This post first appeared in the Constellation Insight newsletter, which features bespoke content weekly and is brought to you by Hitachi Vantara.

Some years are all about questions. Other years deliver answers. For enterprise technology, 2024 is likely to be about the answers. After all, enterprise buyers in 2023 were busy pondering the questions of generative AI, use cases and whether they had the data strategy to innovate.

With that backdrop in mind, here are a few key themes to watch in the year ahead.

2024 will be the year enterprises refocus on data strategy. A frequent quote in 2023 went like this: “Without a data strategy, you don’t have an AI strategy.” Many enterprises will realize they need to hone their data strategies. We surfaced this theme in our 2023 customer story roundup. Those enterprises with a strong data game are poised to lead in AI and generative AI. "We declared five years ago that data and AI was going to be fundamental," said Intuit CEO Sasan Goodarzi, speaking at a recent investor conference. "And everything starts with data."

See: Intuit’s bets on data, AI, AWS pay off ahead of generative AI transformation (PDF) | BT150 Interview: Equifax's Manish Limaye on data architecture, transformation

Generative AI disillusionment appears. In 2023, generative AI disillusionment was percolating and in 2024 there will be a full-blown chorus. Here’s the reality: Many companies simply aren’t ready to scale generative AI and that’s why they need to focus on data strategy. These enterprises will become more frustrated because they fear falling behind and are getting hit by vendors charging more for generative AI features that may not deliver returns. In addition, boards of directors will want generative AI results.

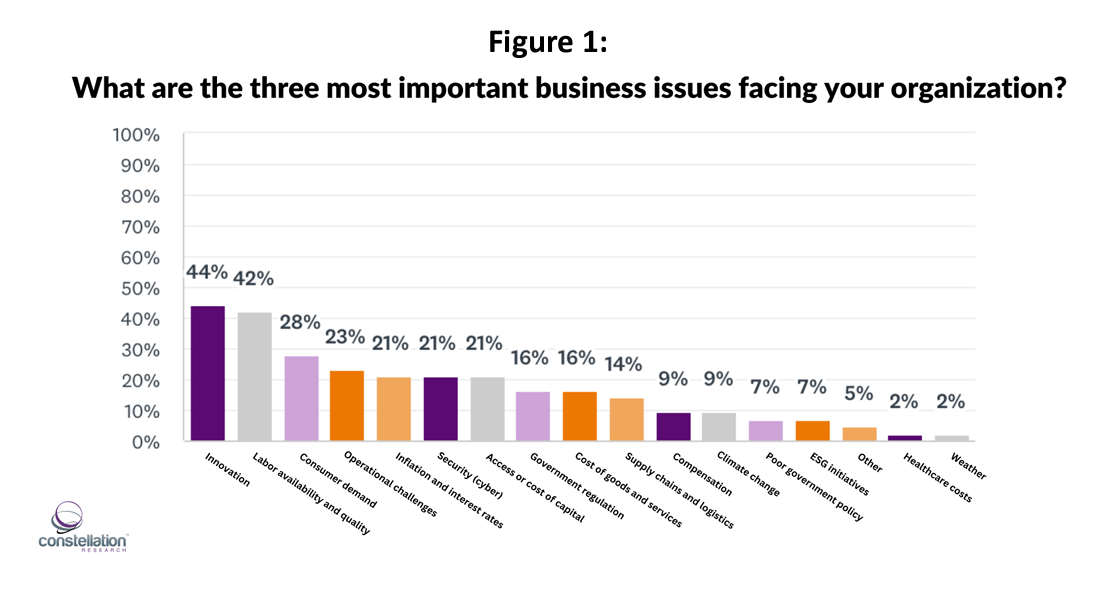

According to Constellation Research's second half 2023 CxO Business Confidence Survey: "Buy-side CxOs are balancing the pressure to invest in the AI space with the need for certainty about the reliability of these new tools. In turn, enterprise tech vendors recognize and predict strong revenue potential in the generative AI space but currently are in the waiting phase of tangible selling and the client's desire to see tangible return on investment (ROI)."

Hybrid models for generative AI workloads will gain traction. Your friendly neighborhood cloud provider will certainly offer you model choices, a bevy of tools and platforms to build out generative AI apps because they want your workloads. But with edge computing devices, on-premises use cases and even the ability to leverage PCs and smartphones, generative AI workloads are likely to go local. I’ll be looking for hybrid approaches to AI workloads throughout 2024.

