Dell Technologies saw a second quarter boom in its infrastructure solutions group (ISG) revenue due to strong server and networking demand. Dell shipped $3.1 billion in AI servers in the second quarter.

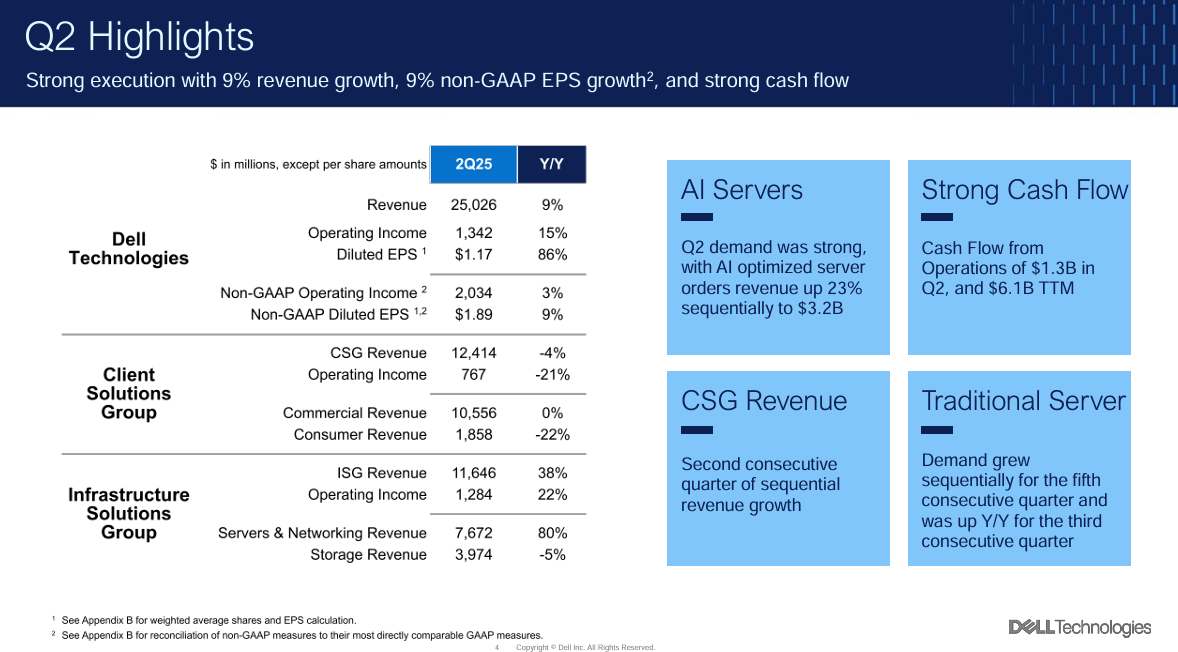

The company reported second-quarter earnings of $841 million, or $1.17 a share, on revenue of $25 billion, up 9% from a year ago. Non-GAAP earnings were $1.89 a share.

Wall Street was expecting Dell Technologies to report second quarter earnings of $1.72 a share on revenue of $24.12 billion. Dell’s results are being closely watched to gauge AI infrastructure demand.

- Dell Technologies goes all-in on AI factories

- Dell Technologies, Supermicro building xAI supercomputer

- PC industry's big dream: AI enabled PCs spur upgrade cycle

- Dell Technology sees Q1 AI-optimized server demand surge

- HPE delivers fiscal Q2, joins AI server sales parade

AI infrastructure drove the quarter for Dell.

