Intel outlined its Intel Foundry results as it recast its financial reporting segments and added a new CFO as the unit aims for break even.

The chipmaker outlined its new reporting segments and historical results. It also named Lorenzo Flores as chief financial officer of Intel Foundry. Flores was CFO of Xilinx.

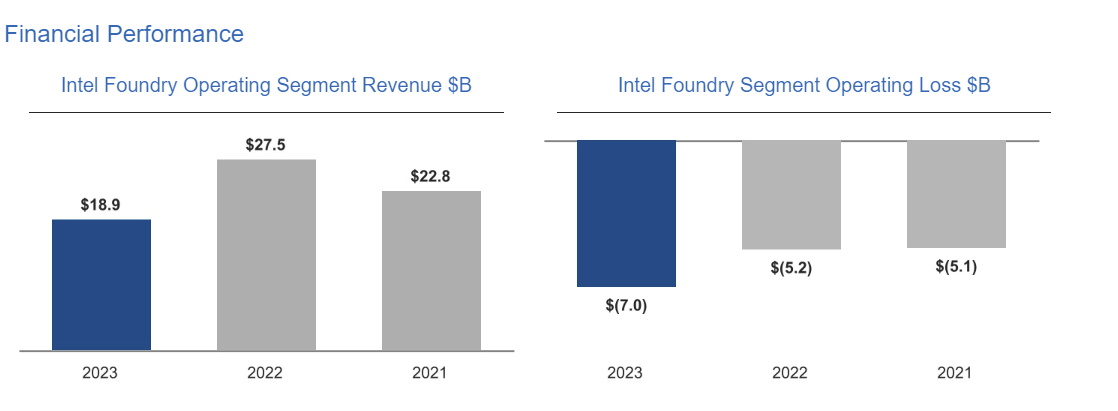

Intel's new operating model creates a foundry relationship between Intel Foundry, the manufacturing unit, and Intel Products, the product business units. In an SEC filing, Intel said Intel Foundry operating revenue in 2023 was $18.9 billion, down from $27.5 billion in 2022. The operating loss for Intel Foundry in 2023 was $7 billion, up from $5.2 billion in 2022. Intel Foundry's external revenue was $953 million in 2023.

- Intel Foundry sets roadmap, aims to be No. 2 foundry by 2030

- Intel's Q4 strong amid PC rebound, outlook light: Here are the takeaways

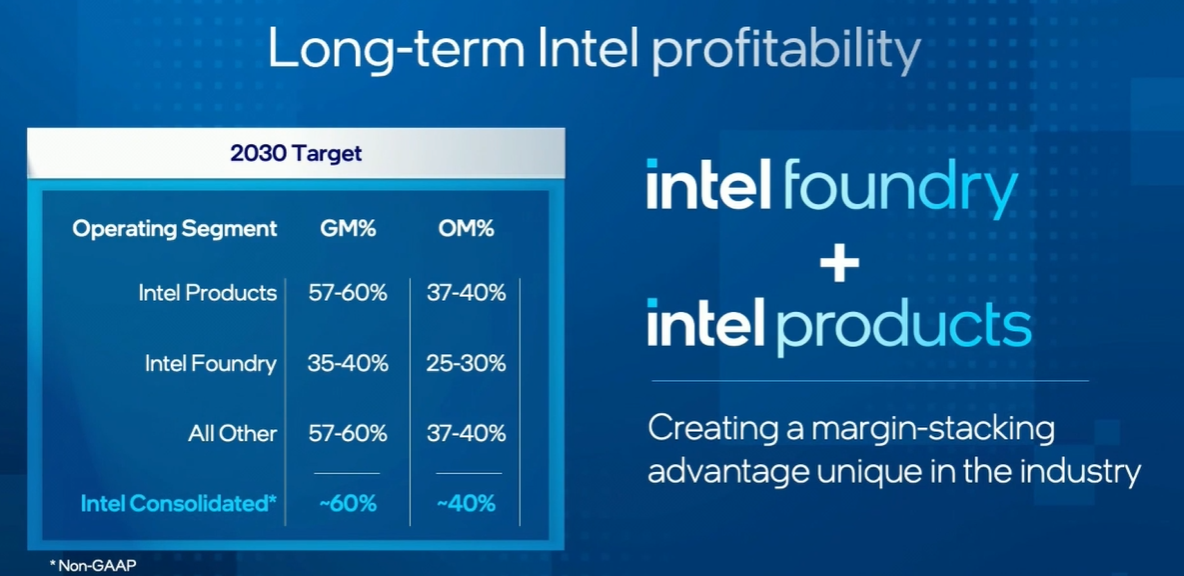

Pat Gelsinger, Intel CEO, said the products and foundry business can drive long-term sustainable growth. Intel Products will include the company's client computing group, data center and AI group, and network and edge units. Altera, Mobileye and Other will be in an All Other category. Intel Foundry will be reported separately and include external revenue as well as sales from Intel Products.