Transformation projects see more scrutiny over returns. Constellation Research CEO Ray Wang argued in a research note that transformation projects need new techniques to measure returns. Enterprises need to consider the likelihood of success in transformation efforts, qualitative benefits and use a wider view than cost takeout projects. Factors such as implementation risk, ease of maintenance, flexibility and durability need to be considered. Transformation leaders have an average tenure of 2.8 years, but the projects live on. Ingram Micro Chief Digital Officer Sanjib Sahoo argued in an interview that enterprises need to think about technologies that will matter three to five years from now.

Also see: Constellation Research's Connected Enterprise 2023: What we learned

Customers push back on enterprise technology price increases. Inflation has receded somewhat, but revenue and earnings growth has stalled. Yet many enterprise software vendors are raising prices in the name of boosting productivity. Some vendors are even talking about value-based contracts. It's highly doubtful that enterprise tech buyers are going to take their hard-earned earnings gains and hand them over to software providers. The vendors that play the long game with customers will benefit.

The economy will be volatile. Many of the factors that inspired people to predict a 2023 recession are still in place, but there’s widespread optimism that the Federal Reserve will engineer a soft landing. Enterprise technology budgets will be dictated by the economic outlook exiting the first quarter. Another wild card will be the presidential election. CXO optimism is likely to fluctuate along with the S&P 500 index. For what it’s worth (not much), here’s a look at what equity strategists are predicting for the S&P 500.

Tech M&A returns. There are a few green shoots of mergers and acquisitions in 2023 and smaller deals picked up headed into 2024. Merger Mondays here we come. While M&A will return, there will be a price band. Deals will have to be big enough to matter, but not so large that they attract regulatory scrutiny.

- Alteryx goes private in $4.4 billion deal: What to watch next

- ServiceNow acquires UltimateSuite, adds task mining

- IBM buys StreamSets, webMethods from SoftwareAG for €2.13 billion

- Celonis acquires Symbio, aims to meld AI, process intelligence in one package

- Palo Alto Networks acquires Talon Cyber Security, Dig Security

- Cisco acquires Splunk in $28 billion observability, AI and cybersecurity play

- Five9 acquires Aceyus, aims to expand analytics, enterprise reach

- RingCentral buys Hopin Events, Sessions: Here's what it means

- New Relic goes private in $6.5 billion deal, aims to accelerate observability platform ubiquity

IPOs will come back in 2024 and likely ramp in 2025. The two-year IPO drought is about to end, argued Ray Wang in a blog post. The argument is that a solid economy and stock market returns will lead to IPO exits.

Enterprises embrace hybrid and remote work and start unloading commercial real estate. The trend to shed office space started in 2023 even as companies will tell employees to get their butts back in the office. Google and Facebook suddenly don't want to own half of New York City. What changed? Expiring leases that aren't being renewed. Another thing that changed: CFOs will veto the corporate culture crowd in the name of earnings.

Apple loses its Wall Street darling status. Everyone owns Apple whether it’s via a mutual fund, index or direct holding. As a result, there’s a large part of the population rooting for Apple growth. The issue is that it’s almost impossible to move Apple’s topline growth. For fiscal 2023 ending Sept. 30, Apple’s revenue was $383 billion, down from $394 billion the year before. Meanwhile, Apple is trailing in generative AI, hasn’t found the next iPhone, and is betting on an expensive Reality Pro AR/VR headset to save the metaverse. Reality Pro won’t be a total flop due to Apple’s developer base as well as hooks into its ecosystem.

PC market bottoms and then bounces due to higher-priced systems. In 2020, everyone bought a PC. Now those PCs are due for a refresh. In addition, workstations and PCs will get upgraded for generative AI features and workloads. The wave of “AI PCs” even features a Microsoft Copilot button on keyboards. This PC rebound will help Intel, AMD and Nvidia, but it’s unclear whether commercial or consumer demand leads the charge. I'm going to run my PC into the ground as I await a quantum desktop (just kidding...sort of). Intel's AI everywhere strategy rides on AI PCs, edge, Xeon CPUs for model training, Gaudi3 in 2024