Chief Financial Officers are bullish on automation, digital transformation and hybrid work arrangements even as they have become more pessimistic in other areas, according to Deloitte's fourth quarter CFO Signals report.

The top line takeaways from the report are notable on multiple fronts. Consider:

- CFOs rating the North American economy favorably in the fourth quarter fell to 47% from 57% in the third quarter. CFO have lowered growth expectations for revenue, dividends, earnings and hiring.

- 35% of CFOs see US equities as overvalued.

- 51% said 1% to 10% of their company’s growth in the next three years will come from mergers and acquisitions.

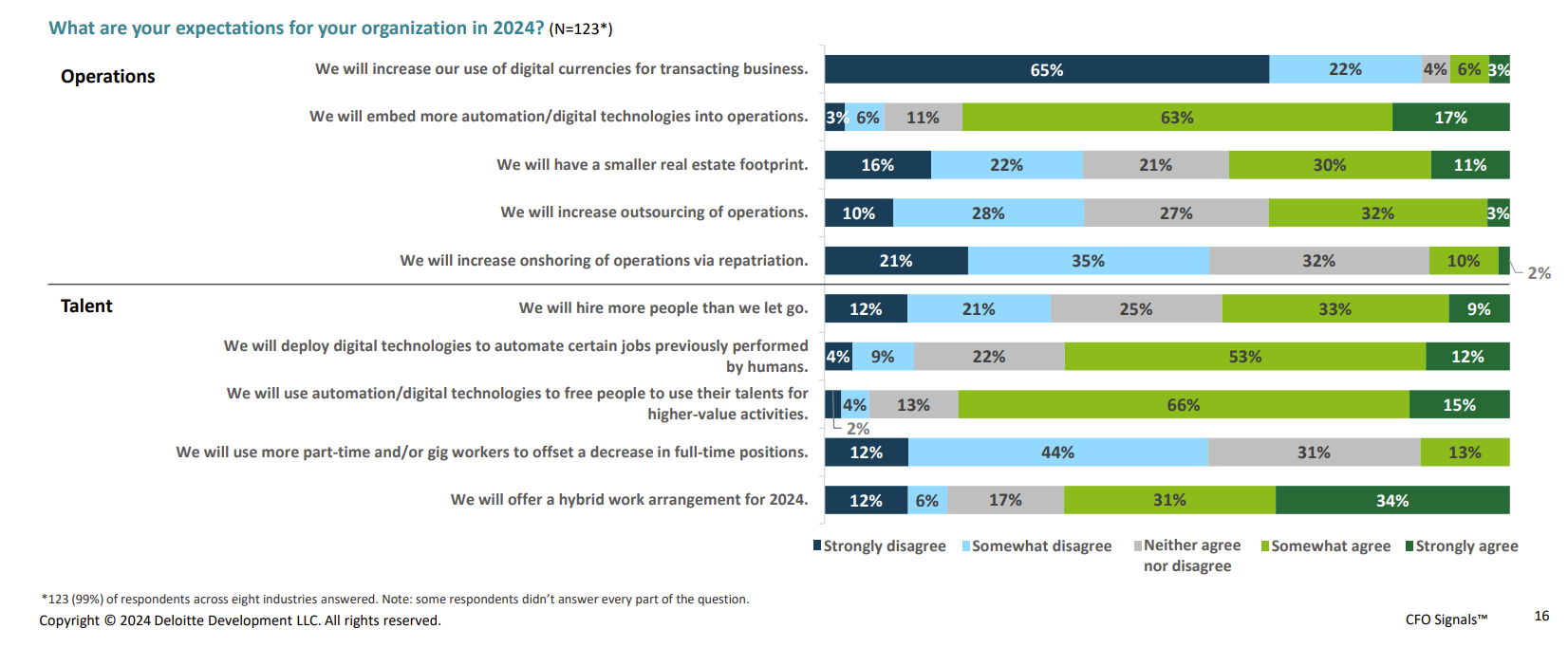

- 87% of CFOs said they won't use digital currencies for business.

While those prognostications are notable, the way CFOs plan to operate is the most tangible part of Deloitte's CFO Signals report for the fourth quarter.

- 80% of CFOs agree that they will embed more automation and digital technologies into operations.

- 65% of CFOs agree that they will deploy digital technologies to automate certain jobs previously performed by humans.

- 81% of CFOs agreed that automation will free people for higher value activities.

While this automation and transformation is starting, CFOs also intend to embrace remote work more, outsource and cut real estate.

- 65% of CFOs said they will offer hybrid work in 2024.

- 41% of CFOs expect to have a smaller real estate footprint, but 38% disagreed with that statement.

- 35% plan to increase outsourcing.

- 66% of CFOs said they won't use more part-time or gig workers to offset a decrease in full-time positions.

- 42% expect to hire more workers than they let go and 33% will do the opposite.

More: