Arm Holdings' chip designs may take over the data center over time as GPUs, cloud custom processors and Nvidia's march to AI factories gains momentum. But the road to licensing and royalty nirvana is going to be lumpy.

And lumpy it is for Arm's fourth quarter results and first quarter outlook. Arm's third quarter ascent caught Wall Street by surprise, but the fourth quarter earnings and first quarter outlook had to deal with much higher expectations.

The chip designer said first quarter non-GAAP earnings will be between 32 cents a share to 36 cents a share on revenue between $875 million to $925 million. Fiscal 2025 revenue will be between $3.8 billion and $4.2 billion with adjusted earnings of $1.45 a share and $1.65 a share. The first quarter outlook was above estimates and the fiscal year guidance was in line.

Higher expectations go with the territory when shares year to date were up 41% going into an earnings report. Arm peaked at $164 after its third quarter report and will fall under $100 today. In other words, Arm has gone from a poster child of trickle-down generative AI economics to not being able to deliver the growth expected.

As with most things in life, the truth lies in the middle. For Arm, that truth looks promising, but chip designs take time to work through data center buildouts. Also keep in mind that Arm stands to benefit from AI processing at the edge--namely AI PCs and smartphones.

Here's a look at the moving parts of Arm.

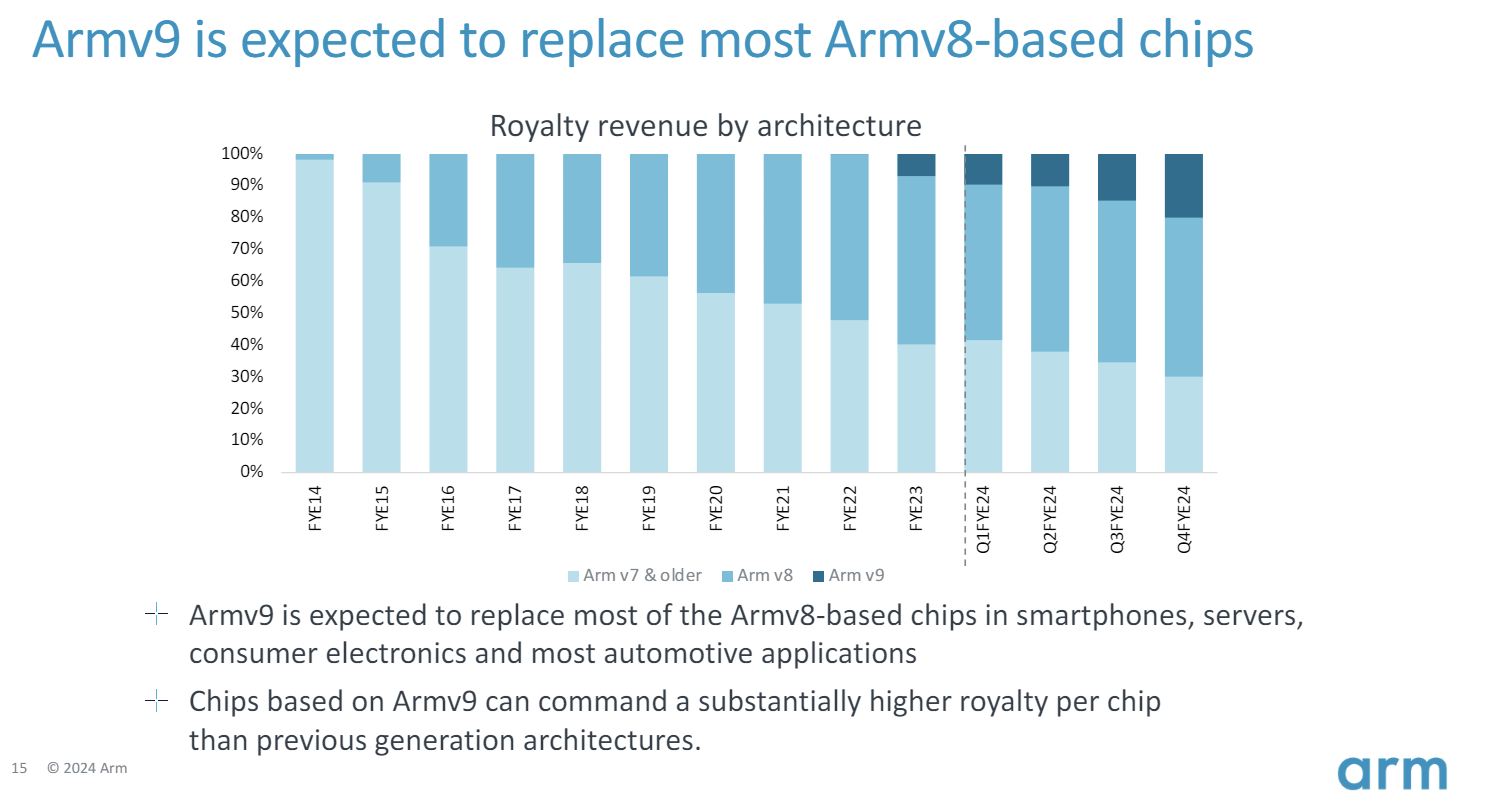

Future growth is all about royalty revenue from chips based on Armv9 designs. In the fourth quarter, Arm said Armv9 technology contributed 20% of royalty revenue due to smartphones, servers, IoT and networking devices. That's up from 15% in the third quarter.

Arm CEO Rene Haas said on the company's earnings conference call.

"What we're seeing is the acceleration of v8 to v9, which drives not only better royalties, but we're also seeing more CPUs inside the chip, which compounds that royalty growth really across all end markets. V9 adoption will only continue to increase."

