Dell Technology reported better-than-expected first quarter results and said it saw strong demand across traditional and AI optimized servers.

The company reported first quarter net income of $955 million, or $1.32 a share, with revenue of $22.24 billion, up 6% from a year ago. Non-GAAP earnings in the first quarter were $1.27 a share.

Dell was expected to report first quarter earnings of $1.26 a share (non-GAAP) on revenue of $21.64 billion.

Dell Technologies goes all-in on AI factories

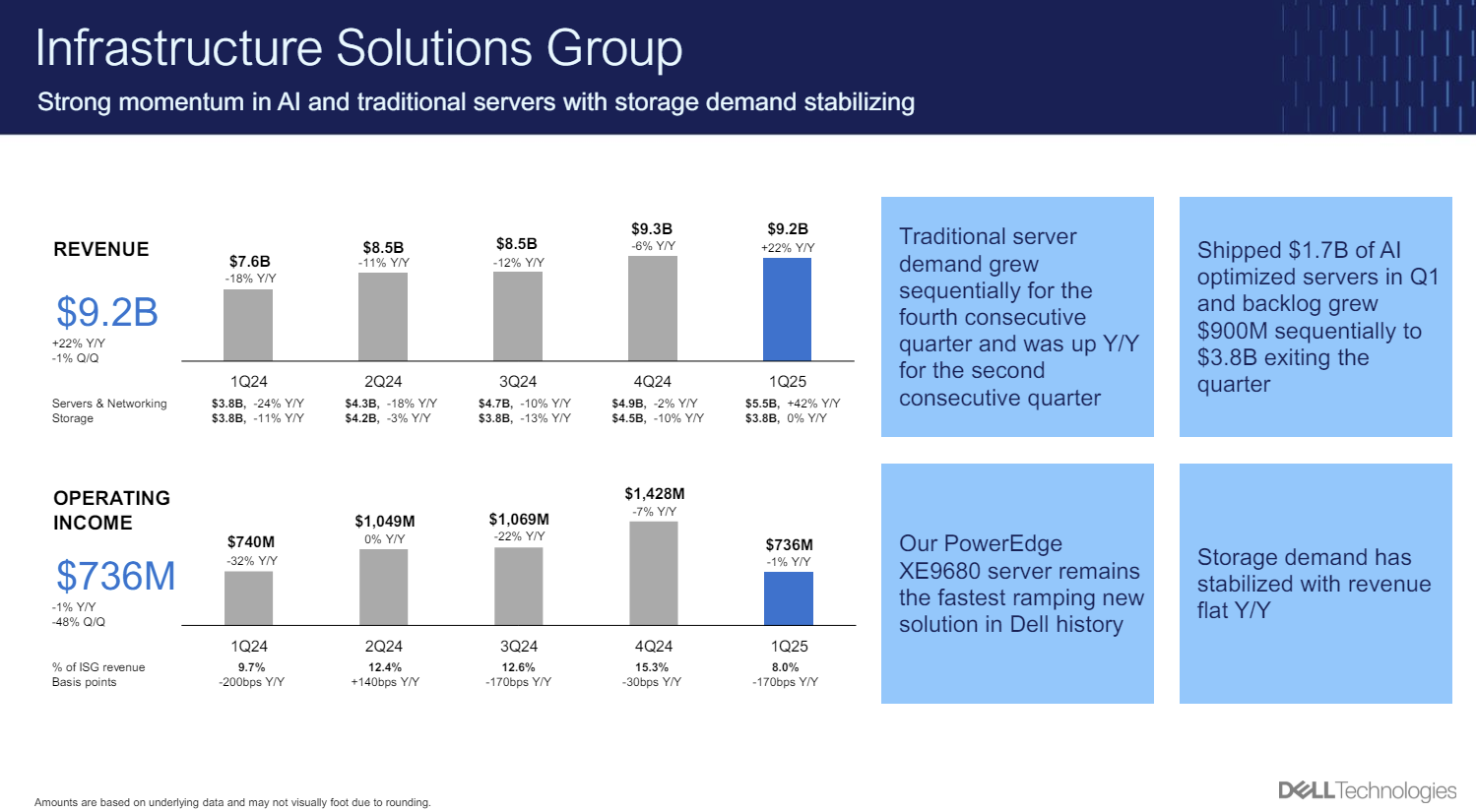

By unit, Dell said its infrastructure solutions group (ISG) had revenue of $9.2 billion, up 22% from a year ago. Server and networking revenue was a record $5.5 billion, up 42% from a year ago. The company said that it saw strong demand for AI and traditional servers. Storage revenue was flat at $3.8 billion.

ISG had first quarter operating income of $732 million.

