Intuit and OpenAI announced a multi-year $100 million contract that will integrate ChatGPT with Intuit TurboTax, Credit Karma, QuickBooks and Mailchimp. Intuit will also expand its use of OpenAI models in its genAI operating system called GenOS for use with its AI agents.

The partnership is a win for OpenAI in that it will expose ChatGPT's integrations to Intuit's 100 million users. OpenAI outlined its plans to leverage ChatGPT as a front-door to multiple applications with an initial focus on consumer apps, but including business software. For its part, Intuit can expose its platform to ChatGPT's 800 million consumer and business users.

Under the terms of the deal:

- ChatGPT users will be able to take financial actions via Intuit applications directly within the ChatGPT experience.

- ChatGPT users often ask financial questions and now can be connected with Intuit's platform and features.

- Intuit's AI-driven expert platform will also be available within ChatGPT.

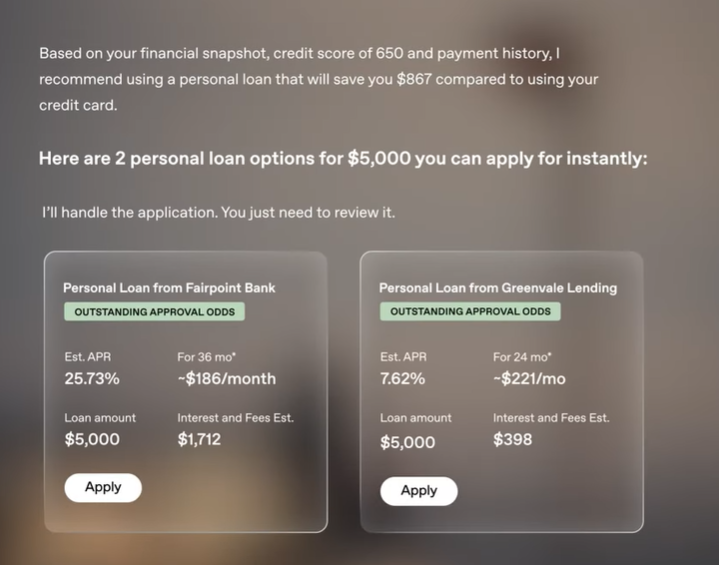

- With permission, Intuit can execute personalized financial actions within ChatGPT for mortgages, taxes and loans. Customers can also schedule time with Intuit's local tax experts.

- The Intuit-OpenAI partnership also covers businesses for queries about revenue, profitability and accounting.

Intuit CEO Sasan Goodarzi said the partnership will combine "Intuit's proprietary financial data, credit models and AI platform capabilities with OpenAI's scale and frontier models."

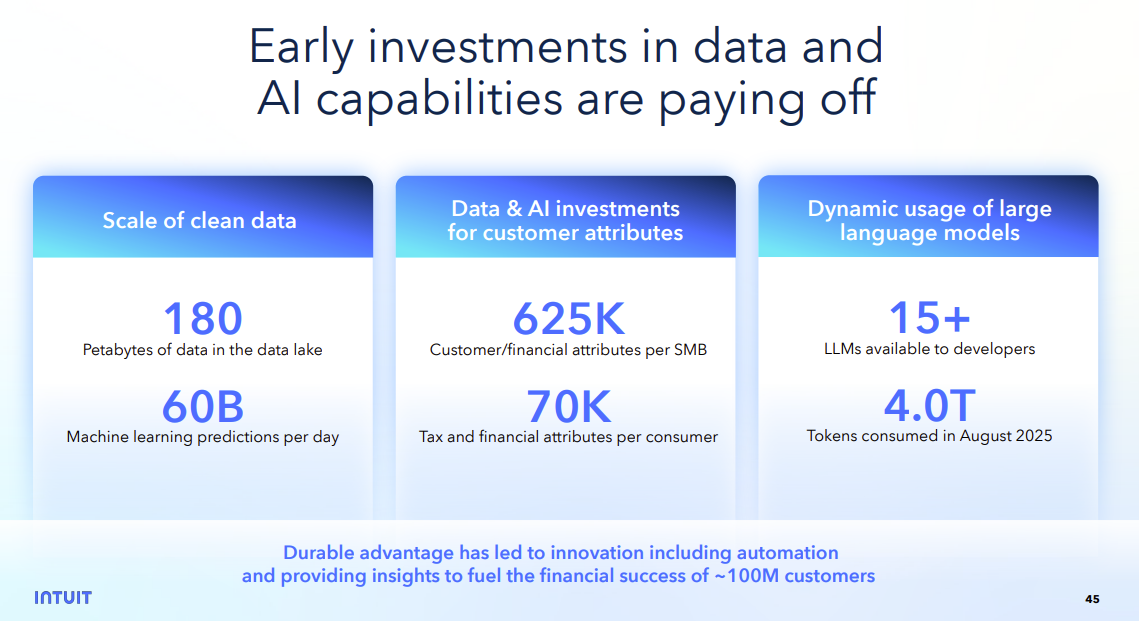

For Fidji Simo, CEO of Applications at OpenAI, the Intuit deal will be a good proof point for the AI company's overall application strategy. OpenAI can also expand its footprint at Intuit, which at last check leveraged at least 15 different models to deliver its experience. Intuit also had 2 million customers on its business platform interacting with AI agents just a few months after a July launch.

