With 2024 ending it’s worth checking in on everything we’ve learned from the CxOs, buyers and sellers of enterprise technology.

Here's everything we learned in 2024:

Some predictions don't quite work out. Yes, I went back into the archive to look at the trends to watch for 2024 published in January. Here's the breakdown:

- Enterprises did refocus on data strategy to make generative AI work and there was a bit of disillusionment with genAI. Not that generative AI was a complete dud, but the reality is that it was a building block on the road to agentic AI. And transformation projects, which included a lot of AI, faced more scrutiny.

- On the flip side of 2024 predictions, that hybrid model for genAI is still on the drawing board, but may appear in 2025. Customers were miffed about enterprise technology price increases, but few did anything about it. I also noted that the economy would be volatile in 2024, but the stock market and leading indicators chugged along for a goldilocks scenario. Tech mergers and IPO remained no shows even though I bet otherwise.My biggest flop was this one: "Enterprises embrace hybrid and remote work and start unloading commercial real estate." You can stop laughing as you read your return to office memos.

See: Constellation Research Presents the 2024 Enterprise Awards | Constellation Research's Connected Enterprise 2024: All the takeaways

Enterprise software is at a crossroads. Enterprise software disruption was a theme we returned to repeatedly in 2024. The seat-based business model isn’t going to fly when AI starts replacing people. Vendors are navigating the rise of marketplaces, models that can keep revenue growth going and balancing margins since genAI isn’t cheap. Most vendors want to be a platform, but we all know there are only a few. Enterprise buyers are pushing back on price increases because software vendors can’t keep gobbling up all the operating expenses.

- Enterprise software 2025: Three big shifts to watch

- Enterprise security customers conundrum: Can you have both resilience, consolidation?

- Big software deals closing on AWS Marketplace, rival efforts

- Disruption is coming for enterprise software

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

What remains to be seen is whether enterprises buyers have any leverage. Broadcom’s acquisition of VMware caused a lot of complaints, but it’s hard to argue that the deal wasn’t a financial success.

Hyperscale cloud providers are only growing more powerful. Yes, cloud providers give enterprises more agility and save them money. But these hyperscalers hold a lot of power. AWS, Google Cloud and Microsoft Azure had banner years with annual run rates of $110 billion, $45.6 billion, and $156 billion, respectively* . Oracle Cloud Infrastructure did too. What remains to be seen is whether a new breed of cloud providers focused on AI—or even hybrid approaches—can check the market power. AI is a cloud workload—especially since the technology is developing so fast—and looking down the road quantum will be a cloud-first workload too. Whether you standardize on one cloud provider or mix and match infrastructure will be your most important enterprise decision.

*Microsoft doesn’t break out Azure revenue so the run rate is calculated on commercial cloud revenue.

- AWS re:Invent 2024: 7 takeaways after drinking from the firehose

- GenAI's 2025 disconnect: The buildout, business value, user adoption and CxOs

- Multi-cloud computing isn't 'a bunch of separate clouds'

AI has impacted industries well beyond technology. AI has become a hot topic on earnings calls beyond the technology sector. GenAI and automation have fueled expanding profit margins at companies such as Lowe’s, Exxon, Rocket and Equifax. Those examples are just a few. The productivity boom from AI has expanded to multiple sectors.

- The art, ROI and FOMO of 2025 AI budget planning

- 13 artificial intelligence takeaways from Constellation Research’s AI Forum

- Enterprises leading with AI plan next genAI, agentic AI phases

- Enterprises start to harvest AI-driven exponential efficiency efforts

- Generative AI spending will move beyond the IT budget

- Enterprise generative AI use cases, applications about to surge

- AWS re:Invent 2024: Four AWS customer vignettes with Merck, Capital One, Sprinkr, Goldman Sachs

