Intel said CEO Pat Gelsinger has retired effective Dec. 1 and will be replaced by two interim co-CEOs as the chipmaker tries to catch up to the AI age.

In a statement, Intel said Gelsinger is out and David Zinsner and Michelle (MJ) Johnston Holthaus will be interim co-CEOs. Intel has begun a search for a permanent CEO. Holthaus has been promoted to be CEO of Intel Products Group, which includes the company's client computing, data center and AI and network and edge units. Zinsner, CFO at Intel, joined the company in 2022 after being CFO at Micron Technology.

It's unclear who will be the new CEO of Intel, but one thing is certain--there will be a lot of work ahead. Here's a look at some of the big questions the new Intel leader will have to resolve.

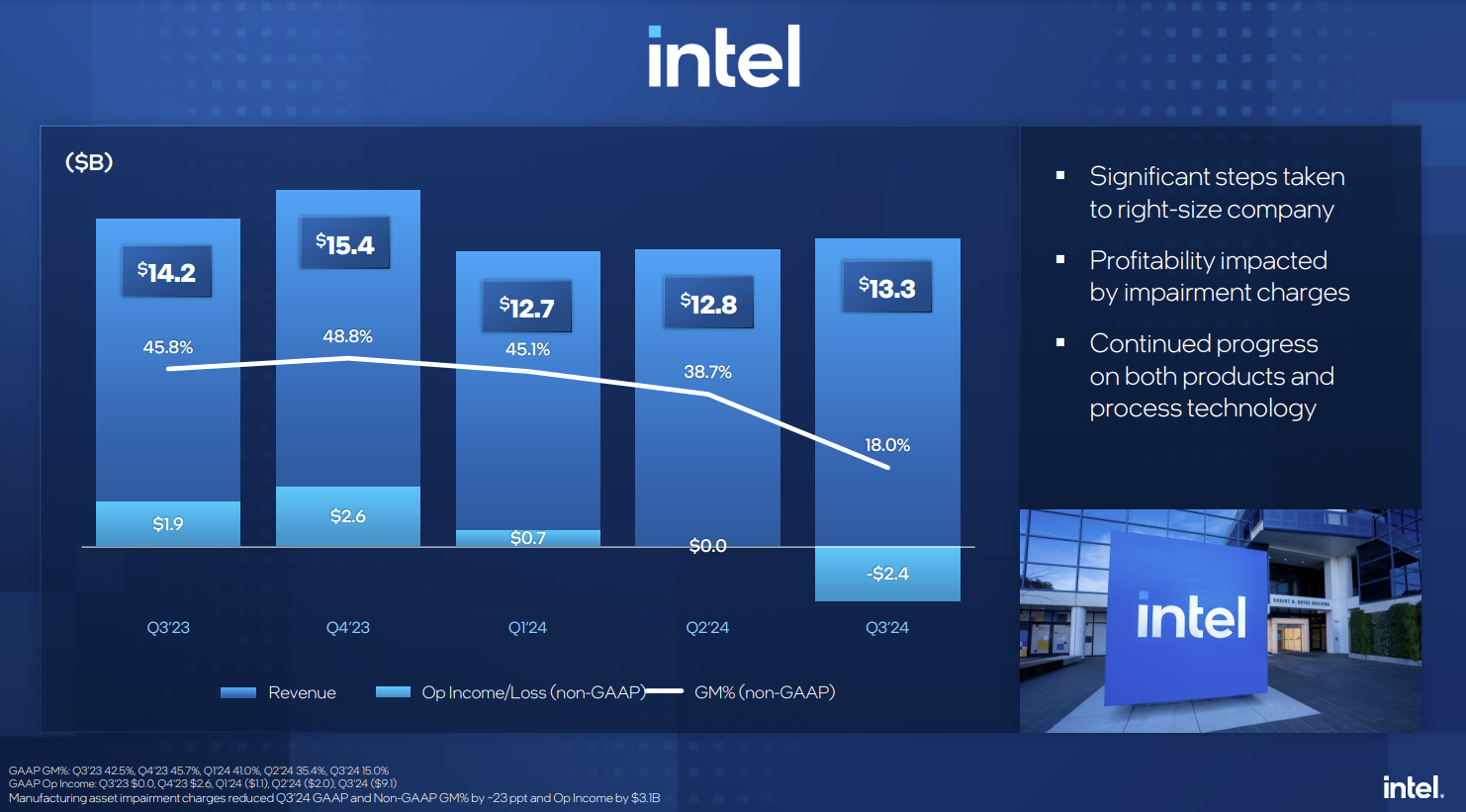

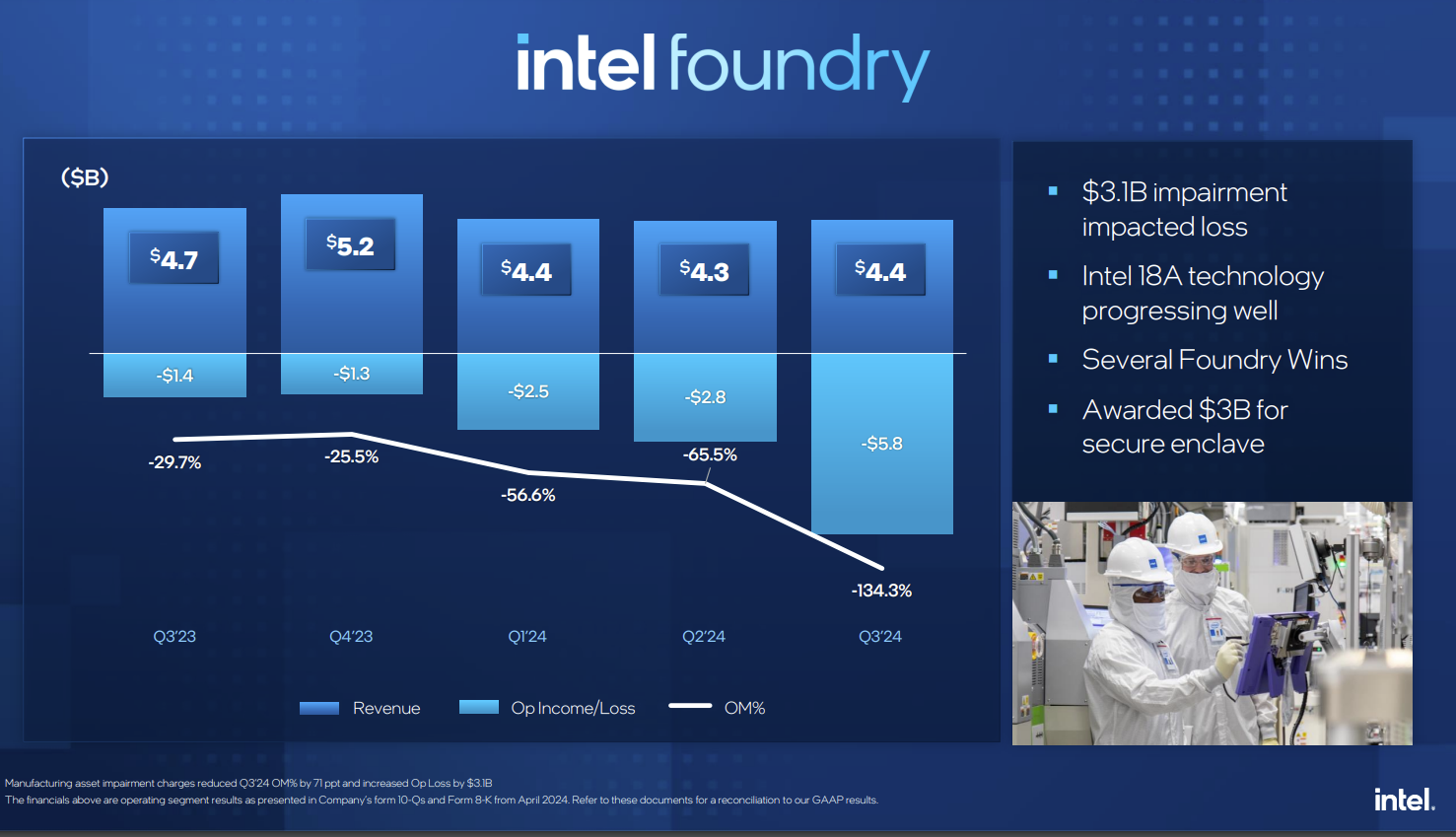

Can Intel really recover? Intel has largely missed the AI turn and Nvidia has clearly run off with the spoils of the buildout. GPUs are taking over data centers and Intel has been slow to the starting line. In addition, AMD is now Nvidia's GPU competitor and is beating Intel in the data center with its EPYC franchise. In addition, Intel's Foundry unit is losing money at a rapid clip and can't compete with the scale of TSMC. Intel has a multi-year turnaround ahead in a chip industry that has moved to an annual cadence. Perhaps Gelsinger fixed enough to give Intel a shot. We'll see.

Intel has fallen so far that rumors swirled that Qualcomm could pick up the company for pocket change--assuming regulators would ever approve it.

Will AI inference save the day? The news of Gelsinger's departure comes as AWS re:Invent kicks off and Intel has a bevy of sessions. Some of those sessions revolve around inference workloads. For Intel's CPU-heavy lineup to succeed, AI inference at the edge will have to assume more workloads. In 2025, those edge workloads should become more popular. Intel could become more AI relevant for inference workloads, but Qualcomm, AMD and Nvidia are all in the mix. Nvidia CEO Jensen Huang makes sure he references the company's inference business every quarter.

