IBM's third quarter was mixed as sales fell short of estimates, earnings were better-than-expected and the company said that its generative AI bookings were $3 billion.

The company reported third quarter earnings of $2.30 a share on revenue of $15 billion, up 1% from a year ago. Wall Street was expecting IBM to report third quarter non-GAAP earnings of $2.23 a share on revenue of $15.08 billion.

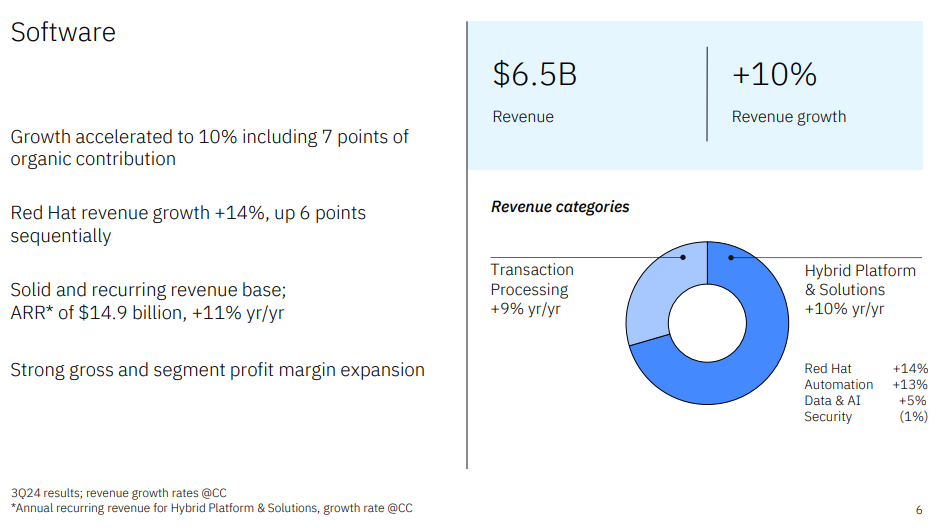

CEO Arvind Krishna said the company was set up well in software with revenue growth consistent with the third quarter. Krishna said the company saw "a reacceleration in Red Hat" and good traction with its models, which deliver good price for performance.

Constellation Research analyst Holger Mueller said IBM's results were hampered by pension costs, but is showing traction in software. Mueller said:

"IBM is becoming more of a software company with 45% of revenue coming from applications. If the trend continues, we will see IBM passing the 50% milestone next year. Good things happen when a former product developer is made CEO, and knows how to leverage IBM Research."

By the numbers:

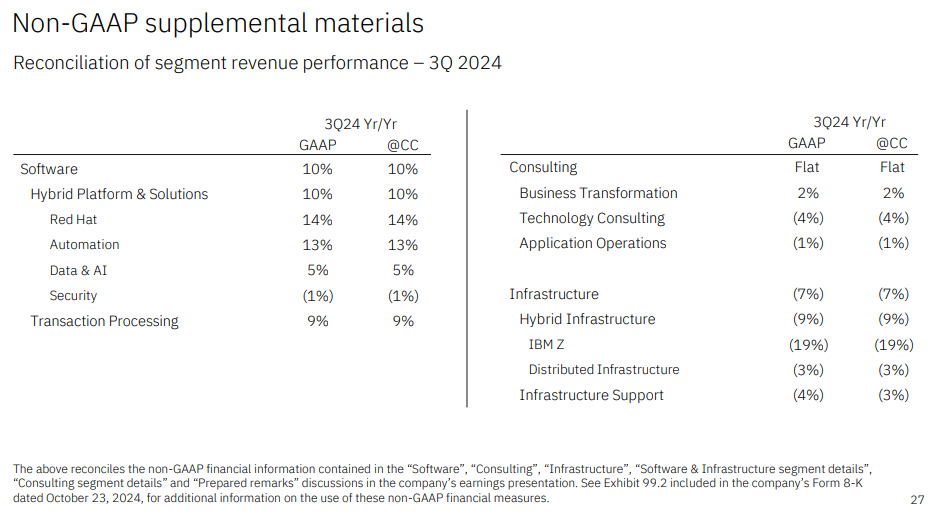

- IBM's software revenue was $6.5 billion, up 9.7% from a year ago. Data and AI revenue was up 5%, Red Hat growth was 14% and automation was up 13%.

- Consulting revenue in the quarter was $5.2 billion, down 0.5%.

- Infrastructure revenue in the third quarter fell 7% from a year ago to $3 billion. IBM Z revenue was down 19%.