- OpenAI's CEO of Applications pens intro missive: 5 takeaways

- OpenAI touts enterprise mojo with 1 million business customers

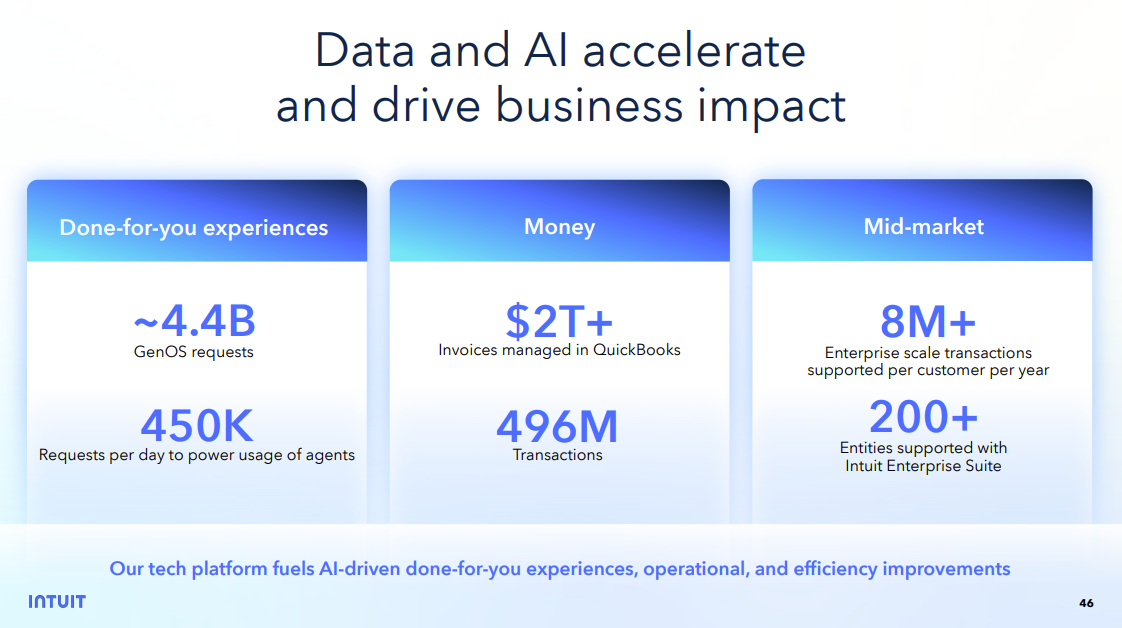

Intuit has been scaling its AI efforts and has been ahead of both the data and AI curves.

- Intuit starts to scale AI agents via AWS

- Intuit embraces LLM choice for multiple use cases

- Intuit’s bets on data, AI, AWS pay off ahead of generative AI transformation

At Intuit's investor day in September, Goodarzi outlined the company's AI strategy. He said:

"We believe that every SaaS company, anybody that makes software is either going to get disrupted or they're going to be the disruptors. And that's because of what's possible with AI. We believe that SaaS players must become the system of intelligence, which means you have to be great at data, data models, data ingestion and AI capabilities to ultimately architect learning systems that learn from customers and deliver the experiences that they are looking for, which means business logic, workflows and the app layer will completely get disrupted."

The partnership with OpenAI is part of Intuit's plan to be a disruptor and meet customers--current and prospective--where they are. Goodarzi outlined the following:

- Intuit is combining with AI and human intelligence (HI) via its expert network. "Whatever you want to engage with the platform on our data, AI and human capabilities can deliver that experience," said Goodarzi. "That is our system of intelligence. That is our strategy."

- "The 3 bets are: shifting and accelerating, delivering done-for-you experiences. Marketing is done-for-you. Customer management is done-for-you. Cash flow management is done-for-you. Payroll is done-for-you. Your books are done-for-you. Your accounting is done-for-you. Your taxes are done-for-you, all of which never has a dead end because it's AI plus HI, with the massive amount of data we have and the capabilities to ingest data. That's the done-for-you experiences across the entire platform," he said.

- Money is everything. "People don't do taxes because they love taxes. They want the money. Businesses follow their passion, but cash flow matters. And so we're accelerating all of our investments around money, helping you get immediate access to your refund, helping you with how to grow your refund, helping you with how to grow your savings," said Goodarzi.

- Long-tail data. "To win in the era of AI, data matters. And I'm talking about long tail of data. When you see here that we have 625,000 data points per business or over 70,000 data points for consumers," said Goodarzi. "Data is our advantage. We have incredible data, but more importantly, we have built data services that can ingest the data from anywhere."