The state of reskilling in the generative AI era looks like it's going to be a bit lumpy if Coursera's first quarter results and outlook are any indication. Coursera CEO Jeff Maggioncalda said, "we remain in the early stages of understanding how generative AI will reshape the way we live, learn and work."

Coursera's first quarter results were mixed as earnings beat expectations, but revenue fell short. The second quarter outlook from Coursera calls for revenue of $162 million and $166 million, well below Wall Street estimates of $177.8 million. Coursera said 2024 revenue will be $695 million to $705 million, which was short of $736.5 million.

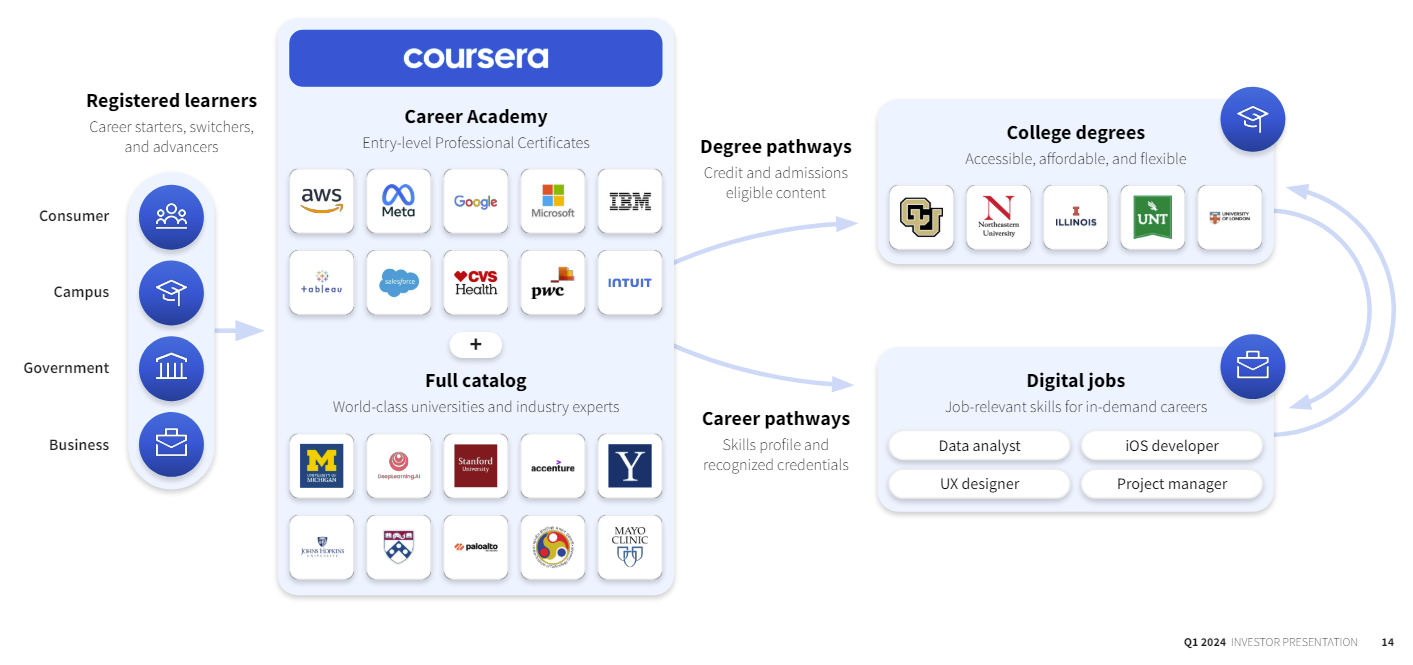

The company has three operating units--consumer, enterprise and degrees. Consumer revenue was up 18% in the first quarter compared to a year ago and enterprise and degrees revenue was up 10%. AI courses were driving demand in consumer and building in enterprise and degrees. Coursera's generative AI transformation is about a year old.

- Why you need to connect your hiring to data, outcomes pronto

- Education gets schooled in generative AI

- Accenture goes big on AI reskilling, acquires Udacity, launches LearnVantage

- 7 future of work themes to know now

However, for all the talk of reskilling in the genAI era there are false starts. Citing an Accenture report, Maggioncalda noted that 95% of employees see value in working with generative AI, but only 5% of organizations are actively reskilling their workforce at scale.

For a company like Coursera, the challenges are leveraging genAI for content creation in an accurate way, being able to swap models as needed and hitting learnings beyond builders. Coursera has built out its AI courses and landed deals with enterprises as well as universities.

Maggioncalda said Coursera partners have built out more than 75 new courses and project in generative AI since the start of the year. Coursera is also using generative AI to power Coursera Course Builder that will enable "any business, government or campus customer, to easily and quickly produce high-quality custom private courses at scale."

In addition, Coursera Coach is designed to be an AI-powered tutor. So, what's the problem? Here are a few.

- Consumer revenue. Ken Hahn, CFO of Coursera, said consumer revenue "was softer than anticipated" in North America. "We underperformed in our North American region, where we are experiencing a lower volume and conversion of paid learners compounded by the delay of the key content launch from one of our educator partners as compared to the timing in our financial plan," said Kahn.

- Businesses are mixed when it comes to reskilling. Government and campus verticals are showing strong demand for Coursera for Business, but corporate learning budgets are tight. "We continue to see a divergence in performance across our verticals, specifically pressuring Coursera for Business, offset by momentum in our other two verticals, government and campus," said Kahn. "Corporate learning budgets remain under pressure."

- The degree revolution hasn't arrived just yet. Coursera's degree revenue was $14.8 million in the first quarter, up 10% from a year ago. Total number of students was 22,200, up 23% from a year ago. There are no content costs for degree revenue, so the segment sees gross margins of 100% of revenue. Kahn said:

"We remain focused on the long-term opportunity in degrees. We believe that our platform is uniquely positioned to fundamentally transform the college degree. We need to start validating that potential with renewed and increasing growth. We believe that the path to better degrees growth lies in working with our university partners to create stronger pathways between our consumer segment where we benefit from scale and the growing selection of pathway degree programs."

Maggioncalda said AI content is driving engagement, but there needs to be more courses that cater to a larger base. He said:

"People want new AI content, both for the builders who are building these models. But also, the users, people who need to learn how to use this stuff. We see broad appetite 4x what we saw last year in terms of people taking AI-related content."

Ultimately, the population of AI users is going to be much larger than the builders. Coursera needs to accelerate content launches that add AI throughout existing courses and launch modules that educate people on how their roles will change.

Maggioncalda said:

"Generative AI will have a huge impact on the way people do their jobs.

They're going to need to learn new skill to be, you name it, a PR comms person or a financial analyst or a supply chain manager or a UX designer. We think there's a very broad opportunity to really refresh the content to appeal to strong demand that we're seeing from learners around generative AI."