CVS Health is betting it can leverage technology and AI to create an "engagement as a service" strategy and an integrated platform that ties together its brands that include Aetna, CVS Caremark, CVS Pharmacy and Health Care Delivery.

The company is outlining its plans at its investor day. CVS Health CEO David Joyner said the company is focused on "building a simpler, more connected and more affordable health care experience for consumers, health care professionals, and payors."

In late 2023, CVS laid out a strategy that revolved around a data flywheel across its customer base that would improve healthcare delivery across multiple touch points. At the time, CEO Karen Lynch touted a plan to "provide panoramic care" for its members. Lynch was replaced by Joyner in October 2024.

Although leadership changed, CVS Health’s data assets and touch points remain. CVS Health is still sprawling with 300,000 employees, 185 million consumers and 1.5 million relationships with health care providers. In addition, CVS Health has multiple touch points via its pharmacies, health care delivery facilities and stores.

The working theory for CVS Health—and other large enterprises—is that AI can be used to break down data silos and provide better experiences.

CVS projected 2025 revenue of at least $400 billion with operating income of $4.37 billion to $4.54 billion. For 2026, CVS sees revenue of at least $400 billion with operating income of $13.26 billion to $13.60 billion. CVS Health is projecting margin improvements at Aetna and CVS Caremark with continued earnings at CVS Pharmacy, which the company calls the "front door to healthcare."

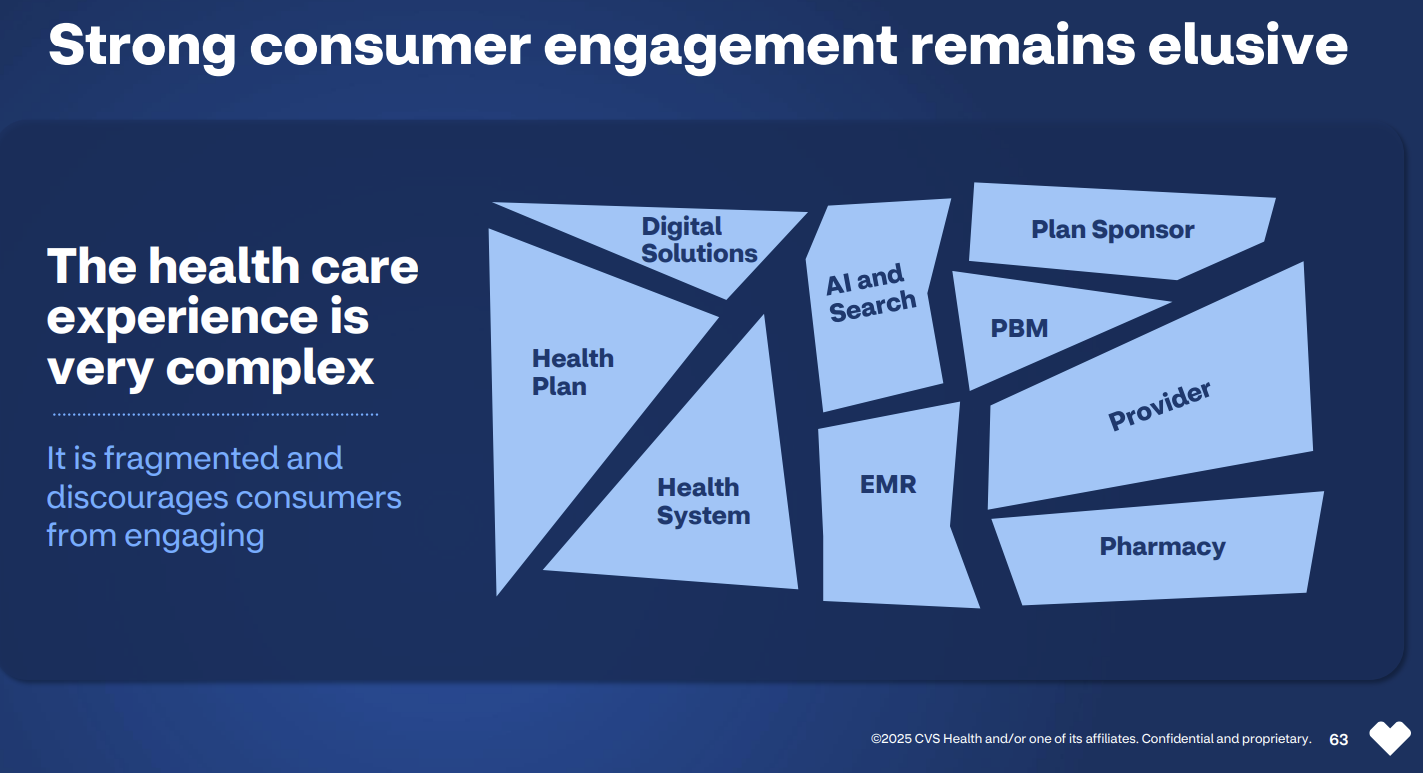

The challenge and promise for CVS Health is integrating its various units so there's one platform to engage consumers and deliver healthcare. CVS Health's 2023 plan revolved around a data flywheel and since then AI has emerged and may make the company's plans easier to implement.

Here’s the high level plan.

