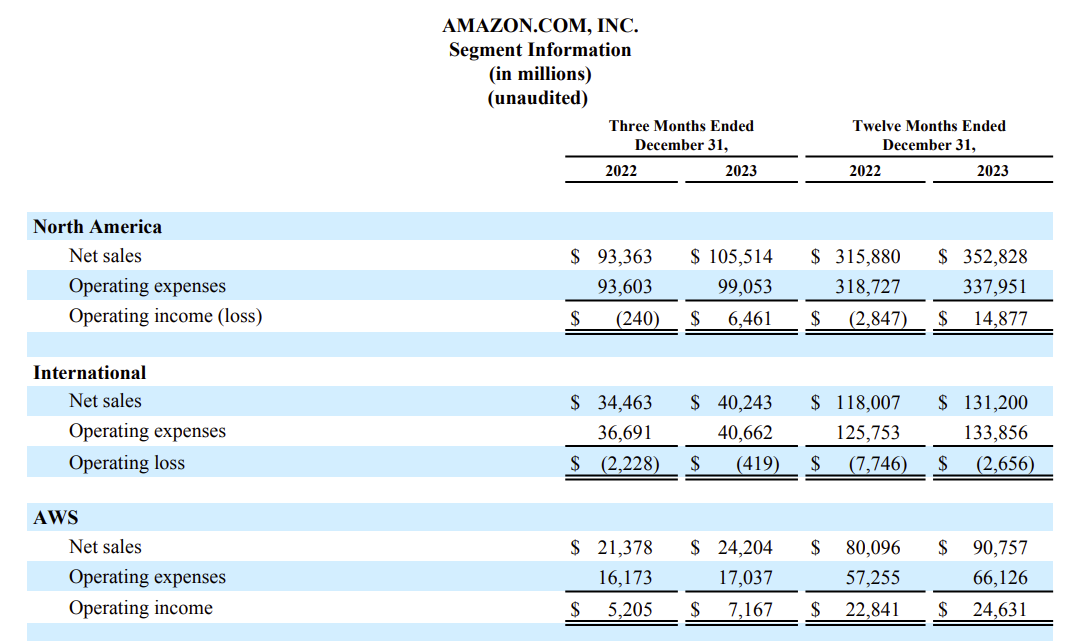

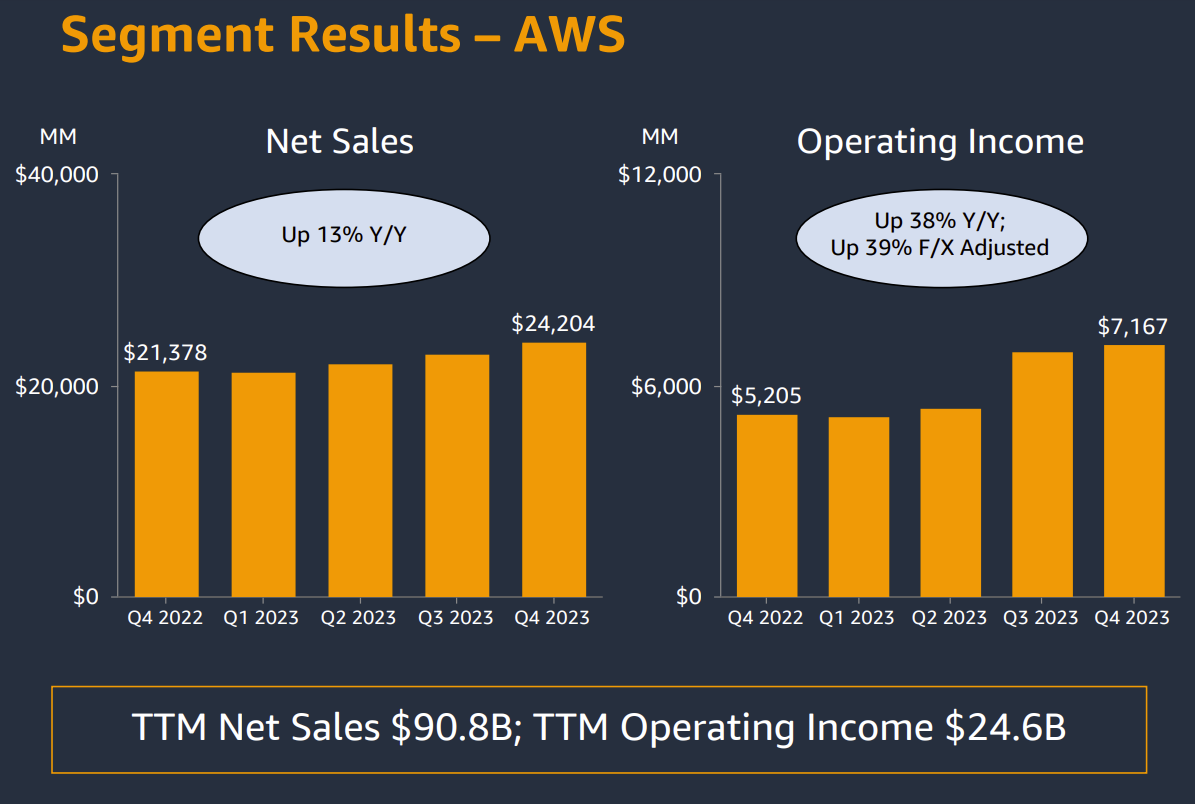

Amazon Web Services' fourth quarter revenue was $24.2 billion, up 13% from a year ago, and below the 30% and 26% growth rates put up by Microsoft Azure and Google Cloud, respectively.

