Cisco reported better-than-expected fourth quarter results, but networking revenue was down 28% from a year ago. Cisco also said it will cut 7% of its global workforce and take pre-tax charges of $1 billion with most of that sum recognized in the first quarter.

The company reported fourth-quarter earnings of 54 cents a share on revenue of $13.6 billion, down 10% from a year ago. Non-GAAP earnings were 87 cents a share.

Wall Street was expecting Cisco to report non-GAAP fourth quarter earnings of 85 cents a share on revenue of $13.54 billion.

For fiscal 2024, Cisco reported earnings of $2.54 a share on revenue of $53.8 billion, down 6% from a year ago.

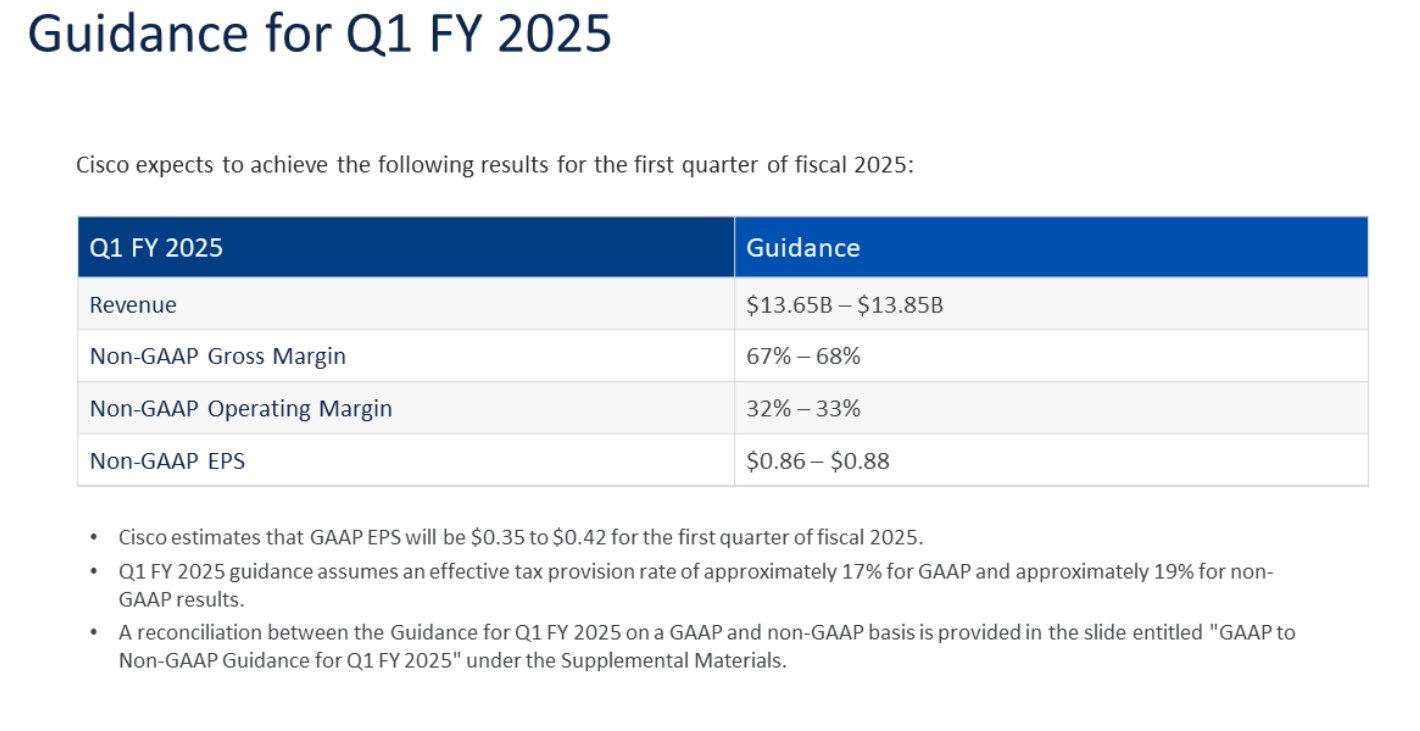

As for the outlook, Cisco projected first quarter revenue of $13.65 billion to $13.85 billion with non-GAAP earnings of 86 cents a share to 88 cents a share. Fiscal 2025 revenue will be between $55 billion to $56.2 billion with non-GAAP earnings of $3.52 a share to $3.58 a share.

- Cisco and Nvidia: Networking partners or frenemies?

- Cisco rolls out AI infrastructure with Nvidia, aims to track generative AI deployments

- Cisco closes Splunk purchase, previews integrations ahead

- Cisco Q3, Q4 outlook better as company preps Splunk integration

The company's results have been boosted by the acquisition of Splunk with total fiscal year subscription revenue of $27.4 billion, or 51% of total revenue. Annualized recurring revenue ended the fiscal year at $29.6 billion, including $4.3 billion from Splunk.

CEO Chuck Robbins said customers' are through with their indigestion with networking gear and demand was balanced.

"Across the technology portfolio, demand was incredibly balanced. We saw a double digit growth in security, double digit growth in collaboration, and then in the networking space. The switching and the enterprise routing businesses were both high single digit growth. And the wireless business was up double digits.

Enterprise customers are now actually upgrading their infrastructure in preparation for AI. And in some cases, they're taking some of the dollars that they've set aside for AI to actually spend it on modernizing their infrastructure to get ready for that."

By the numbers:

- Networking revenue for the fourth quarter was $6.8 billion, down 28% from a year ago.

- Security revenue in the fourth quarter was $1.787 billion, up 81%, due to Splunk.

- Observability revenue was $258 million, up 41% from a year ago, due to Splunk.

- Collaboration revenue was flat for the fourth quarter at $1.02 billion.

- Services revenue in the fourth quarter was $3.78 billion, up 6% from a year ago.

Speaking on an earnings conference call, Robbins said the company saw a strong close to the quarter. Cisco also named Jeetu Patel chief product officer overseeing Cisco and Splunk products.

"Our products will come together in a more integrated way than ever before, positioning us to deliver incredibly powerful outcomes for our customers," said Robbins. "Looking ahead, we remain laser focused on growth and consistent execution as we invest within an AI cloud and cybersecurity to focus on these key priority areas."

Robbins noted:

- The company saw strong product growth even with "persistent macro uncertainty."

- Public sector demand was "particularly strong" driven by federal spending in the US.

- "We signed several $100 million plus transactions in the quarter with global enterprises who are leveraging the breadth of our technology platforms to modernize and automate their network operations and deploy next generation machine learning and AI applications."

- "In our networking portfolio, data center switching also saw double digit product order growth and enterprise routing, campus switching and wireless orders were also strong."

- "We have now crossed $1 billion in AI orders with web scale customers."

- "Three of the top four hyperscalers are deploying our Ethernet AI fabric, leveraging Cisco validated designs for AI infrastructure. We expect an additional $1 billion in AI product orders in fiscal year '25."