Freshworks is planning to expand by courting enterprises fed up with their SaaS providers and layering in AI in its platform. Freshworks is also looking to land ServiceNow defectors.

Speaking on Freshworks fourth quarter earnings call, CEO Dennis Woodside portrayed the company as a giant killer. He said:

"We ended the year with over 72,200 customers who’ve chosen Freshworks CX and EX (customer and employee experience) software to transform their business. Time and again, overpriced legacy software vendors with overcomplicated products drive customers directly into our hands.

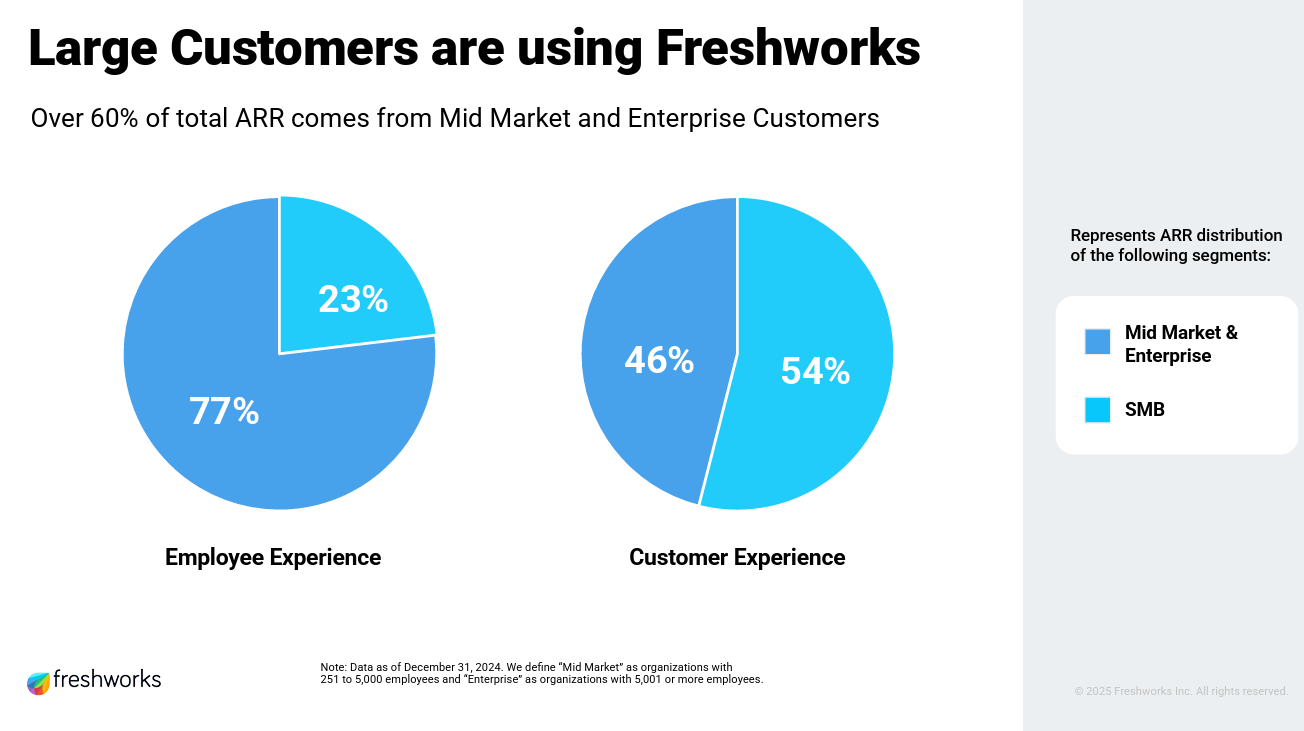

More mid-market and enterprise customers are turning to Freshworks as they leave behind our largest IT competitors. We believe that’s because big SaaS vendors are overcharging and underserving their customers, particularly in the mid-market."

