Infosys is seeing stronger spending from financial services firms as that industry begins to spend more on scaling generative AI. That demand recovery also aligns with what financial services executives have been saying on earnings calls.

Financial services firms have been among the most aggressive with generative AI implementations because their data strategies are solid due to being regulated. Simply put, financial services firms have a lighter lift when it comes to making the jump to AI-driven projects.

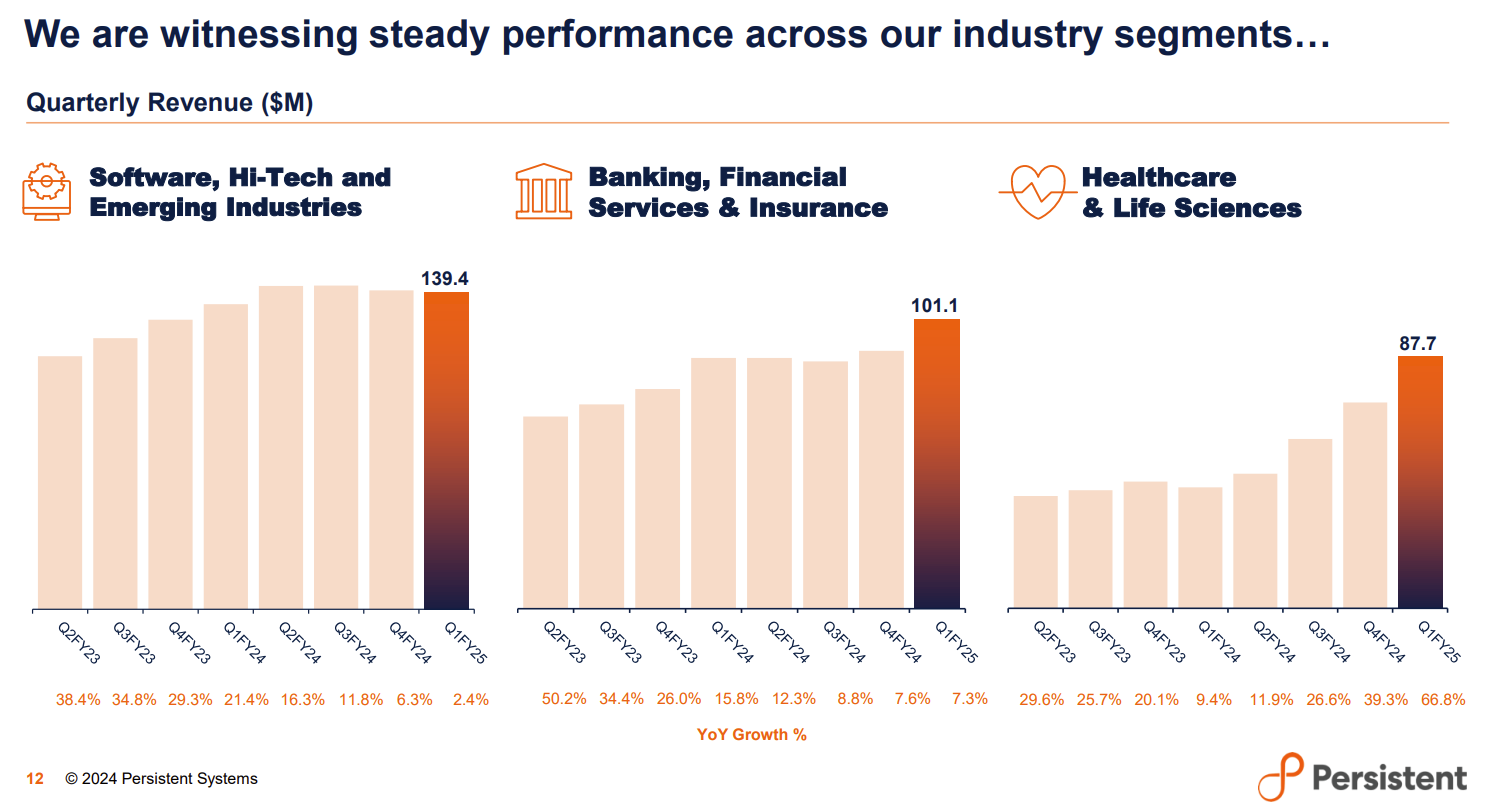

The financial services spending recovery cited by Infosys was also evident in results from Persistent. If this early recovery sticks it'll highlight how generative AI spending is moving beyond infrastructure.