AWS revenue was in line with expectations and fourth quarter operating income of $7.2 billion was well ahead of the $5.2 billion a year ago. AWS's operating income also outpaced the $6.5 billion for Amazon's North America e-commerce business. Amazon's AWS report comes days after both Microsoft and Google reported fourth quarter earnings.

For the fourth quarter, Amazon reported net income of $10.6 billion, or $1 a share, on revenue of $170 billion, up 14% from a year ago. Wall Street was expecting fourth quarter earnings of 80 cents a share on revenue of $166.2 billion.

Amazon reported 2023 net income of $30.4 billion, or $2.90 a share, on revenue of $574.8 billion.

In a statement, Amazon CEO Andy Jassy said:

"The regionalization of our U.S. fulfillment network led to our fastest-ever delivery speeds for Prime members while also lowering our cost to serve; AWS’s continued long-term focus on customers and feature delivery, coupled with new genAI capabilities like Bedrock, Q, and Trainium have resonated with customers and are starting to be reflected in our overall results; our Advertising services continue to improve and drive positive results; our newer businesses are progressing nicely."

For the first quarter, Amazon projected revenue of $138 billion and $143.5 billion, or 8% to 13% growth from a year ago. Operating income will be between $8 billion and $12 billion.

Jassy said AWS is also seeing indicators of strong demand ahead. Jassy said AWS is seeing more migration as enterprises start spending on cloud again. He said:

"The lion's share of cost optimization has happened. It's not that there won't be any more that we don't see any more but it just attenuated very significantly. Migrations have started to pick up again.

If you go to the generic GenAI revenue in absolute numbers, it's a pretty big number, but in the scheme of $100 billion annual revenue run rate it's still relatively small. We really believe we're going to drive 10s of billions of dollars of revenue over the next several years (with GenAI). It's encouraging how fast it's growing and our offerings really resonate with customers."

Speaking on a conference call, Jassy made the following points:

- North America profit margins have approved because Amazon has retooled its network to bring goods closer to customers. This move has lowered costs to serve. "We reduced our cost to serve on a per unit basis globally. In the US cost to serve was down by more than 45 cents per unit compared to the prior year," said Jassy. "Lowering cost to serve allows us not only to invest in speed improvements, but also afford adding more selection at lower average selling prices or ASP and profitably. We have a saying it's not hard to lower prices. It's hard to be able to afford lower prices."

- Advertising revenue was up 26% largely due to sponsored ads across the Amazon network.

- AWS added more than $1.1 billion in incremental sequential revenue. "Our customer pipeline remains strong as existing customers are renewing it larger commitments over longer periods and migrations are growing," said Jassy.

- AWS' generative AI strategy revolves around options and choices for enterprises. "We've launched Bedrock, which is off to a very strong start with many 1,000s of customers using the service after just a few months," said Jassy. "what customers have learned at this early stage of GenAI is that there's meaningful iteration required. Customers don't want only one model. They want different models for different types of applications and different size models for different applications. Customers want a service that makes this experimenting and iterating simple."

- "We're building dozens of Gen AI apps across Amazon's businesses, several of which have launched and others of which are in development," he said. "GenAI is and will continue to be an area of pervasive focus and investment across Amazon primarily because there are few initiatives if any, that give us the chance to reinvent so many of our customer experiences and processes. We believe it'll ultimately drive 10s of billions of dollars of revenue for Amazon over the next several years."

AWS' quarter in review:

- Amazon Generative AI Stack Offering Overview

- AWS delivers $7 billion in operating income in Q3

- Amazon's Vogels says 'cost awareness is a lost art' as AWS launches optimization tools

- AWS, ServiceNow ink 5-year collaboration pact

- These overlooked AWS re:Invent launches could solve pain points

- AWS launches Amazon Q, makes its case to be your generative AI stack

- AWS Expands Zero-ETL Options, Adds AI Recommendations for DataZone

- AWS presses custom silicon edge with Graviton4, Trainium2 and Inferentia2

- AWS bets palm reading will come to an enterprise near you

- AWS Introduces Two Important Database Upgrades at Re:Invent 2023

- AWS launches Braket Direct with dedicated quantum computing instances, access to experts

- AWS re:Invent 2023: Perspectives for the CIO | Live Blog

- AWS, Salesforce expand partnership with Amazon Bedrock, Salesforce Data Cloud, AWS Marketplace integrations