AMD CEO Lisa Su said multiple customers are at the chipmaker to power AI projects and have "initiated or expanded programs supporting future deployments of Instinct accelerators at scale."

Su made the comments as the company reported second quarter earnings. The company reported second quarter revenue of $5.36 billion, down 18% from a year ago, with net income of $27 million, or 2 cents a share. Non-GAAP earnings for the second quarter were 58 cents a share.

Wall Street was expecting AMD to report non-GAAP earnings of 57 cents a share on revenue of $5.32 billion.

As for the outlook, AMD projected third quarter revenue of about $5.7 billion, give or take $300 million.

AMD's earnings report lands after Intel's second quarter financials, which spurred hope that the PC market is recovering. AMD is also gunning for Nvidia since workloads are favoring AI deployments. Su said AMD is on track to launch its M1300 accelerators in the fourth quarter.

- AMD makes its case for generative AI workloads vs. Nvidia

- Intel's Q2 better than expected, issues remain

According to AMD, the company's AMD Instinct MI300A and MI300X GPUs are sampling to HPC, Cloud and AI customers.

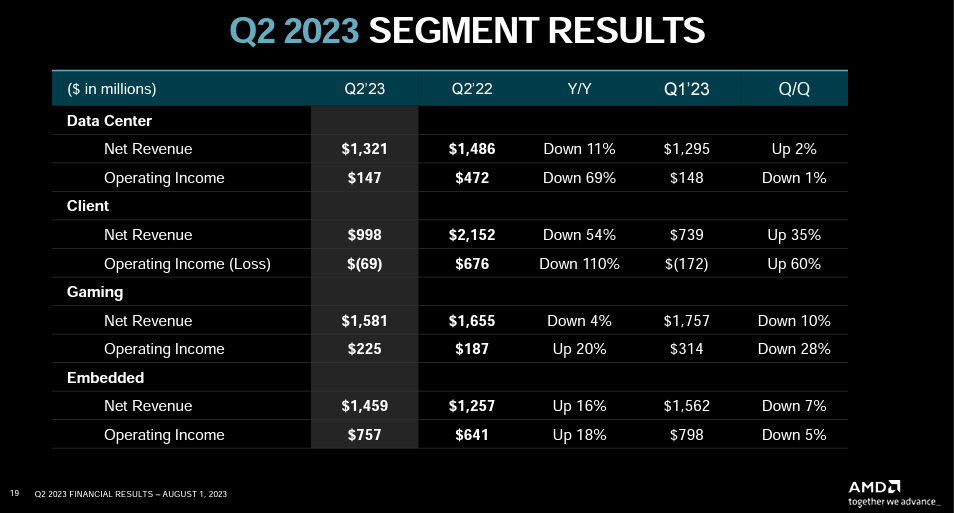

By business unit, AMD said its data center business had second quarter revenue of $1.3 billion, down 11% from a year ago. AMD said data center sales were down due to soft enterprise demand and elevated cloud inventory levels.

The client unit, focused on PCs, delivered second quarter revenue of $998 million, down 54% from a year ago. AMD cited a weak PC market and inventory correction. AMD's gaming unit had $1.6 billion in revenue, down 4% from a year ago. Embedded revenue was $1.5 billion, up 16% from a year ago, due to industrial, vision, auto and healthcare demand.

Speaking on a conference call, Su said data center market demand remains mixed, but the company is seeing more cloud instances powered by EPYC. In enterprise, EPYC saw sequential wins, said Su, noting that EPYC revenue should grow at a double-digit clip sequentially in the third quarter. Su said that AMD's AI strategy revolves around its broad portfolio, open software and partnerships. "We delivered on all three parts in the second quarter," said Su.

AI is a multi-billion dollar opportunity for AMD, said Su. She said AMD has increased investments in engineering, R&D and go-to-market.

On the PC side, Su said she's expecting improvement in the client unit in the second half. "We see AI being a PC demand driver," said Su, who added that AMD has a roadmap to "fundamentally change the PC experience."

Key items in the quarter include:

- AMD said it will invest about $400 million over the next 5 years to expand R&D and engineering operations in India.

- AMD EPYC CPUs have SAP application instances on Google Cloud. AMD 4th Gen AMD EPYC processors added to AWS instances.

- Phil Guido joined AMD as chief commercial officer. Guido was strategic sales lead at IBM, where he held multiple positions over 30 years.