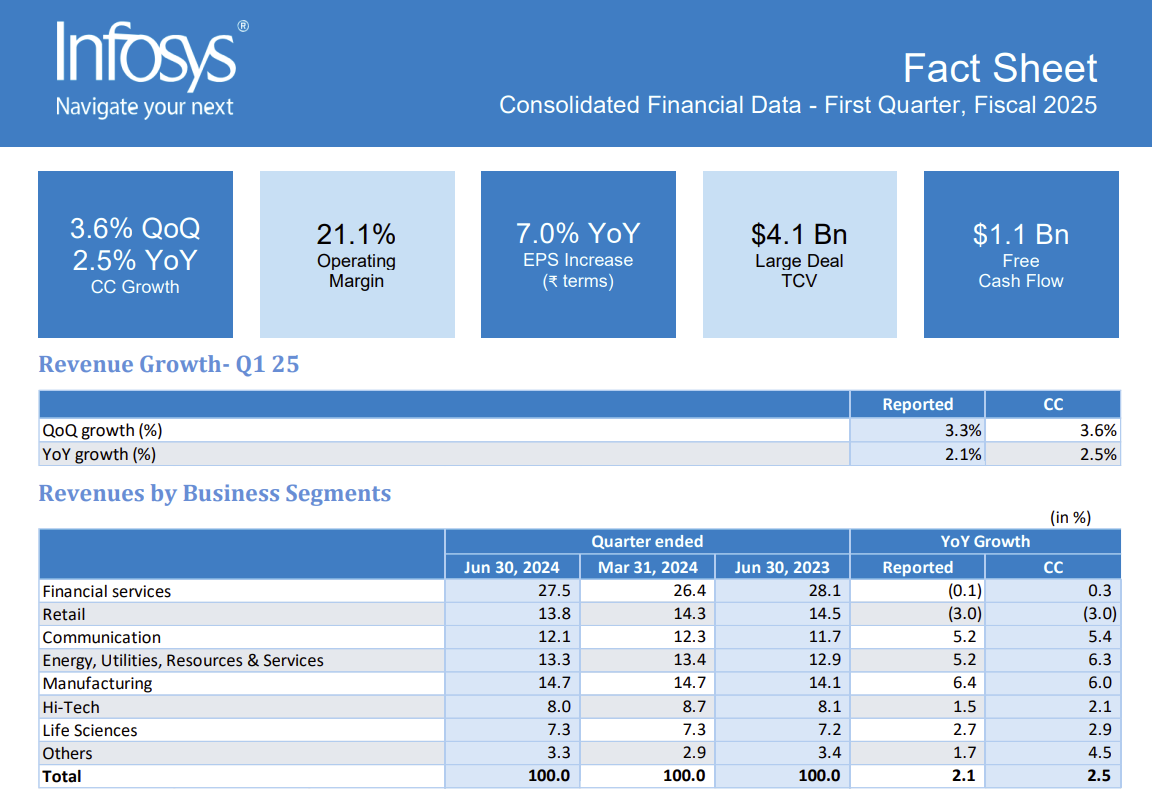

Infosys reported fiscal first quarter revenue of $4.71 billion with net income of $764 million. Persistent reported first quarter revenue of $328.2 million, up 16% from a year ago.

Speaking on a conference call, Infosys CEO Salil Parekh said the company saw 7.9% sequential revenue growth in financial services. Compared to a year ago, financial services revenue was flat, but Infosys is seeing green shoots in the US. Persistent saw financial services growth of 7.6%.