- Nvidia CEO Jensen Huang has a dream...

- Nvidia strong Q3, sees Hopper, Blackwell shipping in Q4 with some supply constraints

- AMD's Q3 on target, data center unit revenue growth 122% from a year ago

Is Intel too important to fail? Intel has secured US government backing and just finalized $7.86 billion in CHIPS Act funding. Intel is getting this funding because it's one of the few players with manufacturing in the US. Intel used to be a US tech champion, but now is limping former giant that's still strategically important. Boeing is in a similar spot. Intel will likely recover to some degree with government backing.

Can Intel's foundry business compete? Intel Foundry has more independence and key partnerships, but at the end of the day it has to compete with TSMC. It's fairly obvious that Intel Foundry is set up as a quasi-independent unit because its capital requirements could bring down the company as a whole.

- Intel to give Intel Foundry more independence, expands AWS partnership

- Is AI data center buildout a case of irrational exuberance?

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

Will technology buyers come back? Technology buyers--consumer and enterprise--haven't completely dumped Intel, but it's hard to ignore AMD's traction in the data center and Qualcomm's encroachment in the PC market. Back in the day, you couldn't get fired for buying Intel. Today, you might if you're betting on Intel for AI workloads over Nvidia. The idea that Intel is a lock in servers has also faded. ARM architecture is also dominant and Intel has few answers. Nostalgia doesn't count for much in an IT budget.