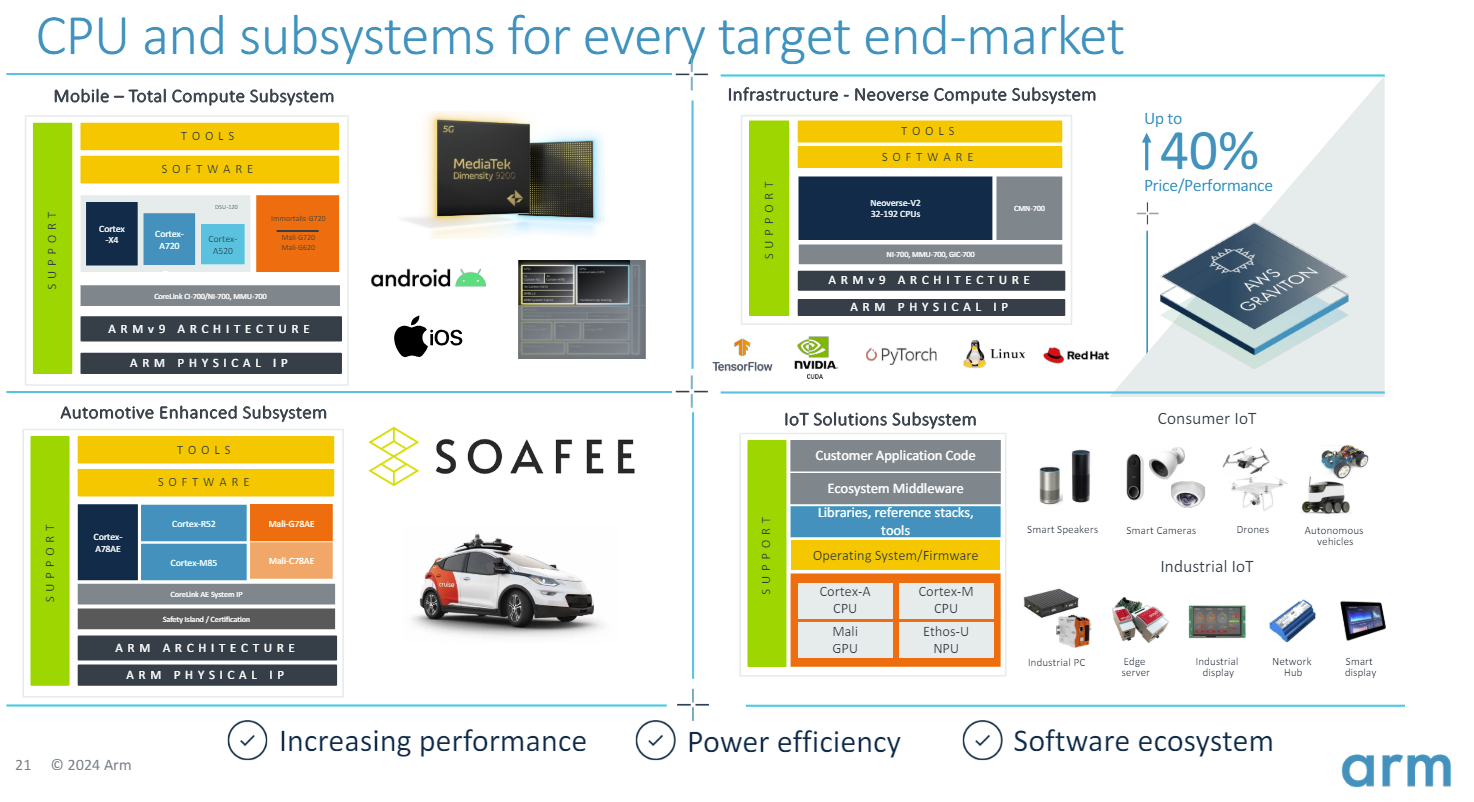

V9 adoption will be faster than previous Arm designs because of the uptake in infrastructure and subsystems.

That uptake of Armv9 takes time and revenue recognition may be lumpy. CFO Jason Child said licensing revenue will be "lumpy" due to timing of revenue recognition. Arm said the first half of fiscal 2025 will be about 40% of licensing revenue for the year. Royalty revenue will continue to grow in the mid-20% range. Child said Arm has a pipeline of new licenses and royalty bearing chips to maintain revenue growth of 20% for fiscal 2026 and 2027.

