on revenue of $53.1 billion, down 2% from the previous year.

As for the outlook, Intel said it will report first quarter revenue of $11.7 billion to $12.7 billion with breakeven earnings per share on a non-GAAP basis. Wall Street was looking for non-GAAP first quarter earnings of 9 cents a share.

Holthaus, who is also CEO of Intel Products, said the fourth quarter was a "positive step" and the company is simplifying its portfolio. Zinsner, who is also CFO, said the first quarter outlook "reflects seasonal weakness magnified by macro uncertainties, further inventory digestion and competitive dynamics."

By the numbers:

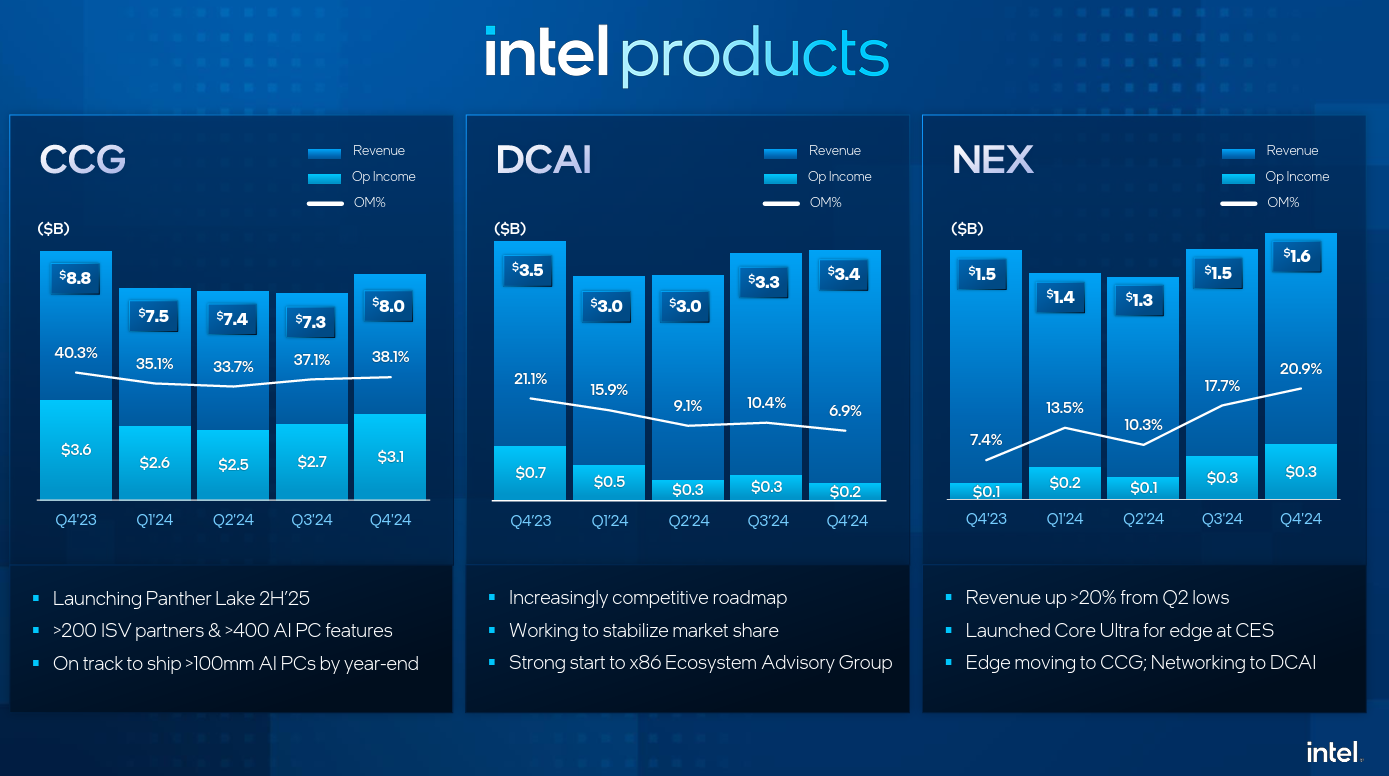

- Intel's Client Computing Group fourth quarter revenue was $8 billion, down 9% from a year ago. Intel said it is on track to ship more than 100 million AI PCs by the end of 2025.