- Takeaways on successful AI, generative AI projects

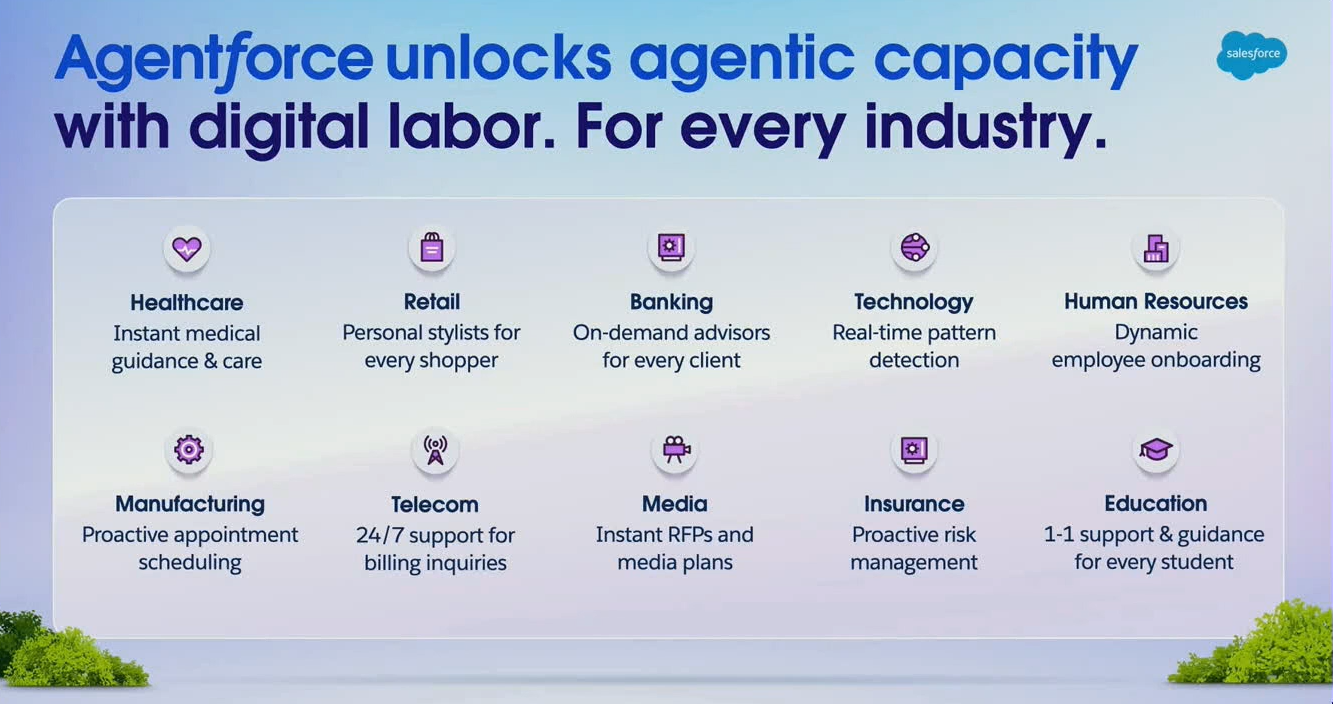

Agentic AI has staying power. Agentic AI pushed generative AI aside for buzzword of the year, but the idea goes beyond vendor marketing. GenAI was a start, but being able to string together models into a flow that automates and executes work is a game changer. There’s a lot of work ahead, but agentic AI is off to a good start.

- Agentic AI: Three themes to watch for 2025

- Agentic AI without process optimization, orchestration will flop

Here’s the digital labor analogy that Salesforce outlined when it launched Agentforce 2.0 this week.

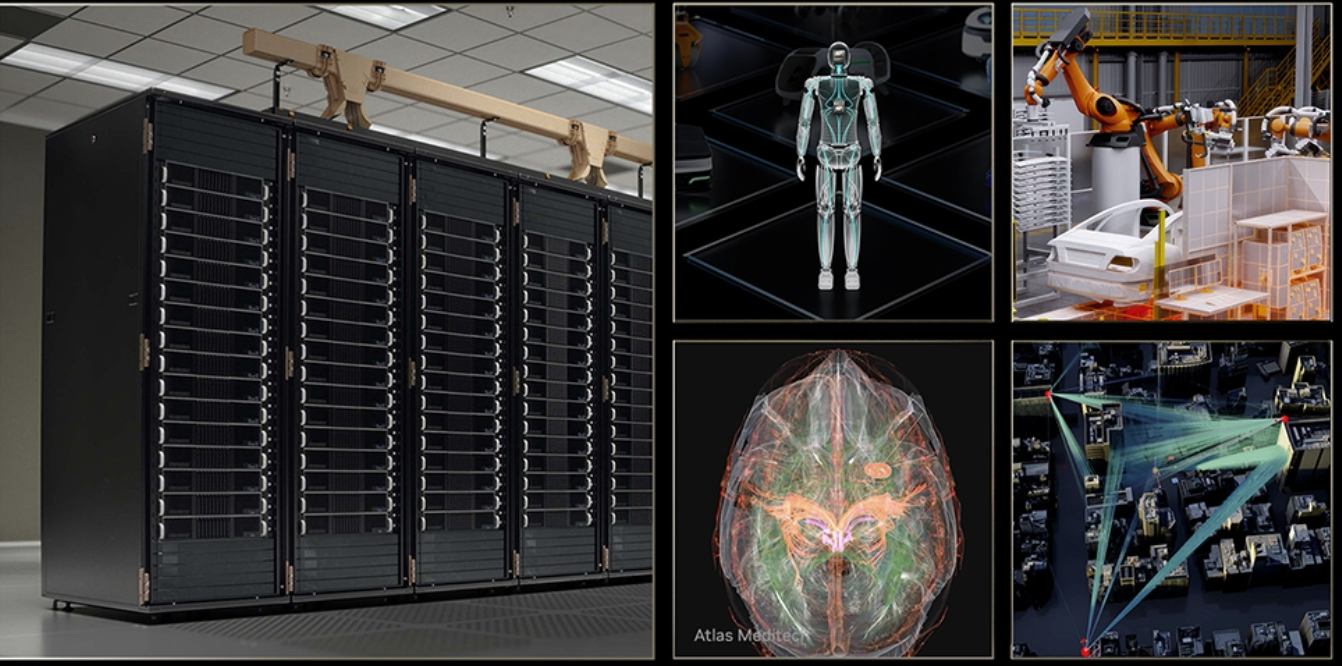

However, the spoils of the AI revolution largely stayed with the infrastructure layer. While AI is promising for multiple industries, the market cap expansion went to infrastructure players. We’re still in the picks and shovels stage of the AI revolution and that means Nvidia has been raking in cash. The big question is when the AI spoils will spread beyond infrastructure.

