Delta Air Lines has migrated most of its technology infrastructure to the cloud and is starting to leverage generative AI (GenAI) for personalized pricing, digital concierge services, and optimizing the customer experience.

The 100-year-old airline recently outlined its technology investment at its Investor Day in November, then announced partnerships and various initiatives at CES 2025 and followed up with strong fourth-quarter earnings and a bright outlook.

Get this customer story as a PDF

Delta reported 2024 earnings of $3.46 billion with revenue of $61.6 billion, up from $58 billion in 2023. For 2025, Delta projected earnings growth of more than 10% with first-quarter revenue growth of 7% to 9%. For 2025, Delta expects free cash flow above $4 billion.

Speaking at CES 2025, Delta CEO Ed Bastian outlined Delta Concierge, which is a GenAI tool designed to personalize customer experience within the Delta app. Delta also announced partnerships with Uber, Joby (an electric air taxi service), and a partnership with YouTube.

“Together, these products and partnerships reflect our continued commitment to investing in and providing our customers with a superior travel experience,” Bastian said. “They drive greater engagement with our SkyMiles members that extend well beyond air travel, improving customer satisfaction and deepening loyalty to Delta.”

Indeed, Delta, which has sparred with CrowdStrike over the security vendor’s outage, is playing the long game with customers and is betting a more agile technology infrastructure and AI can create the personalization needed to drive lifetime value of a flier.

The airline has been investing in technology for the last three to four years. In 2022, Delta said it would migrate its infrastructure to AWS. That work is mostly complete, Bastian said, speaking during Delta’s Investor Day.

“We made some pretty healthy investments over the course of COVID to move the majority of our technology infrastructure to the cloud with AWS,” Bastian said. “And we’re just about at the end of that journey. It’s going to drive a lot of agility that’s going to drive a lot of speed, a lot of efficiency, for our ability to continue to not just provide stability to our infrastructure, but it’s also going to allow us to continue to change and move faster than others. Our platforms are modernized. Our software is continuing to get better, and it’s also allowed for the integration of many of the new AI and data analytics tools that you hear a lot about.”

Bastian said that Delta has invested about $500 million over the last three to four years moving to AWS. But that investment will pay off because it’ll enable Delta to leverage AI.

“We all know there’s a lot of hype around AI, and it’s something that we all look at and wonder if it’s going to live up to the promise,” Bastian said. “I think AI is going to be incredible in terms of its impact on our business, but it’s only going to be incredible if we’re prepared to actually harness the power. Our focus on AI is to learn, and to listen, and to make certain that we’re ready before we jump in with both feet.”

Delta is looking to apply AI to three core areas of its business. These include:

Reliability of operations. “You think about the 5,000 flights a day that operate in all kinds of weather conditions, with all kinds of variables, with staffing coming from all over the world—it’s a Rubik’s Cube every single day, and you’re trying to optimize and get the best answer,” Bastian said.

Bastian added that scheduling, prioritization, and more-efficient routing will all be key use cases for AI.

Connected experiences. Bastian said that Delta is going to leverage technology to connect with customers. At AWS re:Invent 2023, Delta said that it leveraged Amazon Bedrock to try out different models to deliver answers to customers. It’s very early, but Delta is able to hit you up during a log-in and know it’s your birthday. The free Wi-Fi and seamless log-in experience doesn’t hurt, either.

Revenue growth. Delta will leverage AI to drive pricing and revenue growth. “When you have a brand that has a 26-plus-point advantage versus your network competitors but your revenue premium is 14 points, I think there might be opportunity to do better,” Bastian said.

The framework for AI

Bastian said that Delta is early in its AI journey, but it has a framework for projects over the next three to five years. The framework is simple: Every AI project needs to fit into one of Delta’s three core priorities of reliability, experience, and revenue generation.

Delta’s operating margins are typically between 11% to 12% and the company expects those margins to grow to the mid-teens in the years ahead. Delta is also planning to grow earnings at a double-digit clip on average over the next five years.

