Enterprises are beginning to leverage AI and widen their profit moats just as some companies are seeing customers wobble. The efficiency gains are beginning to highlight how digital transformation and AI strategies are becoming self-funding, keeping expenses below the rate of inflation and optimizing processes.

Not surprisingly, the companies that are using AI leverage happen to be in regulated industries and enterprises that have previously invested in data and digital transformation. Why? These companies tend to have strong data quality, governance and strategies.

The payoff from these AI and data transformation efforts will be critical if and when customers pull back on spending. A growing number of CEOs sound like Shelley Simpson, CEO of J.B. Hunt.

"While admittedly the market has been challenging, we have invested throughout this downturn to set us up for future growth and success across the business. We continue to focus on controlling expenses in the near term without jeopardizing our long-term potential, managing our headcount through attrition, while at the same time continuing to deploy and enhance our technology to increase the productivity of our people," said Simpson.

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

Here are 6 vignettes to ponder from enterprise technology's buy side and how companies are driving toward exponential efficiency. These scenes are part of an ongoing series looking at generative AI use cases, takeaways from projects underway and how the technology fits in with broader digital transformation.

Progress Through The Five A's of AI | Margin Compression - Tech Vendors Are You Leading The Way Or In The Way?

Bank of America

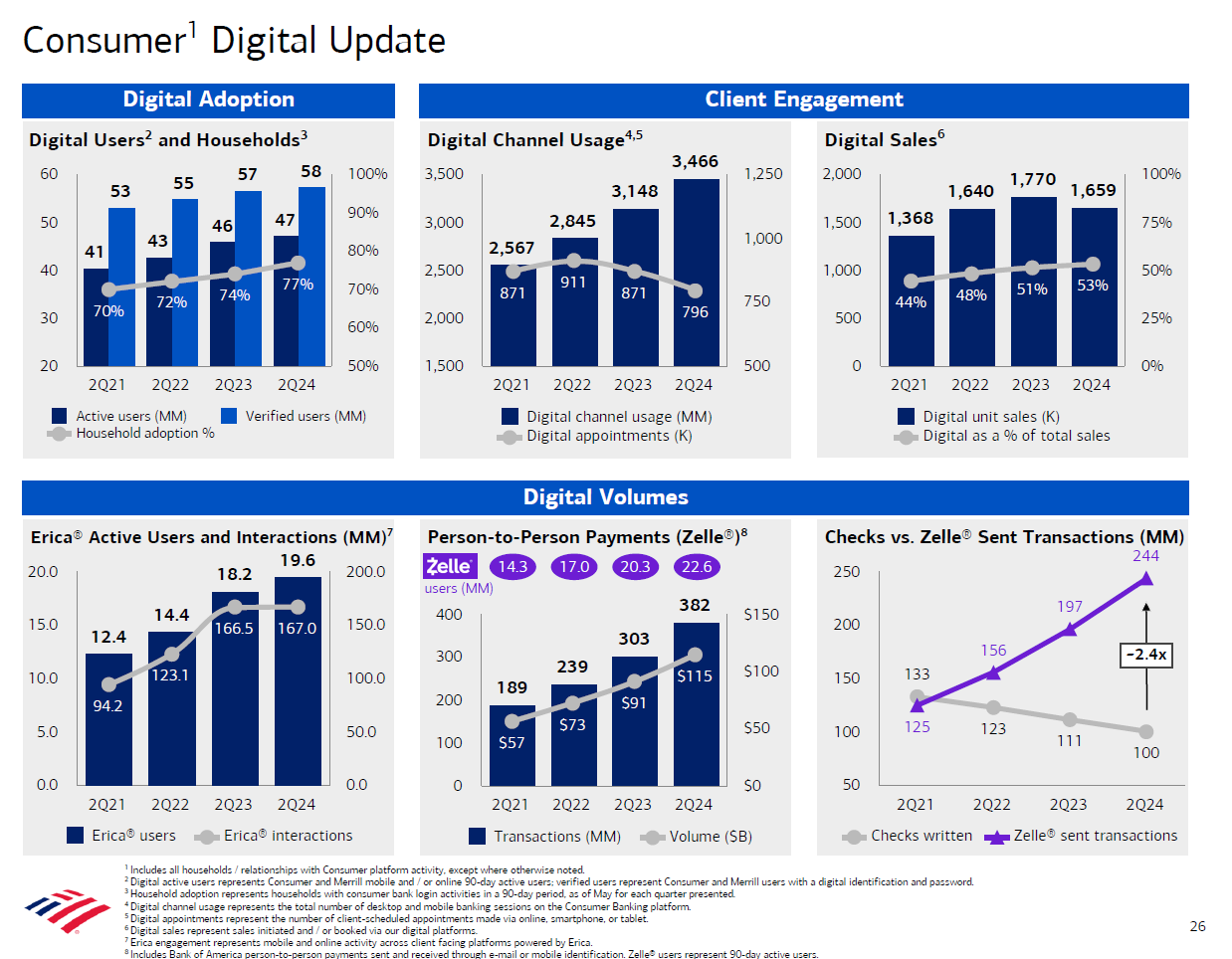

Bank of America expects to spend almost $4 billion on technology initiatives this year focused on AI for its employees and clients. The bank's client insights tool has served up more than 6 million insights to financial advisers to give them proactive reasons to engage.