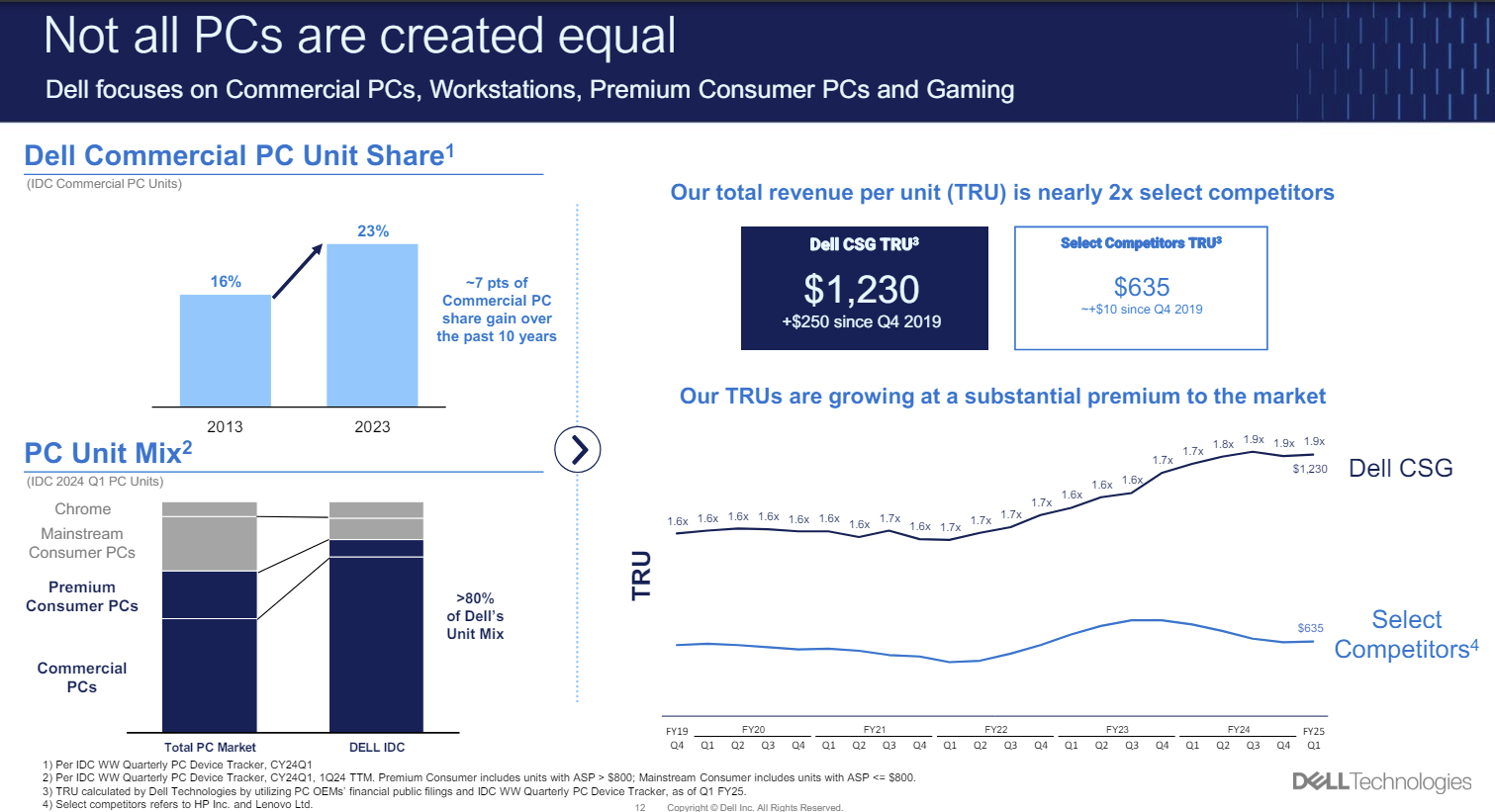

For the PC unit, Dell reported first quarter revenue of $12 billion, flat from a year ago. Commercial revenue was $10.2 billion, up 3% from a year ago, and consumer sales were $1.8 billion, down 15%. Operating income in the quarter was $732 million.

Jeff Clarke, Chief Operating Officer, said AI-optimized server orders were $2.6 billion with shipments up more than 100% to $1.7 billion. Dell added that backlog for AI-optimized servers were up 30% in the first quarter to $3.8 billion.

In prepared remarks, Clarke said the company has "seen an expansion in the number of enterprise customers buying AI solutions." He added that commercial PC demand has stabilized.

The company gave a mostly in-line outlook for the second quarter and fiscal year:

- AI momentum will continue and modular AI optimized servers are scaling with customers.

- "The macro environment is still dynamic" and "indicators point toward a stabilization."

- Dell sees fiscal 2025 revenue between $93.5 billion and $97.5 billion, up 8% at the midpoint.

- Infrastructure solutions group revenue will grow more than 20%.

- Non-GAAP earnings for fiscal 2025 will be about $7.65 a share, give or take 25 cents a share.

- For the second quarter, Dell projected revenue between $23.5 billion and $24.5 billion with non-GAAP earnings of $1.65 a share, give or take 10 cents a share.

