Broadcom has made VMware more profitable and has kept large customers in the fold, but the next wave of competitors, notably HPE and Platform9, is ramping up efforts to migrate them to a new virtualization platform.

To date, Nutanix has been the largest beneficiary of the angst from the VMware customer base. But HPE and Platform9 are ramping efforts and seeing gains.

- Broadcom CEO Tan takes VMware victory lap: Will he go shopping again?

- Rivals up pressure on VMware for enterprise migrations

- Nutanix lands larger deals in Q4, ups outlook, plays long game vs. VMware

- Broadcom CEO Hock Tan aims to woo VMware customers with private cloud, simplification pitch

- Nutanix product additions, partnerships designed to capitalize on VMware customer angst

- Nutanix winning deals vs. VMware, but Broadcom punching back with pricing

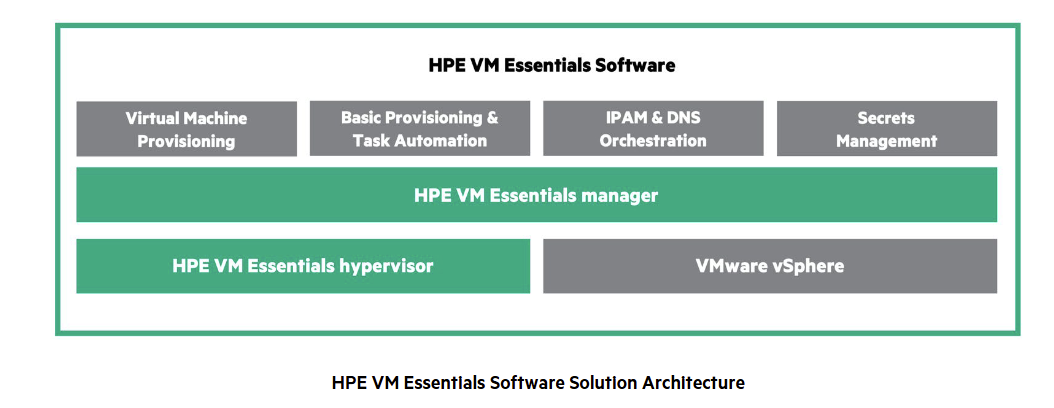

HPE outlined its virtualization plans at Discover 2024 and now is leveraging its large channel base to poach VMware customers. In a blog post, Gilles Thiebaut, SVP, Worldwide Hybrid Cloud Sales, said HPE will offer HPE VM Essential Software as standalone via the channel globally.

Customers will get the option to use HPE VMware Essential Software standalone or as part of its broader Morpheus stack. The subtext here is that HPE is leveraging its partner network as Broadcom largely cut out the channel. For good measure, HPE said VM Essentials is now supported by its latest HPE ProLiant Compute Gen12 servers.

HPE didn't exactly hide the target market. The blog post noted:

"HPE VM Essentials enables customers to manage VMs deployed across both existing VMware hypervisors and the HPE VM Essentials hypervisor (KVM-based). This approach allows our channel partners to guide customers toward a more open and flexible virtualization future."

The HPE news landed just a few days after Platform9 noted that it is migrating thousands of VMware virtual machines to Platform9's private cloud offering via its vJailbreak open source products. The money quote from the press release (literally) is this:

"Industry analysts estimate large-scale VMware migrations will take 18-48 months to complete, with costs ranging from $300 to $3,000 per VM. With Platform9, migrations can happen in weeks to months and at one-tenth of the cost."

The ability to lift and shift from VMware to Platform9 isn't all that surprising given leadership has a lot of VMware experience. Platform9 Co-founder and VP of Product Madhura Maskasky was behind VMware's vSphere product suite. Chief Growth Officer Sirish Raghuram is also a VMware alum.