CEO Brian Moynihan said Bank of America's mobile banking app has more than 47 million active users and digital sales are now 53% of total sales for its consumer business. On the cost side, Bank of America has saved money by streamlining client service requests using AI.

And digital is more than cost. "Digital adoption and engagement continue to improve, and customer satisfaction scores remain near record levels, illustrating customer appreciation of our enhanced capabilities due to our continuous investment," said Moynihan.

The leverage in Bank of America's digital strategy is also in what it calls its "operational excellence platform." Bank of America in its second quarter held its expense growth to 2% from a year ago and below inflation rates.

Bank of America has also kept headcount roughly flat. Moynihan said the company has managed expenses well with the help of AI and digital. "We have huge cleanup stuff going on. We have the new initiatives that free up work," he said.

- Why digital, business transformation projects need new approaches to returns

- Return on Transformation Investments (RTI)

- How 4 CEOs are approaching generative AI use cases in their companies

PepsiCo

In the second quarter, PepsiCo CEO Ramon Laguarta said consumers are being more selective as inflation takes a toll on household budgets. PepsiCo organic revenue growth was 1.9% in the quarter compared to 13% a year ago.

The upshot is that PepsiCo is hitting the limits of price increases. PepsiCo saw its annual revenue surge nearly $7 billion between 2020 and 2023, but noted that "the impacts of persistent inflationary pressures and higher borrowing costs over the last few years have resulted in tighter household financial conditions. Consumers have become more value-conscious with their spending patterns and preferences across brands, packages, and channels."

