Cisco said it will cut 5% of its global workforce in a bid to "realign the organization and enable further investment in key priority areas." The company outlined the restructuring as it reported its second quarter results.

The networking giant reported second quarter revenue of $12.8 billion, down 6% from a year ago, with earnings of 65 cents a share. Non-GAAP earnings were 87 cents a share.

Wall Street was expecting fiscal second quarter earnings of 84 cents a share on revenue of $12.7 billion. The biggest concern going into Cisco's report was the weak demand for networking gear as customers deploy systems that have been purchased.

For the third quarter, Cisco said revenue will be $12.1 billion to $12.3 billion with non-GAAP earnings between 84 cents a share to 86 cents a share. Analysts had expected adjusted earnings of 92 cents a share on $13.09 billion in sales. For fiscal 2024, Cisco said revenue will be between $51.5 billion to $52.5 billion with non-GAAP earnings of $3.68 a share to $3.74 a share.

Cisco said that it will take charges of $800 million for the layoffs and most of the hits will be recognized in the third quarter.

Chuck Robbins, CEO of Cisco, said the second quarter was solid, but the company has to focus its investments on future growth. "Our innovation sits at the center of an increasingly connected ecosystem and will play a critical role as our customers adopt AI and secure their organizations," he said.

Robbins said:

"We're seeing a greater degree of caution and scrutiny of deals given a high level of uncertainty. As we discussed last quarter, and subsequently saw in other technology provider results, customers are starting to deploy the elevated levels of products shipped in them in recent quarters. This is taking longer than our initial expectations."

Robbins added that telecom and cable companies are pulling back on spending. He said that customers will take another quarter or two to digest shipments already received. "Our team is also partnering closely with customers to assist with this heightened focus on deployments at Cisco equipment on hand," said Robbins.

The Cisco CEO said he's optimistic about AI workloads boosting demand, but noted that "we're still in the early stages of AI workloads."

Constellation Research analyst Chirag Mehta said Cisco's future growth is pegged the the acquisition of Splunk, which could close in the third quarter.

- Cisco acquires Splunk in $28 billion observability, AI and cybersecurity play

- Cisco is buying Splunk for $28B in cash. What does it mean for you as a customer?

Mehta said:

"With the acquisition of Splunk, Cisco is poised to elevate the cybersecurity landscape, potentially merging their respective portfolio of products, and enhance them with advanced AI capabilities. This strategic move not only amplifies Cisco's commitment to cybersecurity but also paves the way for unparalleled benefits to a vast spectrum of its customers. As networks and security converge, Cisco's focus on cybersecurity will be paramount to unlock sustained growth in an ever-evolving digital landscape."

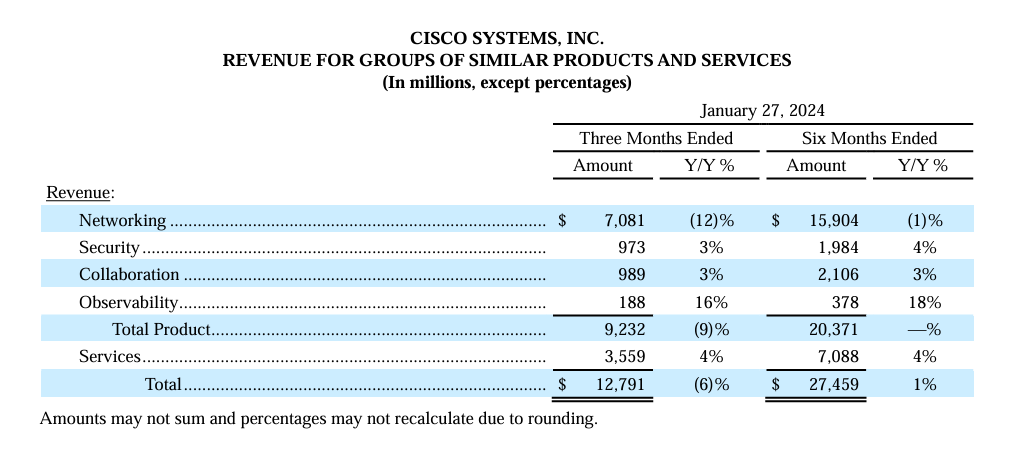

Cisco's second quarter networking revenue was down 12% from a year ago with security and collaboration up 3% each. Observability revenue was up 16%, but from a smaller base. Services revenue was up 4%.

- Cisco moves to simplify Catalyst stack, unify platforms

- Cisco sees weak Q2 as customers digest, implement shipped orders

- Privacy, data concerns abound in enterprise, says Cisco study

- Hitachi Vantara, Cisco launch hybrid cloud suite

- Cisco rolls out AI infrastructure with Nvidia, aims to track generative AI deployments

Cisco’s results land a few days after Arista Networks reported fourth quarter earnings, which were strong. Arista Networks, which counts Meta Platforms and Microsoft as its largest customers, reported fourth quarter revenue of $1.54 billion, up 21% from the same period last year. Net income was $613.6 billion, or $1.92 a share. Non-GAAP earnings were $2.08 a share.

Arista Networks CEO Jayshree Ullal noted that generative AI will create a networking infrastructure upgrade cycle. “AI at scale needs Ethernet at scale. AI workloads cannot tolerate the delays in the network, because the job can only be completed after all flows are successfully delivered to the GPU clusters. All it takes is one culprit of worst-case link to throttle an entire AI workload,” said Ullal.

- IT incidents, response hurdles drive up enterprise costs, says Constellation Research survey

- GenAI trickledown economics: Where the enterprise stands today