Generative AI projects are gaining steam in the enterprise, but there's a big hurry up and wait vibe to them. Why? Enterprises operate on a continuum and don't have their ERP, cloud and data transformations complete.

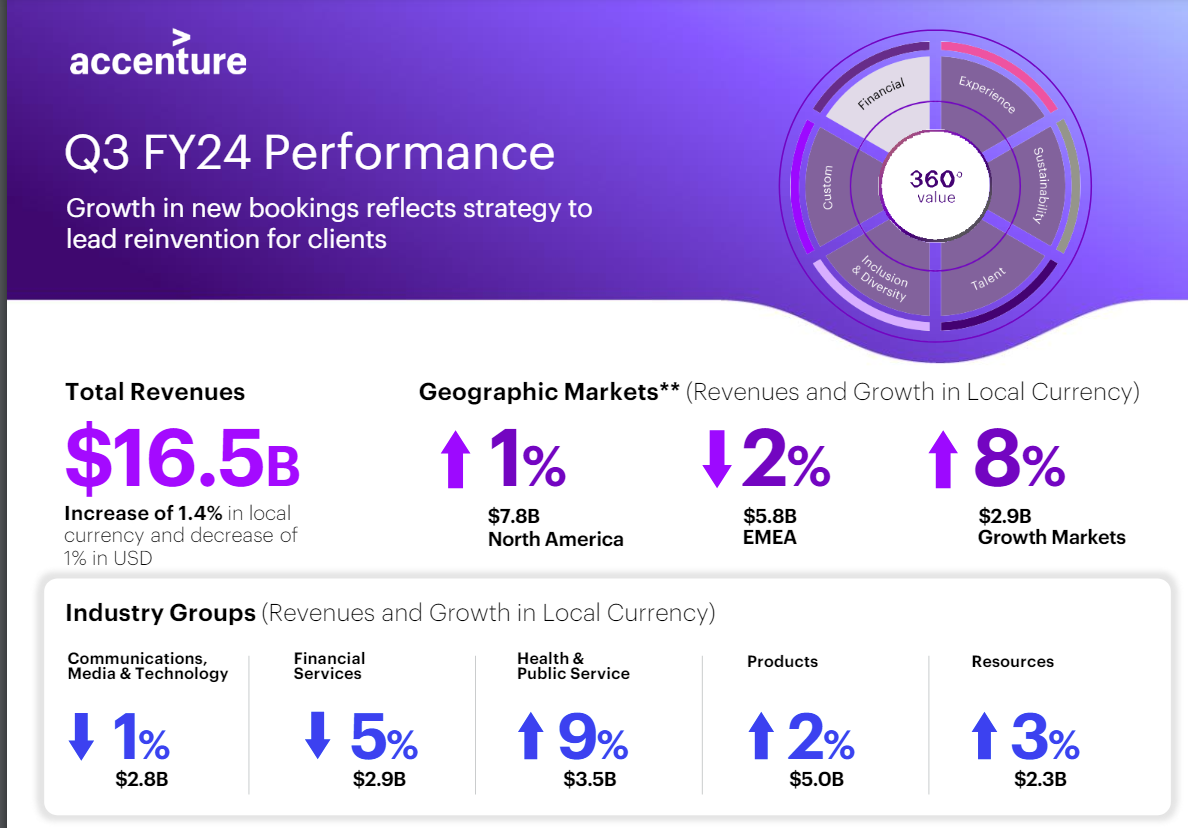

This genAI project progression was outlined by Accenture CEO Julie Sweet on the company's third quarter earnings call. Accenture is seeing genAI momentum and has $2 billion in generative AI bookings over the last 9 months but customers without a strong "digital core" are still on the tarmac.

Sweet said:

"It is important to remember that while there is a near universal recognition now of the importance of AI, which is at the heart of reinvention, the ability to use genAI at scale varies widely with clients on a continuum.

With those which have strong digital cores genuinely seeking to move more quickly, while most clients are coming to the realization of the investments needed to truly implement AI across the enterprise, starting with a strong digital core from migrating applications and data to the cloud, building a new cognitive layer, implementing modern ERP and applications across the enterprise to a strong security layer."

That take isn't news, but does make me wonder if genAI projects may not really hit production and scale for a few years. After all, SAP trumpeted that Bain moved completely to S/4HANA Public Cloud in a project that took four years.

Sweet continued:

"Nearly all clients are finding it difficult to scale genAI projects because the AI technology is a small part of what is needed. To reinvent using technology, data, and AI, you must also change your processes and ways of working, rescale and upscale your people, and build new capabilities around responsible AI, all with a deep understanding of industry, function, and technology to unlock the value. And many clients need to first find more efficiencies to enable scaled investment in their digital cores and all these capabilities, particularly in data foundations.

In short, genAI is acting as a catalyst for companies to more aggressively go after cost, build the digital core, and truly change the ways they work."

Sweet cited a bevy of customers including Macy's, which is migrating mainframes to the cloud; Central Bank of the United Arab Emirates, which is modernizing its enterprise data management; and Independence Health Group, which is moving to a digital first platform.

Now companies that have already made those transformational moves are set up for genAI. "Once clients have a strong foundation, they can explore new opportunities to drive growth and efficiencies with genAI," said Sweet.

Here's the catch: There are a lot more enterprises that need to do the hard work before genAI projects can scale than ones with strong digital cores.

Overall, these prerequisites for genAI impact means more work for Accenture, but it does explain why enterprise software vendors are seeing little uptick from genAI.

More on genAI dynamics:

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Enterprises Must Now Cultivate a Capable and Diverse AI Model Garden

- Secrets to a Successful AI Strategy

- Return on Transformation Investments (RTI)

- Financial services firms see genAI use cases leading to efficiency boom