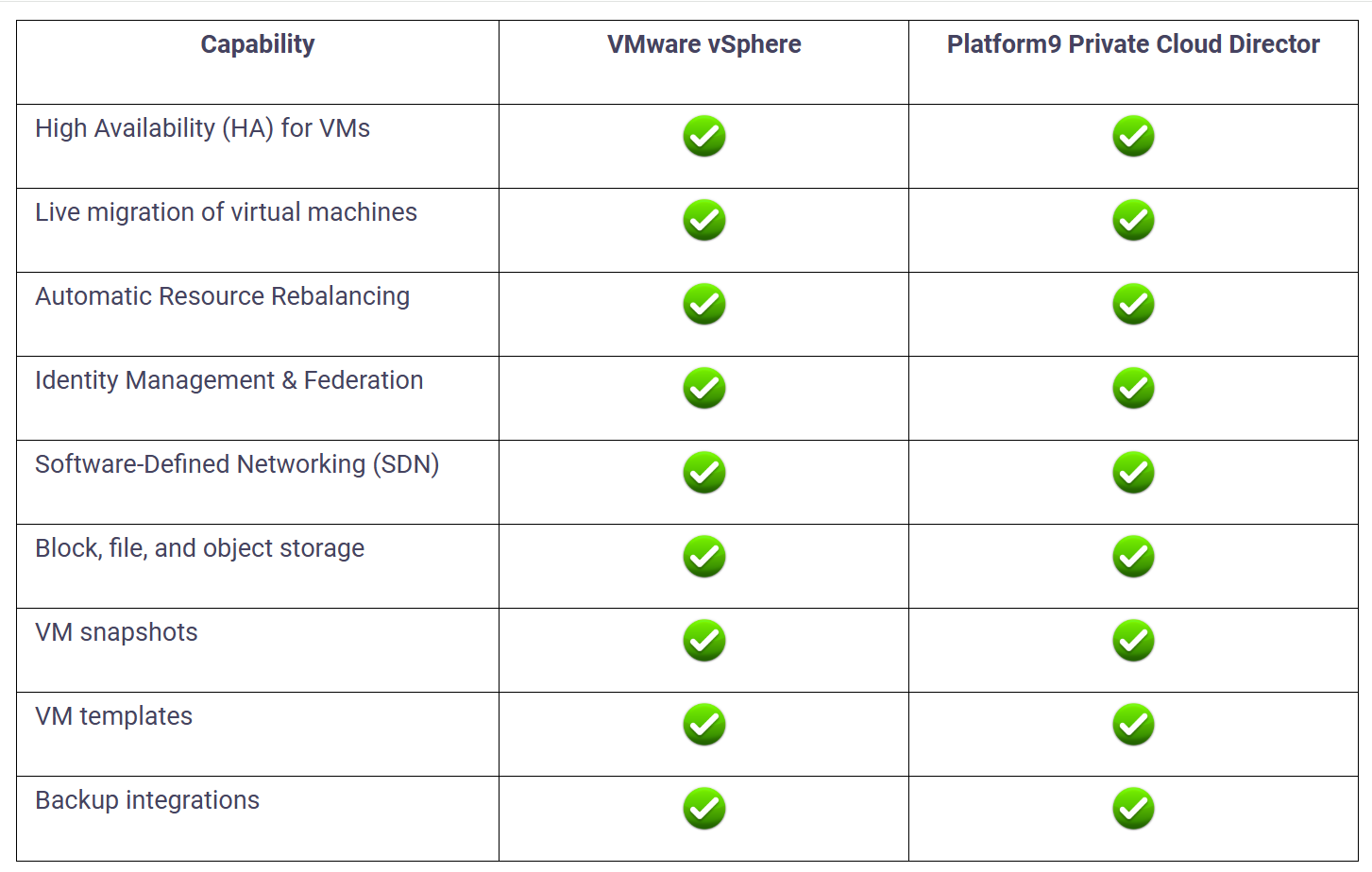

I caught up with Platform9's Maskasky for a briefing along with Constellation Research analyst Holger Mueller. What we can say is that Platform9 is at an inflection point with VMWare customers. The company's Private Cloud Director can match VMware features and enable an easy migration path.

Platform9's secret sauce is that it can work with any storage provider including VMware's Tintri and that works well for virtual machine migrations. Platform9's plan is to match VMware vSphere features line by line.