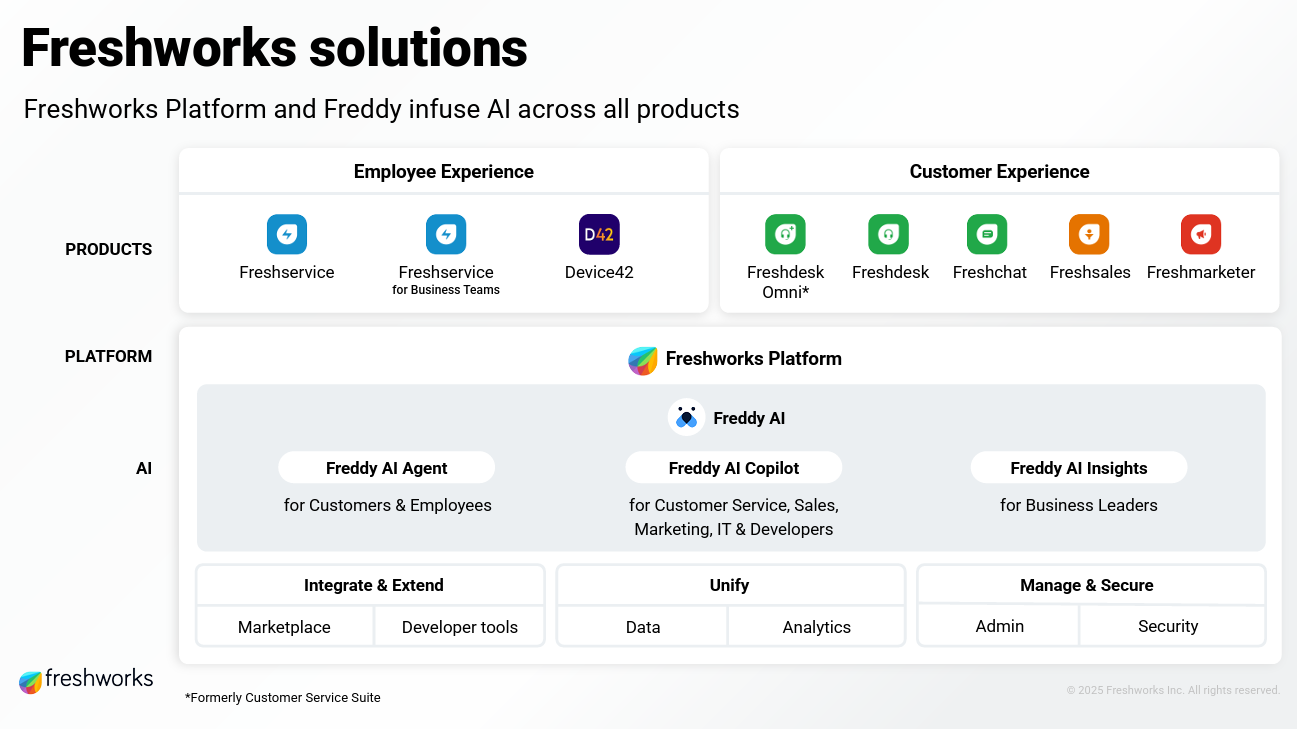

Freshworks offers customer experience software and IT service, operations and asset management applications, which fall under the company's EX category.

Woodside specifically focused on Freshworks ability to poach ServiceNow customers for its Freshservice software. He cited wins over ServiceNow from a hard-drive manufacturer, the city and county of San Francisco and Mesa Airlines.

The Freshworks CEO added:

"Coherent, a global manufacturer of industrial and laser equipment, transitioned 500 internal agents and all ITSM workflows from multiple tools, including ServiceNow to Freshservice. Coherent recently expanded its use of Freshservice beyond IT to their HR department, supporting 25,000 employees. They have plans to expand Freshservice to additional teams, such as facilities and procurement."

Constellation Research analyst Liz Miller said:

"What we are seeing with Freshworks is the result of focus and doubling down on solving real experience issues through a service-driven automated approach. Freshworks had been attempting to compete in a very broad market swath and courting a broad list of customers…the we can be everything to anyone approach. In reality, the midmarket and small business needs focused solutions that can implement fast and scale even faster without breaking the bank at a critical time of growth and velocity."

To reinforce Freshworks' giant killer strategy, the company is also looking to monetize its Freddy Copilot. "We expect AI to be a tailwind for our business as customers are realizing tangible business value," said Woodside. "After launching Freddy Copilot in February, we ended the year with more than 2,200 customers, reflecting quarterly net adds of more than 500 or 30% growth quarter-over-quarter."

For new deals, Freshworks had more than 50% Copilot attach rates in new deals worth more than $30,000. For customer experience, Freshworks saw more than 1,300 customers using Freddy AI Agent.

Freshworks plans employee experience push to land midmarket companies

To keep momentum, Freshworks is also adding executives from some of the giants it is hunting. The company recently hired Srini Raghavan as chief product officer. Raghavan is an alum of RingCentral, Five9 and Cisco. Freshworks also hired Venki Subramanian, SVP of Product Management and an alum of SAP and ServiceNow.

Strong quarterly results

Freshworks reported a fourth quarter net loss of $23.8 million, or 7 cents a share, on revenue of $194.6 million, up 22% from a year ago. Non-GAAP earnings in the quarter were 14 cents a share.

For 2024, Freshworks reported a net loss of 32 cents a share on revenue of $720.4 million, up 21% from a year ago. Non-GAAP earnings for 2024 were 43 cents a share.

As for the outlook, Freshworks projected first quarter non-GAAP earnings of 12 cents a share to 14 cents a share on revenue of $190 million to $193 million, up 15% to 17%. For fiscal 2025, Freshworks is projecting revenue of $809 million to $821 million, up 12% to 14%, with non-GAAP earnings of 52 cents a share to 54 cents a share.