Enterprise software giants have spent heavily on sales teams, channel strategies and cross-selling playbooks, but it increasingly looks like sales are going to run through AWS Marketplace and similar efforts from other cloud giants.

This week featured a round of enterprise heavy hitters all reporting earnings at once, but a trend that's easy to overlook is the growing importance of cloud marketplaces.

Salesforce Brian Millham, President and Chief Operating Officer, said during the company's second quarter earnings conference call: "Our channel diversification has big upside for us. AWS Marketplace is a driver going forward. Three of our top 10 deals went through the marketplace."

Meanwhile, CrowdStrike CEO George Kurtz said a customer doubled spend on its Falcon platform via AWS Marketplace.

"Through Falcon Flex, this customer accelerated consolidation. They contracted for every Falcon module displacing seven technologies. And through the AWS Marketplace, their spend with CrowdStrike will grow from $2.2 million in ARR to more than $5 million in ARR over the subscription," said Kurtz.

This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

CrowdStrike sees AWS Marketplace and Google Cloud's marketplace as a more frictionless way to sell software. CrowdStrike is that fastest growing Google Cloud vendor in its marketplace.

Kurtz said that selling software through cloud marketplaces makes sense since "customers of all sizes are increasingly looking to utilize their committed hyperscaler spend."

For good measure, Nutanix also noted it was landing deals via marketplaces on Microsoft Azure and AWS. Rajiv Ramaswami, CEO of Nutanix, said the company landed significant wins for its Nutanix Cloud Clusters or NC2 via marketplaces.

Ramaswami said one customer was already committed to Microsoft Azure and purchased Nutanix licenses via the Azure marketplace. Nutanix saw similar deals via AWS Marketplace.

What is notable from these examples isn't that sales went through marketplaces as much as big deals ran through them. The enterprise software sales playbook typically revolves around complicated contracts, negotiations, and friction due to lawyers, salespeople, project leaders and procurement departments.

