Alphabet's Google Cloud business is now pushing a $40 billion annual revenue run rate as the company overall delivered strong first quarter results.

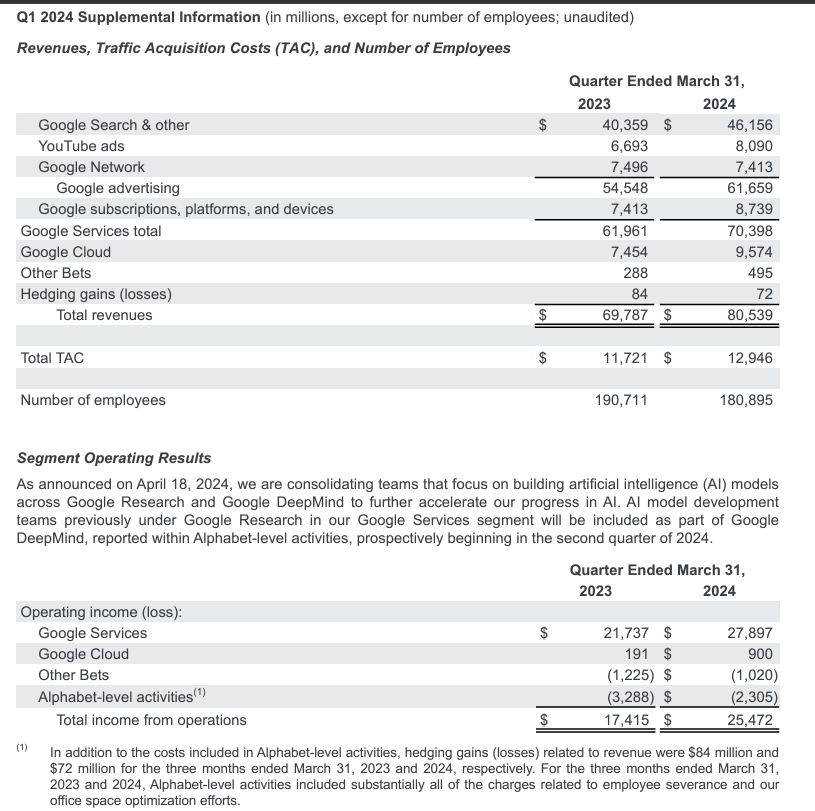

Alphabet reported first quarter revenue of $80.54 billion, up 15% from a year ago, with net income of $23.66 billion, or $1.89 a share. Wall Street was expecting Alphabet to report first quarter earnings of $1.50 a share on revenue of $78.7 billion.

CEO Sundar Pichai said first quarter results were driven by strength in search, YouTube and Google Cloud. "We are well under way with our Gemini era and there’s great momentum across the company. Our leadership in AI research and infrastructure, and our global product footprint, position us well for the next wave of AI innovation," said Pichai.

Ruth Porat, CFO and Chief Investment Officer of Alphabet, said the company's margins were expanding due to "ongoing efforts to durably reengineer our cost base."

- Foundation model debate: Choices, small vs. large, commoditization

- Google Cloud Next: The role of genAI agents, enterprise use cases

- Google Cloud Next 2024: Google Cloud aims to be data, AI platform of choice

- Google Unveils Ambitious AI-Driven Security Strategy at Google Cloud Next'24

- Equifax bets on Google Cloud Vertex AI to speed up model, scores, data ingestion

The company also initiated a dividend of 20 cents a share to be paid on June 17. The company will pay quarterly cash dividends going forward. Alphabet also said it will repurchase up to $70 billion of shares.

On a conference call, Picahi said:

"We are already seeing developers and enterprise customers enthusiastically embrace Gemini 1.5 and use it for a wide range of things beyond Gemini for your build to other useful models, including our Gemma open models, as well as image and visual models and others."

Pichai added that Google is leveraging its infrastructure edge. "We have developed new AI models and algorithms that are more than 100 times more efficient than they were 18 months ago," he said.

Pichai also said Alphabet will continue to invest heavily in AI infrastructure.

"The increases in our capital expenditures this will fuel growth in cloud help us push the frontiers of AI models and enable innovation across services," said Pichai. "We have clear paths to AI monetization through ads and cloud as well as subscriptions."

By unit:

- Google Search revenue was $46.16 billion, up from $40.36 billion a year ago.

- YouTube revenue was $8.09 billion.

- Google Network revenue was $7.4 billion.

- Google Ad revenue was $61.66 billion.

- Google Services’ operating income was $27.9 billion.

- Google Cloud operating income was $900 million on revenue on $9.57 billion.

- Other bets loss was $1.02 billion on revenue of $495 million.

- Alphabet took a hit of $2.3 billion in the first quarter for real estate optimization and severance.

Key points from Porat:

- "Cloud segment revenues were $9.6 billion for the quarter, up 28% reflecting significant growth in GCP with an increasing contribution from AI and strong Google Workspace growth, primarily driven by increases in average revenue per seat."

- "With respect to Google Cloud performance in q1 reflects strong demand for our GCP infrastructure and solutions as well as the contribution from our workspace productivity tools. The growth we're seeing across cloud is underpinned by the benefit AI provides for our customers."

- "Looking ahead, we remain focused on our efforts to moderate the pace of expense growth in order to create capacity for the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure."

- Cap-ex in the first quarter was $12 billion driven by investment in technical infrastructure, servers and data centers. "We do expect the quarterly capex throughout the year to be roughly at or above the $12 billion cash capex we had here in q1," said Porat.