Enterprises are beginning to leverage data centers for generative AI workloads, but it's more of a progression in conjunction with hybrid cloud deployments.

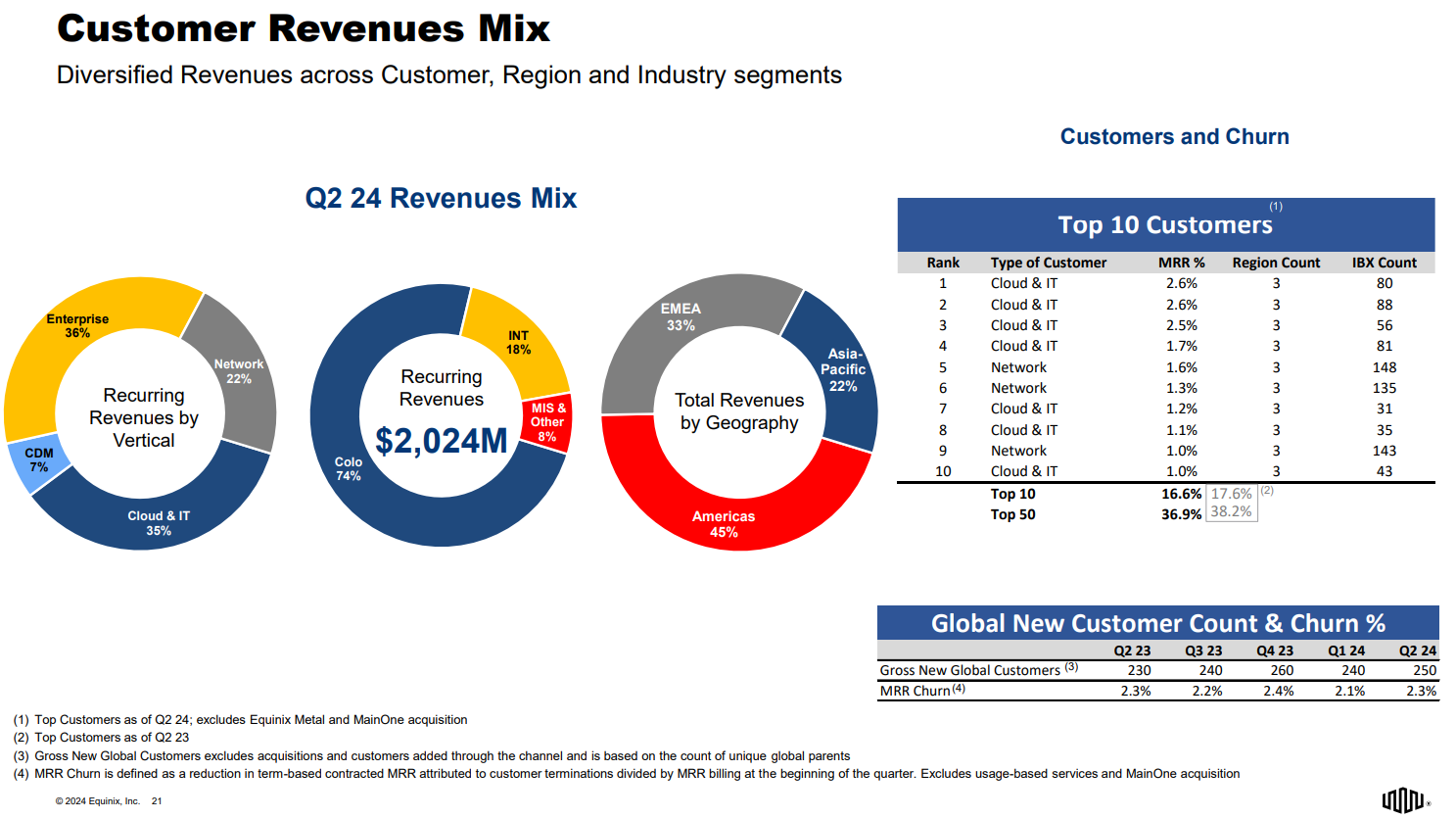

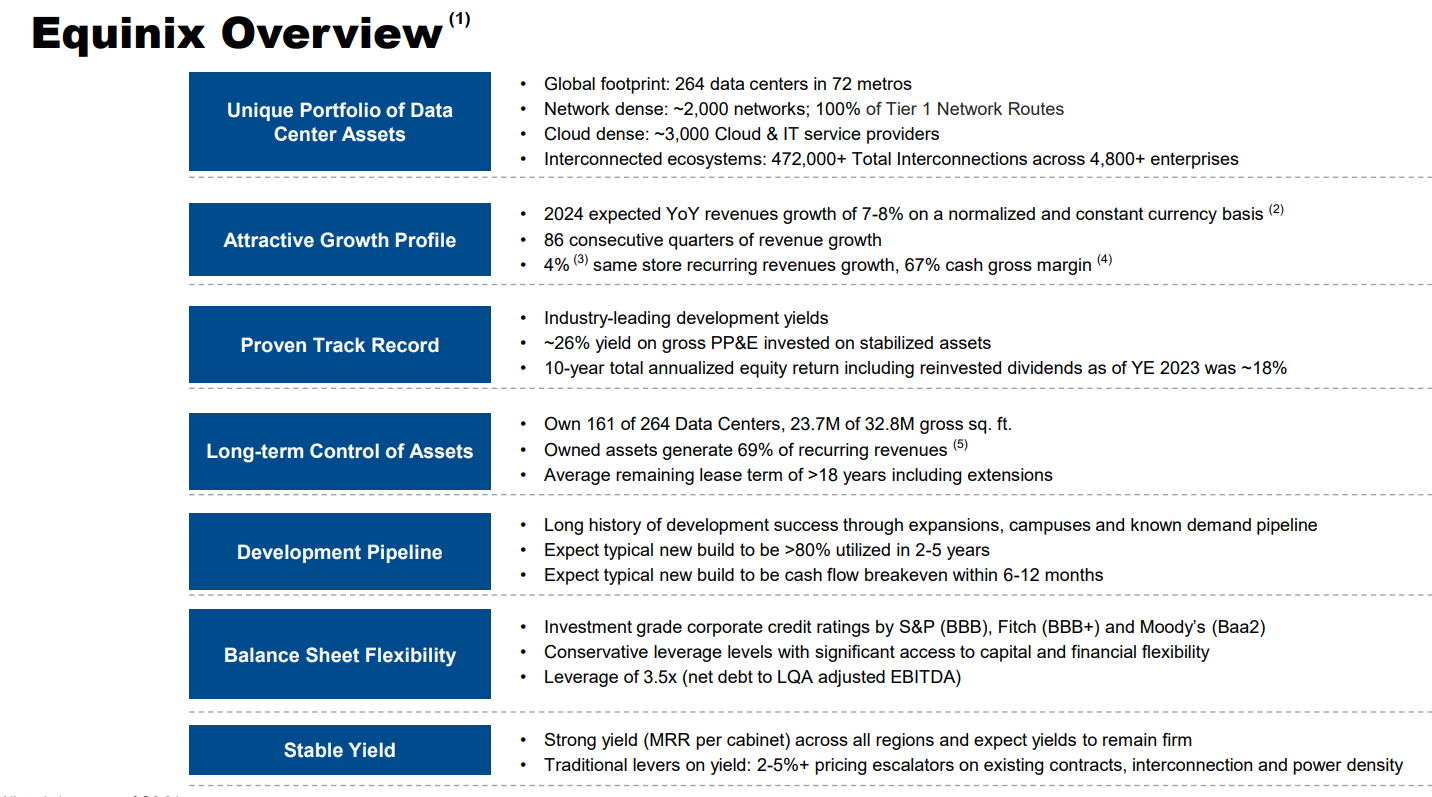

That's one of the high-level takeaways from recent earnings from Equinix and Digital Realty, which have a broad footprint of co-location facilities used by cloud service providers as well as enterprises.

Constellation Research analyst Holger Mueller said:

"AI is moving workloads to the cloud and Equinix and Digital Realty benefit from that demand. We are a critical juncture though, as the next generation of AI requires liquid cooling and there is substantial CAPEX needed. When looking at the cloud growth rates of the top 3 - and their dozen or so liquid cooled data centers - they are doing better than the co-location vendors. We will see in the next quarter where the workloads go. It is clear that the next-gen of AI computing architecture will also follow the rules of data gravity - so critical amounts of data will determine where the AI workloads - and with that revenue will flow."

Speaking on Equinix's second quarter earnings call, CEO Adaire Fox-Martin outlined how AI workloads--training and inference--will work out for the company.

"When I think about our demand and the customer needs, it is actually much broader than the AI portfolio. Many of our customers have made a very significant commitment to hybrid and to multi-cloud. And as customers become more at ease with cloud as a technology paradigm, we can see many more workload-based decisions beginning to occur," said Fox-Martin.

He added that short-term demand is coming from cloud service providers using Equinix's xScale platform. These are mostly model training workloads today, but inference will be a big market too, said Fox-Martin.

- Supermicro sees fiscal 2025 revenue of $26 billion to $30 billion, up from $15 billion in fiscal 2024

- The generative AI buildout, overcapacity and what history tells us

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

"Many CIOs, like in the early days of cloud, are looking to ensure they have an AI strategy. We are beginning to see enterprise training and a funnel as we look at customers evolving from proof-of-concept into working production systems," said Fox-Martin.