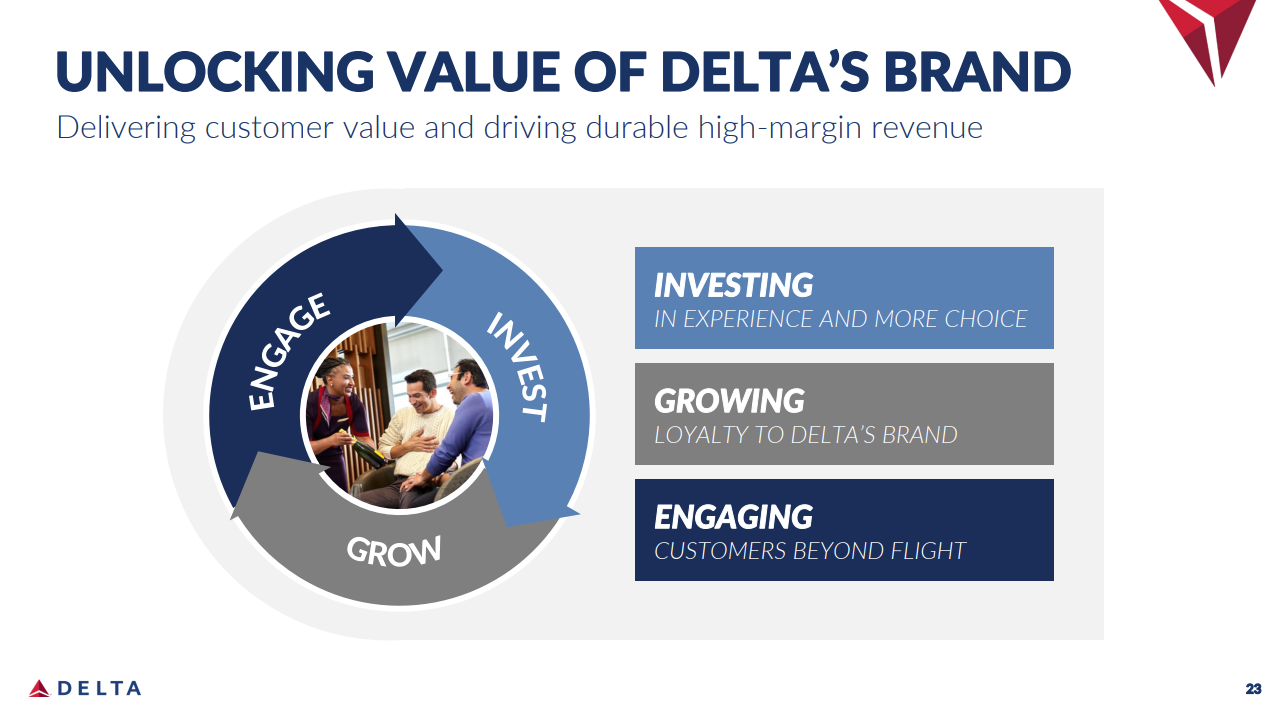

Glen Hauenstein, President of Delta, is on the hook for delivering those metrics and said technology is critical to delivering a premium product and experience. “We saw this many years ago and went on a journey to de-commoditize the airline space,” Hauenstein said.

Hauenstein noted that everything Delta does revolves around the brand: The investment in airport facilities is brand. The network of lounges is brand. Technology partnerships is brand. The ability to expand into adjacent travel categories is brand. And the membership experience is brand.

“We’re able to describe an experience and not only create it, but sell it and retail it,” Hauenstein said. “Retail is really the frontier that we will continue to lead over the next three to five years.”

Delta also plans to use technology to segment its audience. Delta has strong ratings with millennials and baby boomers, two generations with money for travel, and is installing a digital footprint that can grow its share for future generations.

Going forward, Delta will optimize its offering through data and technology. The data will lead to experimentation, new bundles, and subcategories for seating. “We’re going to test and learn along the way, but we’re going to start from the bottom up,” Hauenstein said. “In 2025, we’re going to try some segmenting, some additional segmenting of the main cabin. You’ll see us attempting and really testing what consumers want in their bundles and what they’re willing to pay for. That’s really the way I think good retailers work and we’re going to transform ourselves over the next three to five years.”

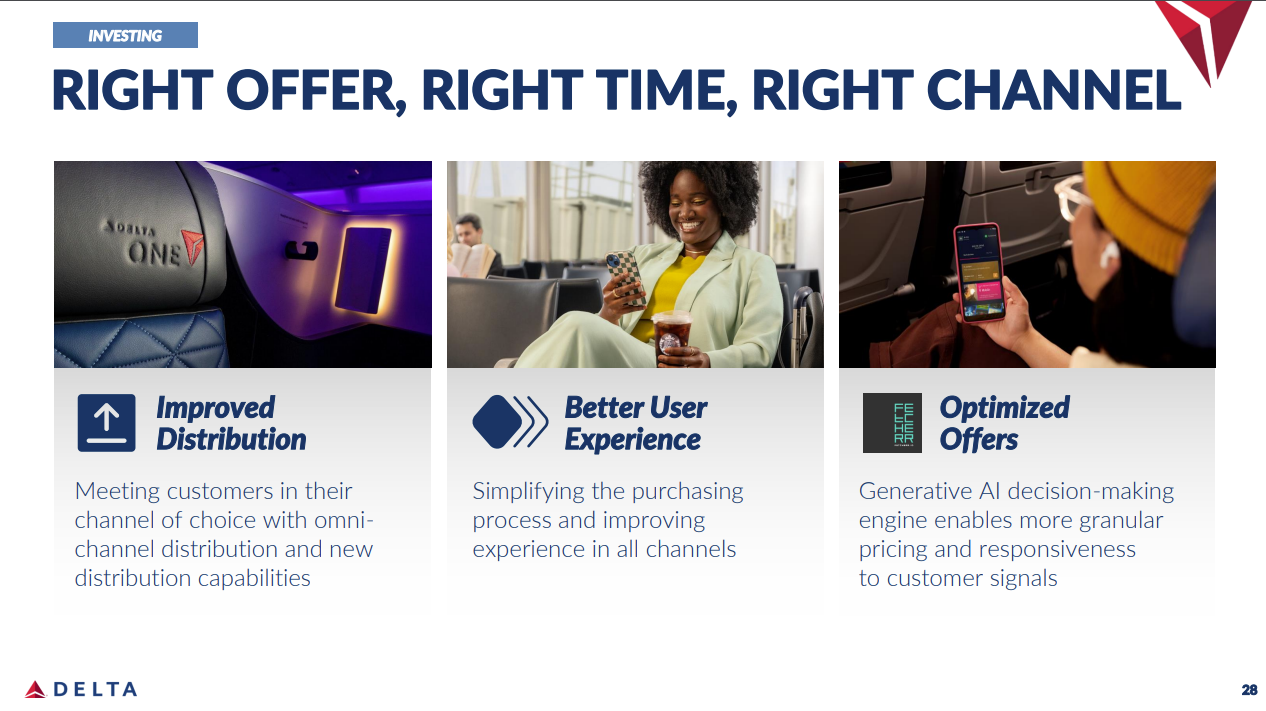

‘Right offer, right time, and right channel’

When you listen to Bastian and Hauenstein riff, they do sound more like omnichannel retailers than an airline.

And like most omnichannel retailers, Delta will be betting on data to connect with customers.

Hauenstein said Delta is looking to connect the “right offer, right time, and right channel.”

“What we’re really trying to do is to get inside the mind of our consumer and present them something that’s relevant to them at the right time with the right price,” Hauenstein said.

Delta has partnered with an Israeli startup called Fetcherr, which uses GenAI to create optimized offers. Hauenstein said Delta has worked with Fetcherr for more than a year and about 1% of the network is being priced by the startup.

“This is a full re-engineering of how we price and how we will be pricing in the future. And if you think about it today, there are two disciplines: There is pricing, which sets the price points, and then there’s revenue management, which controls access into the inventory of those price points,” Hauenstein said, noting that over time pricing and revenue management will converge. “It’s going to really be just offer management. We will have a price that’s available on that flight, on that time to you, the individual.”

With the help of AI, Delta is betting that its systems can act like a digital analyst that can simulate real-time price points and demand.

“We’re letting the machine go ahead and price in a very controlled environment,” Hauenstein said. “It’s going to be a multiyear, multistep process as we continue to learn, innovate, teach the machine and change the business process, but the initial results show amazingly favorable unit revenues.”

Delta executives said the company will go slow even though it wants first-mover advantage and to retool its business processes as quickly as possible. Hauenstein said Delta will iterate to offer “clean choices” that aren’t overwhelming when it comes to multiple offers.

“Personalized and seamless experiences—we put a lot of effort into this, and we have a long way to go,” Hauenstein said, adding that these experiences will be priority now that the cloud migration is complete. “We can redirect to really implementing some of these changes that we have in the queue that have been kind of sitting, waiting for the cloud to be fully migrated.”