- The Data Center and AI unit delivered fourth quarter revenue of $3.4 billion, down 3% from a year ago.

- Network and Edge had revenue in the fourth quarter of $1.6 billion, up 10% from a year ago.

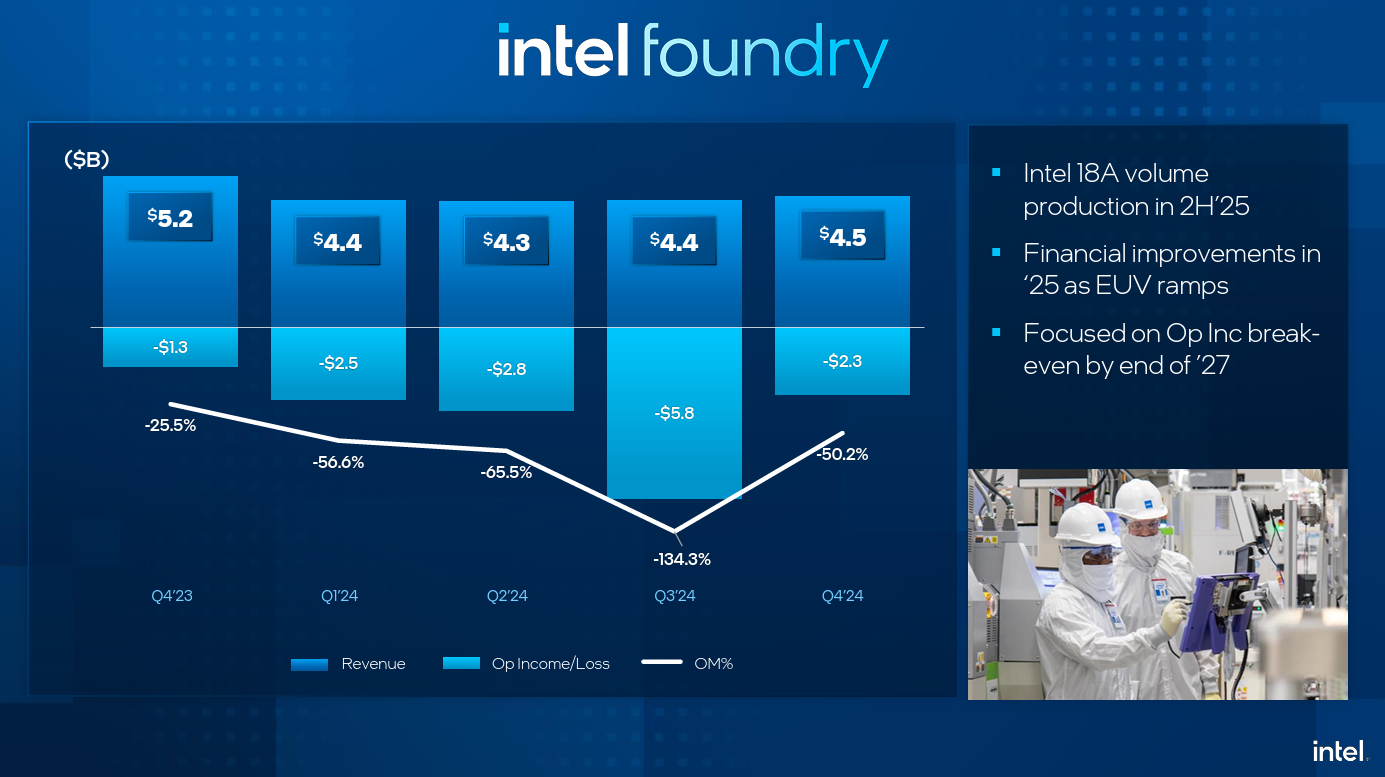

- Intel Foundry revenue in the fourth quarter was $4.5 billion, down 13%.