Equinix is seeing strong backlog for AI workloads as well as strength in the enterprise mid-market retail business. "We absolutely have AI-ready data centers ready to take workloads," said Fox-Martin. "We are working with many of our CIOs to support their AI strategy."

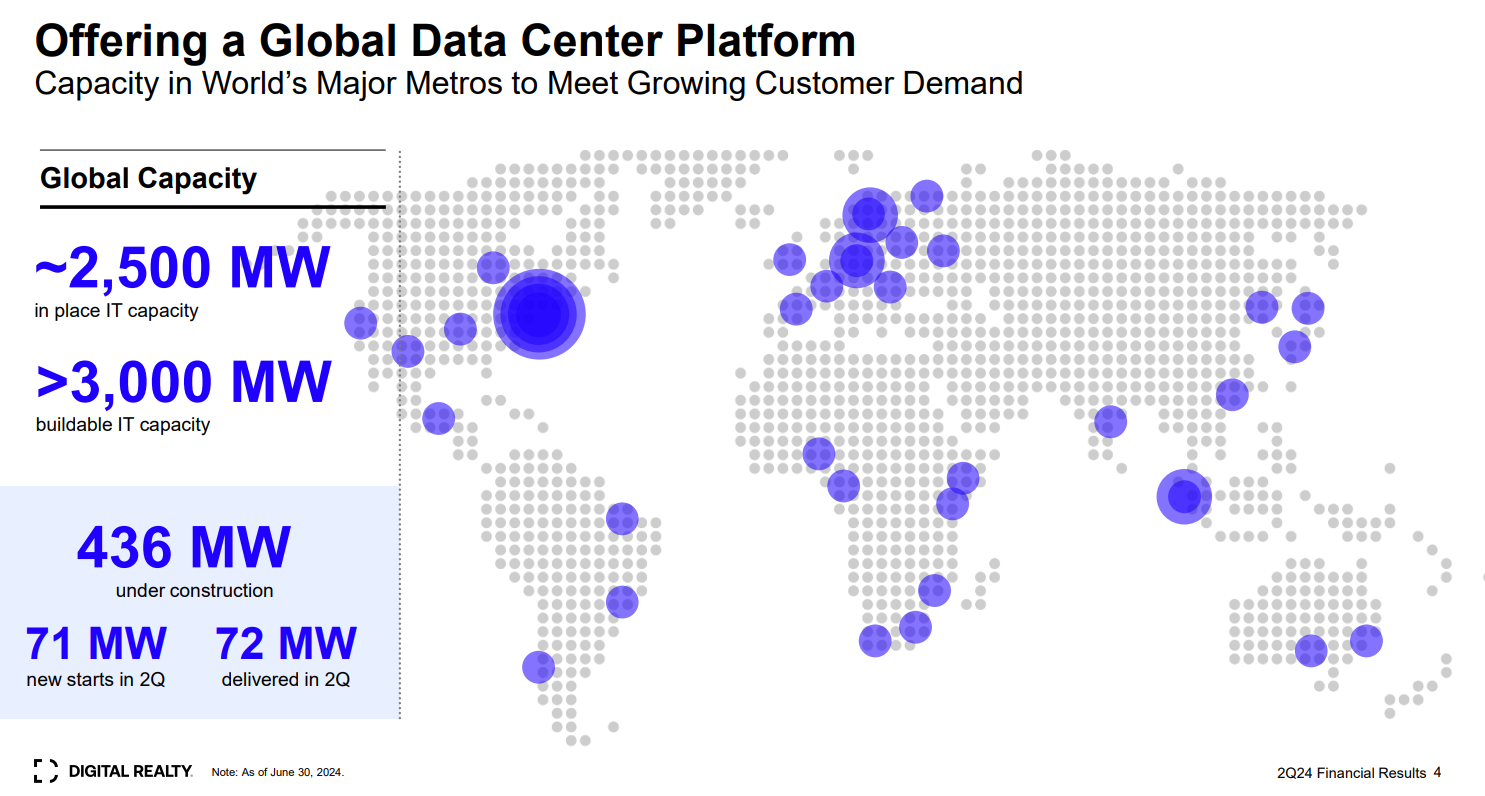

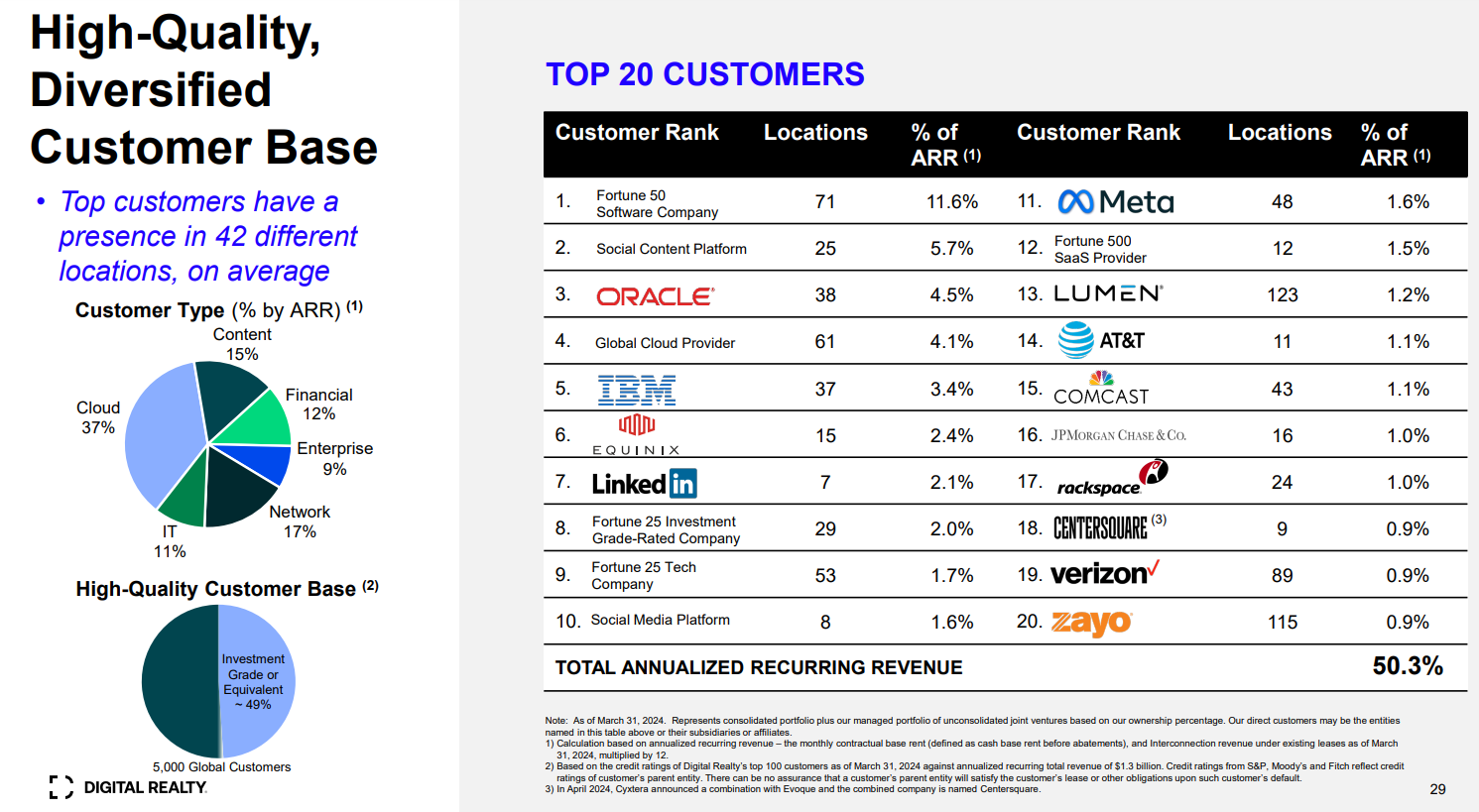

Digital Realty Trust last month on its second quarter earnings call outlined a top customer list that was heavy on cloud service providers and social media companies. JPMorgan Chase was one of the few named enterprises on the list.

Andrew Power, CEO of Digital Realty Trust, said "demand for data center capacity remains as strong as we've ever seen" and noted that the company has "a robust land bank and shell capacity that could support 3 gigawatts plus of incremental development."

It's not hard to figure out who is gobbling up Digital Realty Trust data centers based on its top 10 customers.

Power said the company is seeing strong demand from digital transformation, cloud and AI workloads. Power said:

"Traditional data centers were already being pushed to their limits on demand for cloud and digital transformation. Whereas demand for AI-oriented data center infrastructure is being accommodated in upgraded suites in our existing facilities and in newly built facilities. These AI workloads are taking place on specialized hardware with massive parallel processing capabilities and lighting fast data transfer speeds.

Fortunately, Digital Realty's modular data center design can accommodate these evolving requirements."

The biggest wild cards for this data center boom are power, construction, easements and a concentration of facilities in one area like Northern Virginia, said Power, who added sustainability concerns are critical too.