Cerebras Systems has filed for a US initial public offering, but this alleged Nvidia competitor has multiple risk factors and depends on one UAE-based customer, Group 42 Holding, for 87% of its revenue.

Despite the risk, Wall Street will closely watch Cerebras Systems given a weak IPO market and the need for more competition in the genAI infrastructure market. Cerebras also argued in its IPO filing that it has a more power efficient approach to AI training and inference workloads.

Cerebras Systems launches Cerebras Inference, touts performance gains over Nvidia H100 systems

Here's what you need to know.

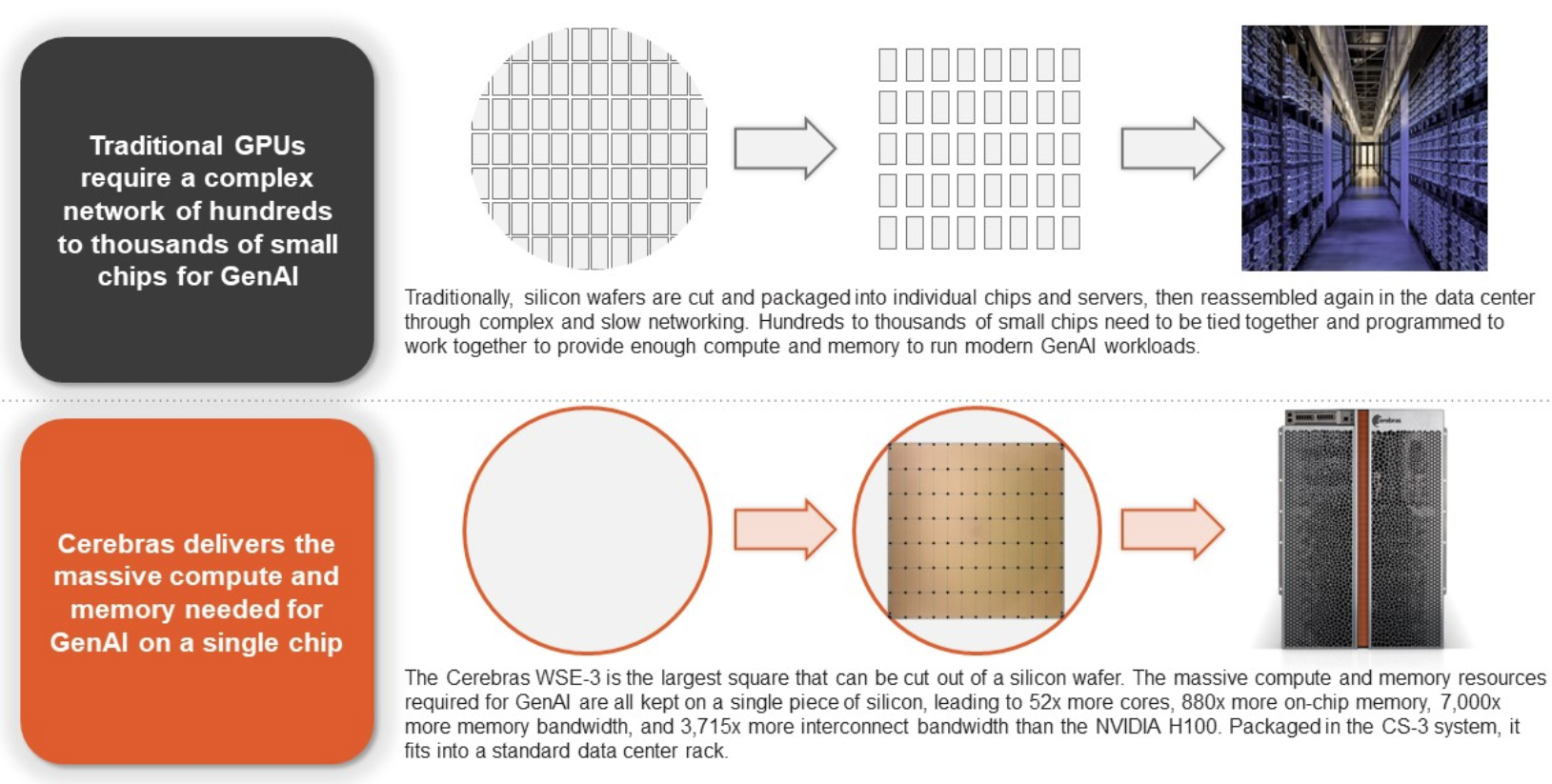

- Cerebras' processors are 57 times larger than the leading commercially available GPU. The company argues that its Cerebras Wafer-Scale Engine (CS-3) is the largest ever sold. It has 52 times more compute cores and 88 times more on-chip memory and 7,000 more memory bandwidth than leading GPUs. By keeping operations on the wafer, Cerebras' processors can solve problems faster with less power. Cerebras said its processors are designed for both AI training and inference.

- Wafer size matters. Cerebras is arguing that its approach with massive processors means that it can scale more easily for model training. The approach also works for memory bandwidth requirements for inference. The crux of the Cerebras argument is that individual GPUs are too small, scaling GPUs is inefficient and limited by memory bandwidth.

- The company is a play on on-premises generative AI. Organizations can purchase Cerebras AI supercomputers for on-premise deployments. Cerebras said its AI Supercomputer can scale up to 2,048 CS-3 systems or 256 exaFLOPs. The plan for Cerebras is to court sovereign AI initiatives, governments, cloud service providers and research institutions.

- The largest Cerebras cluster deployed as of Sept. 27 comprised of more than 100 CS systems so there's a lot of headroom to scale further.

- Cerebras relies mostly on Group 42 Holding Ltd., a UAE company, for its 87% of its revenue for the six months ending June 30. Cerebras said that Group 42 (G42) can acquire $335 million worth of Cerebras shares to give it more than a 5% stake.