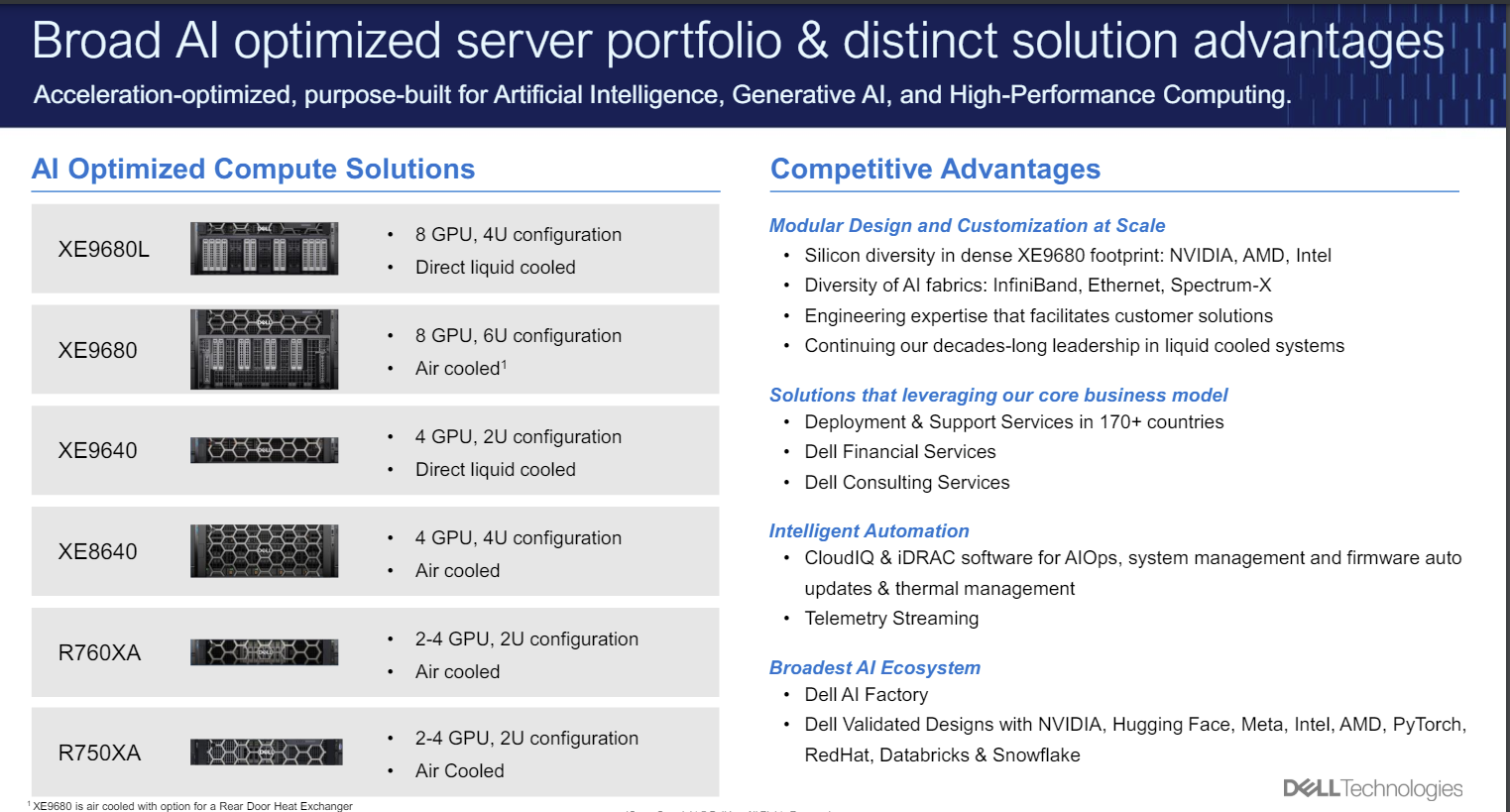

Speaking on the earnings call, Clarke said the AI-optimized servers for now are mostly Nvidia-based systems. He said:

"The lead times on our product varies and is complicated. We have product transitions from H100 to H200, outselling GB200 and B200. Those are customer allocated. So to say that there's an average lead time for our product is very dependent on the customer, what technology we're talking about. But in average, if it was just looking at the availability of parts, the H100 lead time is better. Those products are in full production. NVIDIA is meeting demand, and they'll have availability of the H200 on schedule towards the second or the latter part of Q2. So it's in production, as is the B200. So that's where the backlogs slash lead times are. When you look at the composition of our backlog, it's primarily NVIDIA-based."

Clarke also said that each AI-optimized server sold will drive revenue for Dell Technologies' other products. That halo effect hasn't played out just yet though.

"We think there's a large amount of storage that sits around these things. These models that are being trained require lots of data. That data has got to be stored and fed into the GPU at a high bandwidth, which ties in network. The opportunity around unstructured data is immense here, and we think that opportunity continues to exist. We think the opportunity around NICs and switches and building out the fabric to connect individual GPUs to one another to take each node, racks of racks across the data center to connect it, that high bandwidth fabric is absolutely there and needed. We think the opportunity to extend in doing deployment of the rack itself is an opportunity, installing whether that's cables, heat exchangers, rear door heat exchangers, cooling units, power units, et cetera, the cabling. We think the deployment of this gear in the data center is a huge opportunity."

There are also a bevy of services Dell can sell to implement, manage and scale systems.