Intel is aiming for 60% non-GAAP gross margins and 40% non-GAAP operating margins in 2030.

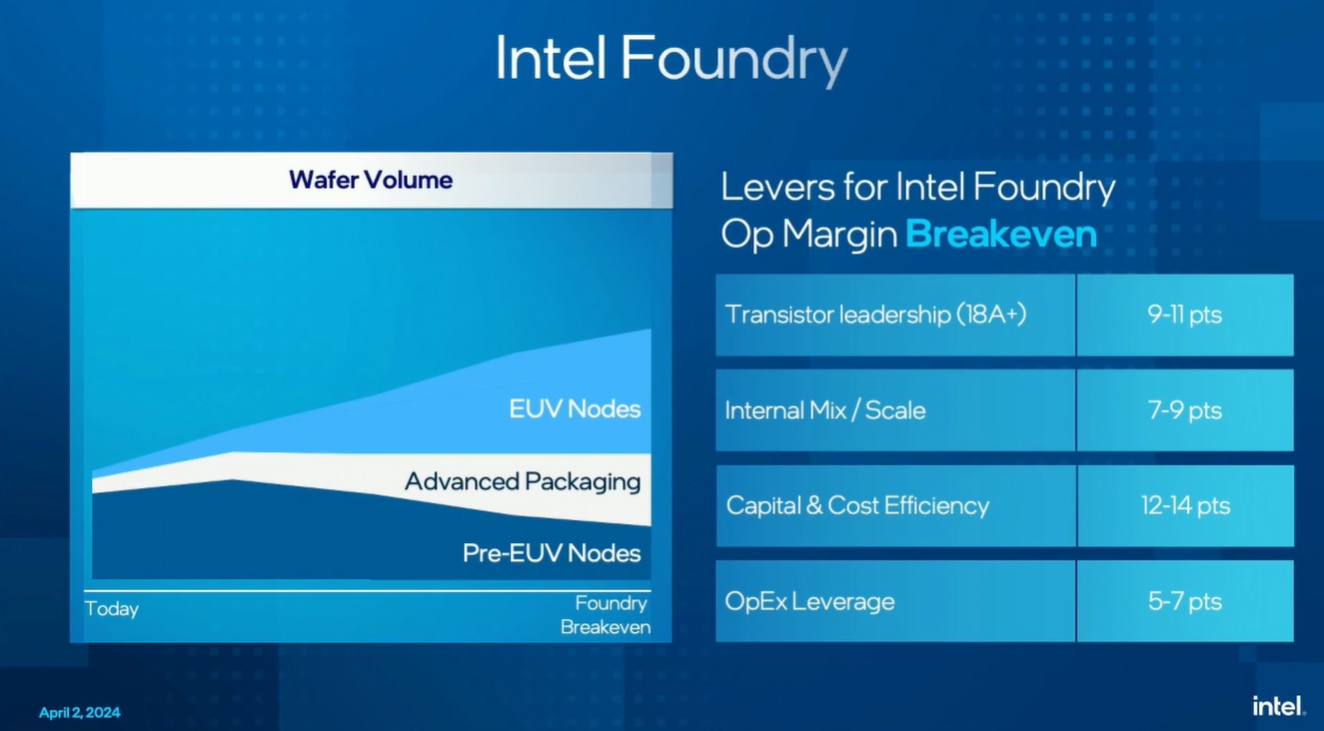

Intel CEO Pat Gelsinger said on a conference call with analysts that "we see this clear path to driving Intel Foundry to break even over the next few years."

"What we see as a self-sustaining model with solid returns for Intel Foundry and the consolidated company by 2030," he added. "We are also making fundamental moves to standard intellectual property blocks and processes, where we became so disconnected from the industry. We are also addressing the rising capital requirements by optimizing for cost efficiency and extending the life of our assets. We are addressing the scale challenges by bringing in external designs into our factory network and monetizing the IP in both our products and our foundry."

Constellation Research analyst Holger Mueller said the burden of profit proof is on Intel. Mueller said:

"Intel goes 'fabless' – though only for the balance sheet. It remains to be seen if investors will fall for valuing the 'fabless' Intel the same as other truly fabless competitors like e.g. Nvidia or Qualcomm. Intel needs to finance the losses of the fab business – unless this is the start of spinning that off – something we saw in the past e.g. with IBM and GlobalFoundries. Intel is not producing competitive chips and for the sake of competition and budgets we can only hope that the old Intel will roar back and create some much needed competition in the years ahead."

The big breakout from the new reporting structure is Intel Foundry. Intel said the unit's operating losses are expected to peak in 2024 and the company will hit break-even operating margins midway to its 2030 goals. Intel Products already has solid operating margin en route to the 2030 targets.