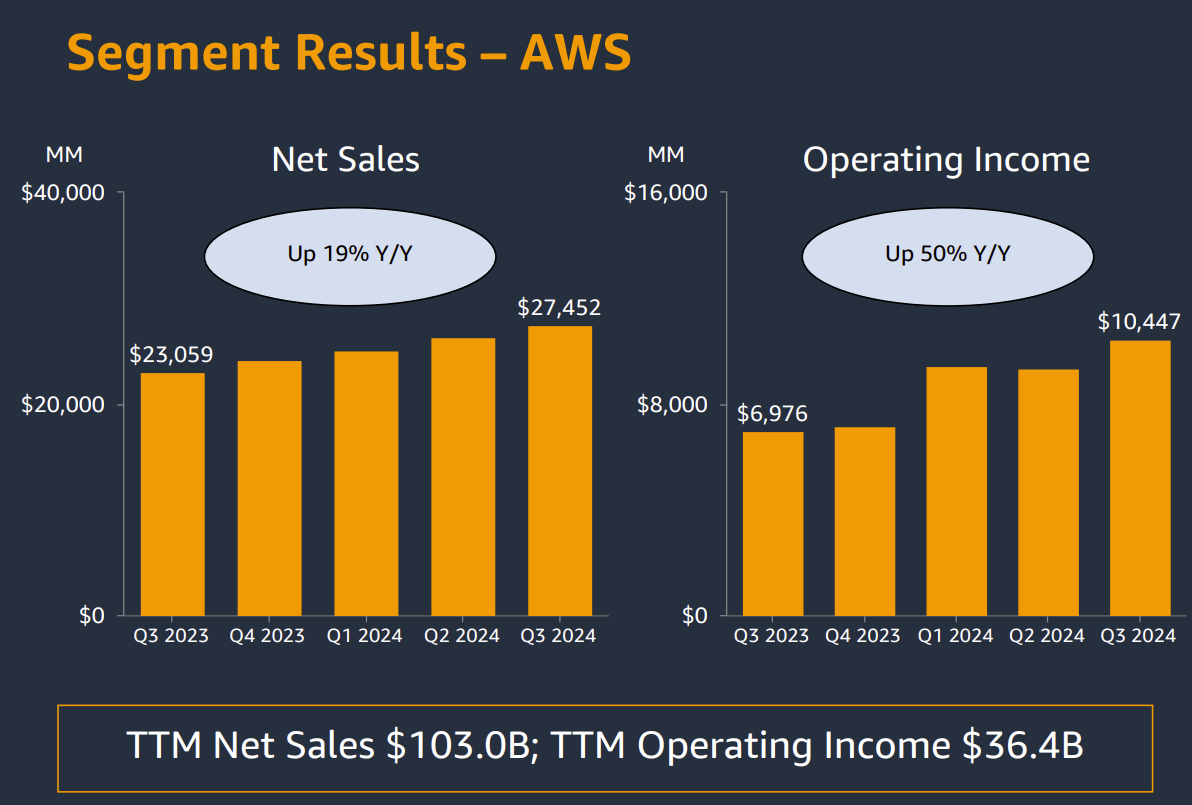

Amazon delivered better-than-expected third quarter earnings as its AWS unit showed sales growth of 19%.

The AWS results land following strong cloud growth figures from Google Cloud and Microsoft Azure of 35% and 33% respectively. AWS, however, is working off much larger revenue figures.

Amazon reported third quarter net income of $15.3 billion, or $1.43 a share, on revenue of $158.9 billion, up 11% from a year ago. Wall Street was looking for

earnings of $1.14 a share on revenue of $157.2 billion.

By the numbers for the third quarter:

