Freshworks reported better-than-expected third quarter earnings and upped its outlook for the fourth quarter as the company is expanding wallet share. The company is also aiming to land more business users.

The company reported a third quarter net loss of $7.5 million, or 2 cents a share, on revenue of $215.1 million, up 15% from a year ago. Non-GAAP earnings were 16 cents a share.

Wall Street was expecting Freshworks to report non-GAAP third quarter earnings of 13 cents a share on revenue of $208.8 million.

Key figures include:

- Freshworks had 24,377 customers contributing more than $5,000 in annual recurring revenue.

- Freddy AI doubled annual recurring revenue from a year ago to more than $20 million.

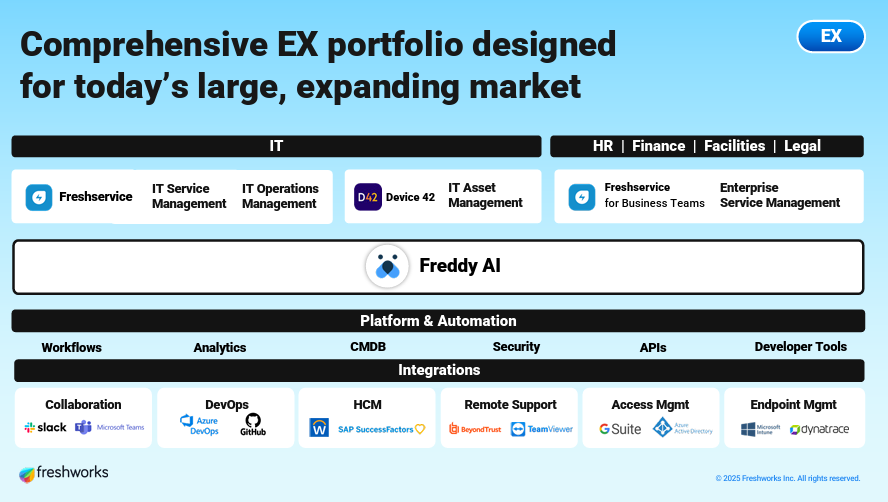

- ARR for Freshservice beyond the IT department is growing as Freshservice for business teams has doubled year over year.

Freshworks will launch a standalone version of FreshService for Business Teams, which won't require the broader platform. The standalone enterprise service management product, aimed at legal, HR, finance and facilities, currently has an annual run rate of $35 million, double from a year ago.

- Constellation ShortList™ Incident Management

- Constellation ShortList™ Sales Force Automation

- Constellation ShortList™ Digital Customer Service and Support

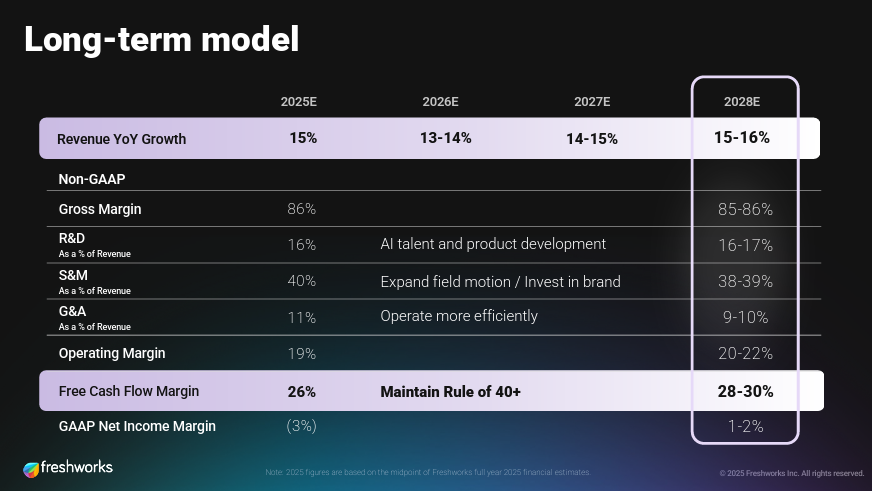

As for the outlook, Freshworks upped its outlook. The company projected non-GAAP fourth quarter earnings of 10 cents a share to 12 cents a share on revenue of $217 million to $220 million. For 2025, Freshworks is projecting non-GAAP earnings of 62 cents a share to 64 cents a share on revenue of $833.1 million to $836.1 million.

In the long run, Freshworks is gunning to be a rule of 40 company with revenue growth in the mid-teens consistently.

Freshworks recently held its investor day where it noted that upmarket demand in the mid-market and enterprise has been growing revenue share. Nevertheless, Freshworks faces tough competition in employee experience as well as customer experience.

Here's the employee experience landscape.

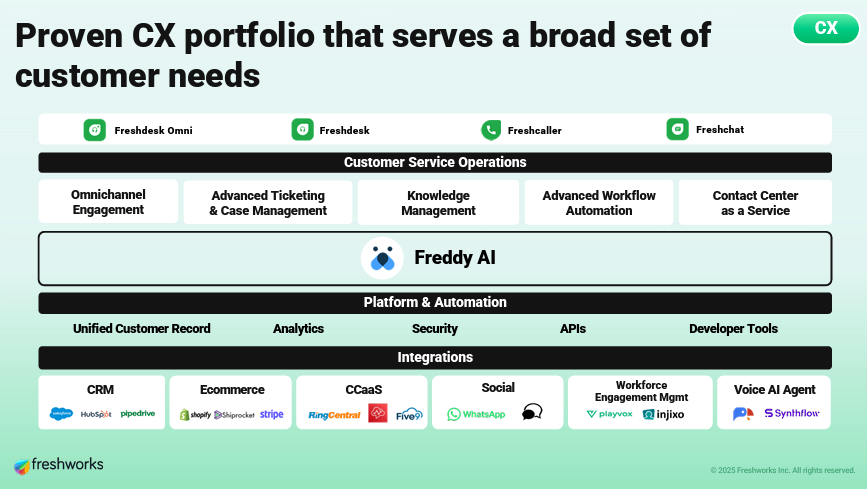

And here's the customer experience landscape.

We caught up with Freshworks CEO Dennis Woodside to talk shop. Here are the key points.

Competitive landscape. Woodside said "we're competing in a 20,000 person company like Seagate. They don't have a large set of resources to throw at an ITSM platform. They want faster time to value." In ITSM, Freshworks' primary competition is ServiceNow in larger accounts and Atlassian in developer led companies.

AI strategy. Woodside said next week at Freshworks Refresh the company will launch four pre-built AI agents for industries. The company already has AI agents for customer support, a Copilot for agent productivity and AI insights for management.

CX. Our CX business has not made the up-market shift as aggressively as our IT business. It will be over time, but right now, it's still more of an SMB-centered business," said Woodside. The CX business is growing at 7% to 8% while ITSM is growing at 20% to 23% clip. Half of the top accounts buy ITSM and CX.

Customer sentiment. Woodside said: "CIOs are just trying to figure out how they can possibly support all of these new AI point solutions, and they're going back to what they already have, looking for AI embedded in their existing solutions." CIOs are also looking for alternatives to large vendors as well as ways to consolidate AI tools within existing systems of record.