Dell Technologies reported better-than-expected third quarter results and strong demand for its AI servers, but weak consumer PC sales.

The company reported third quarter net income of $1.127 billion, or $1.58 a share, on revenue of $24.37 billion, up 10% from a year ago. Non-GAAP earnings were $2.15 a share.

Dell was expected to report earnings of $2.06 a share on revenue of $24.72 billion. Leading up to the report, Wall Street analysts were betting that the company would be a big beneficiary of SuperMicro’s accounting issues along with HPE. Dell Technologies has also been moving to create modular bundles for AI factories based on Nvidia, AMD and others.

- Dell Technologies launches Nvidia Blackwell PowerEdge system, new rack design

- Dell lays out AMD genAI systems, services

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

- Dell Technologies COO Clarke: Data gravity will drive enterprise genAI infrastructure demand

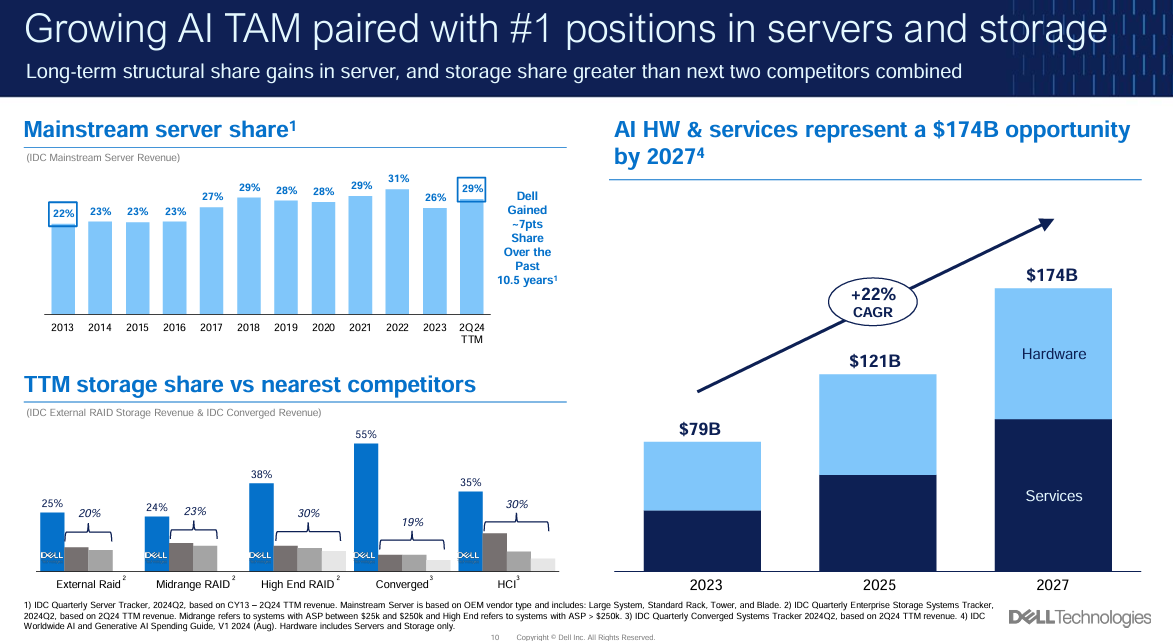

Jeff Clarke, chief operating officer, said that AI demand is showing “no signs of slowing down” and the company saw AI server orders demand of $3.6 billion in the third quarter. Dell Technologies pipeline in the quarte rwas up 50%. Dell’s infrastructure solutions group had operating income of $1.5 billion on revenue of $11.4 billion, up 34% from a year ago. Servers and networking revenue was up 58% and storage revenue was up 4% in the third quarter.

In prepared remarks, Clarke said:

"We continue to gain traction with Enterprise customers, large and small, with over 2,000 unique Enterprise customers since launch. Increasingly, Enterprises see the disruptive nature and the innovation opportunities with GenAI resulting in growing GenAI experimentation and proof of concepts."

Clarke added that Dell sees "profit pools" to surround AI servers including power management and distribution, cooling systems, networking gear, maintenance and services.

According to Clarke, enterprises are consolidating data centers for power and efficiency and "freeing up valuable floor space and power that will support their AI infrastructure."