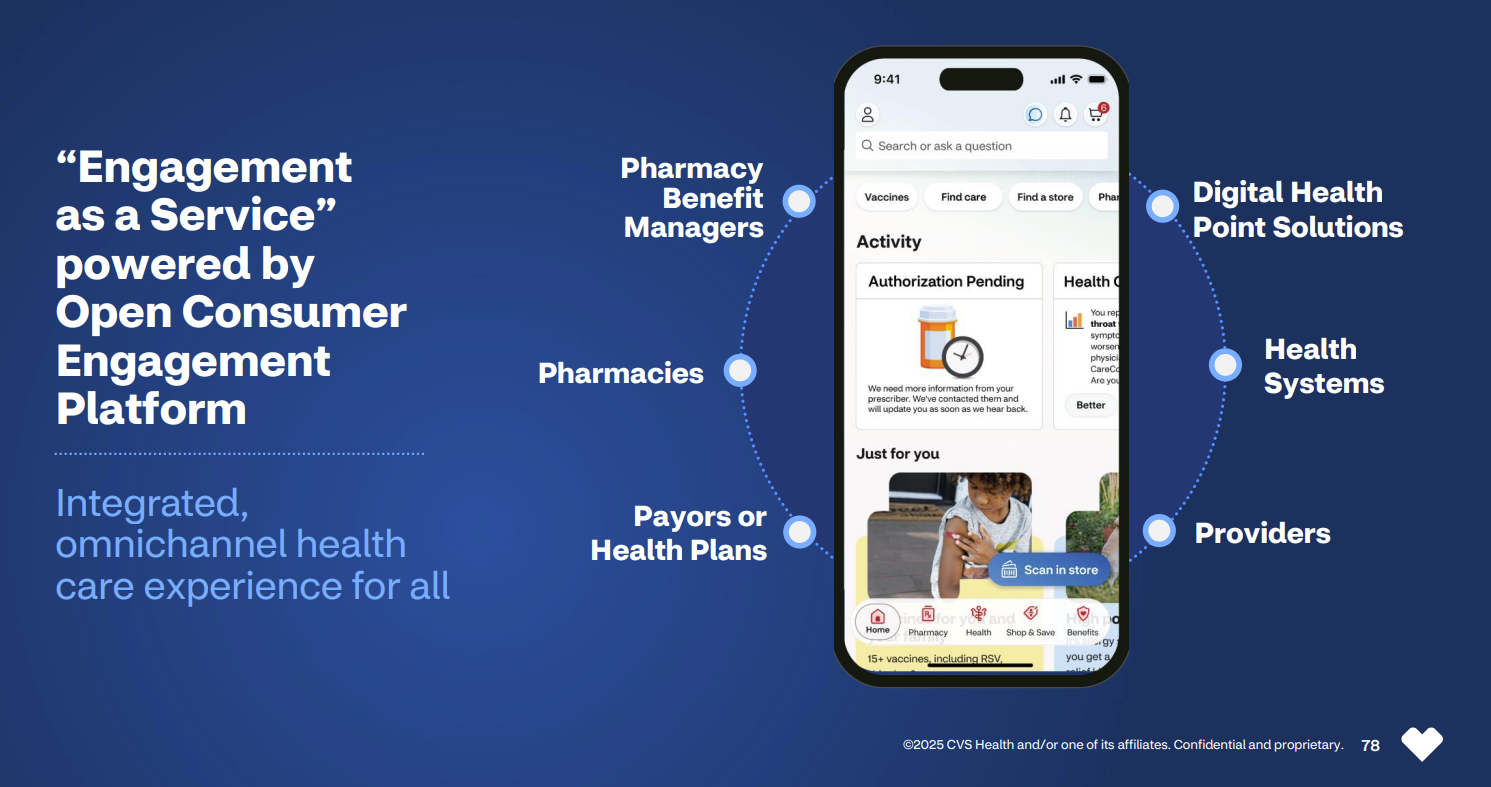

For this next chapter to come together, CVS Health will need to deliver more healthcare value via "Engagement as a Service” with one platform that’ll combine its units to be useful to consumers.

CVS Health’s argued that it has credibility as a technology provider is that AI is being used at the company's Aetna, CVS Caremark, CVS Pharmacy and health care delivery facilities. That knowhow will feed the engagement system and enable the company to be proactive, reach consumers and create an ecosystem.

There's no question that healthcare delivery can be more digital and customer friendly. The big question is whether CVS Health is the company to finally make headway on the problem.

Internal efficiencies

In a presentation, CVS Health argued that it can engage consumers better because it has already leveraged AI internally to become more efficient.

CVS Health said it has saved more than $1 billion to invest in new growth and AI.

Some examples of operating efficiencies include:

- In the Aetna unit, the company has saved 90 minutes a day per nurse by consolidating clinical documentation, reduced call center volume by 30% and created one care management system from four disparate ones.

- Aetna will accelerate interoperability of clinical data.

- Oak Street Health, which provides health care services, has ambient AI scribe tools at 90% of its facilities. CVS Health's facilities include Oak St. Health, SignifyHealth and CVS Minute Clinic.

- CVS Caremark is now able to process more than 300 claims per second at peak periods with a 99% first call resolution.

- CVS Pharmacy will continue to invest in procurement and supply chain to drive down prices.

Does that ability to drive internal efficiencies mean CVS Health can become an engagement platform provider? We’ll find out.

Meet the health care consumer engagement platform

The big plan from CVS Health is to create a platform that will reimagine health care. Tilak Mandadi, Chief Experience and Technology Officer at CVS Health, laid out the plan.

With better engagement, CVS Health can enhance access, simplify navigation and improve affordability. CVS Health is aiming to become a trusted source and consolidate a fragmented experience.

CVS Health certainly has the reach. CVS Health said more than 185 million consumers engage with the company each year and 85% of American live within 10 miles of a CVS Health location. With its omnichannel reach, CVS Health can ultimately commercialize its platform.

For CVS Health, one integrated engagement platform can drive growth for all of its units.

What's unclear is whether CVS Health can become a technology provider. The plan for CVS Health is to launch a series of technology and services in 2026. The play here is to not only engage its own customer base but create an ecosystem revolving around its platform.