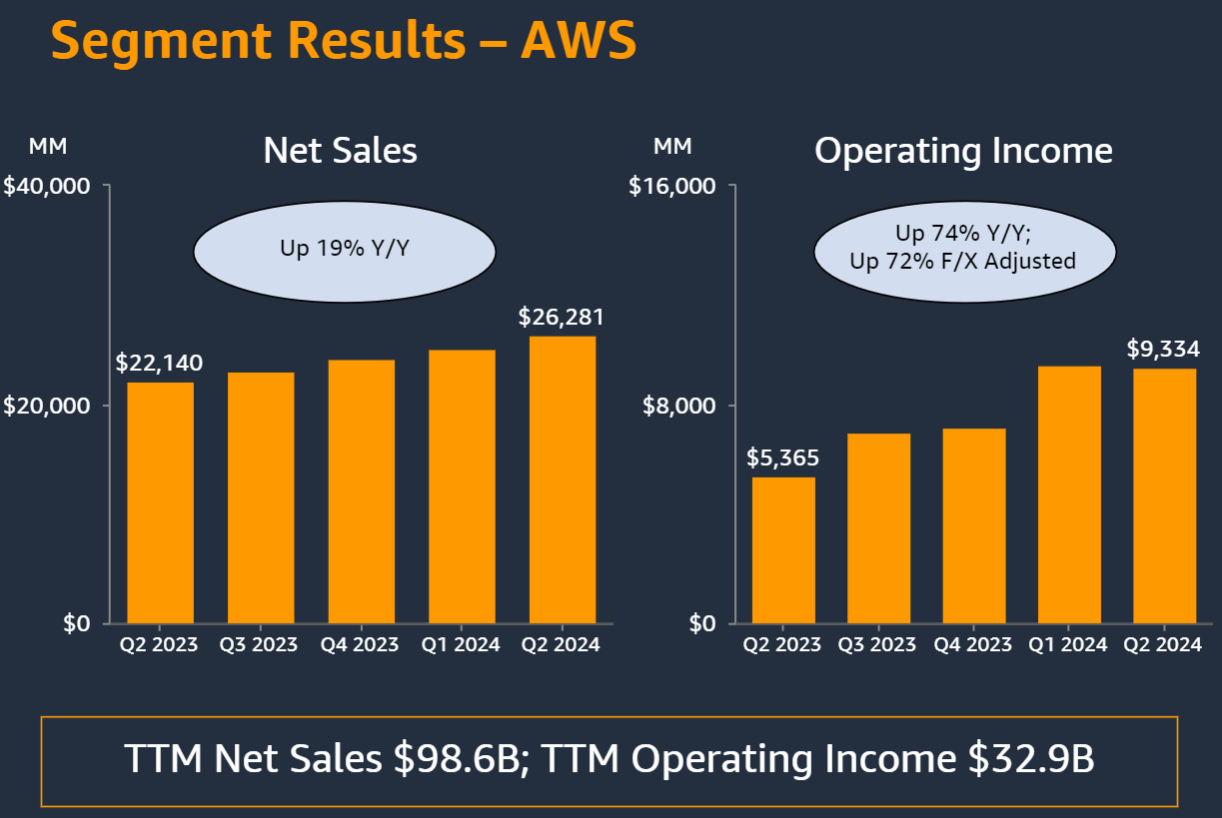

Amazon Web Services' sales growth in the second quarter accelerated to 19% amid a mixed quarter for Amazon overall.

