Cisco's third quarter was better-than-expected and the company outlined its next steps in the Splunk integration. The acquisition of Splunk means Cisco's subscription revenue is 54% of the total.

The company reported third quarter revenue of $12.7 billion, down 13% from a year ago. Splunk's revenue contribution in a partial quarter was $413 million. Earnings for the third quarter were 46 cents a share (88 cents on a non-GAAP basis).

Wall Street was expecting Cisco to report third quarter non-GAAP earnings of 82 cents a share on revenue of $12.6 billion.

As for the outlook, Cisco projected fourth quarter revenue of $13.4 billion to $13.6 billion, above estimates of $13.54 billion. Non-GAAP earnings in the fourth quarter will be 84 cents a share to 86 cents a share. Wall Street expected fourth quarter non-GAAP earnings of 84 cents a share.

For fiscal 2024, Cisco is projecting revenue of $53.6 billion to $54.6 billion. Non-GAAP earnings will be $3.69 a share to $3.71 a share.

Cisco also said former Splunk CEO Gary Steele will become President of Go-to-Market effective immediately. Steele will lead the Splunk integration process. Jeff Sharritts, Cisco’s Chief Customer and Partner Officer will depart in mid-July.

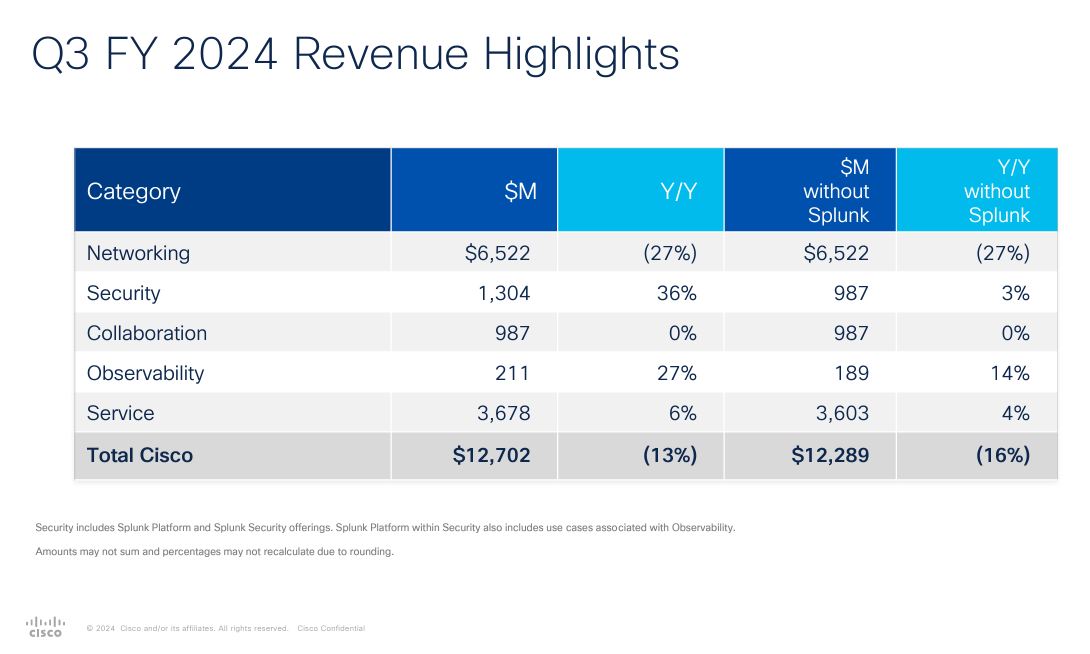

Here's a breakdown of Cisco's third quarter by product line:

- Networking revenue was down 27% from a year ago, but Cisco did note that customers were installing inventory.

- Security revenue was up 36%.

- Collaboration was flat.

- And observability was up 27%.

Splunk integration

Speaking on a conference call, Cisco CEO Chuck Robbins outlined the Splunk integration. The first effort is focused on sales synergies. Robbins said:

"The closing of the Splunk acquisition in q3 will also enable us to begin driving revenue synergies in our security and observability markets. Upon closing the deal, we identified 5,000 existing Cisco customers who have the potential to become meaningful Splunk customers and our sales teams are already making those connections."

- Cisco closes Splunk purchase, previews integrations ahead

- Cisco to cut 5% of workforce, Q3 outlook weak

- Cisco acquires Splunk in $28 billion observability, AI and cybersecurity play

-

Cisco is buying Splunk for $28B in cash. What does it mean for you as a customer?

Robbins added that Splunk will be added to Cisco's partner ecosystem where the acquired company had little presence.

The companies also plan to integrate products and made a first installment at RSA Conference.

"We're working on rapid integration, investing in both product integration and go to market resources, starting with aligning our Cisco and Splunk sales forces and accelerating challenge enablement processes for cross selling and upselling our combined solutions."

Cisco plans to converge its security portfolio with Splunk. For now, the two companies are rolling out new features and integrations. Cisco said Extended Detection & Response (XDR) is now integrated with Splunk Enterprise Security to provide one detection to remediation workflow. Cisco also said its unified AI Assistant for Security is available in Cisco XDR. The company also said its Panoptica application protection platform includes AI and machine learnings for real-time alerts. Cisco also said Hypershield, launched last month, will get tools to isolate attacks from unknown vulnerabilities within the runtime. See: Splunk’s Acquisition by Cisco Accelerates Convergence of Network, Security, and Observability, Fueled by AI | 11 Top Cybersecurity Trends for 2024 and Beyond

AI infrastructure a focus

Robbins added that Cisco designs for AI architecture are doing well in hyperscale cloud deployments. Enterprises are also interested.

He said:

"We continue to see momentum with three of the top four hyperscalers deploying our Ethernet AI fabric, leveraging Cisco validated designs for AI infrastructure in the past two quarters.

Additionally, for those leading-edge enterprise customers who seek to be the early adopters of AI, our partnership with Nvidia will offer easy to deploy cloud based and on prem networking solutions for AI inferencing."

Constellation Research's take

Constellation Research analyst Holger Mueller said Cisco has challenges ahead:

"Chuck Robbins really thinks he can keep the cost structure of Cisco in place, and grow back to a level that justifies the current setup. Revenues were down about $2 billion year over year, but operating expenses are up (incl. restructuring). Splunk's impact was minimal overall, with the executive change of Gary Steele becoming President Go-To-Market for Cisco overall. It is clear that Robbins wants to make up for the networking revenue shrinkage with growth in security and observability, helped of course by Splunk, but with all regions shrinking, this will be a tough 3 to 4 quarters for Cisco ahead – again. The good news is subscription revenue is now 54% of revenue. Can Cisco find a way to gain from cloud and AI growth? So far it has not, but maybe Gary Steele will unlock this challenge."