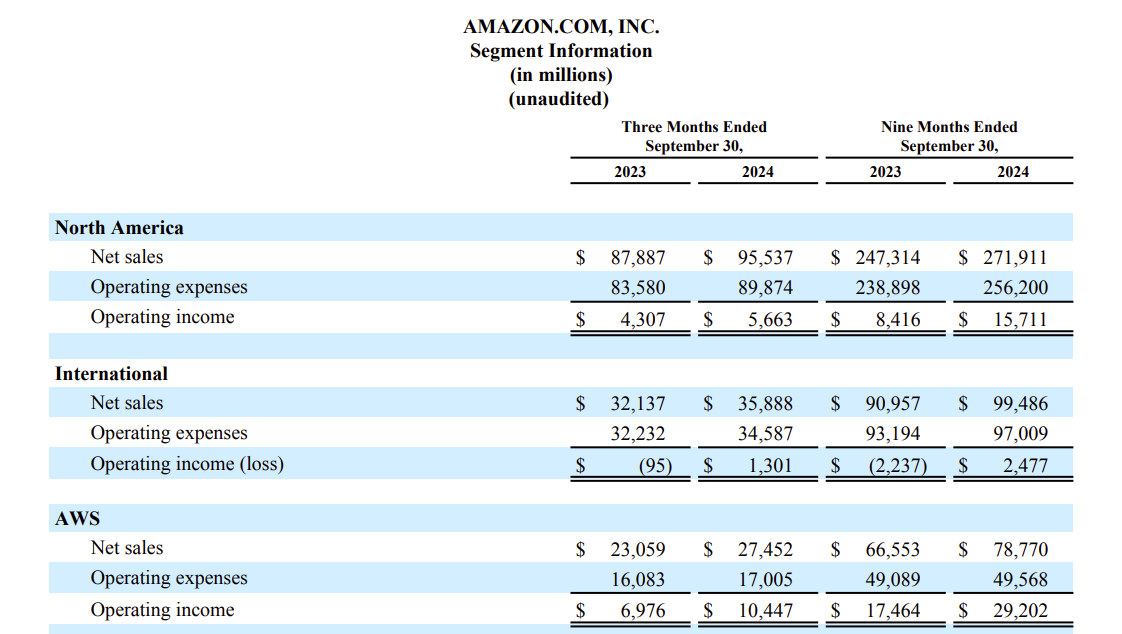

- North American commerce reported third quarter operating income of $5.7 billion on revenue of $95.5 billion, up 9% from a year ago.

- International revenue was up 12% to $35.9 billion with operating income of $1.3 billion.

- AWS delivered operating income of $10.4 billion, up from $7 billion in the same quarter a year ago. AWS revenue was $27.5 billion, up 19% from a year ago.

Amazon CEO Andy Jassy said the company is executing well and prepared for the holiday shopping season and AI and cloud infrastructure advances at AWS re:Invent in December.

Constellation Research analyst Holger Mueller said:

"It is remarkable for AWS to turn the trend of shrinking revenue growth and go back into growth mode. And this is before AWS re:Invent where major innovations for many offerings will be released and shared. But all eyes are on AI. If AWS gets re:Invent right it will show even more growth in the quarters ahead."

As for the outlook, Amazon projected fourth quarter earnings of $181.5 billion and $188.5 billion, up 7% to 11%, with operating income between $16 billion and $20 billion.

On a conference call, Jassy said the following:

-

"We've seen significant reacceleration of AWS growth for the last four quarters. With the broadest functionality, the strongest security and operational performance and the deepest partner community, AWS continues to be a customer's partner of choice. There are signs of this in every part of AWS's business."

-

"Companies are focused on new efforts again, spending energy on modernizing their infrastructure from on-premises to the cloud. This modernization enables companies to save money, innovate more quickly, and get more productivity from their scarce engineering resources. However, it also allows them to organize their data in the right architecture and environment to do Generative AI at scale. It's much harder to be successful and competitive in Generative AI if your data is not in the cloud."

-

"While we have a deep partnership with NVIDIA, we've also heard from customers that they want better price performance on their AI workloads. As customers approach higher scale in their implementations, they realize quickly that AI can get costly. It's why we've invested in our own custom silicon in Trainium for training and Inferentia for inference. The second version of Trainium, Trainium2 is starting to ramp up in the next few weeks and will be very compelling for customers on price performance. We're seeing significant interest in these chips, and we've gone back to our manufacturing partners multiple times to produce much more than we'd originally planned."

-

"We're continuing to see strong adoption of Amazon Q, the most capable Generative AI-powered assistant for software development and to leverage your own data. Q has the highest reported code acceptance rates in the industry for multiline code suggestions. The team has added all sorts of capabilities in the last few months, but the very practical use case recently shared where Q Transform saved Amazon's teams $260 million and 4,500 developer years in migrating over 30,000 applications to new versions of the Java JDK as excited developers and prompted them to ask how else we could help them with tedious and painful transformations."