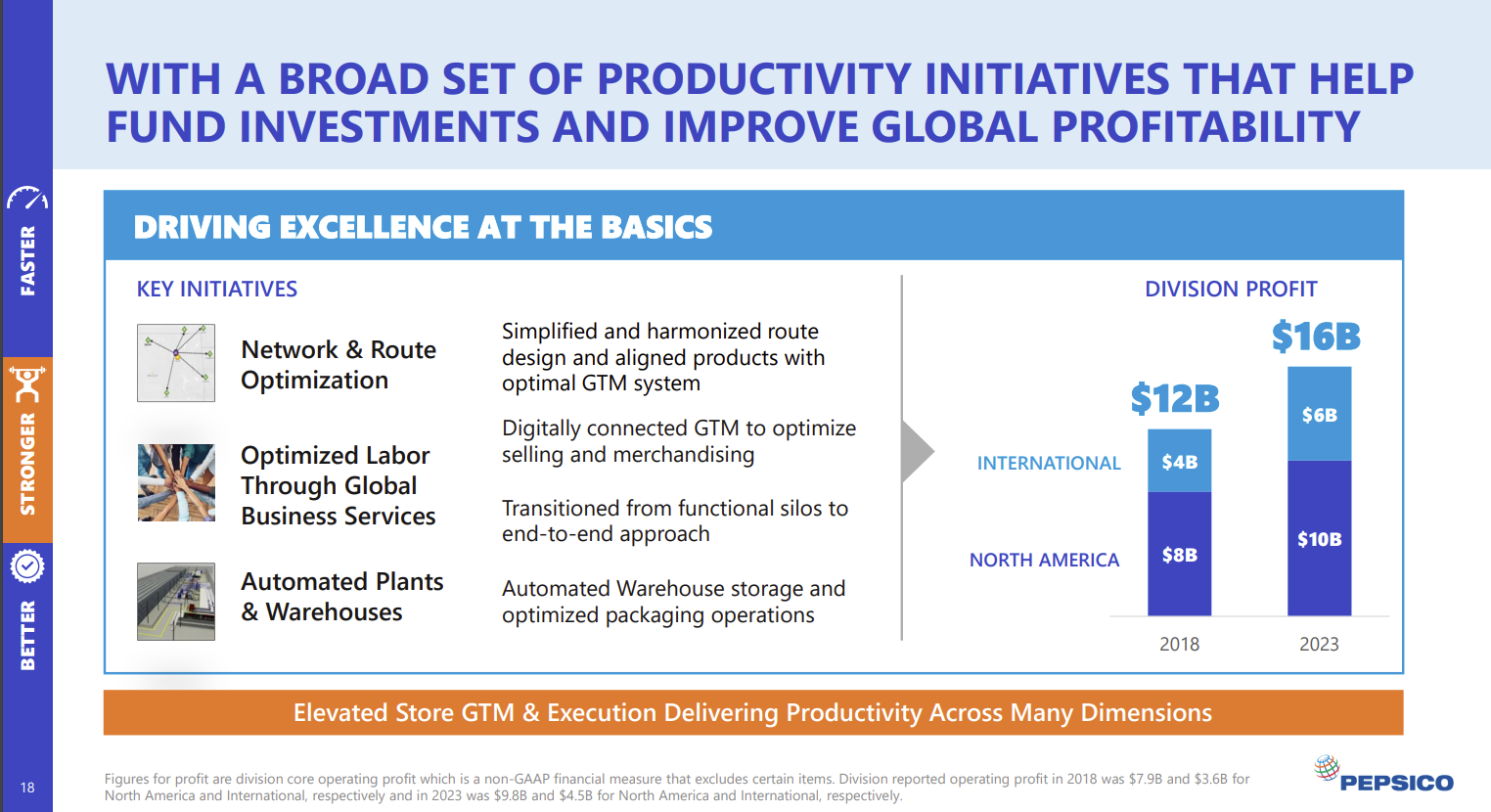

With consumers becoming tapped out, PepsiCo plans to fund investments going forward with productivity savings. PepsiCo has its process optimization game down.

The company plans to:

- Invest in more automation within warehousing, transportation and logistics.

- Advance its digitization efforts and harmonize IT systems.

- Optimize processes across the value chain.

- Enhance analytics for trade promotions, consumer insights, supply planning and demand forecasting.

- And optimize advertising and marketing spend.

Laguarta said: "We're managing total PepsiCo operating margin and as you've seen, we keep improving the margin. This quarter had almost 100 bps of operating margin improvement, and it's been consistent for the last few years. We feel good about our productivity pipeline, it’s not tactical, it's super strategic and it's multiyear and it's based on automation, it's based on digitalization, simplification of the company, standardization, different service models to the business. So, there is a whole portfolio of productivity ideas that are multiyear in nature and we don't think that we will slow down our productivity in the coming years."

UnitedHealth Group

UnitedHealth reported better-than-expected second quarter results as it grows revenue and optimizes operations. CEO Andrew Witty said: "Our growing AI portfolio made up of hundreds of practical use cases will generate billions of dollars of efficiencies over the next several years. These investments enable us to improve consumer experience, enhance provider find and price care capabilities to meet people's needs and improve clinical back-office execution. We expect technology innovation to become an increasingly core driver of our growth over the next two to five years."

UnitedHealth is still taking an earnings hit due to the Change Healthcare cyberattack, but its focus on efficiencies is minimizing the bottom line hit.

Witty said the AI use cases identified by UnitedHealthcare will drive margins and cost savings through the next two years. Witty added that AI and process improvements go together and that AI will create a "fundamental reimagination of business processes" and "allow an existing process to run more efficiently.”