- Nvidia CEO Jensen Huang has a dream...

- AI data center building boom: Four themes to know

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

- Blackstone's data center portfolio swells to $70 billion amid big AI buildout bet

Business transformation is alive and well. The Constellation Research community of CxOs continually outlined projects that transform their businesses away from the fanfare. Business transformation is about continual improvement, change management and process. It’s difficult to synthesize all the conversations we’ve had, but here are a few.

- Winners Announced for Most Transformative Business Initiatives of 2024

- Supernova Award Spotlight: How Singapore's M1 Cloud Transformation Led to Personalized Mobile Plans

- BT150 Spotlight: Centurion Health's Johnny Wu on delivering healthcare in prisons

- BT150 Spotlight: Insight Global's DeWayne Griffin on HR, AI and Humans in the Loop

- BT150 Spotlight: MultiCare Health System's Laurie Wheeler on optimization, change management and healthcare transformation

- BT150 Spotlight: Jewelers Mutual John Kreul on Human-Centric AI, CX, Returns and Futureproofing

- BT150 member Dr. Jonathan Reichental: How autonomous vehicles could change how cities are designed

- Peraton's Cari Bohley: Why internal talent recruiting and retention is critical

- SuperNova Award interview with Joe Prota: How IBM used Adobe Firefly to speed up ideation and iteration

- BT150's Ashwin Rangan on CIO evolution, technology curves and what it means for genAI deployments

- BT150 Spotlight: Sunitha Ray on the difference between enterprise AI and genAI

2024 in Constellation Insights

- Agentic AI: Three themes to watch for 2025

- AWS re:Invent 2024: 7 takeaways after drinking from the firehose

- Nvidia CEO Jensen Huang has a dream...

- GenAI's 2025 disconnect: The buildout, business value, user adoption and CxOs

- Enterprise software 2025: Three big shifts to watch

- Constellation Research's Connected Enterprise 2024: All the takeaways

- Agentic AI without process optimization, orchestration will flop

- On-premises AI enterprise workloads? Infrastructure, budgets starting to align

- The art, ROI and FOMO of 2025 AI budget planning

- Intuit's Enterprise Suite could upend midmarket ERP

- 13 artificial intelligence takeaways from Constellation Research’s AI Forum

- Enterprises leading with AI plan next genAI, agentic AI phases

- With Salesforce push, AI Agents, agentic AI overload looms

- Enterprise security customers conundrum: Can you have both resilience, consolidation?

- Big software deals closing on AWS Marketplace, rival efforts

- Peraton's Cari Bohley: Why internal talent recruiting and retention is critical

- Starbucks lands new CEO from Chipotle: Here’s how digital strategy could change

- Disruption is coming for enterprise software

- Enterprise software vendors shift genAI narrative: 'GenAI is just software'

- The generative AI buildout, overcapacity and what history tells us

- Enterprises start to harvest AI-driven exponential efficiency efforts

- GenAI may be the new UI for enterprise software

- Education tech in turmoil amid genAI: Why consolidation is next

- 14 takeaways from genAI initiatives midway through 2024

- OpenAI and Microsoft: Symbiotic or future frenemies?

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

- Don't forget the non-technical, human costs to generative AI projects

- GenAI boom eludes enterprise software...for now

- The real reason Windows AI PCs will be interesting

- Copilot, genAI agent implementations are about to get complicated

- Generative AI spending will move beyond the IT budget

- Financial services firms see genAI use cases leading to efficiency boom

- Foundation model debate: Choices, small vs. large, commoditization

- Will demographics mitigate the genAI hit to workers?

- An ode to middle managers

- Enterprise generative AI use cases, applications about to surge

- Multi-cloud computing isn't 'a bunch of separate clouds'

- AX100 interview: How The Joint maps the customer journey as it scales

- Will generative AI make enterprise data centers cool again?

- With Equifax's cloud transformation at finish line, AI scale comes into focus

- Nvidia's uncanny knack for staying ahead

- GenAI trickledown economics: Where the enterprise stands today

- General Motors needs to fix its software issues quickly

- Why customer satisfaction, CX shows diminishing returns

- Supply chain transformation critical as resilience worries stack up

- Themes from the healthcare data, AI, disruption front lines

- 2024 in preview: 11 things in enterprise technology to watch