A common mantra among technology companies is that it's better to disrupt yourself than let a competitor do it. On the whiteboard that mantra makes long-term sense. In reality, a business model transition can crush your stock.

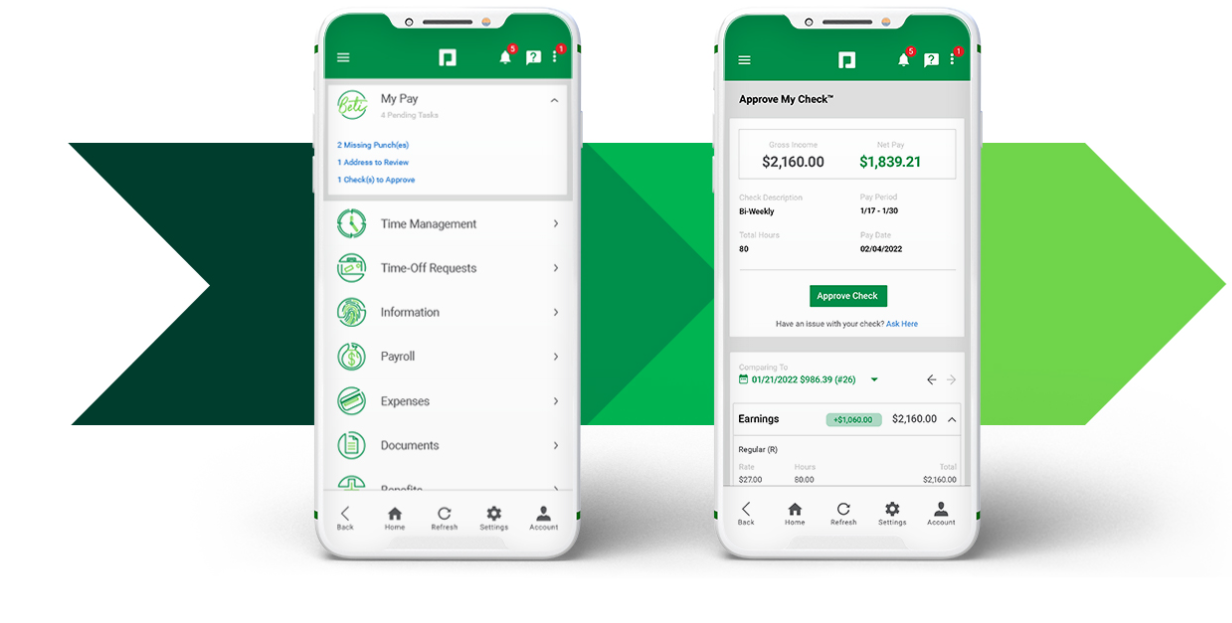

Just ask Paycom, a human capital management software provider that created Beti, a service that dramatically reduces payroll errors and drives value for customers. The concept is shockingly simple: Give employees access to payroll to fix errors before the checks are cut.

Paycom shares were hammered this week because Beti is doing away with unscheduled payroll runs and error fixes. What's wrong with generating returns for customers? A more perfect payroll means fewer billable items for Paycom, which charged for corrections and unscheduled payrolls.

Here’s a look at the carnage (hint: lower right on chart is where “PAYC” wound up.)

To its credit, Paycom is playing the long game with customers. Sure, the business model transition hurts a bit, but other companies have gone through it. Think about how software companies transitioned from licenses to subscriptions after Adobe led the way.

Beti launched in 2021 and now two-thirds of Paycom's customer base is using it. Paycom is rolling out Beti to Mexico to complement US and Canada.

Paycom CEO Chad Richison explained the Beti effect.

"For most employees, the value of the perfect payroll is oftentimes immeasurable. If their check is perfect, they don't need to borrow money from a friend or family member to get through the weekend or make a bill payment. How do you measure the value of that?

We're getting better and better at helping employers measure the full value available to them when payrolls are perfect. A portion of that value is easy to calculate because it's the value they receive by the elimination of after-the-fact payroll errors that require correction payroll runs, manual checks, voided checks, direct deposit reversals, additional wires, tax adjustments, W2Cs, et cetera, et cetera.

Perfect payrolls eliminate these common after-the-fact payroll corrections that would otherwise be billable. So the more employees do their own payroll, the greater the savings delivered to the client from Paycom future billings, which results in lower related revenue recognized by Paycom."

Paycom isn't hurting. The company delivered third-quarter revenue of $406 million, up 22% from a year ago, with net income of $75 million, or $1.30 a share. Non-GAAP earnings were $1.77 a share. Third-quarter sales missed guidance because Beti was working too well. In addition, the outlook was light as Paycom projected revenue between $420 million to $425 million in the fourth quarter.

In other words, the more customers use Beti, the more value they receive at the expense of Paycom revenue. Paycom is expecting revenue growth in 2024 between 10% and 12%. A customer that had to ran 19 payrolls a quarter due to errors can now run 13.

The big question: Should Paycom have disrupted its own services business? It's a conundrum faced by many companies and the decision isn't easy. Here are a few thoughts about answering that question.

Paycom's long game. Richison said that he's focused on "the client value and the differential between what they're paying and what they're actually achieving." Overall, I don't think you can go wrong providing value to customers.

If Paycom didn't launch Beti someone else would have. I'd argue that payroll errors aren't a feature but a bug. Some startup would have disrupted the error-ridden payroll process with something similar to Beti anyway. Paycom would have lost the services revenue and customers too over time. Shortly after Beti launched, Richison said on Paycom's fourth quarter 2021 conference call:

"For years, I have been predicting the end of the old model whereby HR and payroll personnel’s routine of inputting data for employees is replaced by a self-service model that provides employees direct access to the database.

The old model is dying and that is good for both the business and the employee."

Here's a fun fact: Paycom's fourth quarter revenue in 2021 was $285 million, well below the projected $420 million or so two years later.

Don't forget word of mouth. Paycom received a good amount of attention as shares fell this week. Enterprise buyers who dig a bit will quickly find a "man bites dog" headline as Paycom sacrificed revenue for customer value. Something tells me this Paycom stock tale may wind up being good marketing.

Paycom is adding new customers. Should Beti ramp even further Paycom will have more enterprise customers on its platform. These customers tend to buy other services later if the vendor delivers.

"New business sales as well as cross-selling within our base has always been a mitigating factor to any type of transition shift, we make like this," said Richison. "New business sales remained strong. In fact, most of the calls we get in are about Beti. We've got our first enterprise rep and they're only targeting deals that have greater than 25,000 employees. And they've got plenty of leads."

Could Paycom have managed this transition better? Perhaps. But Beti appears to be a hit. In other words, take the win with a bit of pain. Disrupt yourself or be disrupted.