Parekh said:

"Along with our overall robust performance in Q1 and strong opportunity pipeline, we are seeing early signs of improvement in financial services vertical in the US. While discretionary spends continues to be under pressure, a highly differentiated offering around driving efficiencies at scale and transformation capabilities around generative AI have positioned us well in the market."

Parekh said financial services firms are doing the following:

- Discretionary spending is still under pressure.

- There are a lot of ongoing discussions about generative AI.

- Firms are focusing on efficiency, consolidation and automation.

- Mortgage companies, capital markets and credit card processing are seeing more volume and early signs of recovery.

- Infosys is working on actual genAI projects as they've graduated beyond proofs of concept.

Constellation Research analyst Chirag Mehta said:

"Engineering, Research, and Development (ER&D) services are gaining significant traction, fueled by notable acquisitions in the industry. Infosys' acquisition of a service provider in-tech, focused on German automotive sector, and Cognizant's acquisition of a service provider Belcan, focused on U.S. aerospace and defense service provider, have invigorated the ER&D sector, which is poised to benefit from AI innovations. The manufacturing industry, particularly heavy industries, stands to gain immensely from these AI-driven advancements.

Additionally, Persistent's intent to acquire Starfish Associates, an AI-powered contact center, and its strategic partnership with Google Cloud to develop industry-specific GenAI solutions, highlight a robust commitment to AI adoption. This aggressive move is aimed at capturing a significant share of the growing customer spending on AI solutions."

The general tone among the financial services, banks and insurance companies has been upbeat about genAI. At a recent AWS event in New York, a bevy of customers outlined various use cases.

- Financial services firms see genAI use cases leading to efficiency boom

- 14 takeaways from genAI initiatives midway through 2024

- GenAI’s prioritization phase: Enterprises wading through thousands of use cases

JPMorgan Chase at its investor day outlined how AI has moved beyond a central group to being part of every business unit.

"It's not understanding AI. It's understanding how it works," said Jamie Dimon, CEO of JPMorgan Chase. By the end of the year, Dimon estimated that JPMorgan Chase will have about 800 AI use cases across the company as management teams become better at deploying AI. He added:

"We use it for prospect, marketing, offers, travel, notetaking, idea generation, hedging, equity hedging, and the equity trading floors, anticipating when people call in what they're calling it for, answering customer, just on the wholesale side, but answering customer requests. And then we have – and we're going to be building agents that not just answers the question, it takes action sometimes. And this is just going to blow people's mind. It will affect every job, every application, every database and it will make people more efficient."

- JPMorgan Chase: Digital Transformation, AI and Data Strategy Sets Up Generative AI

- JPMorgan Chase: Why we're the biggest tech spender in banking

- JPMorgan Chase CEO Dimon: AI projects pay for themselves, private cloud buildout critical

- GenAI projects may be sucked up into the transformation, digital core vortex

Daniel Pinto, Chief Operating Officer and President at JPMorgan Chase, said the company has moved to transform its data so it's usable for AI and analytics. There will also be a central platform to leverage that data across business units. "AI and particularly large language models, will be transformational here," said Pinto.

Goldman Sachs' CEO David Solomon has talked up the company's AI initiatives before. He said the company has leveraged AI for multiple use cases ranging from coding to equity research and content during the company's second quarter earnings call.

"We are focused on how you can create use cases that increase your productivity," said Solomon. "If you look and you think across the scale of our business, I think you can think of lots of places where the capacity to use these tools to take work that's always been more manual and allow the very smart people to do that work to focus their attention on clients."

Solomon said the AI spending boom is real and can drive productivity and revenue gains. Solomon said:

"I am particularly encouraged by the ongoing advancements in artificial intelligence. Recently, our Board of Directors spent a week in Silicon Valley where we spoke with the CEOs of many of the leading institutions at the cutting-edge of technology and AI. We all left with a sense of optimism about the application of AI tools and the accelerating innovation in technology more broadly. The proliferation of AI in the corporate world will bring with it significant demand-related infrastructure and financing needs, which should fuel activity across our broad franchise."