Apple's first quarter results were better-than-expected as Mac, iPad and services revenue gained from a year ago. But iPhone revenue was down from a year ago as were wearables. China sales also took a hit in the first quarter.

The company, which is betting that Apple Intelligence can drive an upgrade cycle, reported first quarter earnings of $2.40 a share on revenue of $124.3 billion.

Wall Street was expecting Apple to report earnings of $2.35 a share on revenue of $124.03 billion.

CEO Tim Cook said Apple reported its best quarter ever and added that Apple Intelligence will be available in more languages in April.

By the numbers:

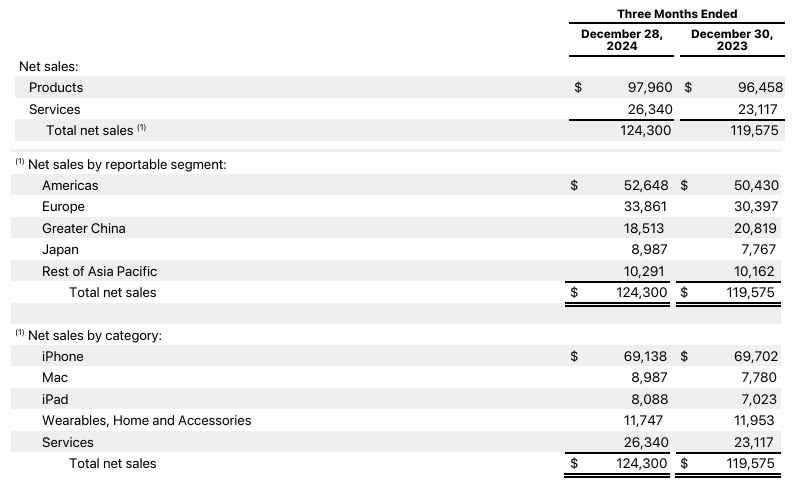

- iPhone revenue in the first quarter was $69.14 billion, down from $69.7 billion a year ago. Wall Street analysts were looking for $71 billion in iPhone sales.

- Those flattish iPhone sales come as sales in greater China for the first quarter were $18.5 billion, down 11% from $20.82 billion a year ago.

- Mac sales in the first quarter were $8.99 billion, up 15% from $7.78 billion a year ago.

- iPad revenue in the first quarter were $8.09 billion, up 15% from $7.02 billion a year ago.

- Wearables revenue (mostly Apple Watch) in the first quarter was $11.75 billion, down from $11.95 billion a year ago.

- Services revenue in the first quarter surged to $26.34 billion, up from $23.12 billion a year ago.

- Sales in the Americas were $52.65 billion, up from $50.43 billion in the first quarter a year ago.

- Apple saw revenue gains in Europe, Japan and the rest of Asia Pacific.

As for the outlook, Kevan Parekh, Apple’s CFO, said the stronger US dollar will be a headwind. The company expects second quarter revenue to grow in the low- to mid-single digit range.

Cook said on the earnings conference call that Apple has more than 2.35 billion active devices. Cook was asked about Apple Intelligence and demand. He said:

"We did see that the markets where we had rolled out Apple Intelligence that the year-over-year performance on the iPhone 16 family was stronger than those where Apple intelligence was not available."

Regarding China, Cook said:

"Over half of the decline that we experienced was driven by change in channel inventory from the beginning to the end of the quarter. And on the Apple Intelligence side, we have not rolled out in China. And it's the most competitive market in the world."

Cook was also asked about cost of compute and DeepSeek's impact.

"In general, I think innovation that drives efficiency is a good thing. And that's what you see in that model. Our tight integration of silicon and software will continue to serve us very well. We do things on the device and we do things in the private cloud. From a CapEx point of view, we've always taken a very prudent and deliberate approach to our expenditure."