Infosys' third quarter earnings highlight enterprise interest in generative AI, large deals and clients that are navigating an uncertain economic picture.

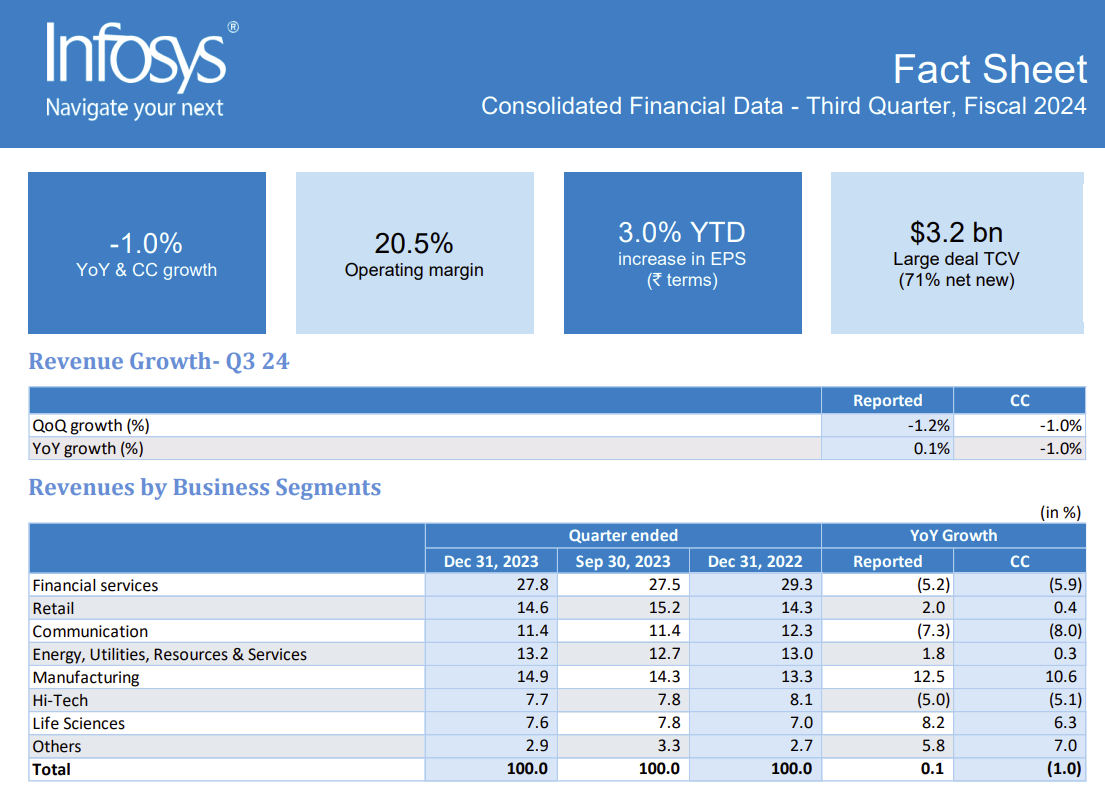

The services provider delivered $4.66 billion in the third quarter and announced large deal wins at $3.2 billion. In the quarter, 59% of revenue was attributed to North America. Infosys added that demand was strong for its Topaz generative AI platform and Cobalt, its cloud services. For the quarter ended Dec. 31, Infosys reported a net profit of $733 million.

Here are some of the takeaways from Infosys CEO Salil Parekh and CFO Nilanjan Roy on the company's earnings conference call.

Generative AI is top of mind for enterprises. Parekh said:

"Almost every discussion with clients involves some element of generative AI. We're working across a large number of clients on different scales, where there are some which are more pilots some which are programs."

Industry demand is uneven. "We have seen impact in Financial Services, Telco and Hi-Tech segments. We see strength in Manufacturing, Energy, Utilities and Life Sciences segment. We are seeing strong traction for generative AI programs leveraging our Topaz capability. We've integrated our generative AI components into our service line portfolio, creating impact for our clients," said Parekh.

Use cases for generative AI emerge across Infosys clients. "We have developed a range of use cases and benefit scenarios across different industries for our clients. Some of these areas are related to client analytics, process optimization, sales, marketing, knowledge analysis, software development, self-service and personalization," said Parekh.

- Automation of IT processes, security, governance, analytics top AI use cases, says IBM survey

- CFOs eye hybrid work, automation, digital transformation in 2024, says Deloitte

He added that Infosys is working with a large bank on a risk analysis program by developing a large language model for them. A food supplier is personalizing food experiences and making operations efficient.

Inflation and an uncertain economic picture are prolonging decisions. "Inflation, uncertain macro and delay in decision-making continues to impact the financial services sector with increasing cost pressures, clients remain cautious on spending and are reprioritizing their programs to deliver maximum business value," said Roy. Telecom was similar.

"Clients are looking at conserving cash, which is visible in delayed decision-making and project deferrals. Our focus on large and mega deals resulted in healthy pipeline and deal wins. Energy, utilities, resources and services clients remain cautiously optimistic about the demand environment with cap in short-term spend," said Roy.

Why digital, business transformation projects need new approaches to returns

Retail eyes generative AI and predictive analytics. "In the Retail segment, cost takeouts and consolidation remain the primary focus for the clients. While discretionary spends remain under pressure, there are pockets of opportunities, leverage generative AI, in predictive analysis, real-term insights and decision support areas. Deal pipeline is strong, though decision cycles remain long," said Roy.