"We actually take steps out of a process and really start to change things. I'd call out payment integrity as a front-runner in that particular regard," said Witty.

A few examples:

- UnitedHealth onboarded a record number of OptumRx customers but spent 9% less this year than last year due to digitization.

- OptumHealth added nearly more than 1.5 million customers with zero increase in personnel headcount in risk-based businesses.

- UnitedHealth is proactively engaging with three-fourths of its members using technology, up from 62% a year ago.

Witty said UnitedHealth is doubling down on its own cost management efficiency and productivity and that focus "coincides with an extraordinarily and exciting moment around technological innovation, whether that's Generative AI, digitization, all wrapped together in our march toward a greater consumer focus within the organization."

Omnicom Group

Omnicom said it has expanded its genAI efforts for both clients and internal use cases.

The advertising and public relations giant's genAI strategy revolves around becoming more efficient and selling products and services to clients. CEO John Wren said on the company's second quarter earnings call: "We also announced first-mover collaborations with Adobe, Amazon, Getty, Google and Microsoft's OpenAI to gain early access to their large language models. Just over a year later, we're seeing these generative AI platforms' tools and partnerships being activated throughout every area of our business from strategy to creative to production, media and precision marketing."

For instance, Omnicom's TBWA unit launched Collective AI, a suite of tools for employees and clients that automates basic tasks and then provides insights. Collective AI uses TBWA's archives to train large language models. ArtBotAI is a content orchestration platform to create digital assets and personalized experiences.

Omnicom also acquired Flywheel, which focuses on retail media and e-commerce. The idea is to combine Flywheels' commerce product and transaction signals with Omnicom's audience and viewership data, said Wren, who noted that Omnicom has also centralized production to go along with the AI investment.

"From Gen AI to e-commerce to production, we are continuing to enhance our offerings to meet our clients' needs for better inform strategic insights using AI, creatively inspired content that can be personalized at scale and investments in targeted media that can be measured through quantifiable outcomes, all delivered in the most efficient and effective manner," said Wren. "We decided that the only way that we're going to efficiently and effectively grow, especially in this AI environment, which is going to change those legacy production businesses was in fact to centralize it."

Goldman Sachs

Goldman Sachs' CEO David Solomon has talked up the company's AI initiatives before. He said the company has leveraged AI for multiple use cases ranging from coding to equity research and content.

"We are focused on how you can create use cases that increase your productivity," said Solomon. "If you look and you think across the scale of our business, I think you can think of lots of places where the capacity to use these tools to take work that's always been more manual and allow the very smart people to do that work to focus their attention on clients."

Solomon said the AI spending boom is real and can drive productivity and revenue gains. Solomon said: "I am particularly encouraged by the ongoing advancements in artificial intelligence. Recently, our Board of Directors spent a week in Silicon Valley where we spoke with the CEOs of many of the leading institutions at the cutting-edge of technology and AI. We all left with a sense of optimism about the application of AI tools and the accelerating innovation in technology more broadly. The proliferation of AI in the corporate world will bring with it significant demand-related infrastructure and financing needs, which should fuel activity across our broad franchise."

WD-40

While many of the examples revolve around AI, it's worth noting that there are plenty of companies doing the data strategy heavy lifting to take advantage of the technology later. WD-40 is a good example.