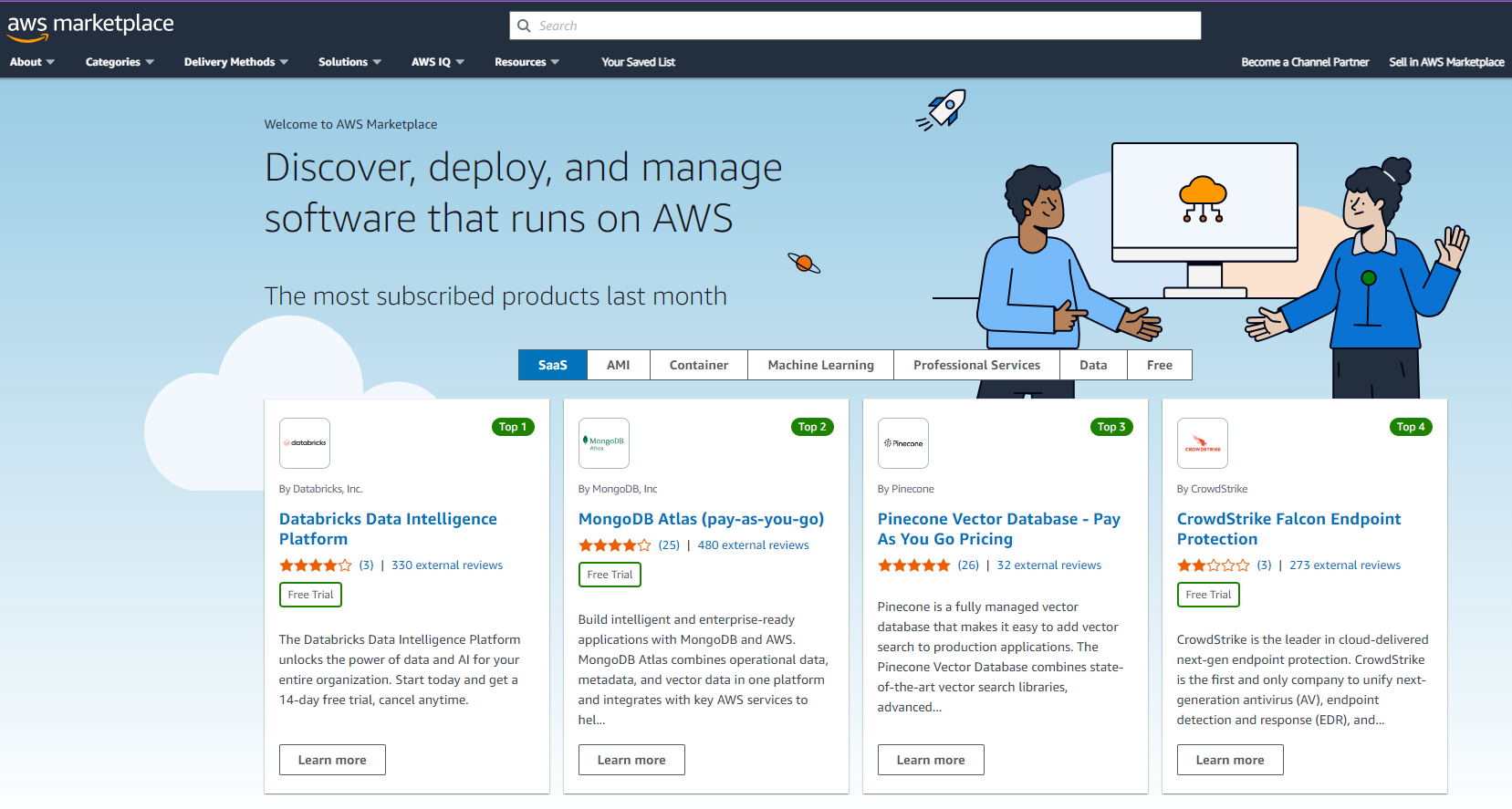

Given the possibilities, it is not surprising that enterprise software players such as ServiceNow, Informatica, Snowflake, Databricks and MongoDB are hooking up with AWS Marketplace.

I'd rank the hyperscale cloud marketplace trends as another disruptive thing facing enterprise software--as if there aren't enough already. To recap:

- Disruption is coming for enterprise software

- BT150 zeitgeist: Dear SaaS vendors: Your customers are pissed

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- GenAI may be the new UI for enterprise software

- GenAI boom eludes enterprise software...for now

The numbers behind AWS Marketplace are hard to ignore for enterprise software vendors. AWS has more than 5,000 sellers across more than 70 categories. Google Cloud offers more than 1,700 SaaS and API products. Azure Marketplace covers 19 product categories.

In July at the AWS Analyst Forum in New York, I had a briefing on AWS Marketplace with Karthik Balakrishnan, GM, AWS Marketplace Core.

Key takeaways from the conversation were the following:

- AWS Marketplace is scaling quickly as vendors realize it's easier to discover products, start small and scale.

- The ability to consolidate invoices, charges, and contracts on one platform is appealing.

- AWS can leverage Amazon's know-how in frictionless commerce.

- And procurement departments are fans of marketplaces due to standard contracts, easier expense tracking and efficient processes.

The win for enterprise vendors is also clear: Marketplaces from cloud giants give them more opportunities to land and expand. There is also something to be said for using standard contracts on the vendor side too and potentially fewer sales headcount.

Insights Archive

- Peraton's Cari Bohley: Why internal talent recruiting and retention is critical

- Starbucks lands new CEO from Chipotle: Here’s how digital strategy could change

- Disruption is coming for enterprise software

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- The generative AI buildout, overcapacity and what history tells us

- Enterprises start to harvest AI-driven exponential efficiency efforts

- GenAI may be the new UI for enterprise software

- Education tech in turmoil amid genAI: Why consolidation is next

- 14 takeaways from genAI initiatives midway through 2024

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Financial services firms see genAI use cases leading to efficiency boom