Adobe reported better-than-expected fourth quarter results as customers leveraged AI tools across its platform, but its outlook fell short of expectations for fiscal 2025.

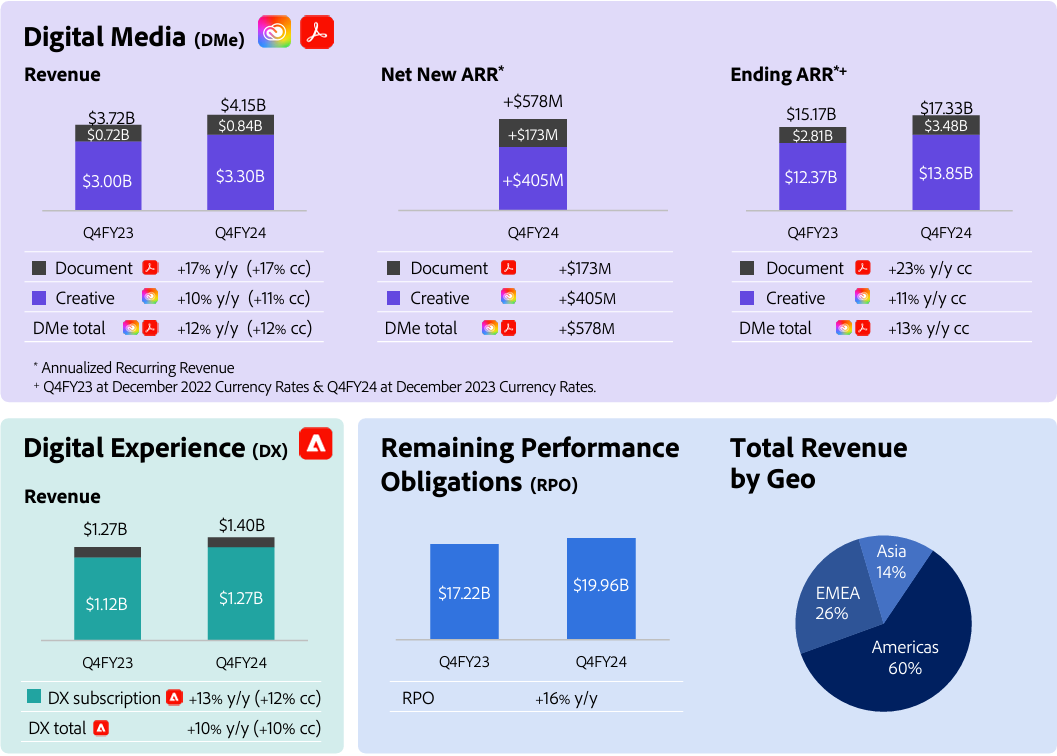

The company reported fourth quarter earnings of $3.79 a share on revenue of $5.61 billion, up 11% from a year ago. Non-GAAP earnings were $4.81 a share. Wall Street was looking for non-GAAP earnings of $4.67 a share on revenue of $5.54 billion.

For the quarter, Adobe's Digital Media unit had revenue of $4.15 billion, up 12% from a year ago. Document Cloud revenue was up 17% from a year ago and Creative Cloud revenue was up 10%. Digital Experience revenue was $1.4 billion, up 10% from a year ago.

Adobe said fiscal 2024 revenue was $21.51 billion, up 11% from a year ago, with earnings of $12.36 a share ($18.42 a share non-GAAP).

Shantanu Narayen, CEO of Adobe, said Adobe saw strong demand due to "the mission-critical role Creative Cloud, Document Cloud and Experience Cloud play in fueling the AI economy." Narayen said the company's Firefly family of models was "driving record customer adoption and usage."

Indeed, Firefly generations across the Adobe platform topped 16 billion.

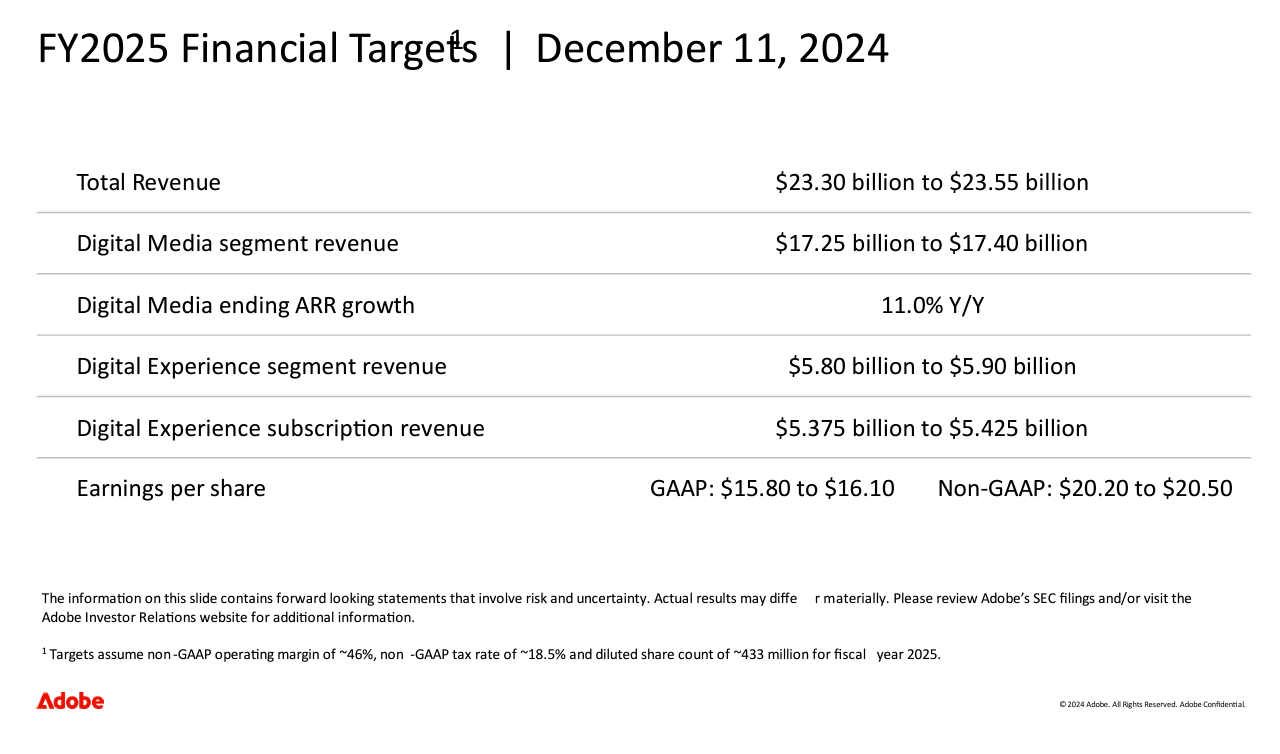

As for the outlook, Adobe projected fiscal 2025 revenue of $23.3 billion to $23.55 billion with non-GAAP earnings of $20.20 a share to $20.50 a share. Wall Street was looking for $20.52 a share in earnings on revenue of $23.8 billion. Adobe said it expected currency fluctuations to hit earnings.

For the first quarter, Adobe projected $4.95 a share to $5 a share in non-GAAP earnings with revenue of $5.63 billion and $5.68 billion. Wall Street was expecting revenue of $5.72 billion.