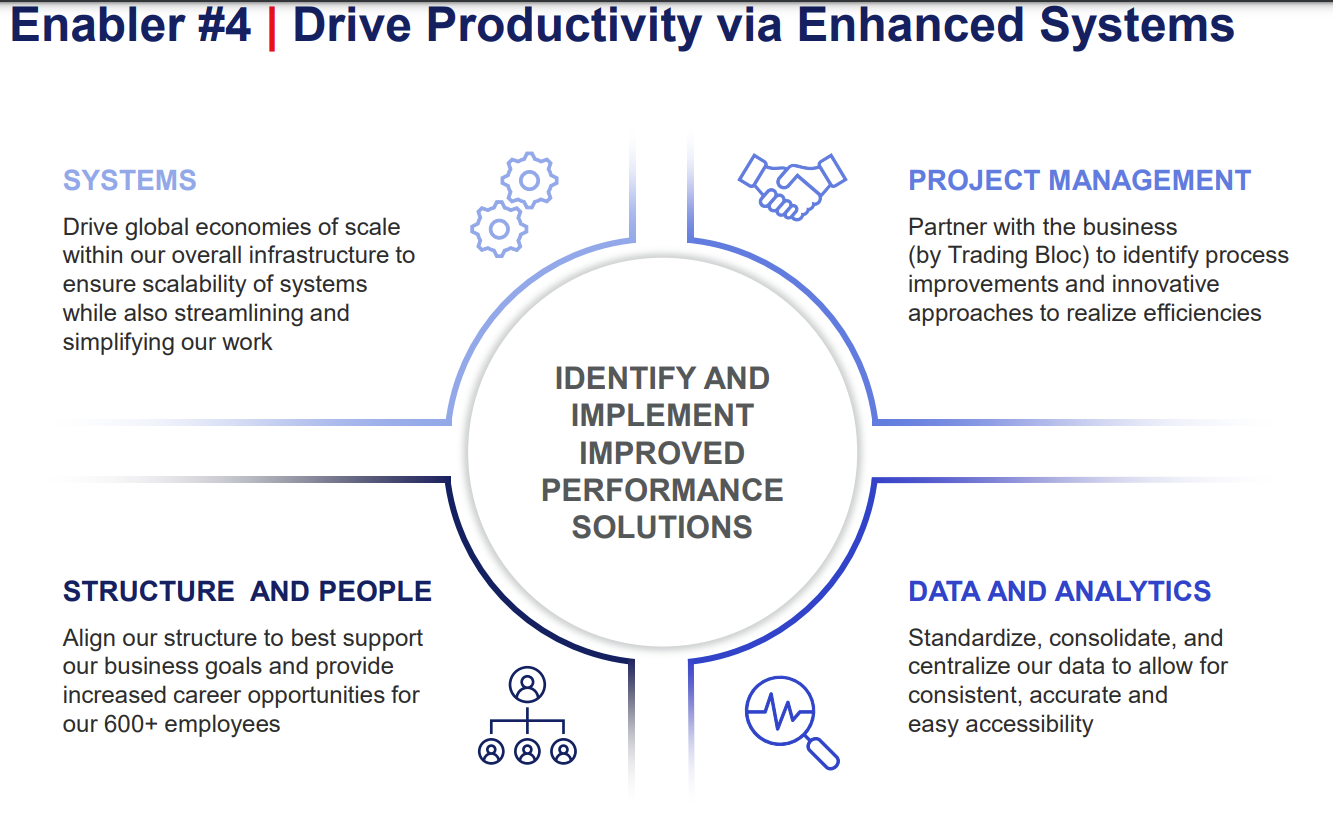

WD-40 CFO Sara Hyzer said on the company's third quarter earnings conference call that it is updating its ERP system, launching Salesforce and looking to "drive productivity via enhanced systems."

Hyzer said WD-40 went live with the first phase of its ERP system across much of its business including the US, Latin America and Asia regional distributor businesses. The implementation resulted in some minor disruptions in the third quarter, but most of the critical issues have been resolved.

"We know there is still work to do and have several enhancements that are already being worked on, which is not unexpected at this phase of the project. Most importantly, we have gained numerous learning moments from this implementation, allowing us to make process improvements and become more proactive," said Hyzer.

The other move for WD-40 is to roll out Salesforce in the US to drive sales efficiencies and reduce costs. "We also know that use of data analytics and automated tools, leveraging data is increasing and can be a real enabler for the business," said Hyzer. "The foundational work we are doing now around data governance, centralizing our data architecture and data quality management will allow our people to leverage our data quicker and drive better decision-making."

Insights Archive

- GenAI may be the new UI for enterprise software

- Education tech in turmoil amid genAI: Why consolidation is next

- 14 takeaways from genAI initiatives midway through 2024

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Enterprises Must Now Cultivate a Capable and Diverse AI Model Garden

- Financial services firms see genAI use cases leading to efficiency boom