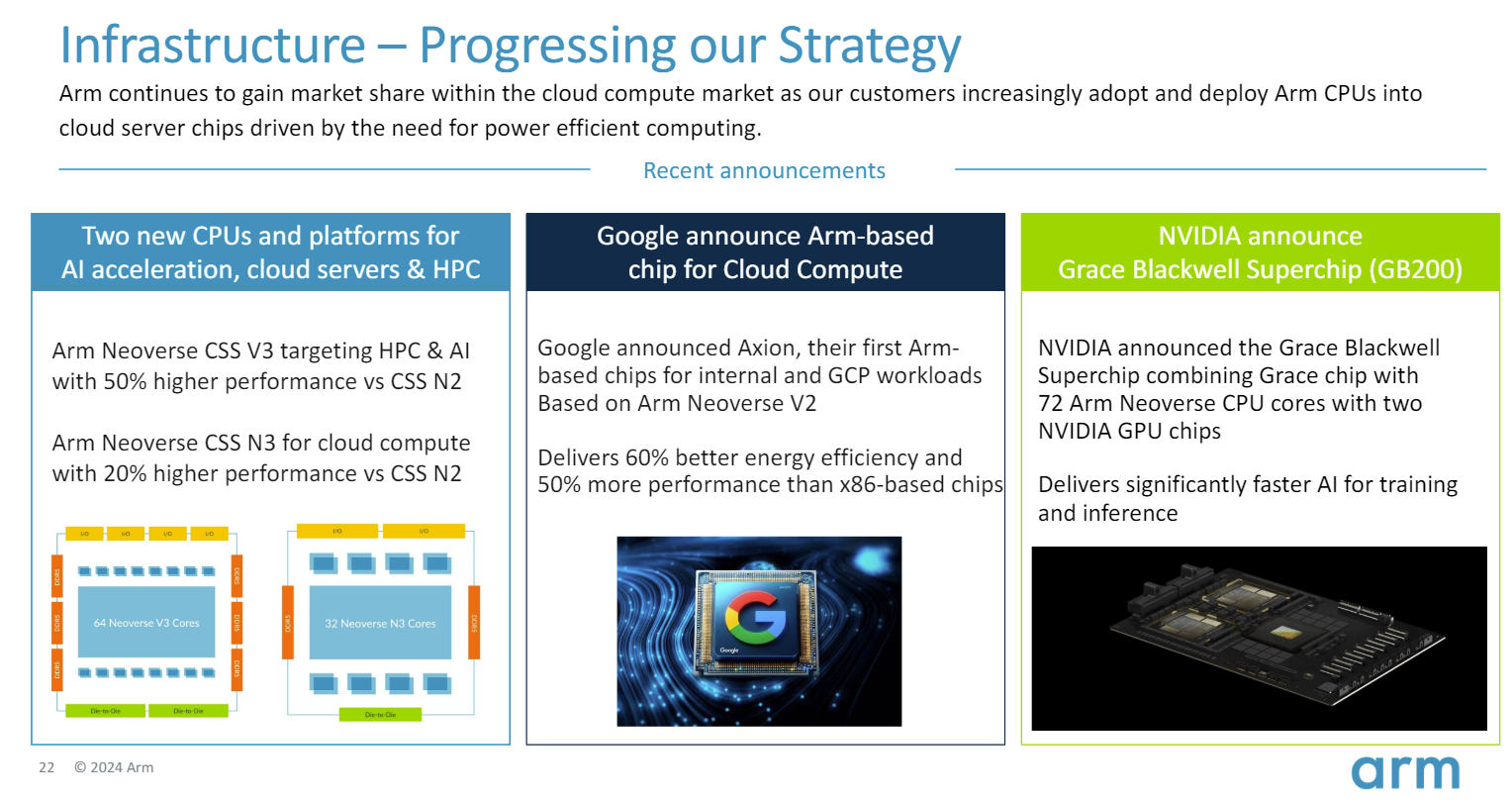

Nvidia is Arm's BFF. Nvidia's surge is going to bring Arm along for the ride. Haas said:

"With Nvidia's most recent announcement, Grace Blackwell, you are going to see an acceleration of Arm in the data center in these AI applications. One of the benefits that you get in terms of designing a chip such as Grace Blackwell is by integrating the Arm CPU with the Nvidia GPU, you're able to get an interconnect between the CPU and the GPU that allows for a much higher access to memory, which is one of the limiting factors is for training and inference applications."

- Nvidia acquires Run.ai for GPU workload orchestration

- Nvidia Huang lays out big picture: Blackwell GPU platform, NVLink Switch Chip, software, genAI, simulation, ecosystem

- Nvidia today all about bigger GPUs; tomorrow it's software, NIM, AI Enterprise

Don't forget the CPU play. Seventy percent of the world's population is using Arm-based CPUs. Those CPUs will become an AI play as AI workloads are moved to the edge. "Our licensing activity is probably the best proxy for that. The way to think about licensing revenue as it applies to Al is as software is moving faster than hardware, the hardware designs need to be upgraded quickly to make sure they can capture the needs of these new Al workloads," said Haas.

Hyperscalers will pay Arm because they need energy efficiency. Google's Axion processor is custom and based on Arm and will be used for inference and training. AWS' Graviton and Trainium are Arm as is Microsoft's custom processor. And then there's the big fish in Nvidia's Grace Blackwell superchip.

Networking is a market. Arm recently announced Ethos-U85, which adds transformer network support to Arm Ethos products, which aim to bring genAI to embedded devices.

Compute subsystems will bring Arm more growth. Arm said it will see growth from Arm Compute Subsystems (CSS), which integrate various Arm technologies for more off-the-shelf components.

Haas said:

"And our first customer in the Neoverse space doing a design, Microsoft, their Cobalt chip is now ramping. We are oversubscribed on this compute subsystem strategy. We have far more demand for the product than anticipated, and we are anticipating growing that significantly over time."