Oracle is continuing its acquisitive ways in 2017, with the latest purchase focusing on Moat, which makes a platform for measuring the effectiveness of digital advertising. It will become a key new feature of Oracle's Data Cloud service, which has expanded in functional scope and intent over the past couple of years.

Moat already partners with popular digital ad platforms such as Facebook, Google, Pinterest, Pandora and Snapchat and it lists major marketers including Unilever, Kellogg's, Nestle and the New York Times as customers.

"Oracle's investing heavily to build a comprehensive suite of solutions targeted at marketers and advertisers," says Constellation Research VP and principal analyst Cindy Zhou. "The convergence of adtech and martech is fueling the market consolidation. Moat brings additional digital advertising measurement and analytics capabilities to Oracle Data Cloud."

In a FAQ, Oracle said it would keep Moat "an open measurement and analytics platform, with deep integrations and partnerships across the entire digital publisher and adtech landscape."

Oracle built out Data Cloud beginning a few years ago with the acquisition of BlueKai, which provides a front end to hundreds of consumer data marts. BlueKai users can select and combine data sets from those sources based on their particular marketing and advertising needs.

Oracle touts Data Cloud's ability to provide consumer and B2B profile data that's updated in real time, rather than collected and aggregated on a monthly or quarterly basis. This means marketers can target at a more immediate level, such as by delivering messages when time a prospect is actively shopping for a new product or service.

Other acquisitions Oracle made in support of Data Cloud include DataLogix and AddThis. Those moves expanded the number of user profiles and targeted audiences available through Data Cloud, particularly for B2B scenarios.

But it's important to note that today, Data Cloud is far from just a data-as-a-service play, says Constellation Research VP and principal analyst Doug Henschen. "The real appeal is its combination of data and analytic services," he says. "Targeting and measurement are the lion’s share of the business, while straight-up data licensing is a smaller part of the business."

Television is the next frontier for targeted and measurable advertising, and that's squarely where Moat fits into Oracle's strategy, Henschen adds. "Streaming digital video—seen on desktops and connected TVs as well as mobile devices—is the fastest growing form of TV consumption, but advertisers have struggled to measure the impact of digital video."

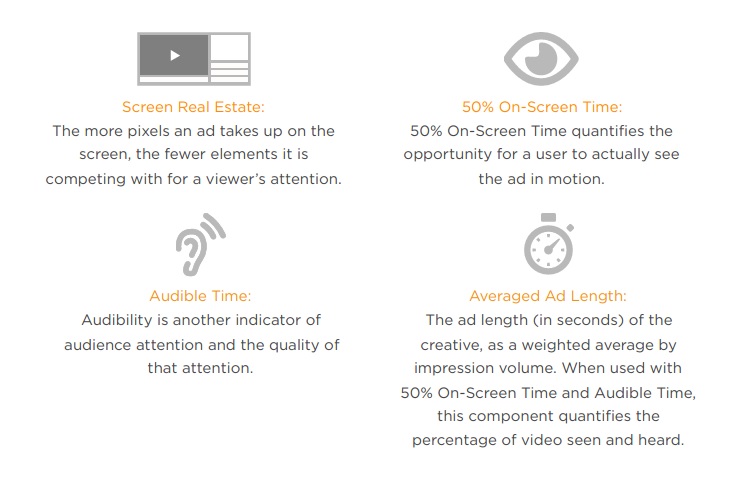

Moat focuses on providing "attention analytics" with its Moat Score, which measures the combination of an ad's length, how long it was visible, how long it was audible and the size of the video viewer relative to the size of the device screen, Henschen notes.

The company says it measures attention analytics more than 19 billion times each day, a sizable figure that Oracle will surely look to scale ever higher.

"Conventional linear television still accounts for more than 90 percent of advertising spend, but addressable advertising, through set-top-boxes and on-demand offerings, and digital video advertising, through connected TVs, Web browsers and in-app viewing, are quickly growing a share of television ad spending," Henschen says.

Oracle's move could spark competitors such as Adobe and Salesforce to scoop up other ad-tech companies in response. Possible targets include Integral Ad Science, comScore and AdClarity.

24/7 Access to Constellation Insights

Subscribe today for unrestricted access to expert analyst views on breaking news.