- But Cerebras is raising capital to expand its customer base. The company, however, has a long way to go. Two customers accounted for 68% and 16% of Cerebras' accounts receivable balance as of June 30.

- Cerebras is losing money. For the six months ended June 30, the company posted a net loss of $66.6 million on revenue of $136.4 million. For the year ended Dec. 31, Cerebras had a net loss of $127.15 million on revenue of $78.74 million.

- The company could be hampered by US export regulations. Specifically, Cerebras must comply with U.S. Export Administration Regulations (EAR), which are administered by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS), as well as economic and trade sanctions, including those administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC). Given nearly all of Cerebras' revenue is tied to a customer in UAE those import and export control laws loom large. Cerebras did note that it has obtained a BIS export license to sell its CS-2 systems in UAE.

- TSMC is the lone manufacturer of Cerebras systems. In its IPO filing, Cerebras said: "We worked with TSMC to develop the processes necessary to manufacture the semiconductor wafers needed for our wafer scale engine, which involve many complexities and proprietary technologies. We are currently dependent on TSMC to produce all of the wafers that we use in our products. We have no formalized long-term supply or allocation commitments from TSMC, and TSMC also fabricates wafers for other companies, including certain of our competitors, many of whom are significantly larger than us and purchase considerably more wafers from TSMC than we do."

- Competition is fierce. Not surprisingly, Cerebras' competitive set is well funded. Nvidia, AMD, Intel, Microsoft and Alphabet were cited as competitors for AI workloads.

Related:

- Nvidia outlines roadmap including Rubin GPU platform, new Arm-based CPU Vera

- AMD expands its data center, AI infrastructure push with $4.9 billion purchase of ZT Systems

- DigitalOcean highlights the rise of boutique AI cloud providers

- Equinix, Digital Realty: AI workloads to pick up cloud baton amid data center boom

- The generative AI buildout, overcapacity and what history tells us