Box added a new integration with Microsoft Azure OpenAI Service in a move that will bring more large language models to Box AI, which is available to customers with Enterprise Plus plans.

Box AI is built to be platform-neutral so it can connect to multiple LLMs. Microsoft's Azure OpenAI Service will bring models to Box's Content Cloud and meet various compliance regulations for financial services, life sciences, public sector and insurance companies.

The general availability of Box AI is part of a broader strategy to use the Content Cloud to surface insights from unstructured data, which represents 80% of enterprise content. Box's plan is to leverage AI for more high-level use cases across a wide range of industries.

According to the company, generative AI will enable its Box Content Cloud to enhance security, storage and collaboration of business content and enable enterprises to generate insights and content from repositories.

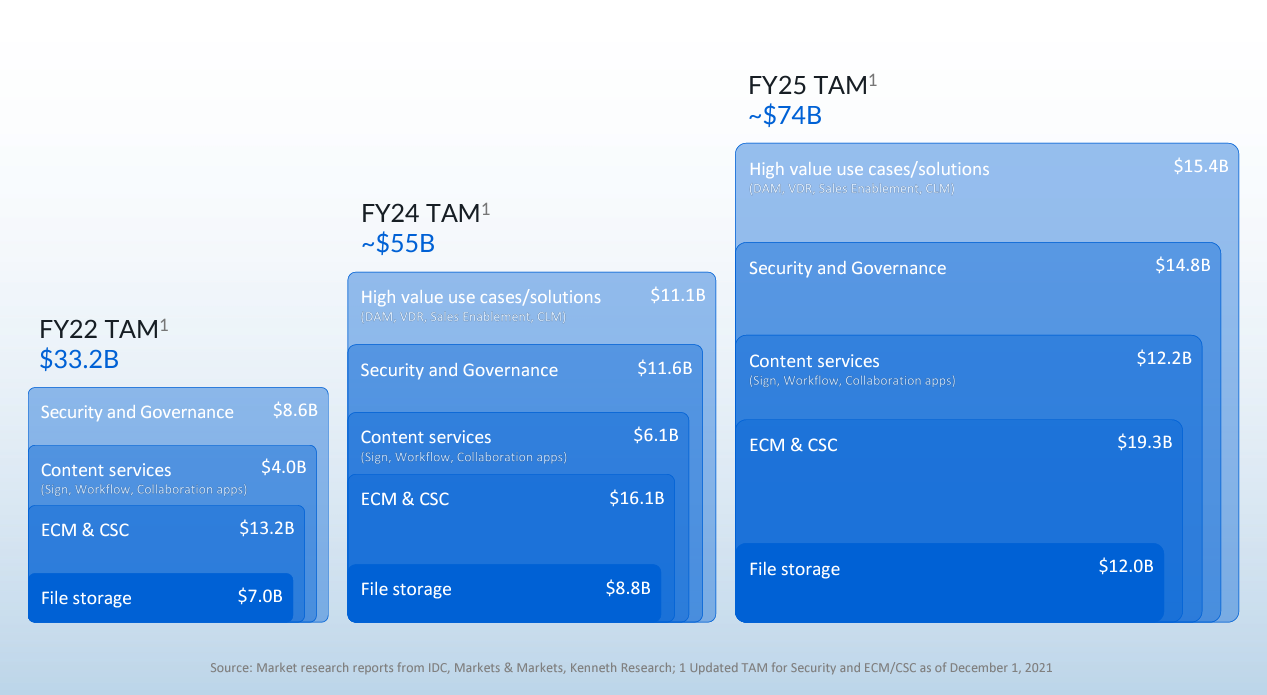

The bet is that high value us cases will drive growth going forward.

- Box CEO Levie on generative AI, productivity and platform neutrality

- Analysis: Box's Acquisition of Crooze Stands To Accelerate Customer Innovation

- Constellation ShortList™ Enterprise File Sharing and Cloud Content Management

In beta, Box AI was used for wealth advisory, clinical research, product marketing and human resources.

Box Enterprise Plus customers will get Azure OpenAI Service included with plans. Individual users under those plans have access to 20 queries a month. At a company level, 2,000 queries are available.

Separately, Box reported fourth quarter earnings. Box's fourth quarter revenue was $262.9 million, up 2% from a year ago. Net income was 57 cents a share. Non-GAAP earnings in the fourth quarter were 42 cents a share. Analysts had expected Box to report fourth quarter earnings of 38 cents a share on revenue of $262.8 million.

For fiscal 2024, Box reported earnings of 67 cents a share on revenue of $1.04 billion, up 5% from a year ago. As for the outlook, Box projected first quarter revenue of $261 million to $263 million, up about 4% from a year ago, with non-GAAP earnings of 35 cents a share to 36 cents a share.

For fiscal 2025, Box projected revenue between $1.08 billion and $1.085 billion, up 5% from fiscal 2024. Non-GAAP earnings will be between $1.53 a share to $1.57 a share.

On a conference call with analysts, CEO Aaron Levie said:

"Combined with Box's upcoming workflow automation improvements, including the expected launch of Forms and Doc Gen this year, Box will be able to power end-to-end critical business processes natively without customers having to do any custom development. And with the acquisition of Crooze, Box will extend into new use cases within our current customers as well as enabling us to rip and replace legacy ECM solutions."

Regarding Box AI, Levie said:

"We were looking at a lot of the usage patterns, seeing their use cases. The first set of use cases were sort of dominated by the core functionality we have today, which is summarizing documents quickly, extracting information from documents as a user is sort of reading that. So, some powerful kinds of end-user productivity use cases. But quickly we got feedback that probably the biggest areas of excitement, and these are things that we've been working on, is one the ability to ask multiple documents a question. So that's the multi-document kind of analysis functionality that we're working on, that will be embedded in our hubs product."

Constellation Research analyst Holger Mueller said Box hit a few key milestones in the quarter.

"Box has managed to break the $1 billion in revenue mark, which is always a historical milestone. The problem is the vendor made the goal at pedestrian speeds with 3% growth. The question is what is holding up Box, as the team around Aaron Levie is doing all the right things in terms of innovation. Let's see if the AI partnership with Microsoft and the acquisition of ECM low code / no code specialist Crooze will change it in the new fiscal year. Otherwise, Box will be a showcase of a software category that is innovating well but can't generate revenue. As Box is gaining customers, it must be all about innovation keeps up price levels but not growing revenue. That's good for customers, but not so good for Box."