Broadcom saw strong AI demand in the fiscal second quarter and said VMware accelerated its software business.

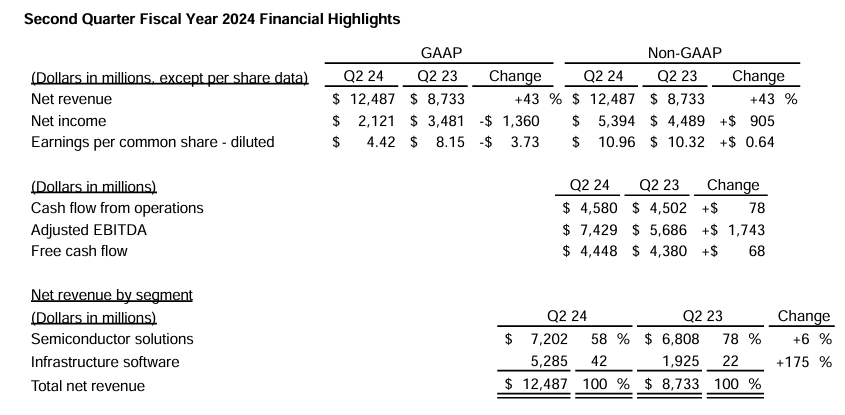

The company reported fiscal second quarter net income of $2.12 billion, or $4.42 a share, on revenue of $12.49 billion, up 43% from a year ago. Non-GAAP earnings were $10.96 a share. The company also said it will split its stock 10-for-1 on July 15.

Wall Street was looking for second quarter non-GAAP earnings of $10.84 a share on revenue of $12.1 billion.

Broadcom also raised its revenue guidance for fiscal 2024 to $51 billion compared to estimates of $50.28 billion.

CEO Hock Tan said the second quarter results were "once again driven by AI demand and VMware." AI product revenue was $3.1 billion in the quarter.

By unit, Broadcom's semiconductor revenue, which is being driven by AI data centers, was $7.2 billion, up 6% from a year ago. Infrastructure software revenue was $5.28 billion, up 175% from a year ago due to the VMware acquisition.

Nutanix winning deals vs. VMware, but Broadcom punching back with pricing

Broadcom ended the quarter with cash and cash equivalents of $9.81 billion.

Key points from the earnings conference call include:

- VMware revenue in the second quarter was $2.7 billion, up from $2.1 billion in the first quarter. Tan said the integration was going well and the company is making "good progress on the transition. The company has signed up nearly 3,000 of its largest 10,000 customers to deals, mostly multi-year contracts.

- Tan reiterated that VMware would deliver $4 billion a quarter in revenue, but declined to give a time frame.

- Networking revenue for Broadcom is expected to grow 40% in the third quarter. Tan said networking products were benefiting from AI data centers.

- Tan downplayed any Nvidia competition. He said Broadcom uses its IP portfolio to create custom AI accelerators so the companies don't compute much. "We are not competitors to them and don't try to be either," said Tan. "On networking that may be different, but we are approaching it from different angles. We are very deep in Ethernet and have been doing it for over 25 years. It's a natural extension for us to go into AI, but we don't do GPUs. We enable GPUs to work very well."