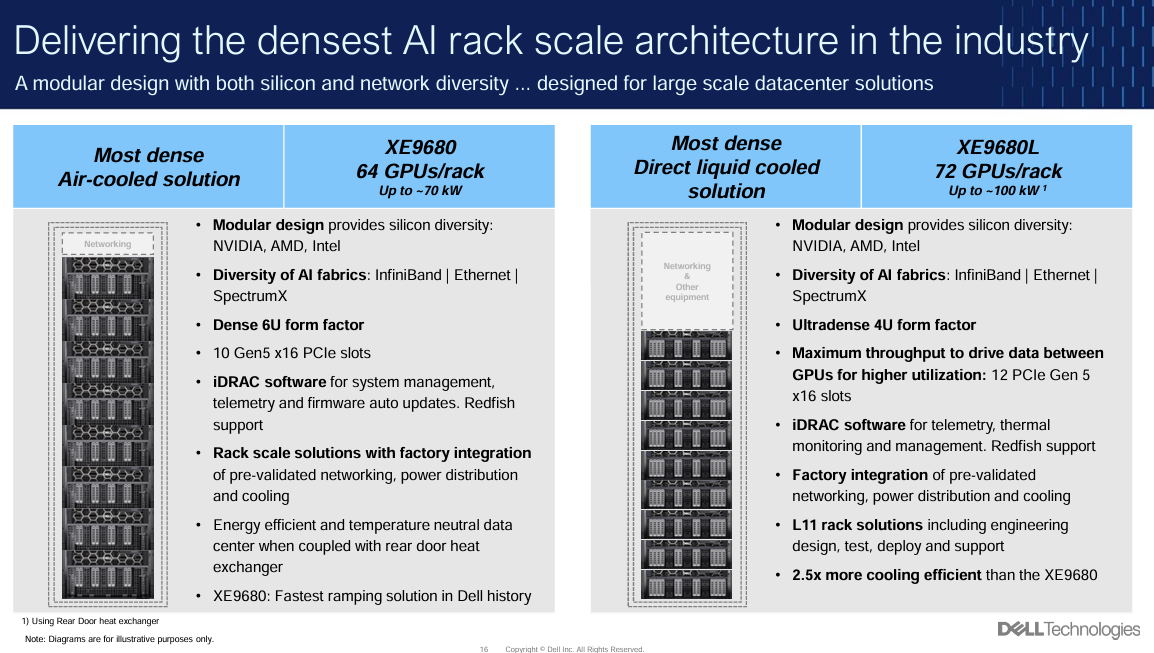

In prepared remarks, Jeff Clarke, Chief Operating Officer, said demand was driven by cloud service providers. “Our unique capability to deliver leading edge air and liquid cooled AI servers, networking and storage — tuned and optimized for maximum performance at the node and rack level — combined with leading ecosystem partners and world class services and support, continues to resonate with customers,” said Clarke. “Encouragingly, we continue to see an increase in the number of enterprise customers buying AI solutions each quarter.”

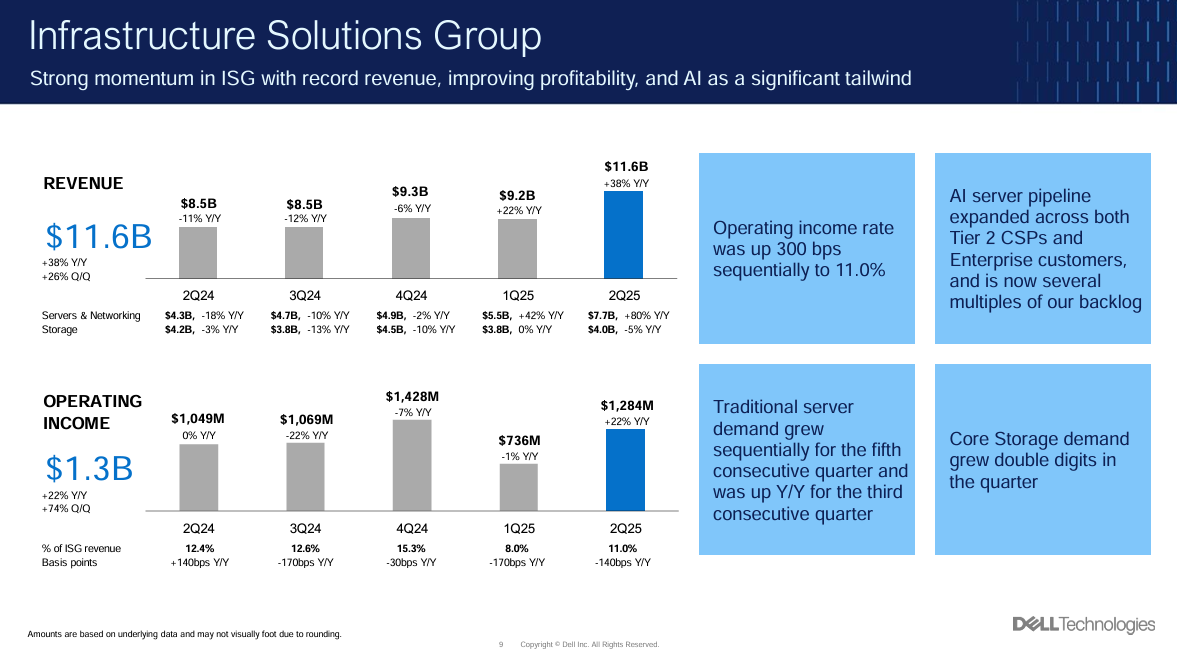

Servers and networking revenue hit a second quarter record at $7.7 billion, up 80% due to demand for AI servers. Storage revenue was down 5% from a year ago to $4 billion. Operating income was $1.3 billion for ISG in the second quarter.

Clarke said AI server backlog exiting the second quarter was $3.8 billion. The pipeline also expanded beyond cloud service providers to enterprises.

“We are competing in all of the big AI deals and are winning significant deployments at scale,” said Clarke. “Progress will not always be linear in the early stages, but we are winning in the market with strong feedback from repeat customers while acquiring new customers every quarter.”

Dell’s PC unit delivered second quarter operating income of $767 million on revenue of $12.4 billion, down 4% from a year ago. Commercial PC revenue was flat with a year ago as consumer fell 22% in the second quarter.

As for the outlook, Dell Technologies said third quarter revenue will be about $24 billion to $25 billion, up 10% at the midpoint. Non-GAAP earnings for the third quarter will be about $2 a share. For fiscal 2025, Dell Technologies expects revenue to be between $95.5 billion to $98.5 billion. ISG revenue will be up about 30%.

CFO Yvonne McGill said operating margins will be pressured due to "inflationary input costs, the competitive environment and a higher mix of AI optimized servers." However, Dell Technologies is using generative AI to save money.

McGill said:

"We are applying artificial intelligence and beginning to realize the benefits across our own business. We're using it to improve customer and team member experiences and sales, software development, services, content management and our supply chain, and in turn, we're using our experiences to help our customers realize benefits of AI for themselves."

Clarke added that Dell Technologies is also improving margins in its AI portfolio. "We are improving margins of our AI portfolio, and we did that with the same sort of price discipline, but more importantly, the engineering value add and the technical value add that we're bringing to our customers, and the expansion from beyond the specific node to the rack level deployment," said Clarke.