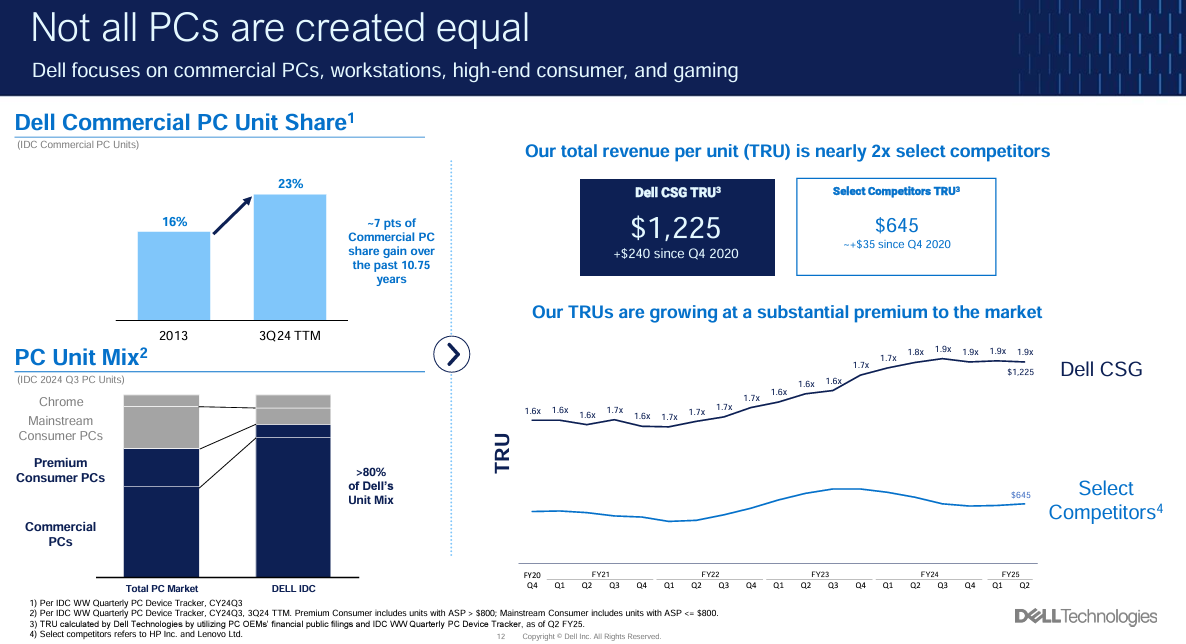

However, Dell said its client solutions group saw third quarter revenue of $12.1 billion, down 1% from a year ago. Commercial PC revenue was up 3% from a year ago to $10.1 billion. Consumer PC revenue fell 18% in the third quarter to $2 billion. Dell's focus is on commercial PC and workstations.

He said enterprises are upgrading PCs, but "lining up their upgrade cycles with new AI PCs in the first half of next year." Clarke said enterprises are balancing their need to refresh while future proofing purchases.

Consumer demand "continues to be challenged," but expects demand to pickup as Windows 10 nears end of life in 46 weeks.

"Dell had a good quarter, largely because its data center revenue is now large enough that its growth can compensate for the stagnating client solutions group. The next quarter maybe the inflection point, when data center revenue will pass client solution group," said Constellation Research analyst Holger Mueller.

Dell CFO Yvonne McGill said IT spending is "dynamic" in that some areas (AI servers) are surging and others (consumer PCs) are lagging.

Dell projected fourth quarter revenue to be between $24 billion and $25 billion. Infrastructure revenue growth rate will be in the mid-20s range with the PC business revenue growth in the low single digit range. Non-GAAP fourth quarter earnings will be about $2.50 a share give or take 10 cents a share.

For the year, Dell said revenue is expected to grow about 9% with non-GAAP earnings of $7.81 a share.

Dell didn't provide an outlook for fiscal 2026, but McGill said:

"We expect multiple tailwinds going into next year, including more robust AI demand supported by our strong five quarter pipeline. There's also an aging install base in both PCs and Traditional servers that are primed for a refresh.

We expect ISG growth to be driven primarily by AI servers followed by Traditional servers and storage. We expect CSG to grow as enterprise customers refresh a large and aging install base."