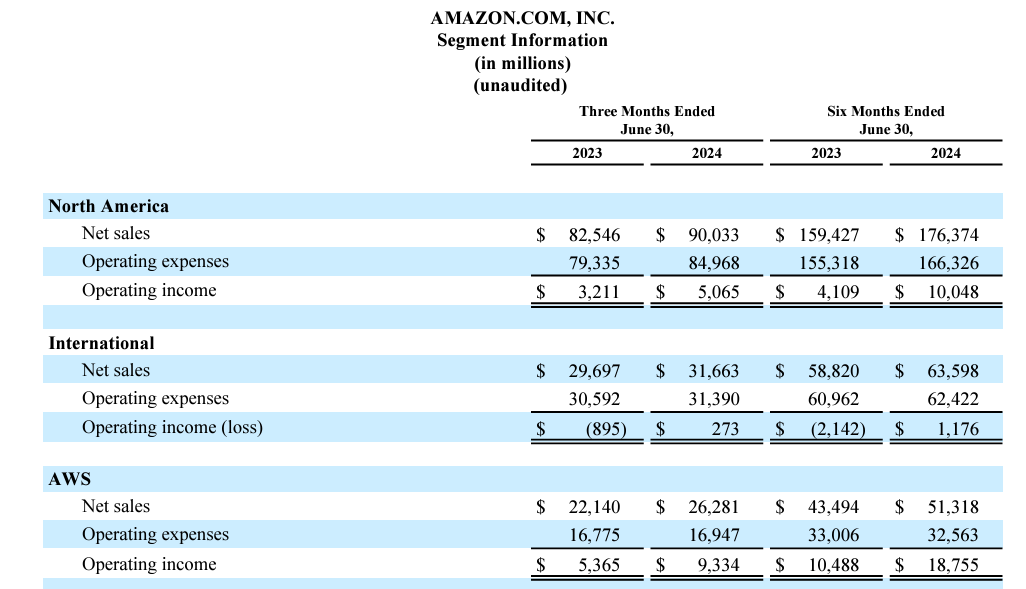

AWS reported second-quarter operating income of $9.3 billion, up from $5.4 billion a year ago, on revenue of $26.3 billion. Analysts were looking for AWS revenue growth between 17% and 18%. AWS is now on a $105 billion annual revenue run rate.

Overall, Amazon reported second quarter net income of $13.5 billion, or $1.26 a share, on revenue of $148 billion, up 10% from a year ago. Amazon's net income included a pre-tax valuation gain of $400 million due to its investment in Rivian.

Wall Street was expecting Amazon to report second quarter earnings of $1.02 a share on revenue of $148.76 billion.

Recent:

- AWS Summit New York 2024: Q Apps, Bedrock fine-tuning, customization, Guardrails aimed at production genAI

- GenAI’s prioritization phase: Enterprises wading through thousands of use cases

- Amazon Q generally available with new pricing plans

- Amazon Bedrock integrated into SAP AI Core, SAP to use AWS chips

- AWS names Garman CEO effective June 3

- AWS' Matt Wood on model choice, orchestration, Q and evaluating LLMs

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

Indeed, Amazon's e-commerce business was mixed in the second quarter. North American e-commerce sales were $90 billion, up 9% from a year ago. International e-commerce revenue was up 7%. North American e-commerce operating income was $5.1 billion and international operating income was $300 million.

Amazon CEO Andy Jassy said in a statement that AWS growth was reaccelerating. Jassy added that enterprises were modernizing infrastructure on AWS and leveraging genAI services.

For the third quarter, Amazon projected revenue between $154 billion to $158.5 billion, up 8% to 11%. Operating income will be between $11.5 billion to $15 billion.

Jassy spent a good chunk of the earnings conference call talking about AWS. He said:

- "We're continuing to see three macro trends drive AWS growth. First, companies that completed significant majority of their cost optimization efforts are focused again on new efforts. Second, companies are spending their energy again on modernizing their infrastructure and moving from on premises infrastructure to the cloud.

- And third, builders and companies of all sizes are excited about leveraging AI. Our AI business continues to grow dramatically with a multi-billion dollar revenue run rate despite with our unique approach and offerings."

- "We've heard loud and clear from customers that they relish better price performance. It's why we've invested in our own custom silicon in for training and inference with very compelling price performance. We're seeing significant demand for these chips."

- "We're continuing to see strong adoption of Amazon Q."

- "We remain very bullish on the medium to long term impact of AI in every business we know and can imagine. The progress may not be one straight line for companies. Generative AI especially is quite iterative and companies have to build muscle around the best way to solve actual customer problems. But we see so much potential change customer experiences."

Constellation Research analyst Holger Mueller said:

"AWS had a good quarter and revitalized growth, fueled by the demand for AI. The most remarkable part of the quarter is that AWS was able to deliver that revenue with practically constant operating expenses. Given the nature of the AWS business this can only be achieved by consuming some of the overinvestment that AWS (and it's competitors) do. As AWS invests the whole year to be ready for Black Friday, this will add interesting question into its investments into capacity. For sure all eyes will be on Q3 and the ratio of revenue growth to expenses."

Research

- Amazon QuickSight Brings GenAI and Cost Advantages to Business Intelligence

- How Rivian Data, AI, and a Software-Defined-Vehicle Strategy Is Paying Off

- Amazon Generative AI Stack Offering Overview

- Intuit’s Bet on Data, AI, AWS Pays Off Ahead of Generative AI Transformation

- Rocket Companies’ strategy: Generative AI transformation in turbulent market

- Constellation ShortList™ MLOps