AMD reported better-than-expected first quarter earnings largely due to strong data center growth and the ramp of the company's MI300 AI accelerator.

The company reported first quarter earnings of $123 million, or 7 cents a share, on revenue of $5.5 billion. Non-GAAP first quarter earnings were 62 cents a share.

Wall Street was expecting AMD to report first quarter earnings of 61 cents a share on revenue of $5.45 billion.

AMD is critical as a second supplier for AI processors and GPUs as enterprises and cloud providers spend heavily on Nvidia. Here's the current state of AI chip players:

- Intel launches Gaudi 3 accelerator with availability in Q2

- Intel Q2 outlook weaker than expected

- Nvidia Huang lays out big picture: Blackwell GPU platform, NVLink Switch Chip, software, genAI, simulation, ecosystem

- Will generative AI make enterprise data centers cool again?

- AWS presses custom silicon edge with Graviton4, Trainium2 and Inferentia2

Lisa Su, AMD CEO, said the "widespread deployment of AI is driving demand for significantly more compute across a broad range of markets. We are executing very well as we ramp up our data center business and enable AI capabilities across our product portfolio."

As for the outlook, AMD projected second quarter revenue of $5.7 billion, give or take $300 million.

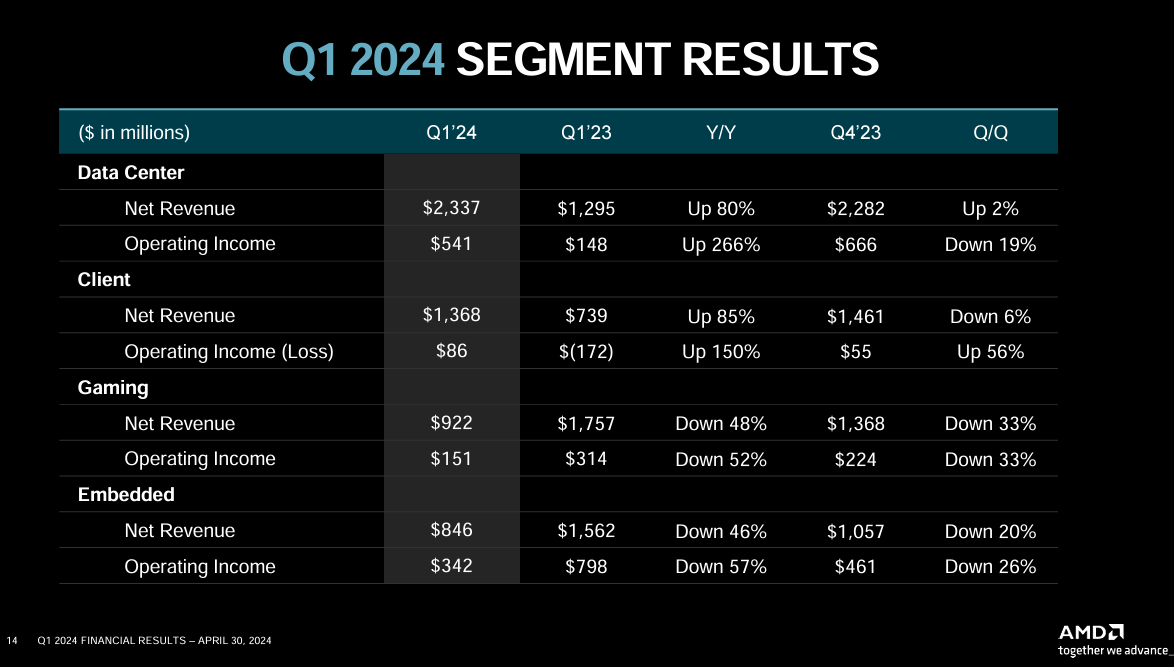

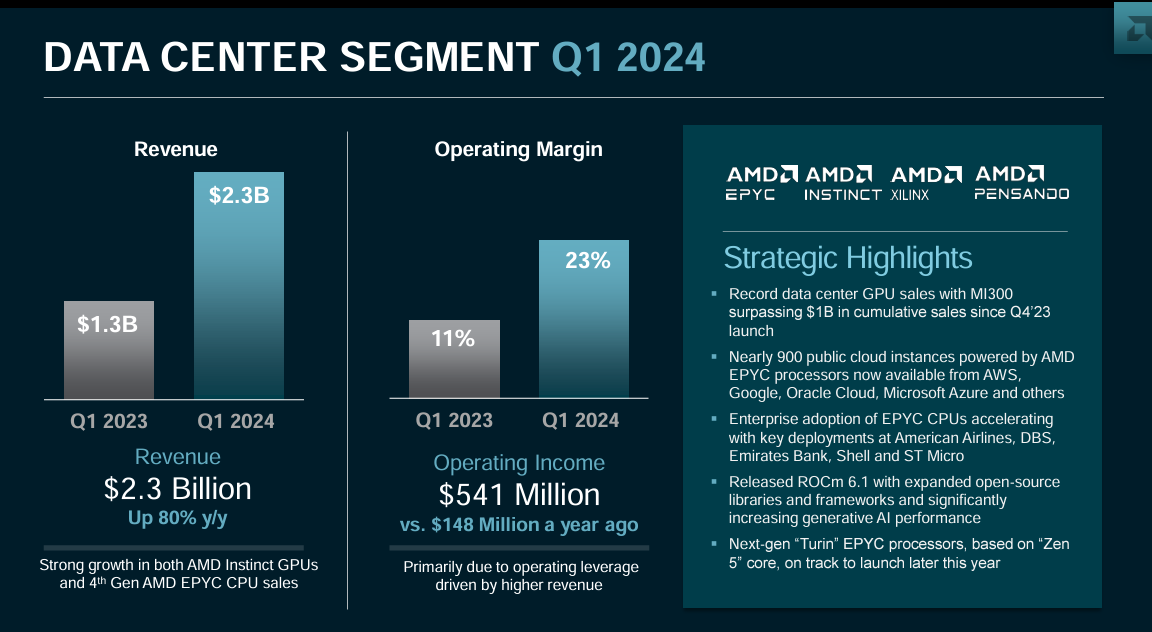

By unit, AMD posted record data center revenue in the first quarter of $2.3 billion, up 80% from a year ago. Growth was driven by AMD Instinct GPUs and 4th Gen AMD EPYC CPUs. The PC unit had first quarter revenue of $1.4 billion, up 85% from a year ago. Gaming revenue was $922 million, down 48% from a year ago. Embedded revenue in the first quarter was $846 million, down 46% from a year ago.

On an earnings conference call, Su said server CPU sales were strong in a seasonally down first quarter due to "growth in enterprise adoption and expanded cloud deployments."

She said there are nearly 900 AMD powered public cloud instances across hyperscalers.

Regarding AI, Su said:

"In the enterprise, we have seen signs of improving demand as CIOs need to add more general purpose and AI compute capacity while maintaining the physical footprint and power needs of their current infrastructure."

She added that MI300 is the fastest ramping product in AMD history and has passed $1 billion in total sales in less than two quarters. "We now expect data center GPU revenue to exceed $4 billion in 2024, up from $3.5 billion we guided in January," said Su. "Longer term, we're increasingly working closer with our Cloud and Enterprise customers as we expand and accelerate our AI hardware and software roadmaps and grow our data center GPU footprint."

She added:

"AI represents an unprecedented opportunity for AMD. While there has been significant growth in AI infrastructure build outs, we're still in the very early stages of what we believe is going to be a period of sustained growth driven by an insatiable demand for both high performance AI and general-purpose compute."

Su also was bullish on prospects for AMD's Ryzen processors and AI PCs with additional market share gains in commercial accounts.