CrowdStrike reported better-than-expected fourth quarter results as the company was seeing strong enterprise demand for its AI driven security platform

The company, which is competing with Palo Alto Networks as a "platformization" play, reported a fourth quarter net loss of $92.3 million, or 37 cents a share, on revenue of $1.06 billion, up 255 from a year ago. Non-GAAP fourth quarter earnings were $1.03 a share.

Wall Street was expecting CrowdStrike to report non-GAAP earnings of 86 cents a share on revenue of $1.04 billion.

For fiscal 2025, CrowdStrike reported a net loss of $19.3 million, or 8 cents a share, on revenue of $3.95 billion, up 29% from a year ago. The company appears to be fully recovered from its July outage.

- Cybersecurity platformization: What you need to know

- CrowdStrike, Palo Alto Networks duel over platforms vs. bundles

- Palo Alto Networks delivers strong Q1, says industry on platformization bandwagon now

- How Platformization Applies to Cybersecurity

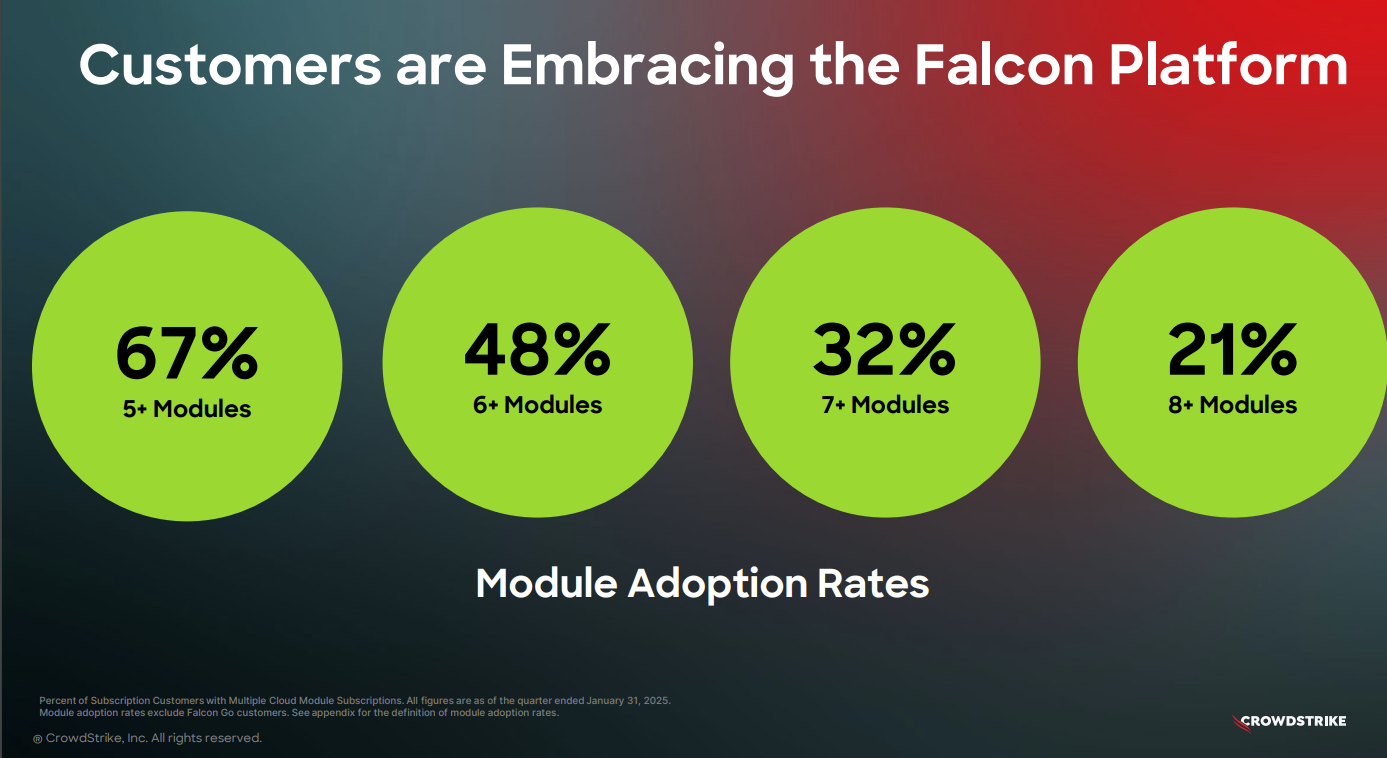

CrowdStrike CEO George Kurtz said the company is "on the flight path to our $10 billion ending ARR (annual recurring revenue) goal." Kurtz added the company was seeing strong demand for its Next-Gen SIEM, Cloud Security, and Identity Protection businesses. Falcon Flex, CrowdStrike's cybersecurity platform, added more than $1 billion in deal value in the fourth quarter.

As for the outlook, CrowdStrike projected first quarter revenue of $1.1 billion or so with non-GAAP earnings of 64 cents a share to 66 cents a share. Wall Street was expecting non-GAAP earnings for the first quarter of 96 cents a share. For fiscal 2026, CrowdStrike projected revenue of $4.74 billion to $4.8 billion with non-GAAP earnings of $3.33 a share to $3.45 a share. Analysts were expecting $4.43 a share for fiscal 2026.

- CrowdStrike buys Adaptive Security

- CrowdStrike, AWS expand partnership revolving around CrowdStrike Falcon and Amazon Bedrock

Speaking on a conference call, Kurtz said:

- "CrowdStrike is the first cybersecurity ISV to cross $1 billion in deal value on AWS Marketplace in a single calendar year, setting a new standard for ecosystem execution."

- "We find ourselves placed at the epicenter of a rapidly evolving demand environment. A new administration, a new wave of technology, and a new threat landscape necessitate all businesses to evolve their cybersecurity programs. Consolidation, cost reduction and automation are now the accepted enterprise and federal priorities."

- "We're still in the early, but rapidly evolving innings of the AI revolution. Businesses and governments across the globe are looking for their AI investments to yield both improved efficiencies and novel outputs. At CrowdStrike, we're requiring every team and function to leverage the power of AI."

- "Businesses are equally grappling with how to secure their environments in this AI age. Here's my take on what this means. First, more AI everywhere means more data, more access, and more processes, services, and products requiring cybersecurity."

- "With tools such as DeepSeek making AI access easier and cheaper, the pace and prevalence of adversarial AI adoption is only accelerating."

- "More access to more third-party and in-house agentic applications and services requires rethinking identity and data protection. Who is accessing data and where is it traveling matters more now than ever before."

- "Securing AI starts a broader enterprise data discussion. I'm seeing CISOs, CIOs, and CEOs going to the drawing board to reinvent their technology stack with AI-powered platforms of record for their next decade and beyond. And for security, it's even more pressing."